This morning, I checked my brokerage account and found an $814.57 gift. As a retiree, I rely on investment income to help fund my spending. The $814 really wasn’t a gift, it was a quarterly dividend payment from one of my companies, but it feels like Christmas. Let’s dig in.

What Happened?

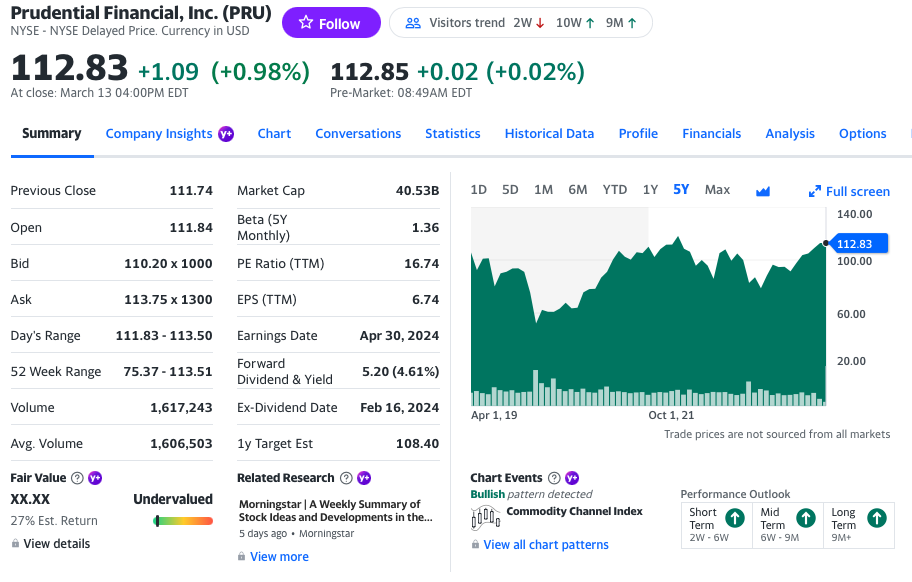

Prudential Financial, ticker symbol PRU, is a US financial services company that was founded in 1875. It offers insurance and investment services. I won’t take you through my thesis for Prudential, but it is a company I like for its income potential. On March 13, Prudential paid its quarterly dividend.

Prudential

Let’s focus on the dividend. Prudential currently pays $5.20 per share annually in the form of a dividend. I own 633 shares, so I will receive $3,291.60 each year. Prudential, like many other dividend payers, makes quarterly payments, so I get a little over $800 each quarter.

Yield

Next to the forward dividend of 5.20, you will see the yield of 4.61%. This is a simple calculation. Dividend Payment ($5.20) divided by Share Price ($112.83) = 4.61%.

Actual Yield

The Yield that is published here is the yield based on the current share price. However, if you bought shares at a different price, your yield is based on your share cost, not the current price. Let’s look at an example.

I bought 200 of my Prudential shares on 11/19/2021 at a cost of $106.54 per share. I received $5.20 for each of these 200 shares. My personal yield on these shares is Dividend Payment ($5.20) divided by Share Cost ($106.54) = 4.88%. I got the same $5.20 per share, but it is based on a lower (than today’s price) cost basis.

Quick aside: Actual Yield becomes really cool when you hold a stock for a long period of time and the price increases. Example: I bought AAPL at a split-adjusted $4.49 per share in 2008. AAPL pays a $0.96 per share dividend for a small yield of 0.56%. My yield is 0.96 divided by 4.49 (my cost) = a whopping 21% yield on my investment.

How Do I Get $814?

Back to the Christmas story, how did I end up with $814 today? I hold 633 shares. I bought them at various times over the past few years for a total cost of $59,727.40. That’s a pretty big investment. Let’s talk about risk.

Risk

$814 per quarter or $3,291 per year sounds awesome, sign me up. But wait, what’s the risk? Good question.

Investing in a company like Prudential for its dividend is different than buying a treasury bond that pays a 4.6% yield, or putting your cash in a CD that yields 4.6%.

A treasury bond is backed by the full faith and credit of the US government. It is viewed as one of the safest investments and it is highly likely that you will get 100% of your investment back when the treasury bond matures.

A CD is backed by both the issuing bank and by FDIC (Federal Deposit Insurance Corporation). Even if the bank goes under, FDIC insures deposits up to $250,000.

However, in buying Prudential or another dividend paying company, you risk both your principal and your dividend payments.

Principal Risk

Prudential is a publicly traded company and its stock price is determined by supply and demand, the bid/ask as we discussed in our post on capital markets here.

The good news is that it can go up. Prudential could improve its sales and earnings and the price could go higher. If interest rates come down, that 4.6% dividend will look better and better to investors and that will likley drive demand and a price increase.

Prudential’s stock price could go down. If interest rates go back up, the dividend is less attractive. PRU also holds a large chunk of bonds. They are a secure investment for an insurance company, but their prices can sink in an increasing interest rate environment. This could drive the price of PRU down.

Dividend Payment Risk

Companies strive to maintain their dividends and even increase them. Read our post on dividend stocks to learn more. In tough times, however, some companies will cut their dividends to keep the business afloat. This has happened with several companies I’ve owned, including Intel, VF Corp, and Texas Roadhouse.

Risk Mitigation

Investing in stocks is risky. While the S&P 500 has increased on average 10% annually (with dividends reinvested) over the last 100 years or so, there is no guarantee that any individual company will grow over time. Many companies have failed. Companies can go bankrupt (remember Yellow, the trucking company?). So we need to manage our risk.

Do Your Research

Look into company financials, performance, dividend track record, payout ratio… Do your research and create a thesis. Evaluate your thesis against company results during quarterly earnings releases.

Diversify Stock Holdings

Buy shares in many dividend paying companies. I hold more than 20. Prudential is one of my largest income positions. I think the company is solid, and I think the share price will recover when interest rates decline. But it is an oversized income position for me. I’m watching closely, but boy is it nice each quarter when $814 shows up in my account. Not so nice when the share price fell to $77 in 2023.

Buy Mutual Funds

While I love to research companies and I’m confident that I can beat the market with my overall stock portfolio, this is my financial future, so I hedge my bets with healthy doses of mutual funds – mostly low-cost S&P 500 funds. There are also lots of dividend-focused mutual funds that aim to provide a higher than average dividend yield. Either way, investing in mutual funds takes some of the pressure (and risk) off of stock picking.

Keep a Large Fixed Income Position

Fixed income investments provide a guaranteed rate of return and will return your principal investment in full at maturity. Depending on the fixed income instrument you choose, there could be more or less risk involved. A CD or Treasury is fairly low risk, while a high yield (also known as “junk”) bond could be high risk. Read the posts on bonds and asset allocation for more details.

Wrap-Up

While there is nothing better than waking up and finding a fresh new dividend payment under the Christmas tree (or brokerage account), there is risk involved in the underlying investment that provides the dividend payment. We’ve discussed ways to mitigate this risk so that you can enjoy the dividend payments while maintaining a balanced portfolio.

Thanks for reading and as always, let me know your thoughts.

Good “stuff” Brian!!