I’ve been looking at the jobs numbers for March and I have more questions than answers. I know, not a good opening line, but hopefully it generates some thoughts and discussion. Reading the news, we get a very conflicted story about the economy, inflation and job growth.

Inflation

A wrote a post recently on inflation so I won’t rehash that info here, but I will remind all of us about the Ronald Regan quote “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” Regardless of how the news media chooses to paint the inflation picture, any of us who visit the supermarket know very well that inflation is still with us.

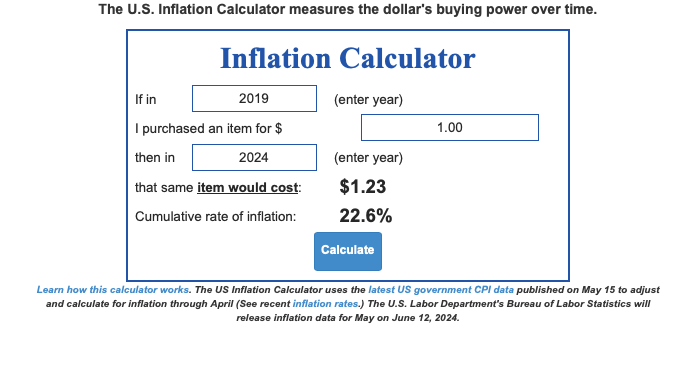

Here’s a neat little inflation calculator.

I can see that since I retired in 2019, prices are up 22.6%. That’s a huge bummer. We all spend 23% more on groceries, food, cars, gas, electricity…than we did just 4 years ago. Did your salary keep up with this?

Fighting Inflation

Governments fight inflation through interest rate hikes. When the Federal Reserve hikes its lending rate, it is harder to get a loan so there will be less money in the system. Less money means less demand and prices will slowly fall. This is a slow and imprecise process, but it’s really the only weapon we have.

Jobs

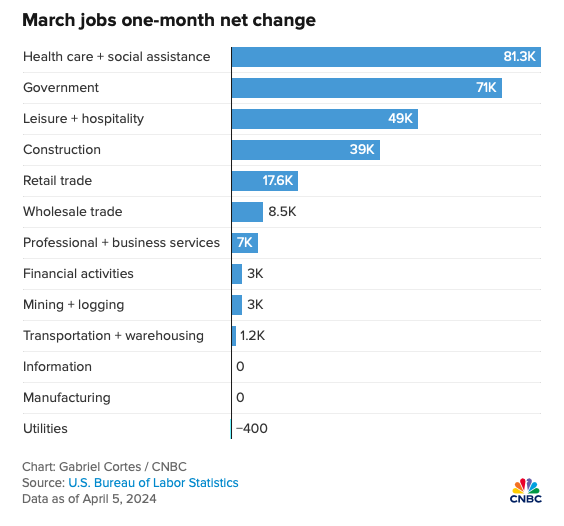

I read the March jobs numbers on CNBC. Here’s a neat little chart from their article where the jobs are in March.

Healthcare makes sense – we have an aging population and have you tried to get a doctor’s appointment? I called 2 months ago and I have an appointment in December.

Then I read Government at 71,000. Yup, that’s right, Government at 71,000. In March, the Federal Government, our federal government, hired 71,000 new people.

Why?

I tried to find some info, but the best I could do was this article from Yahoo. The headline is Biden Administration Job Growth Numbers Are Subsidized By Record Numbers Of Government Jobs — 25% of New Jobs Are In Government.

I applaud putting people to work, especially in this economy, and as the article points out, we are filling some positions that have been open since the pandemic. But my questions are: Is this the right time? Can we afford it? And what are the broader economic impacts?

While I love the solar panel tax credit I got in 2023, I wonder if now is the right time for tax credits?

If the plan is to raise interest rates to take money out of the system and reduce demand and therefore drive prices down, doesn’t adding new government jobs, and issuing government incentives add money back into the system?

I know that there is a balance, and I spent my college time in English classes (and in a few bars) rather than studying economics, so I’m sure I’m missing something, but this seems off to me.

What Can We Do?

This is the tough part. In most of my posts, I try to provide some education and then suggest some things that each of us can do. I’m not sure I have an answer here.

And I want to be clear, this is not necessarily a political party issue. We have had inflationary periods under democrats and republicans. Inflation happens. It’s a normal part of the economic cycle.

I have questions, not answers. Why are we cutting rates and at the same time offering incentives? Can the government afford to be adding 71,000 new jobs? Could they perhaps have added only 35,000 new jobs in March?

And finally, maybe we need to send my post on budgets and saving to our elected officials.

Wrap-up

I’m not the best person to speak to this issue, but the discrepancy I see in the fight against inflation and the March jobs numbers makes me think about how we are addressing inflation.

I’d love to hear comments. Let me know what you think.