How much do you spend each year? Most people don’t know this number, and I would argue that it’s a more important number than your salary, your expected social security benefit, and maybe even your 401k balance. That’s crazy talk – right? Let’s look at why.

How much do I spend?

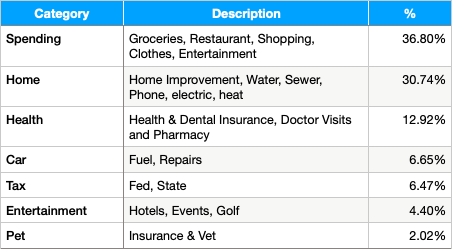

I won’t give you the dollar amounts, but I’ll give you the percentages, along with some fun commentary.

The chart itself is a bit of a letdown, but what’s important and valuable is the process that I go through to create the chart. It starts with reviewing and categorizing the individual transactions, all 1,216 of them. That’s a lot – over 100 per month.

We’ll get to the process in a bit, but for now, what’s important is that I know the total $ my wife and I spent by category in 2023. If I adjust for inflation, it is pretty close to what we spent in 2022, and 2021.

Why is this important? When we think about our financial goals, whether it is retirement saving, college saving, vacation saving, or assessing our retirement readiness, we have less control over what comes in than we do over what goes out.

Knowing what is going out and where I may be able to make decisions to reduce what goes out, makes me very confident that I can handle retirement.

How do I know?

For some of us, all we need to do is pull out our checkbook to get a solid list of our spending. For many however, or financial transactions are spread across many platforms. In order to know how much we spend, we need to build an inventory (create a list) of all of our spending accounts.

Credit Cards

My wife and I have 3 credit cards. Our Fidelity Signature Visa is our primary card because we get 2% cash back on every purchase. We have a Discover It card because it doubled our cash back on certain categories in the first year. It is also tied to my fuel rewards account, so we’ve kept it. My Amazon Prime Visa gets me 5% cash back on Amazon purchases. Given the amount of stuff we buy on Amazon, this is huge.

3 credit cards with 3 different issuers. Each sends its own monthly statement, and each has a different format if I choose to go online and download transactions. This means it’s difficult to put them in the same spreadsheet – we’ll talk about how an account aggregator can help a bit later.

Checking Accounts

We only have 1 checking account so this is fairly simple. We also only wrote 3 checks last year. With online bill pay and direct debit, we’ve gone away from paper checks. I can’t remember the last time we bought stamps.

Quick warning on direct debit

I love the simplicity of direct debit and I love not getting late fees because I forgot. But, this does not mean I can set it and forget it. Last month, my mom’s cable bill seemed a bit high. I went online and found that she had rented the Barbie movie and subscribed to the daily burn. My mom is 86. Her TV skills are limited to on/off and channel up/down. Unlikely she rented a movie, and certainly not Barbie (no offense to Barbie lovers). She’s also unlikely to be doing the daily burn.

I called and had the charges removed, and successfully verified this month’s credit. I will be checking the bill next month to ensure it is back to the expected amount.

Read some of the posts on scams. Some very industrious people and companies are working diligently to separate us from our money. Sometimes it is a legitimate mistake or system error, other times it is malicious. It is our job to monitor closely and address discrepancies. More fun reading here, here, and here.

Cash

I have virtually eliminated cash from my life. I still have a few bills in my wallet, but I pay with my phone, or card whenever possible. In my spending spreadsheet, I include ATM withdrawals – all 3 of them for 2023. And, did I mention that for my Fidelity Visa Debit Card, attached to my Fidelity checking account, I am refunded for all ATM fees. I know, only $10.50 in 2023, but back when I used cash daily and visited the ATM 2 – 3 times per week. This was a $300 – $400 savings per year!

Other payments

In my personal war on cash, I have started using Apple Pay, Venmo and Paypal. While my golf buddy Doug insists on paying us back in crisp $100 bills, most of us transfer money through Apple Pay or venmo. After the round, I tell my phone “Hey Siri, pay Rich $47” and I’m done.

Easy, but we need to watch these as well. The apple pay transactions show on my visa credit card statement and my venmo transactions show in my checking account statement. I verify these regularly.

What else?

Do a personal inventory (list) and assess what other accounts you may have and how you monitor them. Do you get paper statements? Do you download transactions? Do you spend and hope for the best?

Account aggregation

In the post on budgets, I talk more about account aggregators. Read here.

