Your credit score is much more important than you may realize. Let’s dig in.

Many people refer to their credit score as their FICO score. Just like FEDEX is not the only package delivery service, FICO is not the only credit score. While they all use similar criteria, the results can be different, which is why you may see variation in your score.

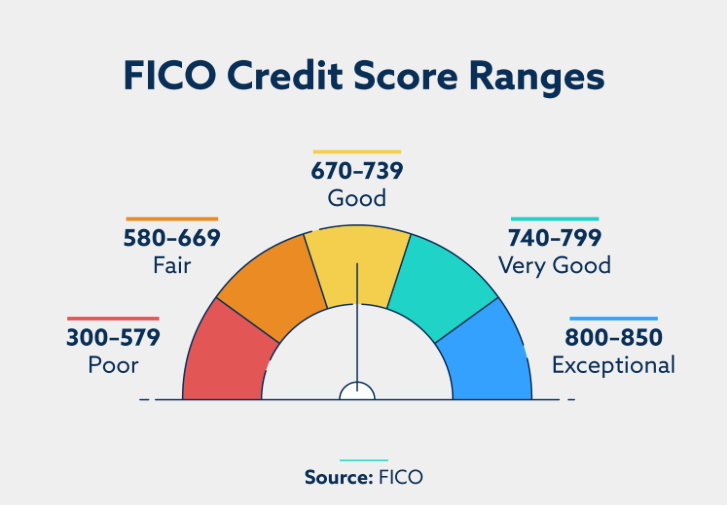

The chart below shows the FICO score ranges. In a minute we’ll go through the factors used to create the score, but in general if you maintain a manageable debt load and make regular payments, you’ll have a pretty good score. It’s important to have a good score because that’s what lenders use to determine the rate to charge you on a loan.

Why does my credit score matter?

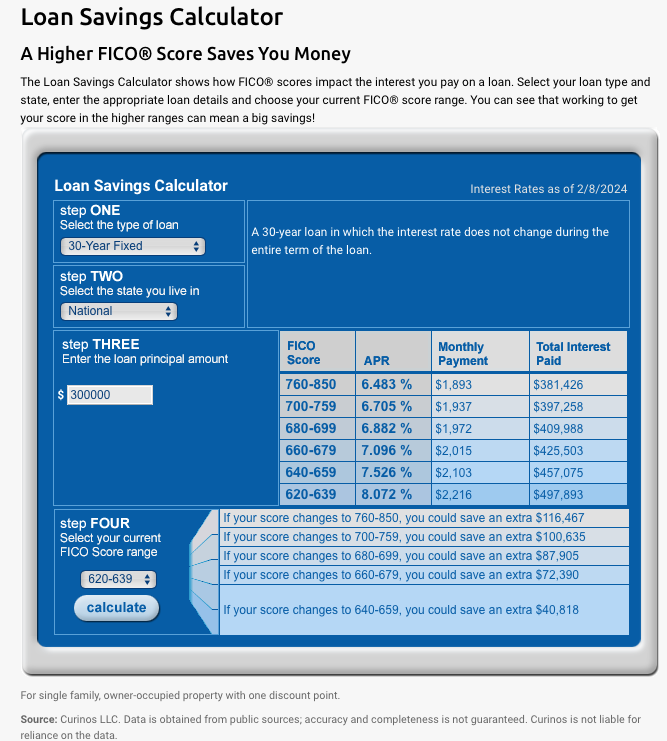

Let’s say you’re out shopping for a new home. You find 2 almost identical homes in similar neighborhoods. One is priced $116,000 higher than the other. Which one do you buy?

It’s not a trick question. The homes both list for $350,000. You’ve saved $50,000 for your down payment. What could cause such a huge discrepancy? The answer…..wait for it…..your credit score.

Let’s dig in. Check out the calculator from myfico.com. Study steps 3 and 4. You’ll see how your credit score can impact your monthly payment as well as the total interest you will end up paying over the life of the loan.

