In an earlier post on Stocks, I talked about trading v. investing. To me, investing is researching different businesses and choosing to invest in those that I think will pay off in the long-run. I see trading as an activity in which one tries to move quickly in and out of different securities, trying to take advantage of small discrepancies in the bid/ask spread.

Bid/Ask Spread

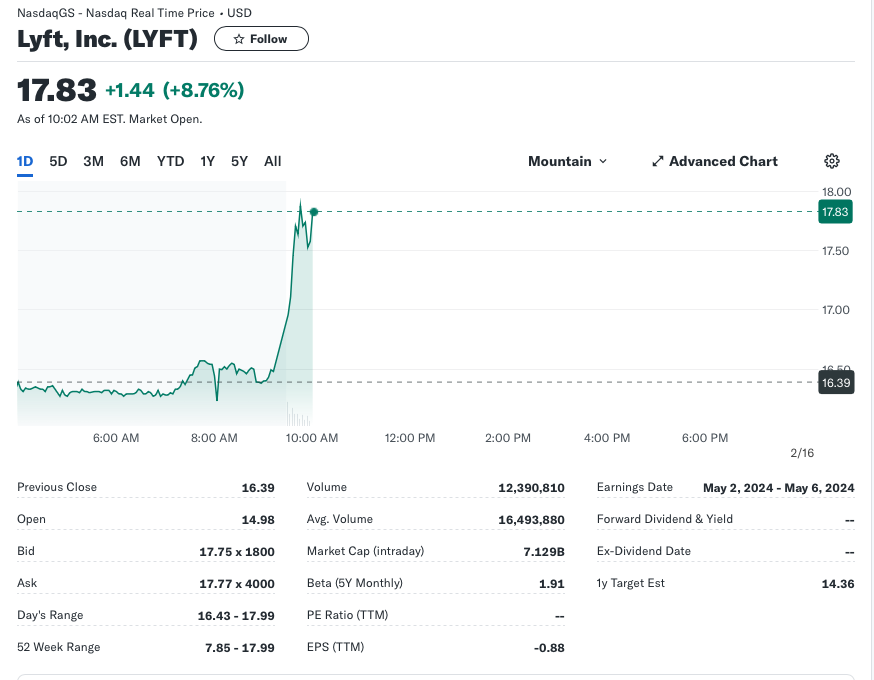

Let me just expand on the small discrepancies thing so you don’t have to read the whole prior post. Securities (stocks, bonds, commodities, options) are traded in an open electronic marketplace. Buyers bid for a security. They announce the price they are willing to pay and the amount of shares they’re willing to buy. Sellers announce the price they’ll sell at and the number of shares they are willing to sell. Take a look at the Yahoo finance summary page for Lyft below.

On the left side below the chart, you’ll see the current best bid and ask. No trading is happening at this moment because there is a 2 cent discrepancy. At some point soon, someone will bid higher and someone will lower their ask, and a trade will happen.

Trading Firms and Computers

Computers generate the vast majority of trades each day. Trading firms (huge organizations filled with experts in math, probability theory and computer science) spend their day writing computer algorithms to allow their computers to analyze huge amounts of data and look for slight discrepancies in the value that the market assigns to a security and what the data tells them. These discrepancies may be only a fraction of a cent, but these firms trade millions of shares very quickly to take advantage of that small discrepancy.

How Can Individual Investors Compete?

My thought in the article on stocks is that individual investors can’t compete with these traders, but can compete as investors by finding great investments and holding them for the long term.

Lyft’s Earnings Release Typo

With that out of the way, let’s get to that example we’ve all been waiting for. It’s Lyft – surprise! Yesterday, Lyft announced their quarterly earnings. In the earnings report, the company had a typo. Lyft stated that its gross margin would expand by 500 basis points (5%) when in actuality, the number should have been 50 basis points (0.5%).

That’s a big oops. Immediately after the earnings release, the Lyft stock price shot up 60% on huge volume. All the computers saw this as a massive change from what they expected and immediately started buying shares which drove the price up.

This overshadowed the fact that it was a pretty good earnings release and shares are up today, just not 60%.

Trading is Hard

A lot of info…the point being that trading is hard. If you are looking to make a profit in trading, it’s not likely that you can analyze a thick earnings release, spot the opportunity (in this case an unexpected – though incorrect – increase in gross margin that made the company’s stock price look more attractive) and trade more quickly than the computers.

These “opportunities” difficult for us humans to identify. Trying to take advantage before the computers get involved and reset the market price is nearly impossible.

Buy and Hold

Trading is hard and it’s high risk. Buying great companies, or low cost index funds, and holding them for many years has been a proven recipe for success.