Unless you end each month with more money than you know what to do with, you need a budget. If that sounds like an exaggeration, it’s not.

Why Budget?

Before we talk about the mechanics of creating and managing a budget, let’s talk a little about why you need one. Most of us work for our money. Many of us work 40 hours a week, or more. We might rather be spending time with kids or grand-kids, playing golf or lying on a beach, but those things aren’t going to pay for our rent/mortgage, our grocery bills, or help us save for retirement. So instead, we get up every day and we go to work. Many of us claim to love our jobs, but would we still go if they stopped paying us? Probably not.

We spend a good chunk of our waking lives working. The main purpose of which is to get a paycheck to help us support ourselves and our families. Given the effort we put in to earn our paycheck, doesn’t it make sense that we would want to maximize the benefit we receive?

My wife and I have built a lot of stuff at our house – patios, decks, gazebos, cabinets and shelves. It’s taken a lot of work to build them so we continue to invest a lot of time and effort to maintain them. Think of your paycheck the same way. You’ve put in a lot of work to earn that salary. It seems worthwhile to spend some additional time to ensure you receive the most value for your time spent.

A budget is an important way to do that. A budget enables you to decide how you are going to spend the money that comes in before you spend it. You’re probably saying “yeah, right. I have all these bills that need to get paid. How does a budget help?” Here’s how.

Start With a List

We start with an inventory of all of our income, and all of our expenses. We’ll talk in detail about how to do this shortly. Hang tight. You may find that your expenses exceed your income. We’ll get to that. At this point, we’re just collecting the facts.

Once we’ve got the inventory, we can then start to make decisions. There are really only 2 types of decisions most of us can make. We can get more income – take a part-time job, drive for Uber, put the kids to work and let them contribute… or we can reduce expenses – turn down the heat, turn off some lights, carpool, hunt for cheaper insurance, cell phone plans, etc. We can get radical and try to survive with 1 car instead of 2. We could downsize our home.

Make Choices Based on Facts

The point is, we now have the facts in front of us which enables us to make decisions. I remember about 10 years ago, I had a lot going on and I had lapsed on managing my budget. That’s OK – happens to all of us. At some point, I looked at my credit card statement and realized I was paying almost $200 a month on home phone, internet and cable TV. And that was 10 years ago. I got angry, I called my cable company and after lots of failed suggestions, I decided to cancel home phone and TV completely.

I was angry because my negligence had caused me to pay $200 for stuff I didn’t need. I proved I didn’t need it. My wife and I have lived without for over 10 years.

I’m not going to tell you that you can’t have cable TV. That’s not my role here. I want to help you pull your expenses and income together so that you can decide. I want to help you become the decision-maker. You should decide where your money goes. The alternative is that you become a victim. You work all week with nothing to show for it but a growing pile of credit card debt. Where you choose to spend your money is your decision.

Gather your Inputs

The first step in creating the inventory is to pull up your checkbook, your bank and credit card statements, a pencil and paper and start listing all of your income. This would be paychecks, but also includes interest earnings, rental income, or anything else that comes in on a regular basis. Next up, do the same with expenses. Electric bill, gas bill, phone bill, rent/mortgage….write down the item and the amount.

Monthly Budget

I like to do a monthly budget. It allows me to keep score on a monthly basis and adjust each month. One of the tricky parts is accounting for expenses that are not paid monthly. For example, I prepay my home, car and umbrella insurance every year. I save a good chunk of money by doing this, but I need to ensure I have enough cash on hand when the bill comes due. In my monthly budget, I need to have a line item for an insurance fund in which I save 1/12th of my payment each month and put it in a separate account so that it is available when the bill comes due. Taxes is another line item. Seems I always end up paying so I need to put money aside each month.

Remember, we are just doing the inventory at this point. If this is your first time, you are going to forget things. That’s OK. You will continually find things that you forgot to account for and you’ll add them as you go. You’ll get better every month.

For anyone who finds that it is onerous pulling all of this together because you may have multiple credit cards and several bank accounts, you may want to consider using an account aggregator.

Account Aggregators

An account aggregator is a website that pulls all of your accounts and transactions together in one spot to make it easier to manage your finances. Many of them will categorize your transactions automatically. For example, if you buy gas at Shell with your credit card, it recognizes shell as a gas station and categorizes the transaction as Auto Fuel. This helps you to use the aggregator’s tools to see how much you spend in each category, do comparisons, etc. Most aggregators also offer some basic budgeting functionality.

