Who doesn’t love tractors – right? That’s how I became a John Deere (ticker: DE) investor. At least, that’s how it started. Read on to see how I decided to buy shares and how I revisited my opinion on Deere this morning.

Technology

I like technology. I was the first person I knew who had an MP3 player. This was back in the mid 90’s when they were so new, they were shaped like CD players.

It took a few years for them to figure out that since you weren’t actually putting a CD into it, it didn’t need that shape.

The point is, I was always the first to have new technology. I worked in technology and read about technology, so I favor technology companies as investments.

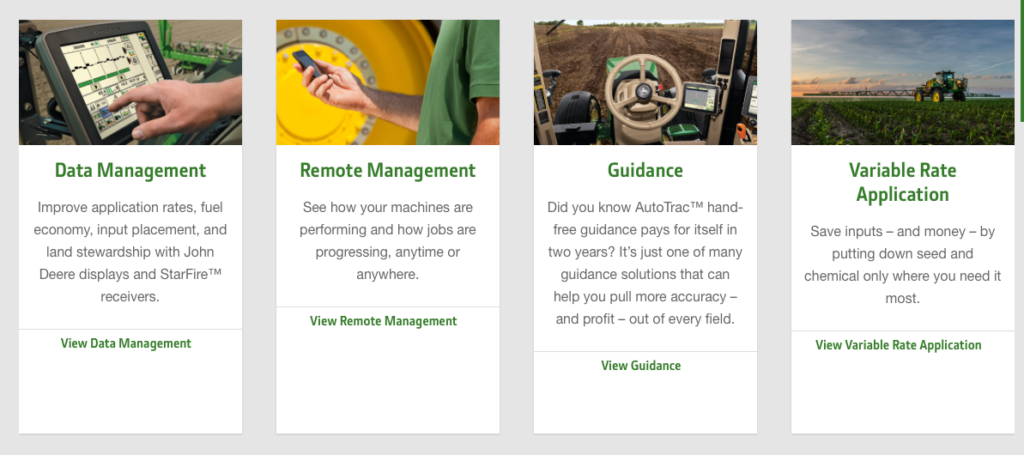

I saw a video about John Deere and was shocked to find out that it is a technology company. See some info from their website.

Thesis

For me, the thesis starts with an idea – wow, Deere is a tech company (and they make tractors – how cool!). Then visit their website – I’m shocked when I meet someone who invests in a company but has not visited that company’s website. Then dig in a bit to see if they are actually doing what they say they’re doing.

Research Report

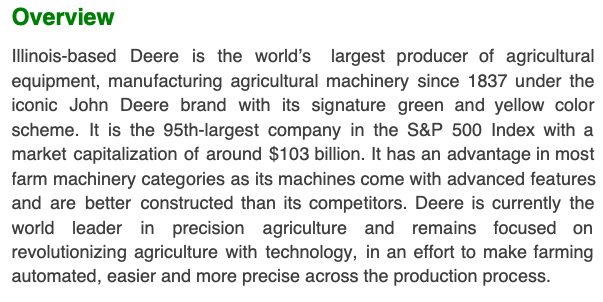

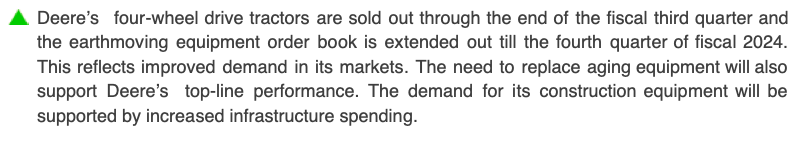

Check out a research report on your broker’s website. Here I learn that:

This is not a marketing piece created by Deere, this is an assessment written by a research analyst at a wall street firm.

This particular report comes from Zacks. I like Zacks because they provide some commentary, not just numbers. I want to know what the analysts that cover this company and this industry for a living have to say.

Deere has been around since 1837. They must be doing something right.

They are the largest producer of agricultural equipment. That’s good.

Its machines come with advanced features. Deere remains focused on revolutionizing agriculture. And it’s products are better constructed than competitors.

You can learn a lot from a paragraph.

Earnings and Sales

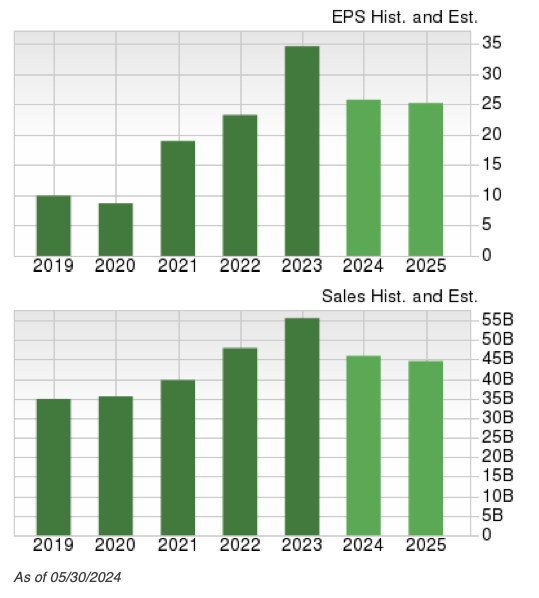

I like it so far, but how is that translating to earnings and sales?

Projections for 2024 and 2025 are not too cool. There is some commentary in the report about high interest rates and supply chain causing some of this.

Read More

I continue reading. I go to the Motley Fool Stock Advisor page to see what they think.

Having a track record of beating the market is important – how’s Deere done since it became public?

Pretty amazing, but I can see the 1 year slowdown that aligns with the muted guidance I saw in the report.

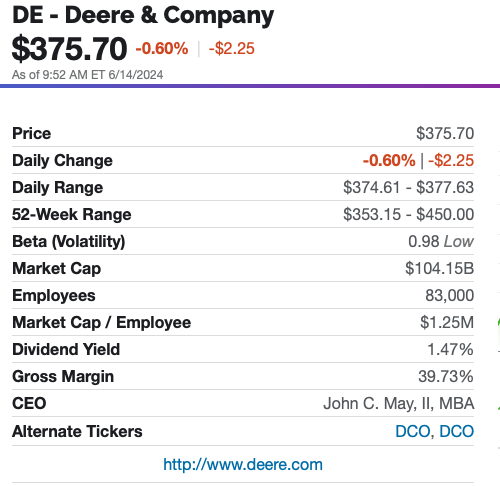

Solid gross margin at 39%, and it pays me a 1.47% dividend to help ride out the slow periods.

I also read:

Summary

In 30 minutes or less, I completed my refresh. There was no math involved.

I saw a consistent message – from Deere, from Zacks and from the Motley Fool. Some headwinds weighing on sales and earnings. I also read:

We rarely see an investment report that says Buy this stock and you are guaranteed to make money. We read the facts and opinions and then we need to make a call whether we think this company is a good investment.

I think farming is important. I expect people will continue to eat for years to come. Farming is a tough business and there are fewer farmers every year so I expect technology and automation will be key. I also like companies that have had proven success for long periods of time. Deere has been around for almost 200 years and has handily outperformed the S&P 500 since going public. I also like the dividend.

After 30 minutes, I’m more optimistic about Deere than I was yesterday. I’m holding the shares I have – and adding a couple of notes to my thesis.

Questions? Comments?