Today as I walked Rosco, I started thinking about inflation and the best ways to keep our money safe while keeping up with inflation. As much as it stinks to go to the grocery store and either pay more, or come home with fewer bags (and forget about bacon – ouch!), what really hurts is when we discover that the money we’ve painstakingly managed to squirrel away and keep safe is slowly losing value.

Losing the battle

Today (before the walk) I read on CNBC that the consumer price index rose 3.4% in April. This means that the stuff we buy costs 3.4% more today than it did a year ago. Huge bummer, especially since last year’s prices were inflated pretty significantly as well. But let’s stick with the 3.4% yearly increase for now.

Let’s go out and see what we’re getting for an interest rate on our savings and checking. If we’ve got a High Yield Savings Account, we’re probably OK. Here are some current rates from our friends at NerdWallet. If we have a Marcus by Goldman Sachs Online Savings Account, we’re getting 4.4%. That means that while inflation stole 3.4%, our money still grew by 1%. Not great, but better than losing.

I was horrified to discover what my local brick and mortar banks are offering. I won’t name names, but one is giving us 0.03% interest and the other is giving us 0.01%. And this is savings. Checking gives us nothing. One of them proudly advertised that they would waive fees. Bravo for them.

We need to get at least 3.4% or we’re losing money to inflation. Stay tuned for a broader post on what to do with cash, but let’s get back to treasuries. But before we do, take a minute to inventory (create a list) of your accounts and the interest rate you’re getting.

Treasuries

I have talked about treasuries in several posts, but I have not gone into the details on evaluating and buying them. It’s not rocket science, but I remember I had to do some work and some reading before I was comfortable buying one.

When I buy treasuries, I am buying a bond that is issued by the US treasury. More on bonds here. As we know, when we buy a bond, we are essentially loaning money to the bond issuer. In this case, we’re loaning money to the US treasury with their promise that they will pay the full amount back at maturity, and that they will pay periodic interest at a specified rate until the bond matures.

Treasuries are backed by the full faith and credit of the US government. They are considered a very safe investment.

Types

Bonds, Bills, Notes, Zeros, TIPS, and their friends. We’ll go into the nuances on another day, but for today, here are a couple of important points. I’ve included links to treasurydirect.com – the US government bond website.

- Treasury bills or T-bills are short duration bonds, typically in durations of 4 to 53 weeks

- Treasury notes are intermediate term bonds with durations of 2,3,5,7 or 10 years

- Treasury bonds are long duration bonds, typically 20 or 30 years

- Treasury zeros are zero coupon bonds. They do not pay interest. Instead they are sold at a deep discount to par (face value).

- TIPS are inflation protected securities that adjust their par value based on inflation.

There are a few more, but this starts to get complicated. We’ve probably gone too far already, but at least we know the terms.

Why would I buy one?

Simply put, we buy them to get a little better return than we might get from other cash options. We’ll certainly do better than we will at your brick and mortar bank, we may do better than the high yield savings accounts, and we also get the nice benefit of not paying state tax on interest. You’ll have to pay federal taxes on the interest, but no state tax – nice!

Treasuries are backed by the full faith and credit of the US government so they are considered safe. If the US government fails, you and I have bigger problems.

How do I buy one?

treasurydirect.gov is the government site to learn about the different types of treasury bonds, and purchase and sell treasury bonds. I have an account and I’ve bought I-bonds here. If there were any other way to buy I-bonds, I would. I am not a fan of treasurydirect.gov. It works, and is a good source of information, but I prefer to deal with my broker’s website.

Your broker

Hopefully you have one. Whether it is Fidelity, Schwab, Vanguard, Robinhood, or the many other brokerages, pick one. You should be able to open an account for free. The big reason I prefer my brokerage account to treasurydirect.gov is that I can see all my info in one place and I don’t have to move money around between platforms. Also, as I stated above, I find it much easier to use.

