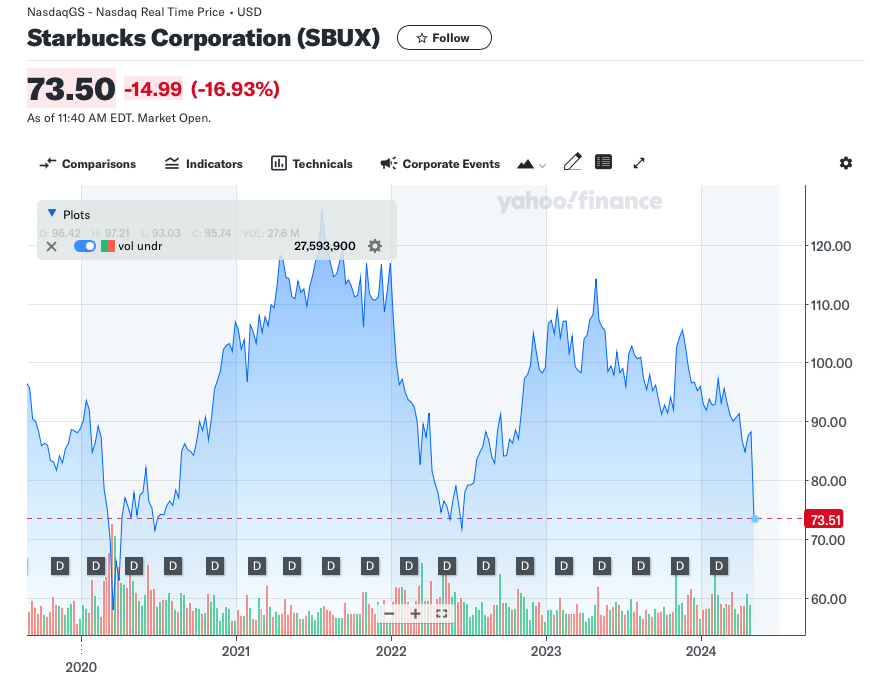

Today is turning out to be a rough day for Starbucks. And that after a pretty uninspired last few years. Time to worry? Let’s take a look.

I love Starbucks (as an investment)

If you’ve read my posts on building an investing thesis here, or dividend stocks here, you’re familiar with Starbucks. It is one of my favorite investments. I bought 94 shares in my brokerage account at $27.71 per share in February 2013. Total Cost $2,605.17.

At a price of $73.52 today, the stock is up 165%. That’s cool, but I’ve reinvested dividends so the dividends contribute an additional $1,507.47. My Starbucks investment is worth $8,418.33. So with dividends reinvested, it is up over 223%.

I’ve also invested in Starbucks in my IRA, done some covered calls, and reinvested dividends, so my total gain on Starbucks is huge.

It’s a pretty good business too

Long lines at the drive thru, huge profit margins on drinks, tons of dollars sitting in Starbucks cards that are essentially an interest free loan, what’s not to like?

There have been lots of headlines about labor relations issues recently and the unionizing of Starbucks stores. That said, their starting wage is higher than Walmart or McDonalds, they offer great benefits like healthcare and tuition reimbursement so despite some of the uproar, they seem to be doing right by employees.

What’s going on?

Disappointing earnings after the bell on April 30 sent the stock down more than 15% after hours. Revenue is down, comparable sales are down and China is weak. I’m not racing to buy shares on sale, I’m worried about the shares I have.

Looking at the last 4 years, it’s been tough. Buying shares at almost any time would have put us at a loss, unless we caught the dip in 2020 or the dip in 2022.

Take a deep breath

My initial reaction was that maybe I should sell my shares and take my gains before this gets worse. I decided to hold steady and do some reading before I reacted.

Easy for me to say

This is much easier to do when I’ve bought the shares at $27 and they are trading at $73. I’m still way ahead. I don’t want to lose more, but I’m solidly ahead on the investment.

If you bought at $120+ per share in 2021, it is much harder to pause and think this through. But you should.

Go back to your thesis

Whether you’re ahead, flat, down a little, or down a lot, go back to your thesis. Again, easy for me because I wrote it down. I also published it in the posts on dividend stocks and investing thesis. Still lots of cash on hand. I skipped Starbucks yesterday because the line was too long, but I went last Saturday and saw the usual hustle and bustle.

This is a good start but let’s supplement the boots on the ground research, which is important, with some analysis on the business.

Find a good analyst

I’ve done the analyst joke before so I’ll skip it here, but I know that a deep dive by yours truly into Starbuck’s financial statement is not going to make me any smarter. I find it more helpful to read analyst assessments, both pro and con, by analysts who follow Starbucks, its competitors and the food and beverage industry. How is Starbucks doing v. its peer group?

Brokerage

I start on fidelity.com and take a look at the research reports. LSEG data analytics published a report on April 29. Revenue growth and net margins look pretty solid v. peers.

fool.com

This is one of my favorite sites. I’ve been a member of their Stock Advisor paid service for almost 20 years, but I read many of their free articles as well. Luckily they posted a post-earnings analysis of Starbucks today. 2 analysts presented their bull and bear case for Starbucks and also ranked Starbucks based on its business, financials, management and growth prospects.

I feel better

After an hour or so of reading, I feel better about Starbucks. I also remind myself that in my post on investment thesis, I recognized that Starbucks’ high growth days were behind it and that it pays a roughly 2.5% dividend. While I’m not expecting drops of 15% in a day, I expect slow growth over time and at a payout ratio of 57%, the dividend seems pretty secure.

What next?

I feel better, but there is enough to worry about in the recent earnings report that I don’t feel like this is a buying opportunity. I like the business and I’m optimistic, but I will continue reading closely. I’m ahead on my initial investment so it’s easier for me to stay the course, and the 2.5% dividend provides some additional comfort.

Let me know what you think.