In order to build wealth through investing, it is important to have the right mentality. In this post, we’ll dive into some historical data to better understand market trends and help us remain steady through market volatility.

In prior posts, we’ve talked a lot about the mechanics – how markets work, asset allocation, stocks and bonds…and while it is important to understand how these things work, it is equally important to understand how you feel and how you react to market volatility.

Most Investors Trail the Market

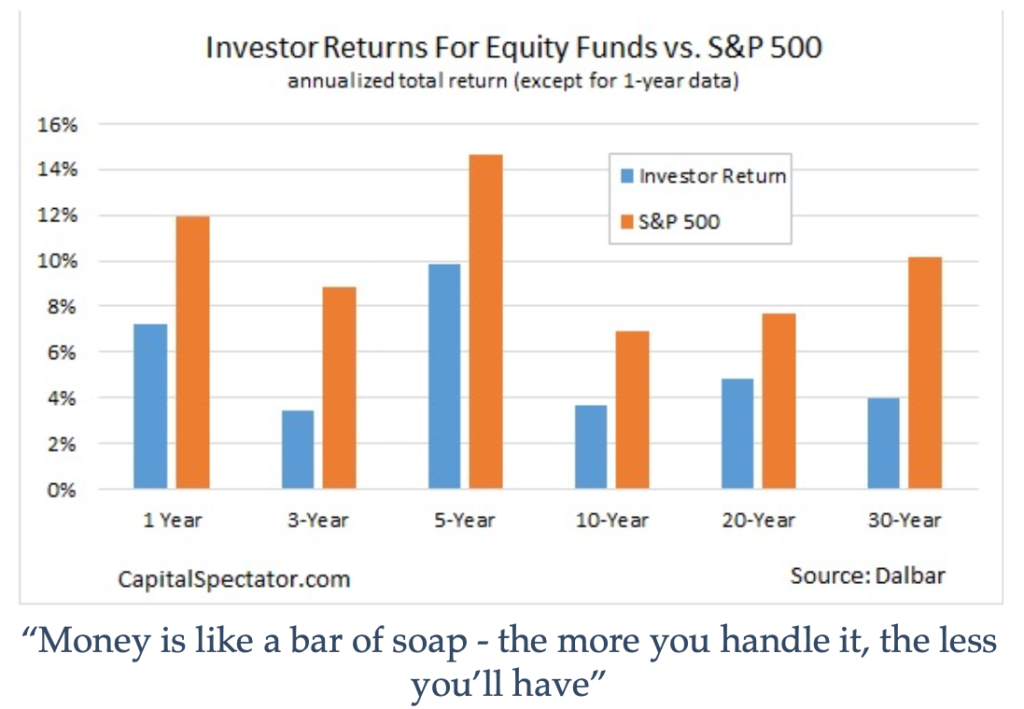

Let’s start with a picture borrowed from our friends at capitalspectator.com and Dalbar. The chart below shows us that the average investor significantly trails the S&P500. Why? I gave you the answer in the quote below the chart.

Many of us chase the hot fund. Whether it’s in our 401k or our brokerage account, we hear about how the xxx fund has crushed the market. We want in so we sell what we have and buy xxx.