I’ve used several different account aggregators – Fidelity Fullview, Mint (which is now Credit Karma) and Investnet. They all work basicaly the same. You set up an account with the aggregator and then the aggregator’s website walks you through adding your financial accounts. Typically, it will pop up a screen and ask you to sign in to your financial account. After that, it is able to regularly import transactions from your financial institution.

The benefit to this is that the aggregator does the hard work of mapping all the different amounts and descriptions and categories on the different sites and shows us a single view of all of our transactions with a consistent set of categories.

The risk of this is that you are providing your financial account credentials to one of these sites. Do you trust them? Do your research. I looked closely into Mint which is owned by Intuit. Intuit bought Credit Karma, so while I haven’t done subsequent research, it is fairly safe to assume that Intuit has done its due diligence. That said, it’s your account info, so do some of your own.

Transaction analysis

We can do this the easy way or we can do this the hard way. We’ll talk about both.

The easy way

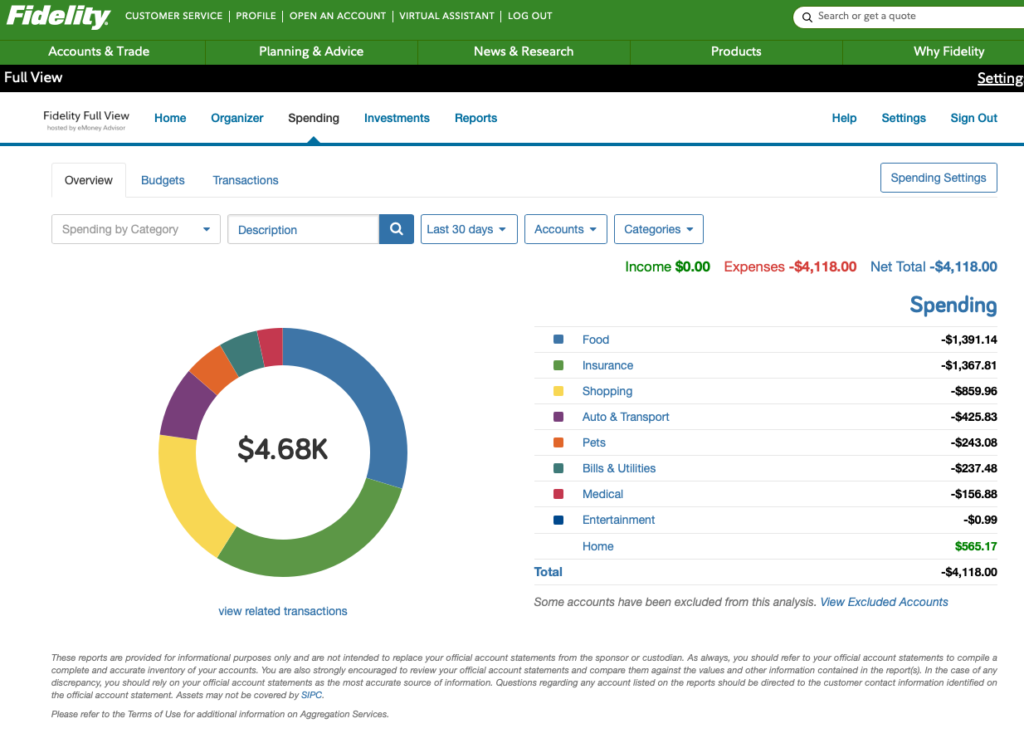

Once I’ve set up an account aggregator – I use Fidelity Fullview, so that’s what you see here – I can see my spending by category for various time periods. I get a nice chart, and I can click in to see transactions.

