Towards the end of each year, I do an annual portfolio review. I’ve written about this here and here.

This year I had some help. Grok helped me plan a vacation and helped me come up with a tax minimization strategy using Roth conversions so I thought I’d have him check out my portfolio.

Privacy Warning

As much as I love Grok, I am still cautious about what I share. I like that I can have a conversation with him and he remembers things from prior conversations. This prevents me from having to provide a whole lot of context, but it also means he’s built a profile on me. And while he promises that he doesn’t share, who really knows?

So I’m not uploading my brokerage accounts and positions to get some feedback. I’m providing some performance numbers for my total account and asking for some input.

Good News and Bad News

Grok was quite impressed with my longer term performance, but noted that I’d under-performed in 2025 and he made some helpful suggestions.

I can be a bit competitive so I really dove in on the under-performance comment. I looked at all my holdings and started a what-if spreadsheet to analyze how I might make some sales and buys to boost my returns.

Aha!

Digging into my holdings and their recent performance v. past performance (I hold shares of over 70 individual companies, as well as holding a number of mutual funds and ETFs) took some work.

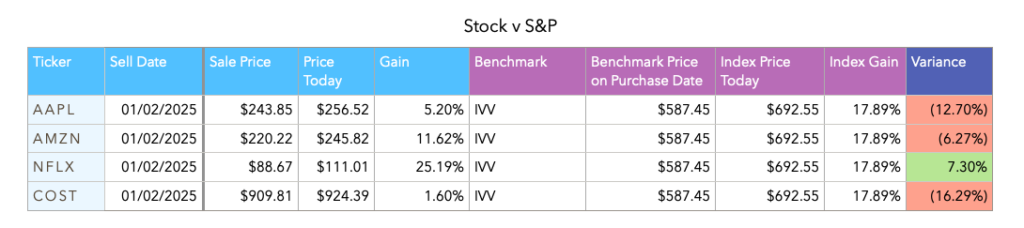

And yes, quite a few of my largest holdings under-performed a nice low-cost S&P 500 ETF like iShares Core S&P 500 ETF (IVV) in 2025

And of course, now that we know the problem, we better do something about it, right?

Thus the big what-if spreadsheet.

Laziness Pays

I spend no more than an hour or so a day on a problem like this. And even that is a lot, but I’m retired, I’ve got time and this is something of a hobby for me.

This whole process of asking Grok, doing some analysis, creating the spreadsheet… occurred over a week or so.

And over the course of the week, I had some time to think about what I was doing.

And the lesson here, and key #1….Don’t react!

I was developing a plan to cut some of my biggest long-term winners because they had one rough year.

I was also thinking about cutting some big dividend payers. This would reduce my annual dividend income.

Re-Assess Goals

I lost the 2025 performance race. I hate to lose. I won’t lose in 2026.

But that wasn’t the race I was running.

Wait, what?

When I was in my 20s, 30s and 40’s, my goal was to build wealth to fund my retirement. It was important to me at that time to beat the S&P 500 by investing in high-conviction companies that I believed would win over the long term. These were companies like Apple, Amazon, Netflix and Costco.

And while winning feels great, that’s no longer my goal today. I should remember, because I wrote about this in the 2 year-end posts, but it’s easy to get caught up in the competition and to be distracted by races we’re not in.

And I was reminded about this today while reading a post from one of my favorite analysts.

Key #2 – Know your goals.

Write them down so you don’t forget. This helps when we get dragged into the race we’re not running.

Like Jason, I’ve been working for almost 10 years to move to a protect-my-wealth portfolio. I am invested in more bond funds. I’ve moved to slow-growth dividend paying companies. My goal is to protect my wealth and generate the income I need in retirement.

I can’t have this and beat the S&P 500 too. I need to choose.

Keep Score

I love golf and play often, but I’ve never been a good putter. In my final round last year, I played alone and instead of keeping score of the number of shots per hole, I kept score of the number of putts.

It made a huge difference. I started thinking about making putts and putting myself in a better position on the green to make it easier to 1 or 2 putt.

Changing how I kept score changed my behavior.

My Investment Scorecard

My (new) investment scorecard prominently shows me my annual investment income from dividends and interest.

This is pretty easy to calculate.

I have $14,000 worth of National Grid (NGG). National grid pays a 3.93% dividend. I will get about $550 in dividend income from NGG this year.

I can get the yield for all of my companies and funds via the stock function in Excel or Mac OS Numbers. I just multiply this by the Market Value that I hold. I total the column and that’s my dividend income per year.

I now see this on my spreadsheet and it’s one of my focus areas.

Key #3 – Keep Score

You probably already guessed it.

Key #3 is keep score, but be sure to keep score based on goals.

Writing down those goals in key 2 will help us figure out how we want to keep score. What will we measure?

Wrap Up

I’m pretty focused on my personal finance goals and objectives. I write about them regularly. But still, it is incredibly easy for us to get distracted.

These 3 keys help me to stay focused on the right things.

Don’t React. This is really important. It’s easy to react to headlines or to feel like we need to make a big move because a market crash is coming, or because a stock is on sale after a big pull-back. I tend to start with a spreadsheet. Rather than take action, I map out what I might do and then think about it and see how it plays out. More often than not, that cheap stock just gets cheaper.

Know Your Goals. I panicked when I realized I was not beating the S&P 500. After thinking about this for a few days, I remembered that I wasn’t trying to beat the S&P 500.

Keep Score. Based on my goals, I develop a score card that shows me how I’m performing against those goals. My goal is to generate income. I have a new spreadsheet that lists all my holdings, their yield, and the annual income based on market value. I monitor the amount this group pays me in annual income.

I also record the cap gain for each. But my goal for this group is not to beat the S&P 500. My goal for this group of securities is to not-lose-money. That’s very different. Some of these companies will be down, some will be up. Very few, if any, will beat the S&P 500. But that’s not the goal.

So, I learned a little something this week. And it’s really about navigating uncertainty. When we’re uncertain about the market (which is always) and we’re tasked with managing our retirement, there is a lot of uncertainty for us to deal with.

And humans aren’t good with uncertainty. We get distracted.

The key is to understand our goals and be able to articulate them, keep score based on our goals, and resist our tendency to react.

Good luck.