In a recent post, I talked about how important it is to put away a little money in order to build an emergency fund and to invest. Investing over long periods of time has been a proven way to build wealth. While there are no guarantees in investing, the S&P 500 – an index of the 500 largest US companies, has averaged 10% annual gains with dividends reinvested over the last 100 years.

Equities, including equity mutual funds, like an S&P 500 fund, are volatile. They can be down big for a year or 2 or even 3, but in the long run, they have tended to be up more than they’re down, and over 10, 20, 30 year periods, investors have done quite well. Don’t put money you’ll need in the short term in equities, but put aside some long term dollars and let them run. Read more here and here.

In order to grow our wealth we need to save some of the money we earn and invest it. While saving gets a bad name – it’s hard and no fun, it doesn’t have to be.

Look for Small Savings

In my recent post, I talked about the $7.50 I saved filling my tank with gas. I saved via my Fuel Rewards account which is free to join and gives me 5 cents off per gallon. I drive about 12,000 miles per year and I have averaged 36 miles per gallon since I bought my latest car back in March 2023. 12,000/36 is 333 gallons of gas purchased. The annual Fuel Rewards savings are $16.65. Great, once a year I can go through the McDonald’s drive thru.

I also am a T-Mobile subscriber. T-Mobile has a weekly T-Mobile Tuesdays promotion where I get an extra 15 cents per gallon. I always fill up on Tuesday so my annual savings are 20 cents X 333 gallons = $66.60.

Better but still seems insignificant. That annual savings won’t even get me a full tank of gas.

Small Savings Grow

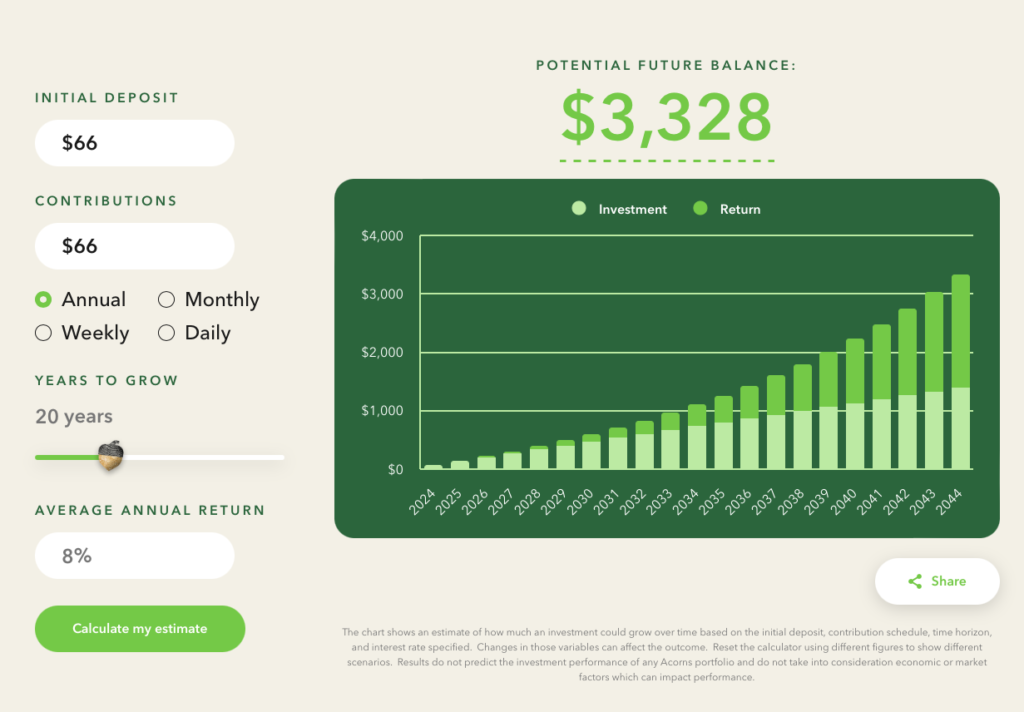

Over time, small savings grow. Check out the projection from acorns.com.

This projection shows the $66 for the first year, adding $66 every year, and assuming a less than historical average of 8%, I’d have $3,328 in 30 years. Look at the investment (money I put in) v. gain. At 30 years I’ve earned more money than I put in.

Big Deal

$3,328, 30 years from now won’t make me rich. I get it.

The point is that I have not deprived myself of anything. I got the same gas I always buy. Fuel Rewards is linked to Shell stations which sell top tier gas, which is important. All I did was install an app on my phone and fill-up on Tuesday after T-Mobile sends out this week’s code.

Top Tier & Clark

Quick aside: The info above about top tier gas comes from clark.com. I came across Clark Howard while listening to a podcast years ago. He taught me that the shaving razor that I was throwing out after 2 weeks could actually last 7 months if I just wiped them down after each use. He was right.

I had been using the Gillette Fusion 5 which I had been buying for $3.33 each. Keeping them for 2 weeks, I was using 26 per year for a cost of $86.58. This cost goes down to around $5.00 since I use less than 2 per year. That’s $80 per year in savings. Again, no depriving myself, just wipe down after each use and swap in a new one after the first nick. I had one last over a year.