Buying

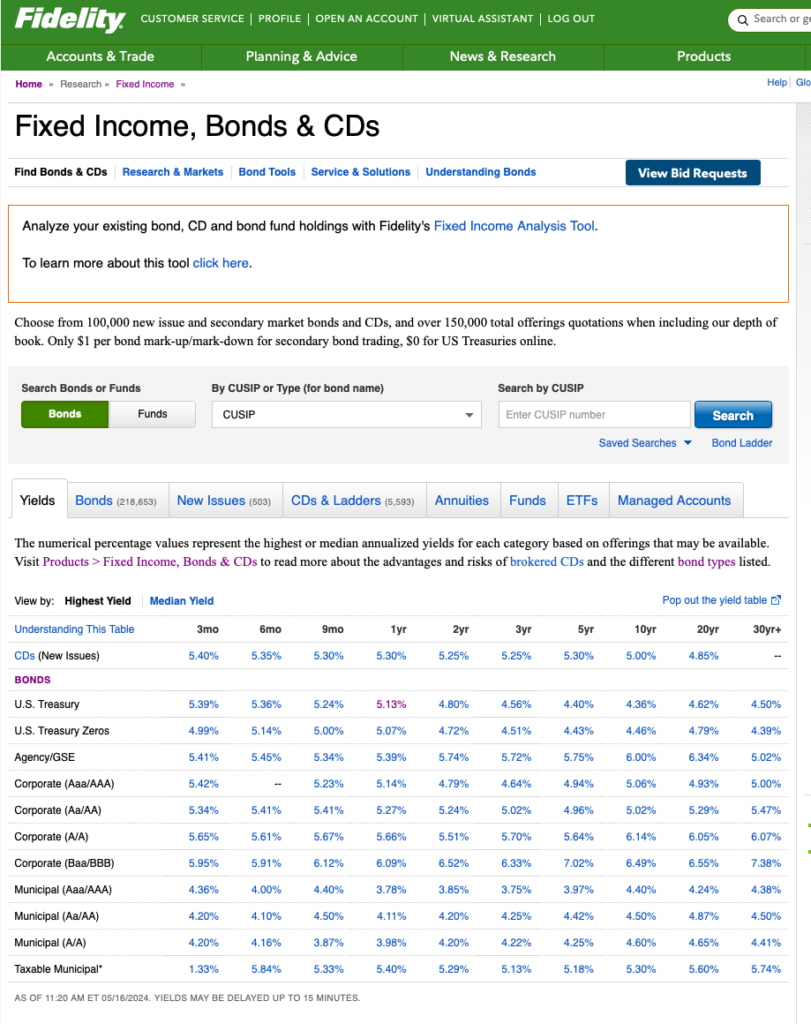

So, I have money sitting around in cash, and I want to buy a treasury. I use fidelity.com, and I go to research, fixed income, and I see:

Here’s another reason I don’t use treasurydirect. I can comparison shop here. I can pretty easily see what the rates are for different durations across different fixed income types. Let’s say I want a 1 year treasury. I see they yield 5.13%, let’s click:

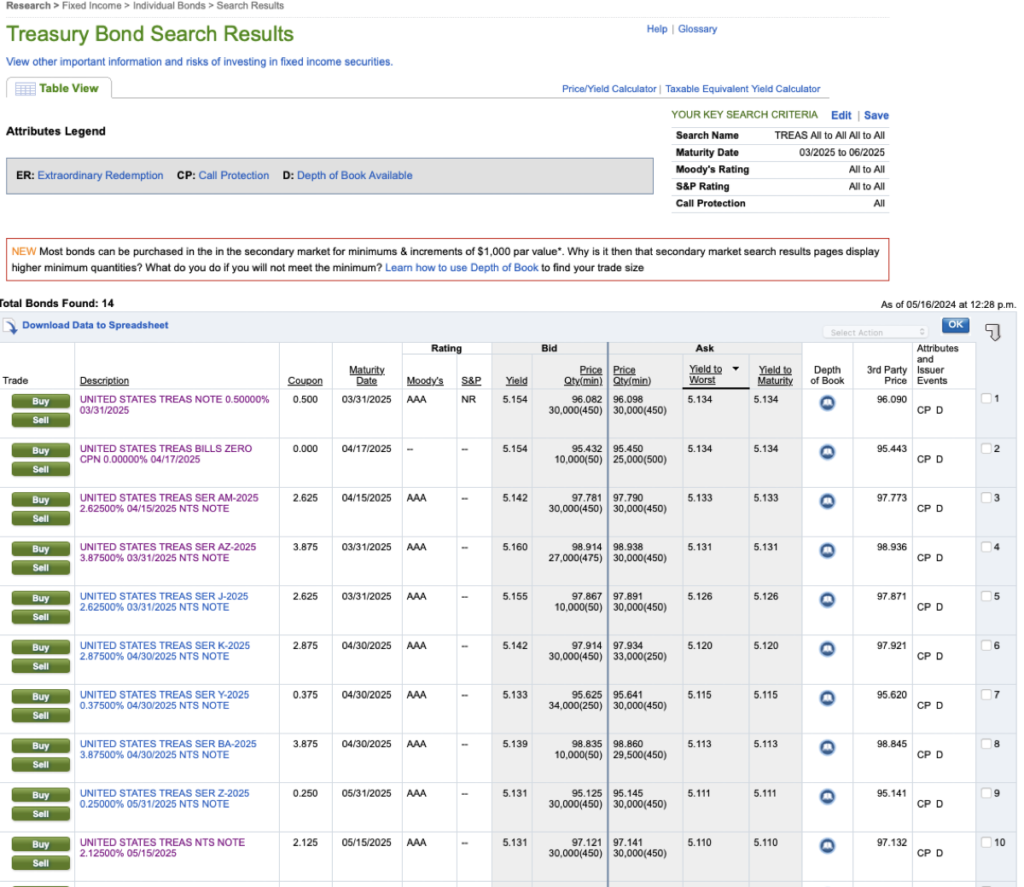

Here are the top 10. All of these bonds are not new issues. These are bonds selling on the secondary market. Rather than describe this, let’s look at an example.

Let’s choose the first bond on the list.

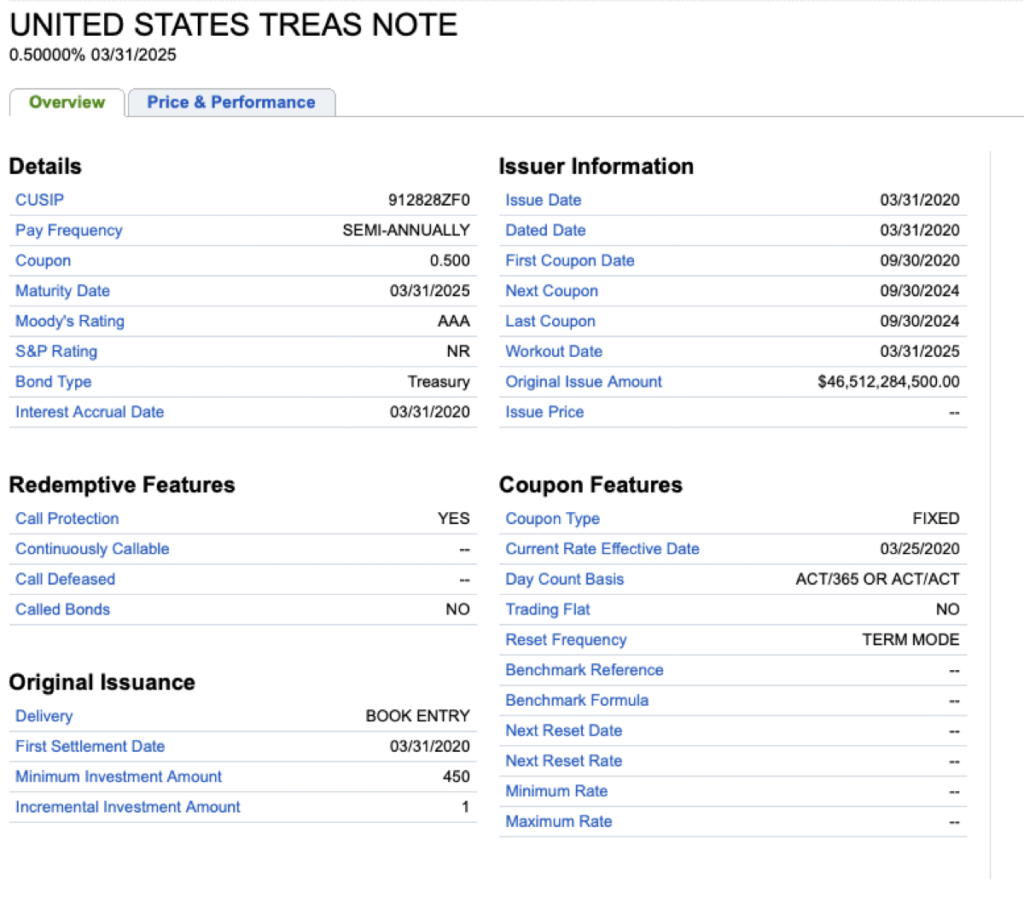

First item to note. This was issued on 3/31/2020. This is a used bond. It’s not shiny new. It also has a coupon, which we know is the annual interest rate, of 0.5%. That’s crap! Who wants a bond that yields 0.5%?

