Dividend Stocks are a compelling investment option. They have the potential for capital appreciation, and they also make regular dividend payments to shareholders.

You can see more detail about stocks and dividends in my post on stocks, but to give a quick recap, stock ownership is ownership of shares of a company. Companies that are no longer in high growth mode often decide to take a portion of their earnings and return it to shareholders. One of the ways they do this is through dividends. The other is through buybacks – we’ll talk about that in an upcoming post.

What is a Dividend?

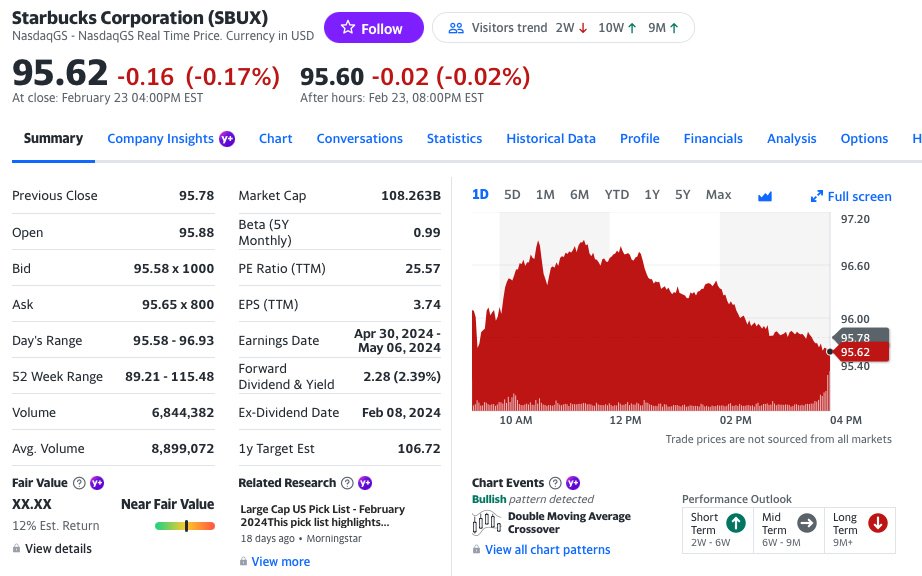

Let’s look at an example. Starbucks is one of my favorite companies. Back in the early 2000’s, it seemed like a new Starbucks store appeared daily along my route to work. The company was in high growth mode. Today, they still are opening lots of locations internationally, but growth overall has slowed. There seems to always be a line at the drive-thru, and when I sit in the store, there is a constant parade of uber eats and doordash drivers picking up orders and taking them to waiting customers. Then there is the billion plus dollars that customers have sitting with Starbucks on gift cards – this is like a zero interest loan for Starbucks. Read here.

Starbucks has transitioned from ultra-growth to cash generation. It can’t spend all the cash it brings in, so it pays a healthy dividend to shareholders. Let’s take a look.

Look for the Forward Dividend and Yield in the right column above. Let’s talk about what these numbers mean.

Forward Dividend

Forward in this context means that it is what the board of directors of the company has authorized for the next upcoming dividend. In the line below, you can see that the ex-dividend date is Feb 08, 2024. We’ll cover the important dates in a minute. Since today is Feb 25, 2024, this means the company has not yet announced their next dividend….they will. This is typically done at the earnings release.

The forward dividend of 2.28 specifies that the company pays its shareholders an annual $2.28 for every share they own. If you own 100 shares of Starbucks, you will get $228.00 in dividends in the upcoming year. Starbucks, like many companies, pays a quarterly dividend so you will receive $0.57 per share each quarter. If you own a hundred shares, that’s $57 per quarter.

The Yield is 2.39%. This is calculated by dividing the divided per share by the price per share ($2.28 / $95.62 = 2.39%). This is helpful in comparing the dividend for your company against other income sources – other dividend stocks, treasuries, high yield savings, etc.

