In many of my posts, I’ve discussed low-cost S&P 500 mutual funds and ETFs. Today we’ll take a look at what we’re actually getting when we buy shares. Saddle-up.

What is the S&P 500?

The S&P 500 is a stock index. There are many indices available. The S&P 500 is a very popular one. Investment research companies like Standard and Poor’s (S&P) develop these indices as benchmarks against which individual investments or portfolios can be measured.

Example Please

That was a mouthful, so let’s look at 2 examples.

The Dow Jones Industrial Average is another popular index. It is assembled by the Dow Jones corporation and consists of 30 companies that are chosen to represent a broad perspective on the US economy. It consists of American Express, which was added to the index in 1982, and Amazon which was just added in 2024. More on the Dow here.

Standard and Poor also publishes a US Aggregate Bond Index – yes we have indices for bonds too. Per their site here, “The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.”

How are Indices Used?

The most popular way is by news agencies and investors. We all aim our browsers at CNBC each day to see what “the market” is doing. We see the 3 big indices – the S&P 500, the Dow and the Nasdaq and that’s how we judge how the market is doing.

Another popular way to use indices is to compare our individual security picking performance to an appropriate benchmark. We’d like to think that if we, or an advisor, is picking individual securities, that we, or they, would be outperforming the relevant index. If we can’t outperform the index, why not just keep it simple and invest in a fund that tracks the index?

The S&P 500

We now know that the S&P 500 is published by Standard and Poor. It is a list of the 500 largest publicly traded companies in the US. More on this later, but the S&P 500 is a popular indicator of how the overall US market is performing.

The Dow

There are lots of indices published by Dow Jones, but the Dow Jones Industrial Index (DJIA) is the most well-known. The Dow has been around for over 100 years and is also viewed as a proxy for the overall US stock market, even though it is made up of only 30 companies v. the 500 in the S&P 500.

The NASDAQ

The National Association of Securities Dealers Automated Quotations (NASDAQ) is an index of 2500 companies that trade on the NASDAQ exchange. Many of us are familiar with the New York Stock Exchange (NYSE). We’ve seen the trading floor of the old days where brokers screamed bid/ask prices at one another and securities were traded.

NASDAQ is an exchange as well. It became popular with start-up tech companies because it cost less to list on NASDAQ than it did on NYSE – probably because it was automated as the name suggests. That’s why the NASDAQ is considered a proxy for tech companies more so than of the total US stock market.

Back to the S&P 500

I’m laughing to myself because this is the 3rd time in this post I’ve tried to describe the S&P 500. The 2 other times, I’ve gone off on tangents, but I think it provides important background and perspective, so we’ll leave it as is.