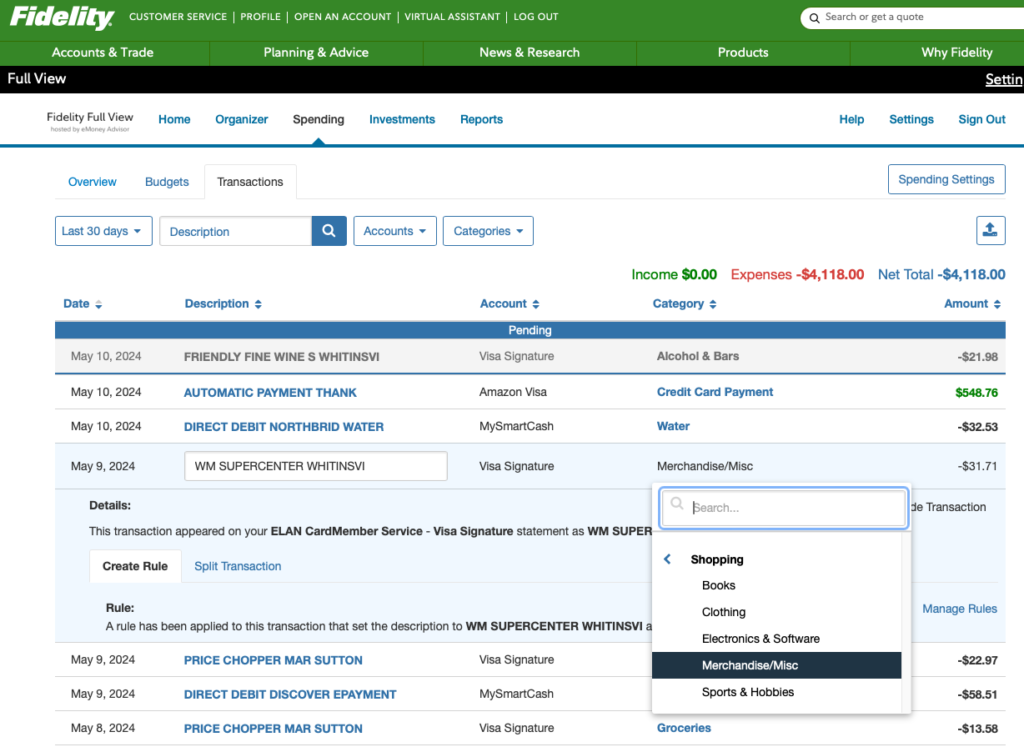

I can also see a full list of transactions and I can review them to make sure they are accurate, and I can adjust categories. In the Walmart transaction, Fullview categorized it as shopping/merchandise/misc, but I may want to change it to Clothing.

You’ll also see a budget tab. Fullview lets you manage a budget here as well. How cool is that? Most aggregators have similar functions.

That’s the easy way. Set up the aggregator and use their online tools. You can review transactions, recategorize them, and run reports to compare spending by period, or find out how much you spend each year.

The hard way

Not that hard, but I like to go the extra mile, especially when it comes to monitoring and understanding our spending. Like I said, we have limited control over what comes in, but we have ultimate control over what goes out. I think it is worth a little extra time.

You’ll see a download button at the top right, under the spending settings button. Each month I download the year to date transactions. I open the file in my favorite spreadsheet program and sort by category and date.

I always find a transaction or 2 that was mis-categorized by fullview that I missed on my online transaction review. Somehow they are easier for me to find when I see them together. Yes I could do this by sorting online, but I’m 60. I correct them in fullview and re-download.

I then look at each category. I look at my health insurance premiums to make sure I made a payment each month. 1 not 2. This is automated, but I look closely at the amount and the number of payments to make sure a system glitch didn’t overcharge, or forget to debit my account, in which case my insurance may be canceled or I may owe a penalty.

Next I look at the total amount per category. Lots of little payments can add up to a surprisingly large amount over days weeks and months. Is this how we want to be spending our money?

No it’s not

Category review has made me angry a couple of times. Back around 2010, I noticed a huge jump in my cable TV bill. I called my cable company and they explained that in my 2 year contract, the 1st year was heavily reduced and I had just entered year 2. I canceled TV and reduced this to zero.

In 2022, after adding a hot tub, which is so worth it, my electric bill was out of control. Ignore the articles that tell you a hot tub costs a dollar a day to heat. In New England in February, it costs $180 for the month. As Jackie Chiles would say “That’s outrageous and egregious.”

I had solar panels installed on the roof and brought my annual electric cost down to roughly zero. Read more about my panel journey here.

Wrap-up

How much do you spend? Now you have the answer. It’s not that hard. I am a huge fan of account aggregators, but if you choose to go without, that’s fine too. You can do this with a spreadsheet, it just takes a bit more time.

Whether you go with the aggregator or the spreadsheet, spend some time to do some analysis. At a minimum, make sure:

- The payment amounts are legitimate and accurate

- You are making the payments you’re supposed to (am I paying my phone bill each month or did I miss one?)

- You’re not making unexpected payments

- You’re spending on the things that are most important to you

There is huge value in knowing how much you spend each year. Knowing this will make you more confident in planning for your goals.

Step 2, after knowing what you spend, is making decisions to maximize the value of what you spend. Cable TV was not providing the value for the money we spent. My wife and I decided to axe it. Solar panels were a big up-front cost, but the zero dollar electricity bill each month will offset the cost in about 6 years, at which point, we’ll have free electricity for life.

Let me know if you have comments or questions.