This morning I was browsing some old posts and wanted to follow-up on things I’d said to see how they were holding up.

Bitcoin

Back in November of 2025 – 3 long months ago – I wrote I Own Some Bitcoin, But That Doesn’t Mean I Have To Like It. Cryptocurrency and Bitcoin especially, seem to be in the news quite a bit and none of us really understand them, but we feel like we must be missing out on something big.

The post is worth a read. I discuss why I am comfortable investing in a business, but less so in bitcoin.

But anyway, invest, I did. On February 3, 2025, I took the plunge and invested $8,692.02 to buy 200 shares of the GRAYSCALE BITCOIN MINI TR ETF (BTC).

I’m nervous about buying actual bitcoin – what is it, where do I keep it….so many questions. And it seems like every other month we read about a person or company that lost their bitcoin key and their bitcoin is lost forever. I’ll stick with an ETF that owns bitcoin. Hopefully they keep the key in a safe place and not under the flowerpot by the back door.

Today is February 18, 2026. How’s my bitcoin ETF doing? Am I rich?

I’m down 31% in a year.

I have no idea why. I can’t read bitcoin’s earnings report. I can’t tell if its opened new stores, started cost cutting initiatives or explored new markets. There’s no management to tell me what they’re seeing and projecting for the coming quarter.

I’m holding on as a science experiment, not because I have any faith in bitcoin.

And just for old times sake, let’s revisit the November post and compare a year of bitcoin with a year of O’Reilly.

O’Reilly (the boring auto parts store) is the light blue line that is up 7.19% in a year while bitcoin is down 29%.

I still own bitcoin and I’m still not happy.

National Debt

I’ve been worried about the skyrocketing national debt for a while. Do a search on debtclock and you’ll find every post where I rant about the national debt. Or click here.

Quick thanks to reader Mike for pointing out that the search had fallen off of the mobile site. The IT department has been working overtime and I’m pleased to announce that search has been restored to all of your phones!

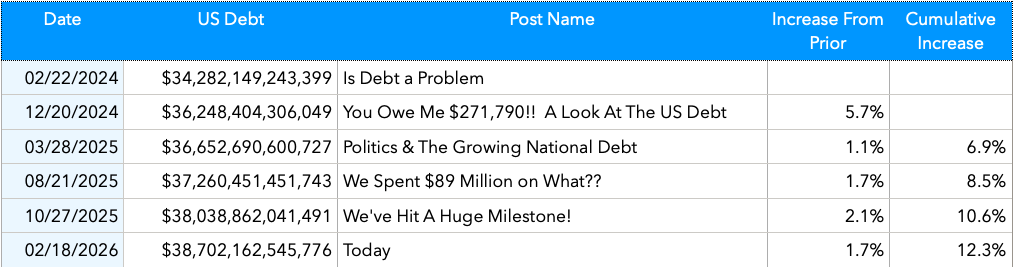

Today, I thought it wold be fun to tiptoe through some of the debt levels in prior posts.

We’ve got about 2 years between my February 2024 rant and today, February 18, 2026.

The US national debt has increased by more than $4 trillion. It’s up 12.3% in just 2 years.

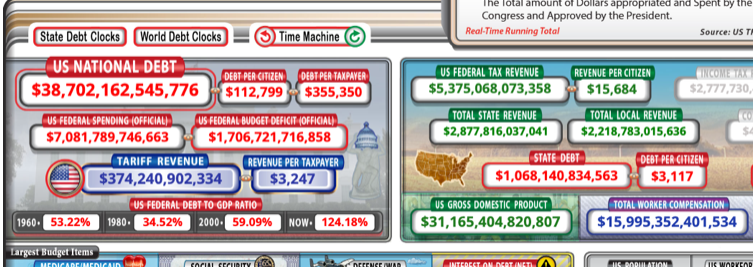

The reason is simple. We can see the federal tax revenue of about $5 trillion, the federal spending of roughly $7 trillion, which leaves an annual deficit of $1.7 trillion.

I was wrong. This wan’t as much fun as I’d hoped.

The Market

Is the market up this year? Down? And what exactly is the market?

Back in November 2025, I wrote about how I asked Grok to evaluate my investment performance. While I’d done pretty well in the long term, my last year hadn’t been so hot.

I had pretty significantly lagged the S&P 500.