I subscribed to Clark’s news letter and I go to his site periodically to look for new ideas. Check out his latest post How To Save Money: Spend Less & Build Your Savings. I love Clark.

Food Shopping

My wife does the food shopping. She has the app for our neighborhood supermarket and she compares prices between Shaws, Market 32, Market Basket and Wegmans. Last week at Shaws, she got $150 of groceries for $50. She reads the flyers and builds menus around what’s on sale, but again we’re certainly not deprived of anything and she regularly saves over $100 per month.

Bigger Savings

And there are bigger items. Years ago we switched cellphone providers. We got our phones paid off and saved over $50 per month. In the process we ended up with unlimited data v. the 2GB shared on the prior plan.

We swapped cable internet for T-Mobile wireless internet and saved $30 per month.

We also regularly shop for car, home and umbrella insurance to get a lower price.

Each of these things, as well as the items on my prior posts on savings here and here, have helped us build an emergency fund, and have funded our investments.

Those Aren’t Savings!

I talked about the T-Mobile Tuesdays and the savings on gas. That’s real money in our pocket to be used for investing. I also regularly see an add for Little Caesars Pizza on the app. Each time, I think “wouldn’t it be nice to have a delicious pizza and save a few bucks.” All day, I hear the Little Caesars guy in my head saying “pizza pizza“

Be careful. If tonight was pizza night and you had planned to go elsewhere and pay full price, but you can now save a buck or 2 by going to Little Caesars instead, good for you. If the “pizza pizza” call rallied you to an unplanned pizza-fest, then you’ve spent more than you’ve planned and you’re in the hole.

Savings are only savings if you pocket the money and then do something constructive with it. Pay off debt, build an emergency fund, or add to investments.

Subscriptions

Subscriptions are the new crack. They are more socially acceptable than crack cocaine, but the jury is still out on which is more harmful. Several of my friends with teen-age children have recently completed subscription inventories and have been horrified to learn that they have 4 different paid music streaming services (family plan on each), Apple TV+, Hulu, Netflix, Disney+, Max…all billed monthly through credit card auto-pay. How about games? Subscriptions as well as in-app purchases. Just click OK.

It’s so easy to sign-up. Start a free trial and forget. Use it or not, it has simple automatic payments. They are small amounts, but they add up.

Do a subscription inventory, you may be surprised.

Is it Easy?

Yes and No.

For my wife and I, we are wired the same way. We’re always on the lookout for a way to shave a buck. It makes it easy when the whole team is rowing in the same direction.

Some of my friends, not so much. When kids are involved it can get dicey. It’s tougher to get them on the saving page. It helps when they have a job and they start to make spend v. save decisions with their own money. I heard a story about a guy who instead of buying his kids things at the mall would give them $10. The kids had a choice to spend it or save it. The change, or the whole $10 was theirs to keep. More often than not, they saved for something they really wanted.

I have a friend who posted his family spending on the fridge for all to see. When he plays golf, it goes up on the list. Groceries, on the list. Pizza night, and any other purchase by any family member, up on the fridge. Sure you may want something, but does it hold up to scrutiny by the whole family?

Goals

Be sure to have shared goals. A trip, college, retirement….these are family goals that should be discussed. Saving can’t be done to penalize, it needs to be done for some larger benefit. Think your retirement isn’t important to your kids? Ask them how they’ll feel when you run out of money and have to move in with them?

And you will likely find some goals that aren’t shared. I like to go out to dinner and my wife does not. She is an excellent cook and she can make what she wants, how she wants it, better than any restaurant. I like to meet up with Tony for lunch at Napoli, Mike for breakfast at Peg’s, Rich for coffee and breakfast at Heritage or Starbucks, BBQ with Tucker at Goodstuff.

My wife’s passion is gardening and home improvement. We have a beautiful yard thanks to her, but left to my own devices, my yard would be asphalt and grass. More of the former and less of the latter, and who needs plants and flowers…

We need to find a way to fund both in our budget.

Wrap-Up

I think the biggest take-away is that it is not so hard to squirrel away a few bucks here and there without depriving ourselves.

Depriving ourselves doesn’t work for weight-loss and doesn’t work for savings. Find ways to save that make you feel good. Groceries, gas savings, switching cell phone and internet providers, shopping for cheaper insurance…all are fairly easy to implement. You’ll save big and likely won’t even notice the lifestyle difference. That’s what we’re looking for.

Check out clark.com for more great ideas.

And adding a spouse or family to the financial decisions and prioritization can certainly ramp up the challenge. Involving the whole family in decisions, and establishing financial goals and sharing progress can help get everyone on the same page.

Take your savings and start to pay down debt, put it towards an emergency fund and invest. Time is your friend. I am 61 and I invest a large chunk of my portfolio aggressively so that I’ll have money 20 years from now in my 80’s. If you’re in your 20’s you’re even better positioned to put aside a manageable chunk of money each month and watch it grow over the next 60 years.

Thanks for reading. Let me know if you have questions or comments.