Fear/Greed Cycle

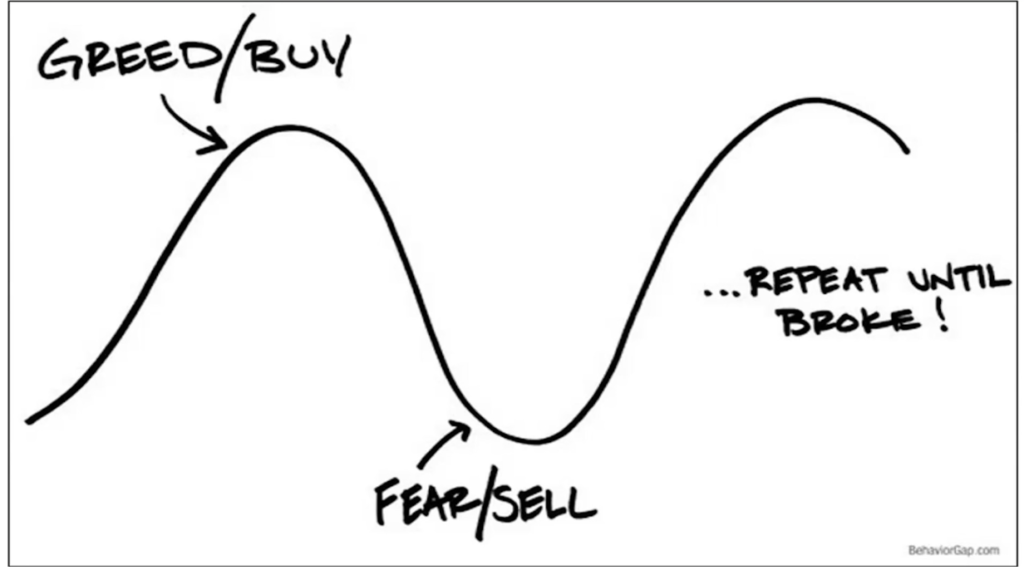

While we like to think that we’re rational people, most of us are driven by emotion. This is especially true when it comes to our money. We want to own the hot fund even though it is rare for a fund to be a winner 2 years in a row. When the market is up, we’re energized by the growth in our portfolio. We’re optimistic so we buy more. When the market is down, we’re pessimistic. We’re afraid because our balance is down and the money we need for retirement, college, braces or a vacation is at risk. Sell now before it gets worse.

You’re Not Alone

Every single investor has the same emotions. We all feel exactly the same way. The difference is how we act on these emotions.

“Be Greedy…”

We’ve all heard the Warren Buffet quote “Be greedy when others are fearful and be fearful when others are greedy.” This is somewhat taken out of context and it causes a lot more problems than it solves.

Here’s The Full Quote

“What we do know, however, is that occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Be Wary of Quotes

“Sell in May and Go Away”, “Be Greedy…” whatever the quote, if your investing thesis is based on a quote, you’re probably not going to crush the market.

Halftime Pause

Let’s take a pause. My goal is not to discourage you, but I did want to set up what comes next. The key point to remember is that whether you are a new investor or an experienced investor, we all feel the same emotions. We all want to own the hot stock or fund, we all panic when our balance is plummeting, and we read quotes from great investors and try to implement them only to end up worse off.

Up next, the good news. Laziness prevails! Not entirely true but not far off. Read on for examples of how staying the course often wins in the long run.

The S&P 500

The S&P 500 is a stock market index. It is basically a list of the 500 largest publicly traded US companies and their market cap. Larger market cap companies have a higher weighting in the index. Apple, Alphabet, Microsoft, Amazon and NVIDIA have grown so huge they have an outsized weighting in the index, but that’s a story for another day.

In the upcoming examples, we’ll look at the S&P 500 index because it is a good representation of American industry and as investors, it is easy for us to invest in the S&P 500 through a mutual fund or ETF.

We’ll also talk about the S&P 500 performance with dividends reinvested. Today the S&P 500 index components pay an overall 1.3% dividend. If you hold an S&P 500 fund, you will receive 1.3% in annual dividends. If you choose to reinvest that dividend to buy more fund shares, historically, you would have had a roughly 10% annual return since 1926. Click here for a calculator that you can use to see returns over different periods.

S&P 500 Performance

See chart below showing the S&P 500 historical performance. It looks great.

Some minor ups and downs, but all-in-all, it pretty much goes straight up. Buy and hold looks easy.

Return by Year

Full chart here from slickcharts. This shows a different view of the same info. While we average 10% annual return, there are lots of ups and downs on the way. More blue than red so we’re up more than we’re down. Looking at the red, there are some big down years. 1999 was a tough year to get into the market. 3 down years in a row. A few years we had over 40% return. And lots of years are over 20%. But there are at least a dozen times that the S&P 500 pulled back more than 10% in a year.

Even if you knew that the market would return on average 10% per year with dividends reinvested, you would have some very challenging periods along the way. Investing isn’t easy.

