Can I retire comfortably? That’s the big question. Let’s dig in and talk a bit about what it means to retire comfortably and how we determine if we can in fact achieve our goal of comfortable retirement.

Credit to my Saturday morning coffee buddy Rich, this was his topic. This is a popular discussion topic among many of my friends so I hope it is helpful. First, let’s talk about a comfortable retirement.

A Comfortable Retirement

It seems I’m constantly reading about another billionaire who’s bought a new island or a massive yacht. The news and social media parade this stuff in front of us non-stop. Is that what a comfortable retirement is?

I remember when I started my first real job out of college, many of the folks my age were competing to build or buy the best house. It seemed each of my friends was building a bigger house than the last guy. While for many of us, it is in our nature to compete, and we seem to always want the new hot thing that we see in the news or on social media, step one in planning a comfortable retirement is sitting down and thinking about what you really want.

Retirement Goals

I’d like to get out of the cold. I live in New England. Last year, my wife and I spent a good part of the winter in warm weather. This year we stayed home. I’d like to get away someplace warm every year, but every other year is OK.

I like to play golf. Not every day, but 1 or 2 times a week. I like to try different courses and when I get an opportunity to play a really nice course, I’d like to be able to.

My wife and I have done a lot around the house. We’ve built gardens and patios and there are plants as far as the eye can see. I expect we’ll continue to spend on our home.

You get the point. Spend some time thinking about what you want to do and how much those things will cost. Make a list.

Expense Inventory

If you read the post on budgets here, you already have this. If not, you need to know what you spend. Get your credit card statements for the past year, your check ledger, or download transactions from your financial accounts (bank & credit card) and start a list.

List out your recurring monthly bills: Electricity, Mortgage/Rent, Phone, TV and/or streaming services….

List out things you pay off-cycle. I pay my insurance annually, but I need to save for this so that I have the money when it comes due. What else?

Finally, account for new expenses post-retirement. Will you have to pay for your own health insurance? Will you need long-term care insurance?

Budget

An expense inventory is good, but for everyone, and especially for those nearing retirement, you need a budget. You get to make all the decisions about where your money goes. You need to have a budget on paper that accounts for everything that comes in and everything that goes out and prioritizes where you spend.

Account Aggregator

For those nearing retirement, especially if you have multiple credit cards as well as other accounts, I highly recommend an account aggregator like Fidelity Fullview or Credit Karma (was Mint.com). These sites pull all of your account transactions together in one spot, categorize them and allow you to do some analysis on your spending. Read the account aggregator section in the budgets post for more details.

Income Inventory

What will you have for income in retirement?

Pensions

Some lucky folks will have a pension. Congratulations. Very few companies still offer defined benefit pension plans. Many state, local and federal government jobs do, but pensions aren’t as common as they have been in the past. If you have one, contact your HR department to find out what the terms are. In many cases, pension participants will receive regular monthly payments from age 65 until death, but make sure you understand the terms, as well as any decisions you’ll need to make (like spousal benefits)

Social Security

For many of us, Social Security will be an important part of our retirement finances. We’ve been paying into Social Security via payroll tax for our entire careers so we expect we’ll see some benefit when we retire. If you have not already done so, create an account at ssa.gov. There is a ton of important info here. You can find out if you have enough credits to be eligible for social security, you’ll see your expected monthly benefit at age 62, 67 (or your full benefit age), and 70.

Investment Income

There are 2 big questions here.

- How much will I have in my investment accounts when I retire?

- How much can I take out of my account to live on without running out of money?

Let’s take these one at a time.

How Much Will I Have?

You’re going to have to make some assumptions on this one. But the web is full of calculators to help you figure out a range of what you might have. Here’s one I like from acorns.com

It’s pretty simple to find what you have now, and decide how much you will contribute. If you have a 401k or other defined contribution plan, you’re probably making a contribution today from each paycheck. Nice work!

The tough part is the average annual return you should expect. Let’s talk about this.

Average Annual Investment Return

What can I expect for return on my investment?

If you’ve read some of my other posts, I talk about the S&P 500 and how it has an average annual return of 10% with dividends re-invested, over the past 100 years or so. If you want to understand more about your investments, take a few minutes and read the posts on stocks, mutual funds and bonds. You may also want to check out here.

