I was watching the Netflix movie Dumb Money this morning and it got me thinking. While the meme stock rally of 2021 was fascinating to watch, did it really create wealth? Game Stop (GME) was the poster child of the rally, how did it make out?

GME went from a buck a share to over $80 a share to $18.32. Quite a wild ride.

Did Anyone Make Money?

I’m sure some did. If you bought before the price got crazy high, and were lucky enough to sell at a peak, you probably did. If you’re still holding today, you may be out of luck. If you bought at the peak of the craze in 2021 at $80 and you’re still holding, I’m sorry.

And then there are those who traded options. I won’t get into the complexities of option trading, but essentially, the option prices are based on the price of the underlying security (in this case Game Stop), but option prices tend to exaggerate the price movement by huge factors. Options can multiply our gains, but also can multiply our losses. I typically steer clear of them.

Even those that made money, what then? Did they put it into a high yield savings account, did they pay off their mortgage, or did they keep holding and ride the price back down to $18, or did they find the next big thing – Hertz or AMC and then did they win or lose? To make money over the long term, we’d need to keep picking winners and know when to buy in and when to get out, over and over. And one mistake could put us in the poorhouse.

But It Seems So Cool

Back to the movie….it seems so cool, being part of a group that is sticking it to wall street. Some members are making a fortune – at least on paper, and at least for a period of time. It was a compelling story.

Investing

First off, I’m not opposed to having a little fun. If you want to be part of the Game Stop movement, or you want to speculate on the price of bitcoin, who am I to say no? That’s a decision each of us needs to make for ourselves.

That said, we need to invest if we want to grow our wealth. Investing is buying something with the expectation that it will appreciate over time.

I am quite regimented about sticking to my principles on investing. I worked hard for my money. I know that I need to continue to build wealth so I need to make smart investments. While I’m sometimes willing to put down a few dollars on something I want to believe in, I allocate the majority of my investment dollars to investments that have a solid track record and a high likelihood of growing my wealth over time.

Gambling

Yes, I’ve made some bets on unlikely stocks. Whether it’s Game Stop, Hertz, AMC, or whatever, it’s fun and energizing to just jump in. The prospect of huge gains is enticing. That’s why Vegas is popular and the lottery is a billion dollar business. We just need to be honest with ourselves. This is gambling. Again, who am I to tell you that you can’t gamble? It’s your money. I’m just advocating for keeping a separate pool for investing.

The S&P 500

If you’ve read my other posts, you’ll know I am a huge fan of the S&P 500, and of low-cost S&P 500 funds and ETFs. Let’s look at why.

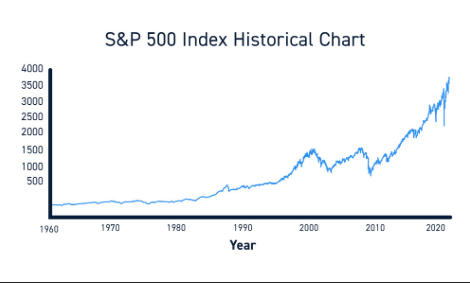

This is a chart of the S&P 500 price change since 1960. Overall, it’s done pretty well. Compare this with Game Stop. The S&P 500 has gained an average of 10% per year with dividends reinvested over the last 100 years. Past performance is no guarantee of future results, but it is a pretty solid indicator of what’s likely to happen. Read more here.

You Can Do It

So that’s the preamble, let’s get to today’s post. Apologies to Rob Schneider and Adam Sandler. Hopefully they won’t sue me for using the pic.

Today’s lesson is that you can do it. It’s not that hard.

Can you save $50 per month. Think for a minute. Try it for a month. Put aside your change every night, skip the lottery tickets, skip the drive thru a time or 2. What could you do to put aside $50 this month. If it works out, we’ll try it again next month. Need ideas, read here or here.

Watch it Grow

On a lot of the posts, I demonstrate using a calculator that projects accumulation of wealth based on a specified rate. For today, let’s look at real numbers. Let’s say I was able to put aside $50 per month, I started in 2019, and I invested in the iShares Core S&P 500 ETF (IVV).

