A lot of my posts encourage investing in low-cost S&P 500 Funds and ETFs. My premise is that we need to invest in equities in order to build wealth. Look at the post on compounding as an example. At one point we compare the portfolio gains of 2 folks – Al and Peg – assuming one starts earlier. The demonstration clearly shows that Al, who starts early, and invests less money overall, is the clear winner. Time is magic.

That’s a cool demonstration, but what if the S&P 500 goes down? Great question.

As much as we’d like the S&P 500 to increase in value, we have absolutely zero control over this. And it does go down sometimes.

The S&P 500

I often talk about the S&P 500 as a proxy for the US equity market. Why? Because the S&P 500 is an index made up of the 500 largest US public companies. That includes Amazon, Apple, Netflix, Alphabet, Meta, Nvidia, as well as General Motors, Proctor and Gamble, Walmart and McDonalds. The index is built and maintained by Standard and Poors, and each of us can participate in the index by buying shares of a mutual fund or ETF that tracks the index. One of my favorites is the iShares Core S&P 500 ETF (IVV). IVV has an expense ratio of 0.03% which means we pay $3 in management fees for every $10,000 we invest.

So, I think the S&P 500 and funds like IVV are a great representation of the broader US equity market. And thanks to records going back over the past 100 years or so, we know that the S&P 500 has gained an average of 10% per year every year (with dividends re-invested) over the past hundred years.

Some years, the S&P 500 has been down 40% or more, but overall, if we bought 100 years ago and held strong, we would have gained 10% per year.

Again, awesome, but I can’t wait 100 years. Today we’ll take a look at some shorter holding periods to see if our bull-case holds water.