Buying bonds on the secondary market

The answer to our question is that no one wants a bond that yields 0.5%. Someone bought this bond in 2020, when 0.5% was a competitive interest rate. They now want to unload it. If you read the post on bonds, you know that the only way to sell a bond with a lower interest rate in a higher interest rate environment is to sell it at a discount.

That’s exactly what’s happening here. If you look at the 1st screenshot, you’ll see that the 3rd party asking price is $96.09. It is trading at a discount of $3.91.

* Note on terms

Just to make things more confusing….treasury bonds have a par (face) value of $1,000. One bond is worth $1,000 at maturity. Fidelity (and maybe other brokerages, who knows?) quote prices as if they were $100 par. You just need to multiply by 10, but it seems unnecessarily confusing.

Calculating return

We’ll talk through 3 components of return

- Discount

- Interest

- Adjustments/Accruals

- Date/Interest Calc

Discount

Let’s say I decide to buy. I buy 1 bond at a price of $96.09. I buy a $1,000 bond and the price is $960.90. I’ve netted a cool $39.10

Interest

On the 3rd screen-shot, we see that interest is paid semi-annually, the coupon is 0.5%, the next coupon is 9/30/24, and that is also the last coupon. We are expecting a half a year’s interest payment on 9/30/24 of $2.50. We’ll also get a final interest payment at maturity.