Comparing Dividends

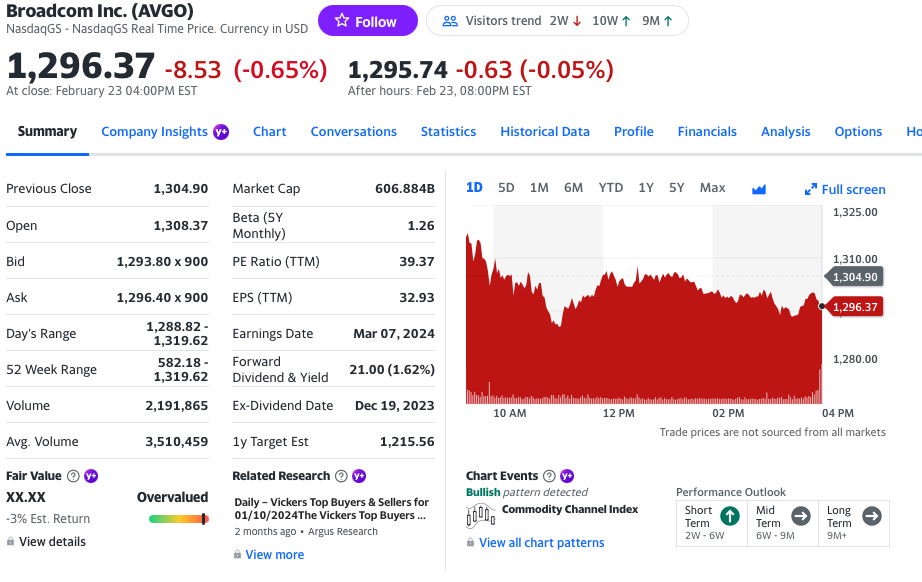

Quick example of why it is important to look at yield instead of the dividend amount, and why Yahoo finance shows you both. Broadcom is another dividend paying stock.

The forward dividend amount is $21.00 per share. How cool is that? That’s way higher than Starbuck’s paltry $2.38. Let’s buy that one. Well hold on a sec. The price of a share of Broadcom is $1,296.37. The dividend yield is 1.62%.

Yield gives you an easy way to quickly compare the return on your investment without doing a whole lot of math.

Dividend Dates

There are 4 important dates relating to dividends that all investors need to know.

- The dividend declare date – this is the date that the company announces the dividend along with the details of the dividend payment.

- The record date – every shareholder of record (owner) at the close of business on the record date is entitled to a dividend payment.

- ex dividend date – this is the first day that the company trades without the dividend included in the company’s assets. This is significant. Starbucks has 1.13 billion shares outstanding. To pay $0.57 for each share, the company needs to take about $750 million dollars off of its balance sheet to make its quarterly dividend payment to shareholders.

- pay date – this is the date that the divided shows up in shareholder’s accounts. Most brokerages give you the option of taking the payment in cash, or reinvesting it in more shares.

Quick clarification: To be entitled to a dividend, a shareholder must purchase shares 1 day before the ex dividend date. Shares exchange hands on trade date, but settlement can take 2 days. If you want the dividend, buy shares the day before the ex-dividend date.

Dividend Yield

I want to go back to dividend yield for a second. It is important to remember that this is an expression of the yield based on the current stock price. Yield is great for comparison when you are looking to buy. It is not however, a representation of your actual return on investment for shares that you’ve held a while.

Let’s look at an example. I bought shares of Starbucks on 8/1/2012 for $22.22 per share. For this current dividend cycle, I am receiving $2.28 for each of those shares, which is 2.39% based on the current price. But I didn’t buy at the current price, I bought at $22.22. The yield on my investment is $2.28 / $22.22 = 10.26%. Assuming the share price increases over time, the yield on your original investment will also increase.

Dividend Payments

Most companies that start a dividend payment, do so with the intention that they will continue paying for the foreseeable future. Many of them strive to be Dividend Aristocrats (companies that have increased their dividend every year for 25 consecutive years or more) or Dividend Kings (companies that increase their dividend for 50 consecutive years or more). Dividends are a way to reward shareholders like us, who are the owners of the company.

Dividend Increases

Companies will also try to increase their dividends over time. This helps them get on the Dividend Aristocrat or Dividend King lists but it is also a way for the owners to participate in the growing profits of the company. Look for companies that have a track record of growing their dividend. These companies are likely to continue growing their payout in the future.