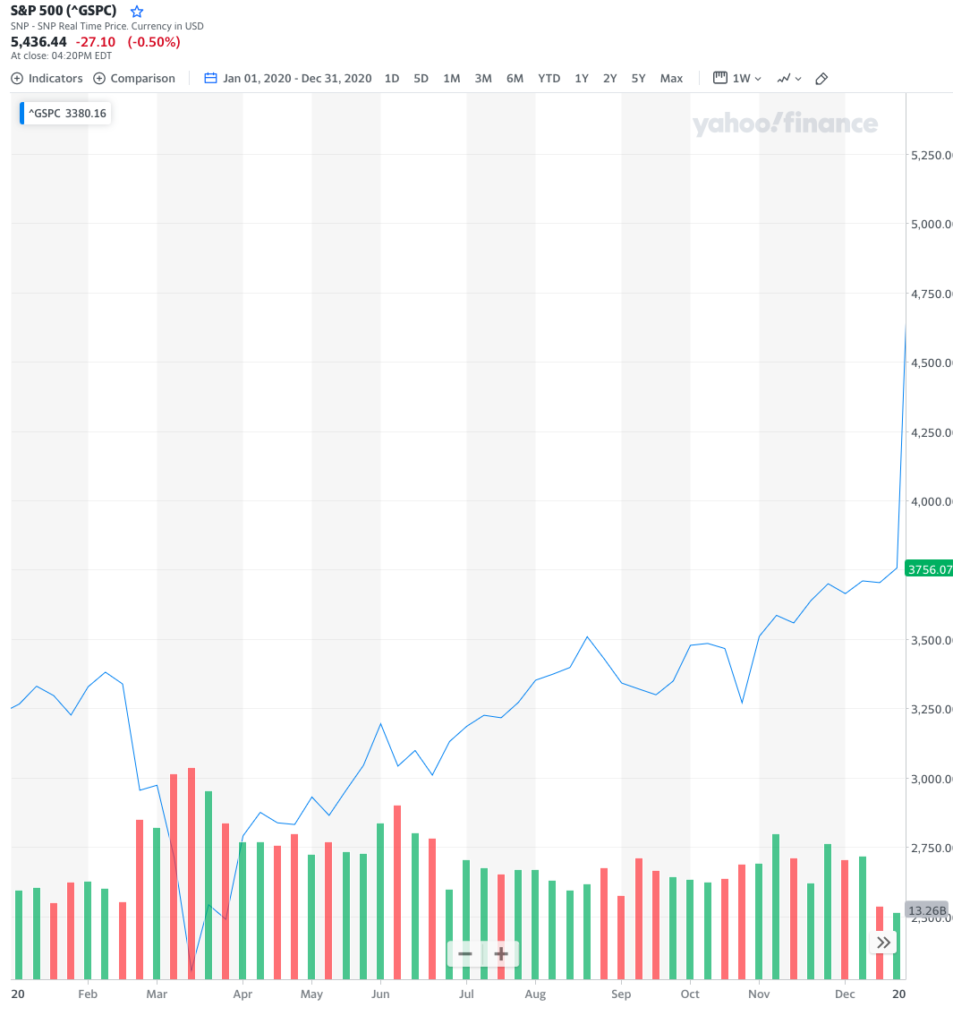

Who Remembers 2020?

We tend to remember the year-end performance of the market, or for our purposes the S&P 500. In 2020, the S&P 500 ended the year up 18.4%. Not too bad, right?

But don’t forget what happened when COVID reared its ugly head.

Check out the chart below. A pretty solid start to the year and then in March, the S&P 500 dropped 23%. That’s a pretty stunning drop in a short period of time. The market gained this all back and more pretty quickly, so many of us forget the panic we felt for a while.

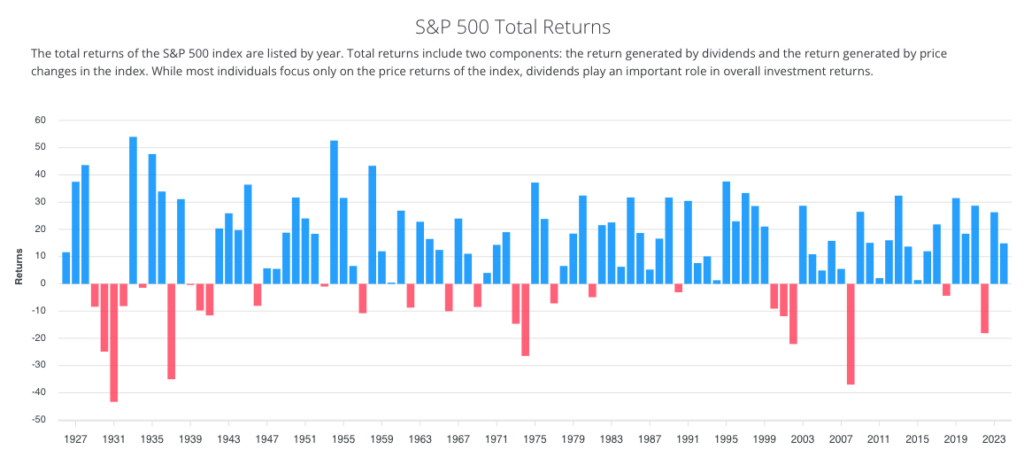

S&P 500 History

Here’s one of my favorite charts. It’s from slickcharts.com and it shows the S&P 500 total returns by year since 1926.

The chart tells us that there are certainly some down years, but there are many more up years than down.

Helpful, but what does this mean to me as an investor who is looking to build wealth over the next 10, 15, 20 years?

20 Years is the Magic Number

I read a great article here. The author analyzes returns over multiple market periods with the result that:

Using just one-year intervals of time, the market can be a crapshoot. Unfortunately, if you were to just choose a one-year period at random, there would be a significant chance of losing money.

However, as the timeframes get longer – the animation goes to 5-year, 10-year, and then 20-year rolling periods – the frequency of losses rapidly decreases. By the time you get to the 20-year windows, there isn’t a single instance in which the market had a negative return.

Test it Yourself

I’m not one to believe everything I read, so I decided to test this out myself.