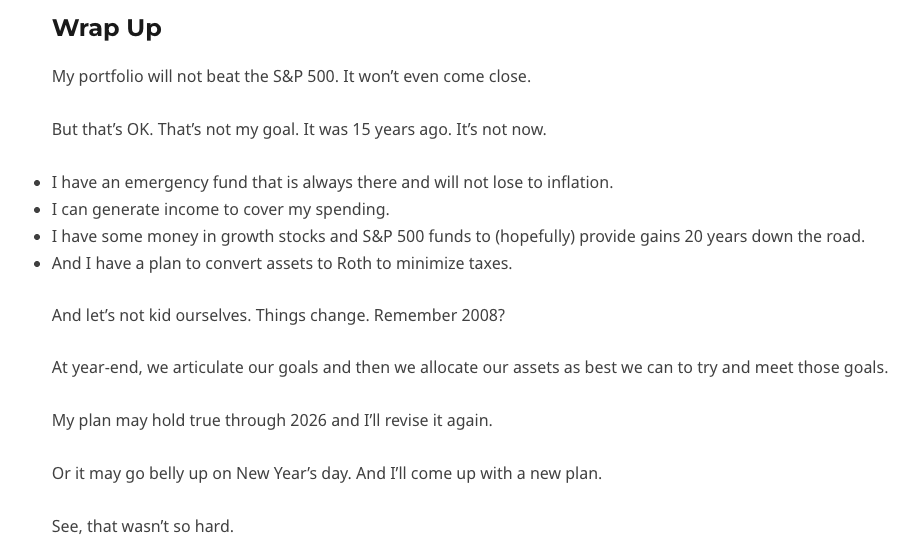

Upon reflection (and after some panic) I realized that I should have expected underperformance because I had traded growth for income (seeing that I don’t have one – an income – anymore).

The post was called Year End Planning and you can read it here.

Here’s my wrap up from that post.

Not So Fast

I’m OK with my underperformance due to the income I generated. But just like bitcoin, I don’t have to like it.

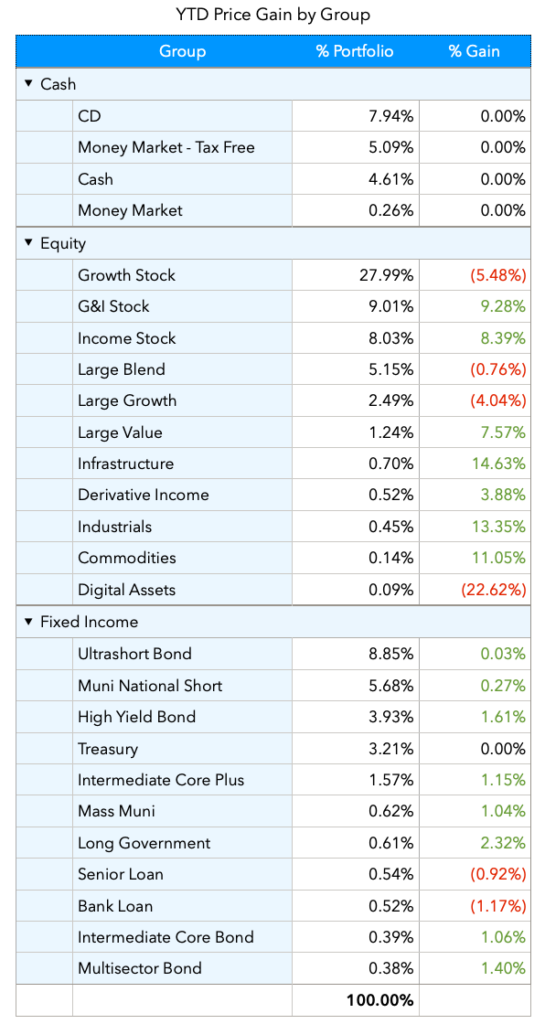

So, at the beginning of 2026, I made a point-in-time copy of my big beautiful spreadsheet. And I added a new sheet that monitors performance by security asset class and group within class.

Keep in mind, this is year-to-date so we’re looking at January 1, 2026 – Feb 18, 2026 – about 6 weeks.

We’re also looking at change in security prices only. This does not include dividends. And dividends are a big part of the gains for income stocks and fixed income.

The chart shows the % of my portfolio allocated to each group, and the YTD price change.

Aha!

Growth stocks (Amazon, Apple, Netflix, Alphabet…) are by far the largest chunk of my portfolio and they are in a bit of malaise due to AI spending. Not a surprise, but makes me reconsider my 27% allocation.

Large Growth is basically the mutual funds (like S&P 500 funds) that hold many of these same companies.

Those income and growth and income stocks that are still paying me regular dividends that I use to pay my bills are winning this year. And winning big.

What Does This Tell Me?

Not much. It’s only 6 weeks.

We’ll check in again later.

But it does show the importance of diversification. Some groups are up some are down.

Going into 2026, I would not have guessed that industrial companies like Caterpillar (CAT) and Cummins (CMI) would continue their out-performance.

I wrote about my dilemma with CAT and CMI just a few weeks ago in Most Investors Are Terrible At Predicting The Future.

Wrap Up

Bitcoin – 1 year in and so far it’s a bust. We’ll check in again same time next year.

The national debt is a growing problem. I wondered briefly whether all these days of government shut down actually helped with the national debt. It turns out that it makes it worse as there is a significant cost to get things restarted. Bummer.

And I like the new spreadsheet. While history tells us growth beats income in the long run, even 6 weeks of data shows us the importance of being diversified.

Hope you enjoyed the trip in the wayback machine.