This morning, CNBC Reported that Nvidia is in correction territory. Read here. Nvidia, ticker: NVDA, has been in the news quite a bit lately. It’s one of the “magnificent 7” stocks that has had a tremendous run-up. Does this mean that run is over? It’s in correction territory, do I buy more, have investors lost all of their gains?

I’ll cut to the chase. This isn’t news and while I sympathize with sites like CNBC that need to provide lots of fresh content and engage their readers, many folks these days are headline-only-readers so let’s talk about why this is dangerous.

The Headline

It’s true. A correction is a decline of 10% or more in price. Read lots more here from Investopedia. Nvidia’s stock price was over 950 and is now around 850, and the math seems to work. (950-850)/950 = 10.5%. Yup, that’s technically a correction.

The Data

Let’s start with a look at the Nvidia’s price history. Let’s go back over the past 2 years and see what the stock price has done.

Nvidia has done well. It’s up almost 270% over the last 2 years. The run started around October 2022, and really started to accelerate from there. I’ve included a comparison with the S&P 500, which grew a very respectable 16%.

Correction My Foot

Yes, technically it’s a correction. Nvidia has pulled back to prices not seen since late February 2024 (Gee, that was 2 month’s ago). It’s still up a whopping 71% year to date.

While the article does mention “a wild gain of more than 200%” the tone is certainly more about speculation about the decline and what that means to the company and investors.

Stick to Your Knitting

My assessment is that this is not a buying opportunity, and it is not something for investors who hold shares to worry about. It’s a non-event, but makes for good headlines.

Nvidia is a growth stock. As a growth stock investor, we expect large swings in price. Growth stocks trade on expectations more than business fundamentals so it’s not uncommon for the stock price to make a big swing up or down when there is a change in economic expectations, business projections, or even the weather (sometimes they just happen and you can’t explain them).

Growth stock investors should know this and be prepared to hang on for a wild ride.

You can read more about growth v. value stocks here.

Wrap-Up

Aside from having a little fun at the expense of our friends at CNBC, what did we learn?

It’s important to read beyond the headlines before making an investing decision. If this is a stock you own, or a company you are considering purchasing, start with the story and then do some analysis. The headline is a good starting point. It gets your attention, but then you need to start your own research to establish an opinion. You can read more on this in the investment thesis post.

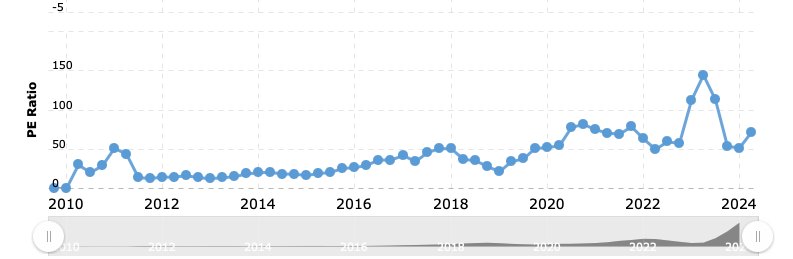

One of my first stops after reading this article was to take a look at the historic P/E of Nvidia.

Based on Nvidia’s historic ratios, and eliminating the spike in 2023 that could be an anomaly, the P/E is at the high end and I’d wait for a bigger pull-back, which could be caused by a drop in price, but could also be caused by a spike in earnings.

The moral of the story is…read a lot. I do like CNBC because they publish a lot of info on the companies I follow. I read the articles and that’s where my analysis starts.

We’re all investing our hard-earned money with the expectation that our investments will grow in value. It is important to take the time to do some independent analysis before reacting to headlines.

Let me know your thoughts.