I started with monthly closing prices for the S&P 500, going back to 1990. I got the prices from yahoo finance and calculated the monthly % change just for kicks. It’s a big table, but skip to the end to see where we go from here.

| Date | Close | % change |

| 01/01/1990 | 329.08 | |

| 02/01/1990 | 331.89 | 0.85% |

| 03/01/1990 | 339.94 | 2.43% |

| 04/01/1990 | 330.80 | -2.69% |

| 05/01/1990 | 361.23 | 9.20% |

| 06/01/1990 | 358.02 | -0.89% |

| 07/01/1990 | 356.15 | -0.52% |

| 08/01/1990 | 322.56 | -9.43% |

| 09/01/1990 | 306.05 | -5.12% |

| 10/01/1990 | 304.00 | -0.67% |

| 11/01/1990 | 322.22 | 5.99% |

| 12/01/1990 | 330.22 | 2.48% |

| 01/01/1991 | 343.93 | 4.15% |

| 02/01/1991 | 367.07 | 6.73% |

| 03/01/1991 | 375.22 | 2.22% |

| 04/01/1991 | 375.34 | 0.03% |

| 05/01/1991 | 389.83 | 3.86% |

| 06/01/1991 | 371.16 | -4.79% |

| 07/01/1991 | 387.81 | 4.49% |

| 08/01/1991 | 395.43 | 1.96% |

| 09/01/1991 | 387.86 | -1.91% |

| 10/01/1991 | 392.45 | 1.18% |

| 11/01/1991 | 375.22 | -4.39% |

| 12/01/1991 | 417.09 | 11.16% |

| 01/01/1992 | 408.78 | -1.99% |

| 02/01/1992 | 412.70 | 0.96% |

| 03/01/1992 | 403.69 | -2.18% |

| 04/01/1992 | 414.95 | 2.79% |

| 05/01/1992 | 415.35 | 0.10% |

| 06/01/1992 | 408.14 | -1.74% |

| 07/01/1992 | 424.21 | 3.94% |

| 08/01/1992 | 414.03 | -2.40% |

| 09/01/1992 | 417.80 | 0.91% |

| 10/01/1992 | 418.68 | 0.21% |

| 11/01/1992 | 431.35 | 3.03% |

| 12/01/1992 | 435.71 | 1.01% |

| 01/01/1993 | 438.78 | 0.70% |

| 02/01/1993 | 443.38 | 1.05% |

| 03/01/1993 | 451.67 | 1.87% |

| 04/01/1993 | 440.19 | -2.54% |

| 05/01/1993 | 450.19 | 2.27% |

| 06/01/1993 | 450.53 | 0.08% |

| 07/01/1993 | 448.13 | -0.53% |

| 08/01/1993 | 463.56 | 3.44% |

| 09/01/1993 | 458.93 | -1.00% |

| 10/01/1993 | 467.83 | 1.94% |

| 11/01/1993 | 461.79 | -1.29% |

| 12/01/1993 | 466.45 | 1.01% |

| 01/01/1994 | 481.61 | 3.25% |

| 02/01/1994 | 467.14 | -3.00% |

| 03/01/1994 | 445.77 | -4.57% |

| 04/01/1994 | 450.91 | 1.15% |

| 05/01/1994 | 456.50 | 1.24% |

| 06/01/1994 | 444.27 | -2.68% |

| 07/01/1994 | 458.26 | 3.15% |

| 08/01/1994 | 475.49 | 3.76% |

| 09/01/1994 | 462.71 | -2.69% |

| 10/01/1994 | 472.35 | 2.08% |

| 11/01/1994 | 453.69 | -3.95% |

| 12/01/1994 | 459.27 | 1.23% |

| 01/01/1995 | 470.42 | 2.43% |

| 02/01/1995 | 487.39 | 3.61% |

| 03/01/1995 | 500.71 | 2.73% |

| 04/01/1995 | 514.71 | 2.80% |

| 05/01/1995 | 533.40 | 3.63% |

| 06/01/1995 | 544.75 | 2.13% |

| 07/01/1995 | 562.06 | 3.18% |

| 08/01/1995 | 561.88 | -0.03% |

| 09/01/1995 | 584.41 | 4.01% |

| 10/01/1995 | 581.50 | -0.50% |

