It’s annual report season. If you hold stock in more than a few companies, prepare to be inundated with emails from your broker with links to annual reports and proxy materials. In this post, we’ll talk about what this means and why this is a great opportunity to dust off your thesis, do some company research and establish a new perspective on each company in your portfolio.

Vote Now!

That’s what the email looks like in my inbox. What is this? As a part owner of a company (yes, that’s you if you own even 1 share of stock) you will be invited to the company meeting and will be asked to vote your shares on important topics. The email will contain a link to the proxy vote materials which will tell you what you need to know in order to vote. Typically, proxy materials will provide an overview of the past year’s accomplishments, tell you who is on the board of directors and their backgrounds, and share details on any resolutions that you’ll be asked to vote on.

Annual Report

Accompanying the proxy materials will likely be an annual report. This will contain commentary from management on the past year, financial trends, and a detailed financial statement.

That’s a Lot to Read

Yup. I’m a shareholder in 70 companies, and I’ll receive well over 100 pages of material for each. Do I read every word? Nope. But, there is a lot of important information that I look for. I’ll talk a little bit about the research process for the companies of which I own shares. For me, it is important to categorize the companies in which I invest. This helps me allocate my company research time.

Top 10

I have several different ways to categorize the companies I own and the companies I follow (Companies in which I’m interested and might want to own at some point). The first and most important category is my top 10. The companies in this group are Amazon, Netflix, Apple, Google, Visa, Waste Management, Starbucks, Nike, Berkshire Hathaway and Costco.

These 10 companies I follow regularly. I follow news reports, I periodically review company research reports on my brokerage website, and they are talked about regularly on my favorite investor podcast.

These companies also make up more than half of my stock investment. The other 60 companies make up less than half of my total stock investment.

I spend a lot of time on the reports. I don’t read every word but I want to see that the message is consistent with what I’ve been seeing in the news and in investment reports. I’m interested in management’s insights.

Note that I said these companies make up more than half of my stock investments not equity, because I also hold a significant portion of my equity investment in low-cost S&P 500 index funds.

The Rest

The remaining stocks are grouped into more industry-standard groupings like Growth, Growth & Income, Income, REIT, etc.

Depending on the category, I will be looking for different things in the reports. And what I look for should align with my thesis for investing in the company in the first place. But, I am always learning something new, so it is a great opportunity to go back and update my thesis. The categories are:

Growth Companies

This is an easy one. I’m looking for growth. The value proposition for a growth company is that it will grow sales, customers and cash flow faster than its competitors and will, at some point, achieve profitability. The annual report usually will show you a very simple chart that shows these metrics year over year. There will also be commentary about the company’s progress on their journey toward profitability. If there is not, that’s a warning sign. If profitability is getting further away, that’s trouble too. Trouble is not necessarily a reason to sell, but update the watch areas in your thesis and check quarterly earnings updates for progress.

Income & REIT

Income, Growth and Income & Real Estate Investment Trust (REIT); I have a similar approach for this group. I’d like the stock price to go higher, but I mainly invest in these companies for the dividend. I’ll be patient in my capital gain expectations, but I expect a healthy dividend and regular dividend increases. Share buybacks are nice too. In order to support dividends and share buybacks, the company needs to be growing free cash flow and managing expenses. There should be charts and commentary to support this.

What Else?

What else is worth a read? I like to look at the management commentary. These companies, and the leadership have valuable insights into the global economy and the markets they serve. What are they seeing? What’s important enough to them that they feel the need to call it out in the annual shareholder report?

I also like to see who’s running the company. I like to look at the background of the officers and board members. What experience do they bring?

Sherwin Williams

I own a mid-size position in Sherwin Williams. Back in 2017, I was looking into home improvement. My wife and I spend a ton in this category, as do many of my friends and neighbors. Home Depot and Lowes seem to be doing pretty well based on the lines at the registers. I’ve been an investor in Home Depot since 2015 and have been quite pleased. Sherwin Williams caught my attention and I bought some shares.

I have to admit that with streaming, search, online commerce, cloud infrastructure, and lots of other cool and exciting areas in which I invest, paint was not getting the attention it deserved. Today when I looked at the proxy materials and annual report, I was a bit surprised.

First of all, Sherwin Williams has been around since 1866. That in itself is impressive. It also has over 60,000 employees. I hadn’t realized it was this big. I went back and looked at my positions. I bought some in 2017, but then bought more in 2021 (2 times). I’m up 200% on the 2017 investment and the 2021 investments are up about 50% each. The first purchase beat the market by 93 percentage points, the 2nd group beat by 15 percentage points.

How’s Sherwin Williams Performing?

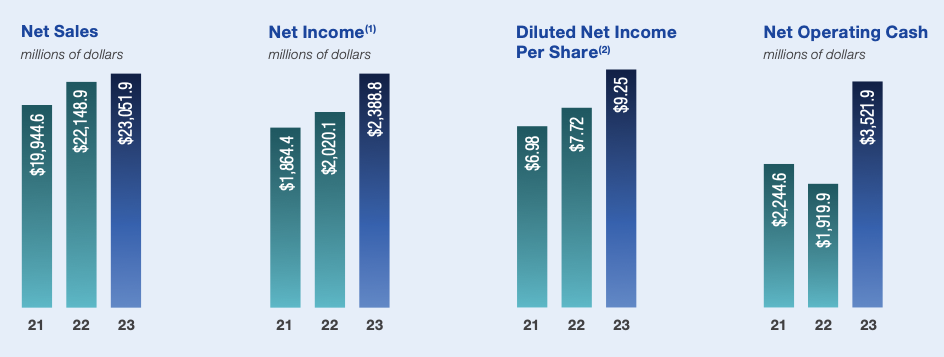

Sales, income, earnings and cash are all moving in the right direction. This was a relatively small investment for me, and I’m embarrassed to say, I haven’t paid much attention.

This is one to watch. All businesses run in cycles. We don’t know when these cycles will start and end, but very few stocks go straight up. This is one for which I will set a price target and wait for a pullback of 20%. It may never happen, in which case, I’ll enjoy the growth in the shares I have, but if it does, I will be ready to buy more. The key is, I am now following this company a lot more closely.

Wrap Up

The key takeaway here is to at least take a look at the proxy materials. Don’t just delete the email.

Read the proxy vote. It will probably be an election of the board of directors, an extension of the external auditor, and maybe a resolution on executive pay. But there may also be some shareholder resolutions to vote on. Read the summary. Some you may feel strongly about. Vote your shares.

Take a look at the annual report. Read what management has to say about the company, the industry, and the global market. These folks have information and connections that are not available to most of us. What they choose to write about is valuable to us as investors. Look at the performance. Also test what the company announces v. your investing thesis.

Read one and let me know what you think.