Special Dividends

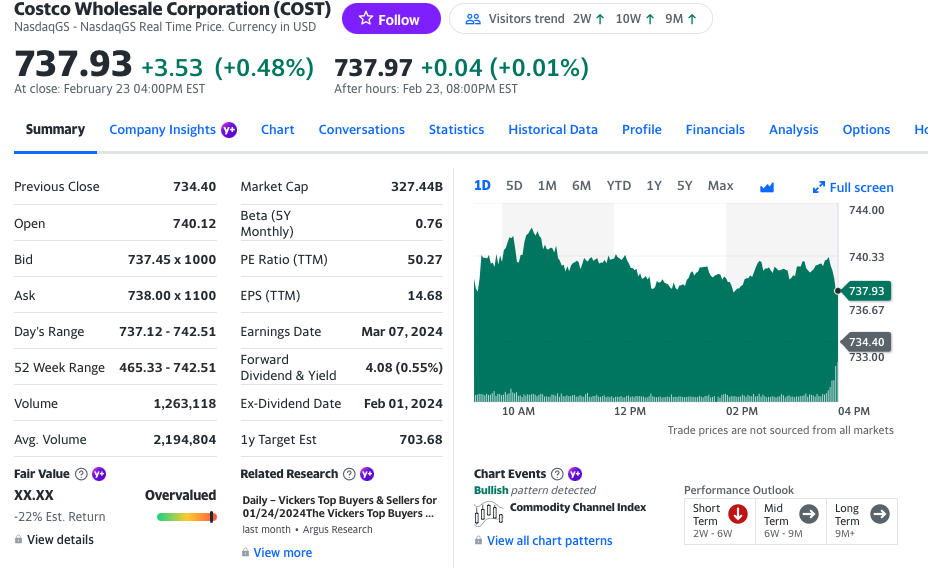

Some companies occasionally struggle with the problem of having too much cash on hand. Lucky them. Costco, the warehouse chain is one of these companies. It periodically pays a special dividend. Special dividends are typically one time payments with no commitment by management to pay a special dividend in the future. The company may also pay a regular dividend. Let’s look at Costco as an example.

Costco pays a small but growing $4.08 (0.55%) dividend. Each quarter it pays $1.02 per share. It’s a nice little payment, but nothing to get excited about when 1 year treasuries are at 5% ish. In December of last year, Costco paid a special dividend of $15 per share. That was pretty exciting. It paid special dividends in 2012, 2015, 2017, and 2020. This is not a dependable revenue stream for shareholders, but it’s a nice surprise and because it has paid these several times, there could be more to come.

Can a Company Afford its Dividend?

I’ve been waiting for you to ask…Good question. One of the key reasons for buying shares of a dividend paying company is to receive a regular stream of payments. As a retiree, I expect my dividend payments to supplement my social security to help me pay my expenses. If my companies lower their dividend or stop paying, I am in deep weeds.

Dividend investors will want to know the payout ratio for the companies in which they invest. Simply put, this is the percentage of a company’s earnings that are being paid out as dividends. Starbuck’s payout ratio is 57.75%. Slightly more than half of its earnings are paid out to shareholders in the form of a dividend. Costco has a payout ratio of 26.99%. All things being equal, Costco’s dividend is probably safer than Starbucks because Costco is paying out a much lower % of its earnings.

What is a Safe Payout Ratio?

Everyone has an opinion on this – below 75%, around 50%, 45% is safe…but what seems to be most common in all cases is that payout ratio needs to be assessed along with other aspects of a business. Utilities like Con Edison, are in a regulated industry and as such have a much more dependable revenue stream. These types of companies may be more comfortable paying a higher % of earnings as dividends.

We also need to look at a company’s balance sheet. A company that doesn’t carry much debt and has a lot of cash can afford a higher payout ratio. A good rule of thumb is to compare within the same industry while considering the cash on hand, and debt.

Variable Dividends

For those who aren’t yet confused, let’s talk about variable dividends. Devon Energy breaks its dividend into 2 components. It has a base dividend and a variable portion that is assessed each quarter based on the company’s profits. Shareholders know to expect that the dividend could change significantly from quarter to quarter. If you are not aware of this going in, you could be in store for a letdown when the payment you were depending on suddenly drops.

REITs

Real Estate Investment Trusts deserve their own post so stay tuned. For now, it is important to know that they are like a mutual fund. A REIT is a company that owns income producing real estate. REITs are required to pay out 90% of their taxable income as dividends. Investors typically don’t expect as much capital gain from REITs but will expect a high and consistent dividend payment.

Are Dividend Stocks Safe?