Some aggregators are free, some are paid. While these tools provide a helpful service (I have used both mint.com* from Intuit, and fullview from Fidelity for years and have found them incredibly useful), you are making a trade-off for that functionality.

The aggregator may sell your data. While they will “anonymize” the data so that it can’t be easily traced back to you, they are gathering an awful lot of information about you. Also, aggregators need you to authorize them to pull your data from your credit card providers, banks and other financial institutions. Some will need you to enter your login id and passcode into their site, some will ask you to authorize this through you financial institution.

Either way, make sure you understand how this works and what they do to protect your accounts. It’s also important to deal with an aggregator that has been around a long time. For a company like Intuit or Fidelity, they have a lot at stake to make sure your information is protected. But still make sure you do your homework.

Sample Budget

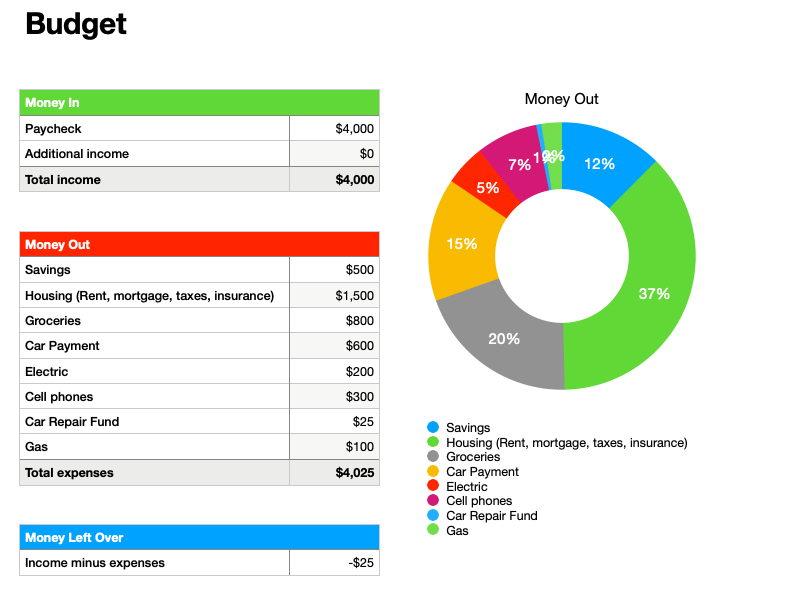

Now you have your 1st draft of your budget. See sample below.

You’ll notice that I listed savings first. This should be the most important item in your budget. Pay yourself first.

Car repair fund is an example of a fund you might set up to save for expenses that may not be monthly, but will come due sometime in the coming year.

What Now?

You’ll notice we are in trouble. The income of $4,000 is less than the total expenses. Our budget doesn’t work. Had we not done a budget we never would have known. With no budget, I’m guessing most or all of savings would not happen, the car repair fund wouldn’t get funded, and the money that would have gone here would go to something else.

Now that we know our income and expenses, we can make some decisions.

A while back, my wife came home from grocery shopping. She spent $50 and got over $100 worth of groceries. She read the flyer, she bought what was on sale and she used coupons. Groceries aren’t optional, but there are ways to spend much less.

Cell phones are a big chunk of the monthly expense. Many of us survived in the days before cell phones existed. This could be an area to save.

Be creative. There are lots of ways to save. Check out our post on saving. Don’t be afraid to try some and see if they work for you. You can always go back if they don’t.

Get the Whole Family Involved

I also encourage you to get your entire household involved in the process. I have one friend who put an expense sheet up on his fridge. He, his wife and his kids had to write any expenses here for all to see.

A Budget is the First Step

A budget is going to take a little bit of work to set up, but once you’ve done this, you will be able to make decisions about where your money goes. This is a good first step to help you get out of debt, to save more, and most importantly, to make sure the fruits of your labor are going to the places you want them to go.

As always, I’d love to hear your experiences with budgets, your questions and suggestions.

* Update 2/9/24….I received an email today that I needed to migrate my mint data to CreditKarma. I remember reading a while back that Intuit had purchased Credit Karma. I had done a cursory review of Credit Karma’s site a few years ago as I was preparing material for a class. I liked what they provided. See below for their info regarding their business model. But before I migrate my data, I will look a bit deeper.