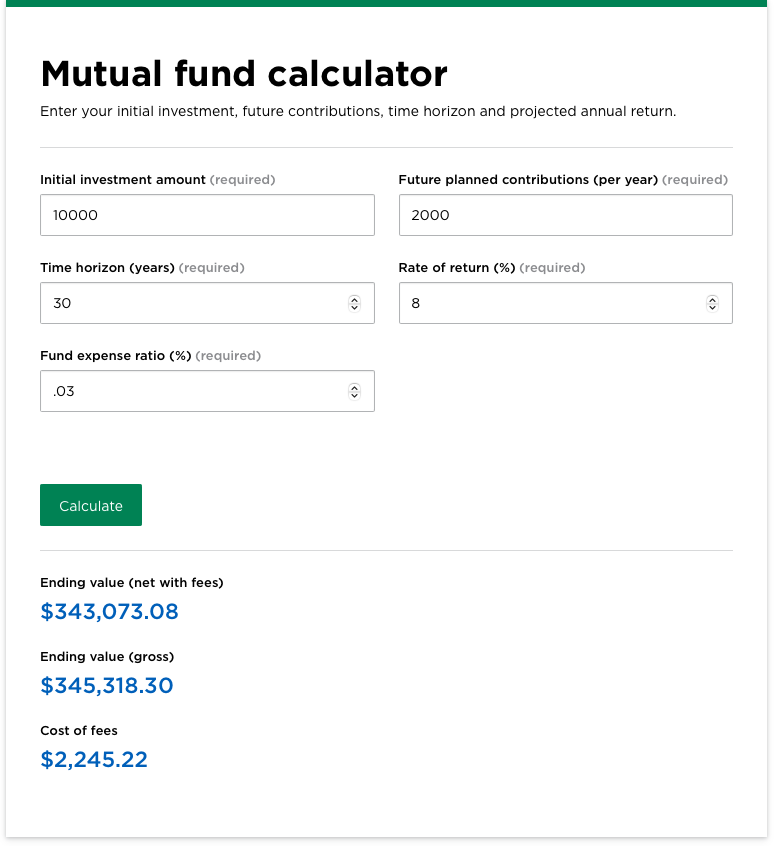

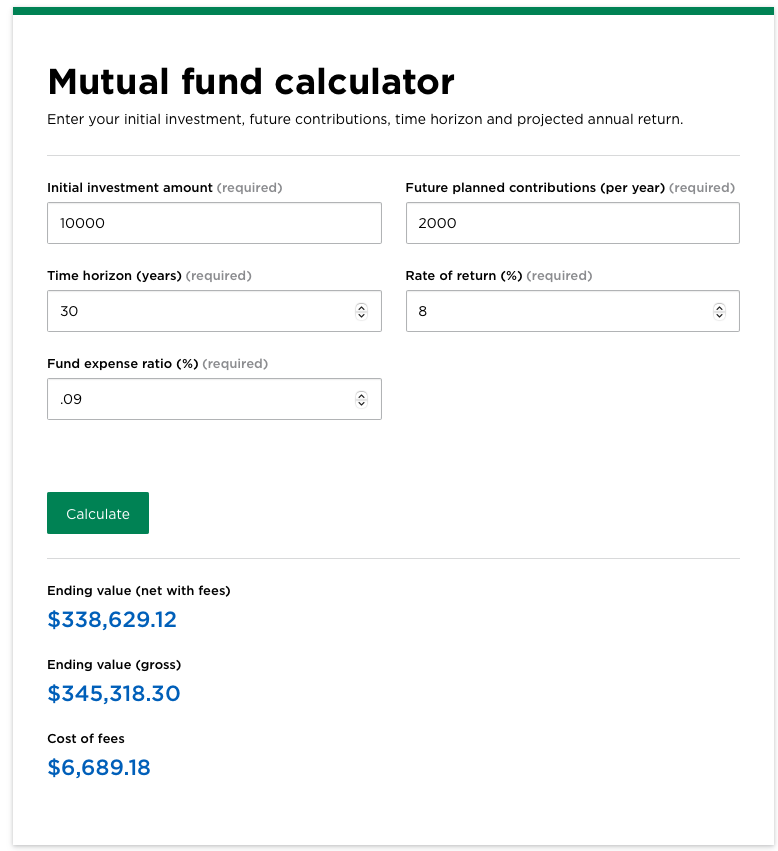

So, you’ve read my posts, and you’ve invested in a low-cost S&P 500 ETF – let’s use iShares Core S&P 500 ETF (IVV) as an example. Why do I like this v. the popular SPDR S&P 500 ETF Trust (SPY)? The expense ratio on IVV is .03% v. .09% for SPY. They’re both cheap, right, who cares??

Look at the comparison below from our friends at Nerdwallet. Fees matter.

Would you rather have $338,629.12 or $343,073.08. Fees matter.

What Does IVV Hold?

Duh! It holds the 500 largest US companies. That’s easy.

But, the portion it owns matters. The S&P 500 is a market cap weighted index. This means that the bigger companies take up a bigger portion of the index.

As anyone who’s been paying attention can tell you, big tech has crushed it the last 15 years or so. For a while all we heard about was the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google). They were on fire. Today, NVIDIA gets all the press.

In this period of huge tech growth, many companies’ market caps have exploded. And because their market caps have grown, they now represent an over-sized portion of the S&P 500 Index.

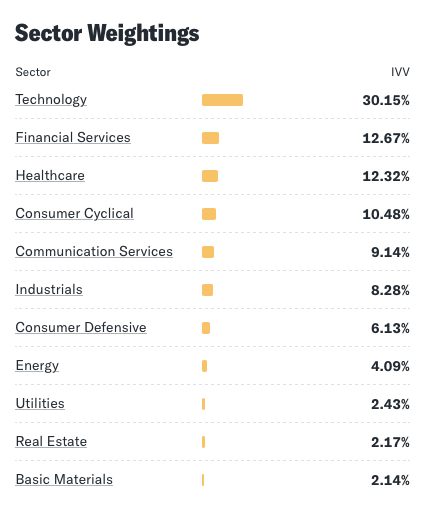

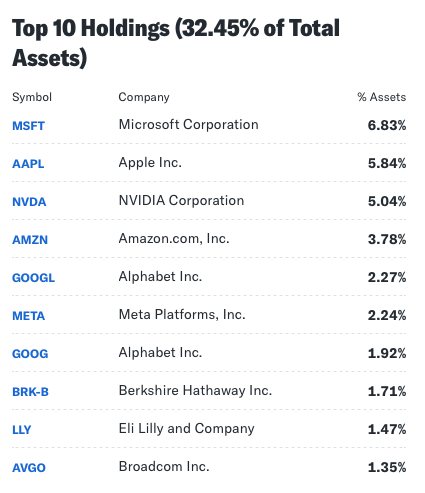

Let’s look at what IVV holds. Yahoo Finance is nice enough to tell us in the Holdings tab.

This looks great. I can buy one ETF, and get exposure to tech, healthcare, real estate and energy, as well as other sectors.