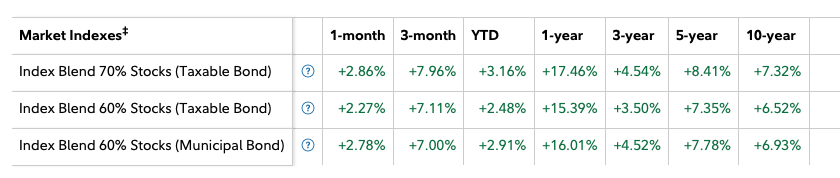

I borrowed a table from my brokerage website (thank you Fidelity!) that shows the average annual return for a portfolio with various make-up (asset allocation) of stocks (equity) and bonds (fixed income). Based on this, I felt pretty good about using 6% as a conservative estimate in our projection. But I encourage you to pick a low number and a high number and see what the range looks like.

Gathering this info and using the acorns calculator should give you a pretty good idea of what you may have in a range of different scenarios.

How Much Can I Take Out?

We want to be able to take money out to fund our spending, but we recognize that we need the money that is invested to continue to grow to fund future spending needs.

The 4% Rule

The 4% Rule is a pretty common piece of retirement advice that has been around for a long time. While I am suspicious of most rules, I think it is a pretty good starting point to assess how much you can safely withdraw on an annual basis. The rule states that you can take out 4% of your retirement account value in the first year. In subsequent years you can withdraw that same amount, adjusted for inflation. This should last you 30 years. Here is some more detail about the rule from investopedia.

In the above example, I have $536,228 at retirement. 4% of that is $21,449. I could take out $21,449 in my first year. In my second year of retirement, assuming a 3% inflation rate, I could take out ($21,449 + $21,449 X 3%) $22,092. In the third year, I would adjust the $22,092 for inflation and so on for 30 years.

How Solid is the 4% Rule?

If you read the investopedia article, it suggests you may want to shoot for 3%, It also gives some history on how the 4% was derived. Nobody knows. I suggest using both and coming up with a number of scenarios both for your expenses and income.

Put It All Together

We now have:

- Retirement Goals – things that we want to do in retirement and a rough budget for what they’ll cost

- Expense Inventory – what are you spending now? Some retirement experts claim you’ll spend less in retirement. I’m not convinced. To be safe, I’d say plan for what you spend today.

- Income Inventory – what’s coming in each month? A Pension check, Social Security, and your ranges of estimates for investment income.

Now, put it all together into a rough annual post-retirement budget. Will your income cover your living expenses as well as your retirement expenses?

If yes, congratulations!

If no, then it’s time to think about adjustments.

Adjustments

If you’re young, and retirement is many years away, you have time to save more and increase retirement plan contributions. Check out the post on saving.

If you’re young at heart and nearing retirement, you’ve got fewer options. Saving more is always a good solution. Sharpen your pencil and go through your budget. Make sure you are prioritizing your spending appropriately. You need to maximize the value of every dollar you spend. This doesn’t mean eating cat food, but make sure you’re spending on the things that are most important to you – and at this point, saving should be at the top of that list.

If saving alone won’t get you where you need to be, it may be time to consider downsizing your home, moving to a new location with a lower cost of living, or maybe a reverse mortgage on your home. You may want to consider delaying retirement or thinking about a part-time job post-retirement. For a while, I sold cars part time after retiring. It was fun to do something totally different, I just couldn’t handle working every weekend.

Planning Tools

Before we leave the topic, I wanted to offer an alternative. There are lots of tools on the web that provide retirement planning help. I’ve used the Fidelity goal planner, which you can find under the planning tab on their website. These tools help you gather all the information we’ve talked about here and will make some projections based on the information you enter.

Wrap Up

The decision to retire is a big one. While I wouldn’t say that it is an irreversible one, you may have fewer opportunities if you choose to go back to the workplace in your 60’s than you would have had in your 20’s, 30’s, or 40’s. It’s certainly better to do some up-front planning to ensure that you are confident about your decision. Following the steps here, pulling together your income and expenses, including your retirement goal expenses, as well as your healthcare and other retirement expenses will give you more confidence. While no plan is perfect, and unexpected changes and challenges can come along, making adjustments to your plan is fairly easy.

I have a retirement plan, like the one we discussed here, and I refresh it at the end of each year. Things change all the time. It’s better to make adjustments now than to find out years later that your plan has gone off track.

Rich, thanks for the topic and I hope this has been helpful. Let me know what you think.