In the table below, I’m starting on 6/1/2019. I buy $50 worth of shares of IVV at the closing price. Cumulative shares shows the growth in total shares I own and the cumulative value shows the growth in value of those shares. I use my saved $50 to buy more shares on the first of each month.

| Date | Close | Buy – $ | Buy – Shares | Cumulative Shares | Cumulative Value |

| 06/01/2019 | 294.750000 | $50.00 | 0.170 | 0.170 | $50.00 |

| 07/01/2019 | 299.230011 | $50.00 | 0.167 | 0.337 | $100.76 |

| 08/01/2019 | 294.269989 | $50.00 | 0.170 | 0.507 | $149.09 |

| 09/01/2019 | 298.519989 | $50.00 | 0.167 | 0.674 | $201.24 |

| 10/01/2019 | 304.970001 | $50.00 | 0.164 | 0.838 | $255.59 |

| 11/01/2019 | 316.059998 | $50.00 | 0.158 | 0.996 | $314.89 |

| 12/01/2019 | 323.239990 | $50.00 | 0.155 | 1.151 | $372.04 |

| 01/01/2020 | 323.239990 | $50.00 | 0.155 | 1.306 | $422.04 |

| 02/01/2020 | 295.910004 | $50.00 | 0.169 | 1.475 | $436.36 |

| 03/01/2020 | 258.399994 | $50.00 | 0.193 | 1.668 | $431.04 |

| 04/01/2020 | 291.160004 | $50.00 | 0.172 | 1.840 | $535.69 |

| 05/01/2020 | 305.179993 | $50.00 | 0.164 | 2.004 | $611.48 |

| 06/01/2020 | 309.690002 | $50.00 | 0.161 | 2.165 | $670.52 |

| 07/01/2020 | 327.820007 | $50.00 | 0.153 | 2.318 | $759.78 |

| 08/01/2020 | 350.769989 | $50.00 | 0.143 | 2.460 | $862.97 |

| 09/01/2020 | 336.059998 | $50.00 | 0.149 | 2.609 | $876.78 |

| 10/01/2020 | 327.619995 | $50.00 | 0.153 | 2.762 | $904.76 |

| 11/01/2020 | 363.320007 | $50.00 | 0.138 | 2.899 | $1,053.35 |

| 12/01/2020 | 375.390015 | $50.00 | 0.133 | 3.032 | $1,138.34 |

| 01/01/2021 | 371.519989 | $50.00 | 0.135 | 3.167 | $1,176.60 |

| 02/01/2021 | 381.769989 | $50.00 | 0.131 | 3.298 | $1,259.07 |

| 03/01/2021 | 397.820007 | $50.00 | 0.126 | 3.424 | $1,362.00 |

| 04/01/2021 | 418.880005 | $50.00 | 0.119 | 3.543 | $1,484.10 |

| 05/01/2021 | 421.649994 | $50.00 | 0.119 | 3.662 | $1,543.91 |

| 06/01/2021 | 429.920013 | $50.00 | 0.116 | 3.778 | $1,624.20 |

| 07/01/2021 | 440.399994 | $50.00 | 0.114 | 3.891 | $1,713.79 |

| 08/01/2021 | 453.709991 | $50.00 | 0.110 | 4.002 | $1,815.58 |

| 09/01/2021 | 430.820007 | $50.00 | 0.116 | 4.118 | $1,773.99 |

| 10/01/2021 | 460.989990 | $50.00 | 0.108 | 4.226 | $1,948.22 |

| 11/01/2021 | 457.630005 | $50.00 | 0.109 | 4.335 | $1,984.02 |

| 12/01/2021 | 476.989990 | $50.00 | 0.105 | 4.440 | $2,117.95 |

| 01/01/2022 | 451.769989 | $50.00 | 0.111 | 4.551 | $2,055.97 |

| 02/01/2022 | 438.720001 | $50.00 | 0.114 | 4.665 | $2,046.58 |

| 03/01/2022 | 453.690002 | $50.00 | 0.110 | 4.775 | $2,166.41 |

| 04/01/2022 | 413.559998 | $50.00 | 0.121 | 4.896 | $2,024.79 |

| 05/01/2022 | 414.869995 | $50.00 | 0.121 | 5.017 | $2,081.20 |