However, a slightly different picture when we check out the top 10 holdings.

The weighting of the tech sector is 30.15%, but almost all of that 30% is made up of just 7 companies (note that Alphabet has 2 share classes – each individually is larger than most other tech companies).

And just about 1/3 of our index performance is based on these 10 companies, again, much of which is tech.

Is This Bad?

No. It’s not bad, it’s just something to be aware of. Tech stocks have done extraordinarily well. Trends like online shopping, online advertising, moving processing to the cloud, streaming, automation, and cyber security have all contributed to the huge growth of these companies. Looking forward, one could argue that they should continue to benefit well into the future.

What Do I Do?

Mostly nothing.

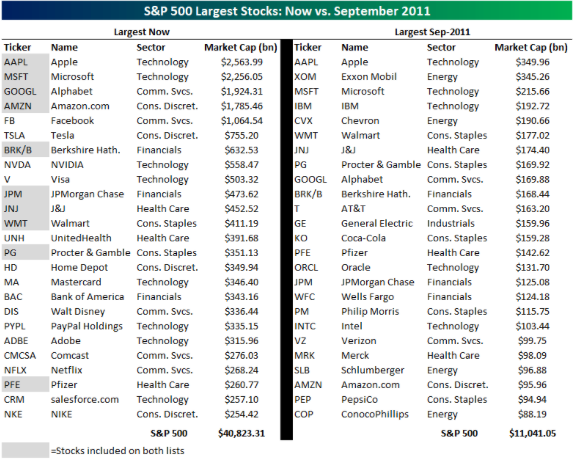

The S&P 500 is a market weighted index of the 500 largest US companies. Inevitably, some of these companies will shrink or drop out of the index entirely. The index (and we, the owners of funds that track the index) may feel some pain as this happens, but the index will rebalance along the way. Look at the comparison between 2011 and 2021 from seekingalpha.

One thing we can do is to make sure we do not over index our portfolio in the top holdings. Let’s look at an example.

Microsoft

I love Microsoft. It’s a great company and has performed well. I’ve researched it a bit, but I do not own shares.

While I do not own shares of Microsoft, the company still makes up a large part of my portfolio. Because I own many shares of IVV, and because Microsoft makes up 6.83% of IVV, 6.83% of my IVV investment is direct investment in Microsoft.

Hypothetical Example

Let’s say I have a $100,000 investment portfolio. I have 70% in IVV to give me a broad range of US equity exposure, 10% in AGG – the US Aggregate Bond ETF for income, and 20% in individual securities that I think will outperform. I hold $5,000 each in McDonalds, Netflix, Bank of America, Walmart, and Microsoft.

I may not realize that I am over-invested in Microsoft. 6.83% of my $100,000 in IVV (or $6,830) is in Microsoft. So I really own a $11,830 investment in Microsoft. That may be what I want, but maybe not. I may not want to put too many eggs in the Microsoft basket.

Portfolio Construction

Portfolio Construction is the process of building a portfolio of securities. We choose stocks, bonds, funds, and cash investments to suit our current needs and future goals. Mutual Funds and ETFs are a large part of portfolio construction for many of us because we want broad exposure without having to choose individual securities.

Diversification through funds and ETFs is effective, but be sure to look at the holdings in your funds and ETFs. Luckily funds and ETFs are required to publish their holdings regularly and sites like Yahoo Finance will show you the most recent holdings and weightings.

Story

Story time. My mom had a financial advisor. A few years back, I started helping with her finances and took a look at her portfolio. She had quite a few mutual funds. She was annoyed because a new fund prospectus seemed to arrive in the mail almost every day. Her advisor seemed like he was actively managing her portfolio and diversifying across many funds.

I took a look at the funds. Many of them had the same top 10 holdings. While the fund names implied that the funds had different objectives, the fund managers were all holding the same companies in roughly the same weights.

This in itself is not bad. As an investor, it’s nice to have choices and one of these funds may be more attractive to us than another. It was not, however, achieving diversity.

Understanding what our funds and ETFs hold is important in order for us to construct portfolios that meet our goals.

My mom no longer has a financial advisor.

Recap

A few key points.

There are many indices and they cover a broad range of groupings of securities, from the 500 largest US companies to emerging market debt. Companies like Standard and Poor and Dow Jones build and publish these indices.

Indices can be used to get a general idea of “how the market is doing” and can also be used to benchmark our investments. We can compare our portfolio, or a group of securities within our portfolio, against a benchmark index to see if we are outperforming. You can read more here and here.

The S&P represents the 500 largest US companies, however, it is market cap weighted which means that the larger companies in the index make up a larger part of the overall index performance.

Over-weighting companies in any index is not necessarily bad, but as an investor, we need to understand these weightings to ensure that we are getting the diversity we expect in our portfolio and that we are managing the allocations of capital to the securities appropriate to our goals.

Thanks for reading. Let me know what you think.