Lenders use your credit score as a way to assess the risk of lending you money. A high credit score typically means you have a long history of paying back loans and credit cards on time and managing your debt. A low credit score could mean you have no, or little history and your ability to payback is unknown, or it could mean you’ve had some problems paying back in the past.

Lenders lend money. That’s their business. They want to offer you a loan, but to be a successful lender, they need to do a really good job of managing risk. Credit score plays a big role in this. Lenders will offer a loan to someone with a lower credit score, but they’ll need to be compensated for taking on the additional risk. They’ll do this by raising the interest rate – often referred to as Annual Percentage Rate (APR). A higher APR means higher monthly payments and a more of your money going to interest payments instead of paying down the principal.

As a borrower, you want to see as much of your payment going to principal as possible. This means you will own the item that you’ve financed sooner, and you will have a bigger ownership stake in the item so if you do sell it, more of the proceeds go to you.

Quick(ish) Tip: Many loan transactions are automated. For example, you go to a car dealership, they enter your info into their system, their system talks to the lender’s systems, and using your credit score, they determine if they will offer you a loan and at what interest rate. Very impersonal. If you have an account with a local bank or credit union who knows you, or at least knows of your payment activity, they may be more willing to give you a loan at a better rate.

Makes sense right? But how do we do this? We don’t control our credit score. Well, that’s not entirely true. Let’s look at how our credit score is calculated so that we can develop some strategies to improve our score, pay less interest, and own things sooner.

Rating Agencies

Let’s start with Experian, Transunion and Equifax. These are the 3 big rating agencies. Their role is to gather information on each of our financial lives. That’s a little scary…more on this to come. The rating agencies compile a list of your credit activity – loans and credit cards – and your payment history. Lenders check with the rating agencies before offering you a loan to assess your credit and to determine the rate of interest they will charge you for the loan.

Rating agencies have a lot of power. They provide the info to the lenders that determine if we get a loan and how much interest we’ll pay. What if they are wrong? Good question.

Each of us is entitled to a free copy of our personal credit report from each of the 3 agencies once per year. You can see exactly what the lenders see. It will show all of your credit and loan accounts listed along with the payment history, missed payments, etc. You should get your free copies each year. You can get them all at once, or stagger them out 1 at a time over the course of the year.

Get your free credit reports here: https://www.annualcreditreport.com

This is the site I use. If you search for credit report, you will find lots of sites that offer you the same reports. Most of them will charge you, or will have add-ons for credit monitoring services or other products that you really don’t need if you’re watching your reports.

When you review your credit report, you’re mainly looking for 2 things:

- Is the information accurate? Do you see late payments that might be incorrect? If you view the report online, most have a button to click to report inaccurate info. Click here and the rating agency will investigate. You can also call the agency directly.

- Do you see accounts that you don’t recognize? This can be tricky, because you may not see a credit card account listed under the credit card name (e.g. Amazon Prime Visa). Instead you may see the name of the institution that is the issuer for that card (e.g. JPMCB Card). JPMCB stands for JP Morgan Chase Bank who is the issuer of the credit card, and the lender. If you look at the back of your card, or on your statement, you should be able to find the issuer. But here is the important point. An account you don’t recognize could be identity theft.

Identity theft deserves its own paragraph so here goes. If you see an account that you don’t recognize on your credit report, it is possible that someone has opened a loan or credit card in your name. This is more common than you might think. We’ll talk more on this in an upcoming post, but for now, its important to know that it is pretty easy for someone to get a hold of your name and SSN and open up an account in your name. They can then make charges up to the limit and then abandon the card or loan. You may be on the hook for payments and it will certainly ruin your credit score. Scary. Get copies of your credit reports and report any discrepancies.

Other ways to monitor credit

Recently I’ve noticed that a lot of credit cards are adding a feature to their phone apps and websites that help us monitor our credit. I’ll use my Chase Visa as an example. I can go to chase.com, sign in, click on credit journey and see:

This is essentially what you would see on your credit report. Chase also performs some proactive monitoring to look for identity theft and other potential problems. I can choose to have alerts sent to my email, or my phone.

Look for this feature on your credit card. I have similar features on my Discover card. The basic versions of these services are typically free and can keep you out of hot water.