| 06/01/2022 | 379.149994 | $50.00 | 0.132 | 5.148 | $1,952.01 |

| 07/01/2022 | 414.279999 | $50.00 | 0.121 | 5.269 | $2,182.87 |

| 08/01/2022 | 397.179993 | $50.00 | 0.126 | 5.395 | $2,142.77 |

| 09/01/2022 | 358.649994 | $50.00 | 0.139 | 5.534 | $1,984.90 |

| 10/01/2022 | 387.790009 | $50.00 | 0.129 | 5.663 | $2,196.18 |

| 11/01/2022 | 409.320007 | $50.00 | 0.122 | 5.785 | $2,368.11 |

| 12/01/2022 | 384.209991 | $50.00 | 0.130 | 5.916 | $2,272.83 |

| 01/01/2023 | 408.309998 | $50.00 | 0.122 | 6.038 | $2,465.40 |

| 02/01/2023 | 397.970001 | $50.00 | 0.126 | 6.164 | $2,452.97 |

| 03/01/2023 | 411.079987 | $50.00 | 0.122 | 6.285 | $2,583.77 |

| 04/01/2023 | 417.660004 | $50.00 | 0.120 | 6.405 | $2,675.13 |

| 05/01/2023 | 419.429993 | $50.00 | 0.119 | 6.524 | $2,736.47 |

| 06/01/2023 | 445.709991 | $50.00 | 0.112 | 6.636 | $2,957.92 |

| 07/01/2023 | 460.179993 | $50.00 | 0.109 | 6.745 | $3,103.95 |

| 08/01/2023 | 452.690002 | $50.00 | 0.110 | 6.856 | $3,103.43 |

| 09/01/2023 | 429.429993 | $50.00 | 0.116 | 6.972 | $2,993.97 |

| 10/01/2023 | 419.940002 | $50.00 | 0.119 | 7.091 | $2,977.81 |

| 11/01/2023 | 458.420013 | $50.00 | 0.109 | 7.200 | $3,300.67 |

| 12/01/2023 | 477.630005 | $50.00 | 0.105 | 7.305 | $3,488.99 |

| 01/01/2024 | 485.200012 | $50.00 | 0.103 | 7.408 | $3,594.28 |

| 02/01/2024 | 510.450012 | $50.00 | 0.098 | 7.506 | $3,831.33 |

| 03/01/2024 | 525.729980 | $50.00 | 0.095 | 7.601 | $3,996.02 |

| 04/01/2024 | 504.440002 | $50.00 | 0.099 | 7.700 | $3,884.20 |

| 05/01/2024 | 528.640015 | $50.00 | 0.095 | 7.795 | $4,120.54 |

| 05/23/2024 | 528.640015 | $50.00 | 0.095 | 7.889 | $4,170.54 |

| $3,050.00 | 7.889 | $4,170.54 |

I put in a total of $3,050.00 and I end up today with $4,170.54. My investment has gained $1,120.54, or 36%. This does not include dividend reinvestment, so I’ve actually done better than this.

What’s Next?

$1,120 is not life changing money. I get that. But what if we could put aside $100 or $200 each month? What if we did this for 30 years instead of 5? Read the post on the magic of compounding here. As your money grows, your gains get larger and larger each year.

Easy for Me to Say?

I’m 61 and retired. I’m probably pretty well off and I’m telling folks they can scrape together $50, $100, or $200 every month???

Again, read the posts on saving to see some of the things my wife and I have done to save. We’ve painted our house twice – both inside and out and I’m afraid of heights. Cheapness beats fear every time. We make decisions every day about what to spend. Saving is not always easy and it is not immediately rewarded, but, saving and investing is a proven strategy to build wealth.

It’s worked in the past and it will very likely work in the future. You can do it!