I’ve used a lot of language that may imply safety. Investors expect consistent dividends, or investors don’t expect much capital gain. Expectations are not promises. You may see a capital loss. Solid companies like Disney, Texas Roadhouse, VF Corp and others have cut or suspended their dividends. While assessing payout ratio and a company’s balance sheet will give you a good indication of the safety of the dividend as well as the health of the company, there is risk involved. The dividend is not guaranteed and the company could lose value or go out of business. Do your research and diversify.

The Monthly Dividend Company

As I neared retirement, I realized that I needed to transition from an aggressive growth investment strategy to a more conservative strategy. I sold some growth companies and bought some dividend-paying companies. One of the companies was Realty Income. Realty Income is known as the monthly dividend company, because unlike many of its peers, it pays its dividend monthly instead of quarterly. Realty Income (a REIT) has raised its dividend for 29 straight years and currently has a 5.8% yield. What’s not to love, I went all-in.

Realty Income was one of several dividend paying stocks that I chose, but, where I usually buy a little, watch and wait, and buy more, I viewed this as a safe income generating investment and invested more than I typically would.

Another Lesson – Free For You, Not So Much For Me

About 2 years ago, I was introduced to sky-high inflation for the 1st time in my investing career. I’ve been investing actively for over 20 years, but inflation has been pretty tame. Here’s what I learned.

Low inflation = low interest rates

When inflation is relatively low, the federal reserve keeps interest rates low. This adds to the money supply because borrowing is cheap, companies and people borrow more and thus spend more. Interest rates are low so yields on treasuries, bank accounts and high yield savings account are low. I remember renewing a CD at 0.5%. Yuck!

In a low-interest environment, dividend payers are expensive

When there are few fixed income securities (read here for more about fixed income) yielding a decent rate, dividend paying stocks trade at a premium. If a stock is paying a 4% dividend, there may be more risk than the 0.5% CD or treasury but investors are willing to take that risk. There is more demand in the market for these dividend paying companies than there is supply. The price goes up. Often beyond what is reasonable, given the company’s financials. Here’s where I bought.

This can change quickly

In comes inflation. In no time at all, the fed has increased rates several times and 1 year treasuries are paying 5%. Demand for dividend paying stocks goes down, and with it, the price.

As an investor, if you have the choice of buying a 1 year treasury bond, backed by the full faith and credit of the US government, or a dividend paying stock, whose price is dropping, which do you buy? Easy choice.

Inflation is bad for us, and bad for business

In addition to the demand problem, higher rates and higher costs are bad for business. Electricity, raw materials, transportation, loan interest – everything costs more for these businesses. That means we need to reassess our growth and profitability projections to account for substantially higher expenses with the same, or in many cases, lower revenue.

Back to Our Example

Our hero – Realty Income – is in a tough spot. I bought at $77 per share in January 2020, shortly after I retired. Its financials and business model looked solid and its stock price chart looked great for a high dividend paying company.

For all the reasons we discussed above, Realty Income now trades at $52.94 per share. That’s a solid 30% drop for me. Not cool.

However, don’t forget the 5% dividend. I’ve held this for 4 (long) years so I’ve gotten 5% per year – so almost 20% in dividend income. That goes a long way to offsetting the loss. It’s also quite comforting to see the dividend deposit into my brokerage account every month. It’s like getting paid.

In the case of Realty Income. I’m sticking with it. It has solid tenants who tend to renew their leases, It has net lease agreements which means the tenants are responsible for maintenance cost on the properties, and it has a pretty solid balance sheet. It also continues to raise its dividend. I expect its stock price will recover as inflation recedes, but this will be a watch point for me. It may not.

Recap

Dividend stocks can be an attractive investment choice. Building a diverse portfolio of income stocks, coupled with fixed income securities can create a relatively steady income stream. But, as with any investment there are risks. Capital losses, dividend cuts or elimination of the dividend can eat into your earnings.

For those who like the idea of dividend stocks, but don’t want to choose individual companies on their own, there are funds like the Vanguard High Dividend Yield Index Fund (VYM) which has a 0.06% expense ratio and a 3.09% annual dividend yield and is made up of companies like ExxonMobil, JP Morgan Chase, Proctor and Gamble, Walmart and many other dividend paying blue-chip companies.

Thanks for reading and let me know what you think.