Credit Freeze

No, this isn’t the new treat from Dairy Queen, but it is an important feature offered by the 3 rating agencies. You can go to the Experian, Transunion and Equifax websites, create a free account, and hunt around a bit and you will find the ability to freeze your credit. They make it a little tough to find, because they also offer paid services that include this feature, along with other perks. Hunt a bit and stick with the free one.

When you turn on the freeze, the agency will no longer accept hard inquiry requests for your SSN. This means that no one, including you, can apply for a loan or credit card because when the lender tries to access the rating agency, the request will be denied due to the freeze.

If you do want to apply for a loan or credit card, you will need to call the agency or go back to the website, find the freeze option and turn it off.

It’s a little clunky to manage, which is why they offer paid services for this, but it is an extra layer of protection against identity theft.

How is my score calculated and what can I do about it

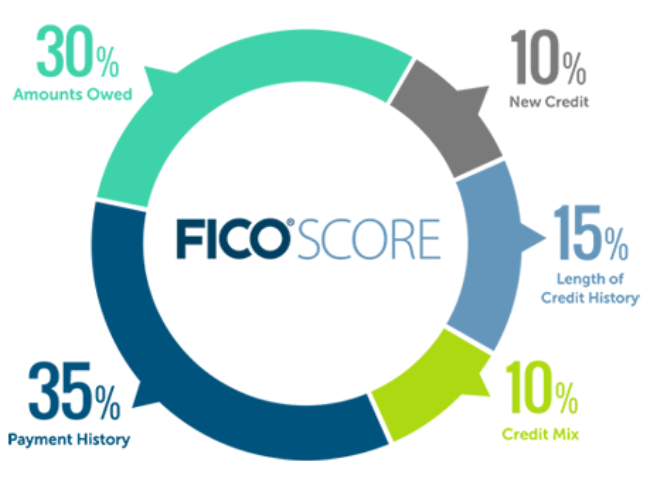

Here’s the good stuff. Let’s look at the breakdown of the FICO score. Remember, there are other scores beside FICO, but they all use very similar methodologies and weightings.

The largest factor at 35% is payment history. When you look at your credit report, you will see a grid for every credit card and loan. It will show every month that the card/loan has been open and a green check or red x showing whether you paid on time or not. Lenders want to see a history of paying on time. Pay your loans on time, even if you can’t pay the full amount.

Next up at 30% is amounts owed. Lenders want to see that you are managing credit well. They look at your outstanding credit balance compared to your credit limit. If you are maxing out your credit, you’ll score low. Having high available credit but low outstanding balances will improve your score. Also, as you pay down the principal on your car loan, mortgage or school loan, your score will improve.

15% for length of credit history. The longer track record you have the better the score. It can be tempting to keep switching credit cards to get card opening rewards, but this will hurt your score. Having a card or loan for a long period of time and making regular on time payments is important.

Credit mix refers to having a number of different types of credit. Having credit cards, a mortgage and a student loan and making regular payments will help you.

New Credit – lenders will be cautious of borrowers who open several new accounts in a short period of time. This can be a sign of a potential credit problem.

Dig into your credit report or your credit card’s app or website and you should see the details to support the calculation. You can see how your credit history impacts your score and maybe get some insights on changes you can make to improve your score.

Quick tip: If you don’t have a lot of credit history, it can be helpful to become an authorized user on someone else’s credit card. Providing that they have good credit, this could help improve your score.

There was a lot here, so let’s recap:

- Your credit score matters. It determines whether you will get a loan or credit card, but it also determines the rate of interest you will pay. A low credit score may cause you to pay hundreds or thousands more over the course of a loan. It may be worthwhile to work on bringing your score up before making a major purchase like a home or a car.

- The rating agencies (Experian, Transunion and Equifax) gather information on your credit history and provide this information to lenders. Be sure to get your annual free copies of your credit reports from each agency and review it carefully.

- Consider using a credit freeze to combat identity theft.

- Understand the factors that go into calculating your credit score and develop an action plan to improve your score.

As always, please let me know what you think and post comments and questions.