Adjustments and Accruals

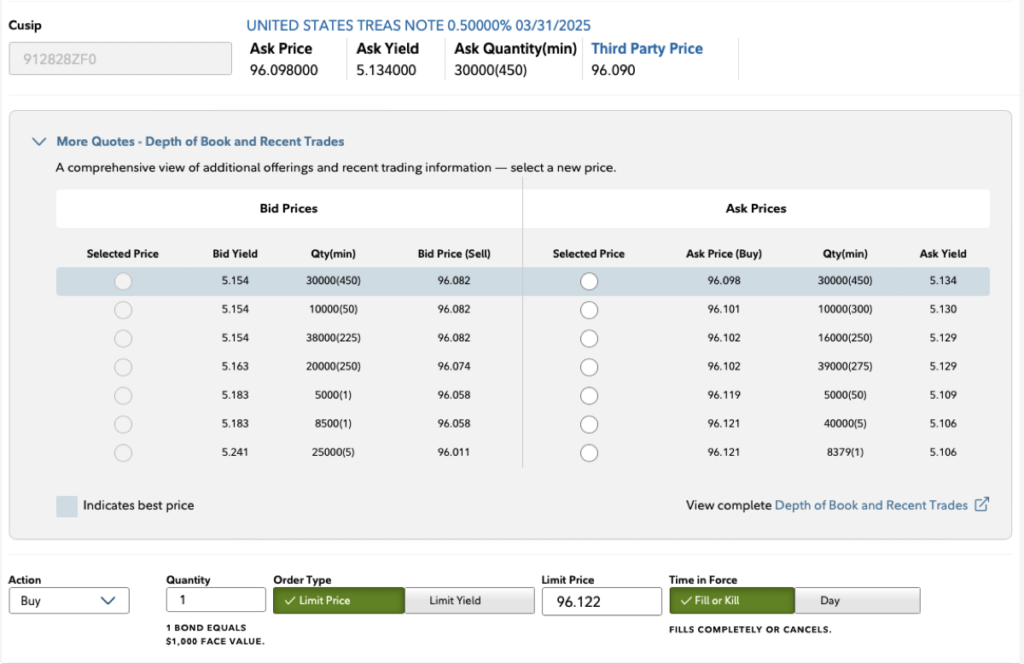

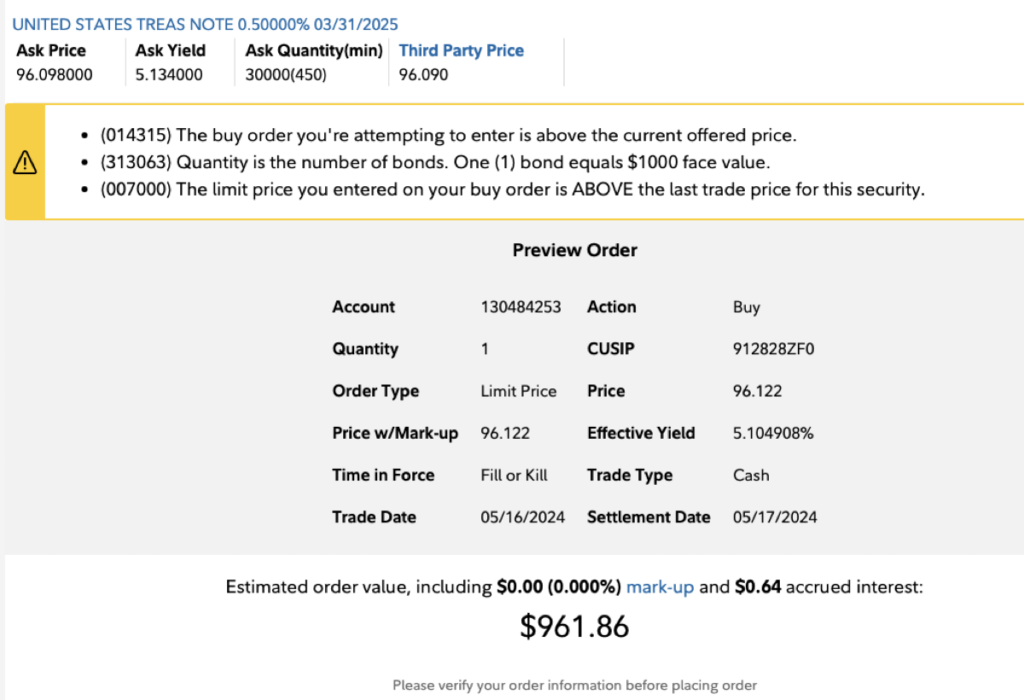

When we get to the quote screen to purchase our bond, there could be some adjustments. We’ll typically get a better price for buying more bonds. Here, we’re buying just one, so the price of $96.122 is a little higher than the $96.09 we saw earlier. This will affect our premium discount, but don’t worry, we’ll recalculate.

Now we’re at the trade ticket screen. Here we see a final note that there is an adjustment for accrued interest. All-in, our cost is $961.86 for our $1,000 par value bond. That’s a $96.18 price v. the original listed price of $96.09.

Note on accrued interest: when a bond is traded, typically someone owes some interest to someone else. Your brokerage nicely calculates this and adjusts accordingly.

(Almost) Final Calculation

My premium discount after adjustments is $1,000 par value – $961.86 cost = $38.14. I also have the interest coming on 9/30/2024 for $2.50. This is a semi-annual payment, so it is half of the $5 I would get for the year. I’ll get the other half at maturity on 3/31/2025.

$38.14 + $5 = $43.14 in my pocket. It cost me $961.86, so my return is $43.14/$961.86 = 4.48%. Hey wait! That’s not the 5.134% it says on the trade ticket!

Date Calculation

The yield is quoted as an annual percentage rate (APR). We need to remember that the bond we are buying matures on 3/31/2025. That’s 319 days from today. To annualize the rate, we divide the rate by 319 to get the rate per day and then multiply by 365 days per year. So we get 4.48/319 = 0.00014 x 365 = 0.513. Multiply by 100 and that’s 5.13% APR.

Wrap-up

That’s a lot of math. I’m exhausted. The good news though is that Fidelity did all the math for us. We just proved that it’s accurate.

We’ve learned that treasury bonds are backed by the full faith and credit of the US government and are considered a very safe investment.

We can buy treasuries at treasurydirect.gov, however, we can also buy through our broker. Buying through our broker allows us to more easily compare against CDs, corporate bonds and muni bonds. We can also see how the rates change across different timeframes to see if we want to go with a 1 year bond or a 20 year bond.

I hope this helps. I did a lot of calculations on my own to try and figure out the money I was paying and the APR I was receiving on my first bond purchase. Like anything else, the first one takes some effort, but once you’ve done it you’re a champ.

Treasury bonds are an interesting alternative to a checking or savings account. They provide relative safety and potentially higher rates.

As a bond buyer, be aware of the discount factor on selling bonds. While we will receive the par value at maturity, if we need to sell our bond on the secondary market before maturity and the interest rates have risen, our bond will be worth less than par. We’ll need to discount it to remain competitive. More here.

Let me know if you have questions or comments.