Volatility

The S&P 500 is volatile. While it tends to rise over long periods, there tend to be pullbacks of 10% or more fairly frequently that will test our mettle (i.e. the quality of our character). And while there are many in the industry who can explain the reasons why a pullback occurred after it happens, very few spot it in advance and those that do are rarely right 2 or more times. No one that I know of predicted the World Trade Center attack on 9/11/2001, or the COVID crisis in 2020. Both of these sent markets plummeting. Christian Bale predicted the 2008 crash in the Big Short but no one believed him.

Investor Mentality

Hey, that’s the name of the post…but yes, having an investor mentality will help you navigate through volatility. Let’s dig in to some of the things that will help.

Optimism

Billy Mumphry was a cock-eyed optimist, but you can’t afford to be. As an investor you need to balance optimism with a healthy dose of skepticism. That said, investing starts with optimism. I just finished watching a History channel special on Vanderbuilt, Rockefeller and Carnegie. It was incredibly inspiring to see how these men saw the future, took huge risks and built the modern America we live in today.

I see the same today. Look at the innovation that is taking place. I remember in high school when the kid next to me got a digital watch. Kids lined up to take a look. It was a watch, a timer and an alarm. It was like black magic. Today I have an iPhone that pretty much replaces every piece of technology I’ve owned over the past 60 years.

Have a Thesis

In a prior post, I wrote about creating an investment thesis for a company. This also extends to mutual fund, ETF and bond investments. Write down the reasons to invest, and the risks/areas to watch.

If I’m buying an S&P 500 fund, the thesis for me is simple. While the iPhone may not be getting as many wow features as it had in the past, the tech revolution is far from over. My car watches for front end collisions and warns we when I get too close. If I don’t react, it hits the brakes. NVIDIA gets all the headlines but chipmakers are on fire. Broadcomm, Taiwan Semiconductor, and Intel are all up big based on huge demand. My Amazon order shows up next day now. What does that say about logistics – warehouses, trucking, planes. I’m optimistic about the 500 largest US companies.

I have some watch areas. Inflation is not going away soon. Try buying bacon. Until we get inflation under control, the economy, and the American people, will suffer. The national debt is staggering. We’re at 34 trillion and growing fast. Read my post here for more.

I have watch areas, but I’m optimistic about the S&P 500.

Commitment

For me, commitment to my investments comes from having a thesis and sticking to it. Doing the research and the reading to create a thesis on the US economy, a mutual fund or a stock, provides the reasons that I am committed to holding a stock for the long term. I was able to persevere through Amazon’s wild ride over the last 15 years or so because they have remained true to their principles.

Amazon has always wanted to be the most customer centric company on earth. Read here. This guides their decisions and when investors were clamoring for profits and were disappointed when Amazon continued to reinvest all of its earnings and more into the business, I was able to hang in there because my thesis hadn’t changed. My commitment grew stronger and I would buy a few more shares every time disappointing earnings came out and the stock pulled-back 10 or 20%.

Read, Research and Test, But Don’t React

For me, investing is a hobby. I like to read about companies and markets. I research new ideas. I build lots of spreadsheets to test my theories or to analyze my performance. I try to minimize my trading. I strongly believe in the quote above: “Money is like a bar of soap – the more you touch it, the less you’ll have.”

In my post here, I talked about how one of my favorite stocks pulled back big on a down day in the market. I was getting ready to buy more when I decided to look at the stock chart on yahoo. I noticed that even though it was down more than 10%, it was still up from just a week ago. It really wasn’t a bargain price. Never make a decision in the heat of the moment.

When All Else Fails, Be Lazy

I know a lot of people, and I was one for a long time, who have much more important things to do with their lives than worry about the day to day gyrations of the market. In my first real job out of college, I started investing in my 401k. I set up payroll deduction and didn’t look at my account again until I left the company 12 years later. I was busy. I didn’t have the time or the interest. In most cases, if you buy low-cost index mutual funds and hold them over long periods of time, you will beat the average investor.

Wrap-Up

Hopefully the pictures helped. There is a lot here. The important point to remember is that every investor is feeling the same thing you are. When our balances go down and we’ve got bills to pay, college coming and retirement getting closer and closer, we all feel some panic. That’s OK. Have a thesis, be committed to your investments, and don’t react. It also helps to have some money in cash and fixed income. Read the post on saving, and the post on asset allocation for more details.

Let me know what you think.