| 11/01/1995 | 605.37 | 4.10% |

| 12/01/1995 | 615.93 | 1.74% |

| 01/01/1996 | 636.02 | 3.26% |

| 02/01/1996 | 640.43 | 0.69% |

| 03/01/1996 | 645.50 | 0.79% |

| 04/01/1996 | 654.17 | 1.34% |

| 05/01/1996 | 669.12 | 2.29% |

| 06/01/1996 | 670.63 | 0.23% |

| 07/01/1996 | 639.95 | -4.57% |

| 08/01/1996 | 651.99 | 1.88% |

| 09/01/1996 | 687.33 | 5.42% |

| 10/01/1996 | 705.27 | 2.61% |

| 11/01/1996 | 757.02 | 7.34% |

| 12/01/1996 | 740.74 | -2.15% |

| 01/01/1997 | 786.16 | 6.13% |

| 02/01/1997 | 790.82 | 0.59% |

| 03/01/1997 | 757.12 | -4.26% |

| 04/01/1997 | 801.34 | 5.84% |

| 05/01/1997 | 848.28 | 5.86% |

| 06/01/1997 | 885.14 | 4.35% |

| 07/01/1997 | 954.31 | 7.81% |

| 08/01/1997 | 899.47 | -5.75% |

| 09/01/1997 | 947.28 | 5.32% |

| 10/01/1997 | 914.62 | -3.45% |

| 11/01/1997 | 955.40 | 4.46% |

| 12/01/1997 | 970.43 | 1.57% |

| 01/01/1998 | 980.28 | 1.02% |

| 02/01/1998 | 1,049.34 | 7.04% |

| 03/01/1998 | 1,101.75 | 4.99% |

| 04/01/1998 | 1,111.75 | 0.91% |

| 05/01/1998 | 1,090.82 | -1.88% |

| 06/01/1998 | 1,133.84 | 3.94% |

| 07/01/1998 | 1,120.67 | -1.16% |

| 08/01/1998 | 957.28 | -14.58% |

| 09/01/1998 | 1,017.01 | 6.24% |

| 10/01/1998 | 1,098.67 | 8.03% |

| 11/01/1998 | 1,163.63 | 5.91% |

| 12/01/1998 | 1,229.23 | 5.64% |

| 01/01/1999 | 1,279.64 | 4.10% |

| 02/01/1999 | 1,238.33 | -3.23% |

| 03/01/1999 | 1,286.37 | 3.88% |

| 04/01/1999 | 1,335.18 | 3.79% |

| 05/01/1999 | 1,301.84 | -2.50% |

| 06/01/1999 | 1,372.71 | 5.44% |

| 07/01/1999 | 1,328.72 | -3.20% |

| 08/01/1999 | 1,320.41 | -0.63% |

| 09/01/1999 | 1,282.71 | -2.86% |

| 10/01/1999 | 1,362.93 | 6.25% |

| 11/01/1999 | 1,388.91 | 1.91% |

| 12/01/1999 | 1,469.25 | 5.78% |

| 01/01/2000 | 1,394.46 | -5.09% |

| 02/01/2000 | 1,366.42 | -2.01% |

| 03/01/2000 | 1,498.58 | 9.67% |

| 04/01/2000 | 1,452.43 | -3.08% |

| 05/01/2000 | 1,420.60 | -2.19% |

| 06/01/2000 | 1,454.60 | 2.39% |

| 07/01/2000 | 1,430.83 | -1.63% |

| 08/01/2000 | 1,517.68 | 6.07% |

| 09/01/2000 | 1,436.51 | -5.35% |

| 10/01/2000 | 1,429.40 | -0.49% |

| 11/01/2000 | 1,314.95 | -8.01% |

| 12/01/2000 | 1,320.28 | 0.41% |

| 01/01/2001 | 1,366.01 | 3.46% |

| 02/01/2001 | 1,239.94 | -9.23% |

| 03/01/2001 | 1,160.33 | -6.42% |

| 04/01/2001 | 1,249.46 | 7.68% |

| 05/01/2001 | 1,255.82 | 0.51% |

| 06/01/2001 | 1,224.38 | -2.50% |

| 07/01/2001 | 1,211.23 | -1.07% |

| 08/01/2001 | 1,133.58 | -6.41% |

| 09/01/2001 | 1,040.94 | -8.17% |

| 10/01/2001 | 1,059.78 | 1.81% |

| 11/01/2001 | 1,139.45 | 7.52% |

| 12/01/2001 | 1,148.08 | 0.76% |

| 01/01/2002 | 1,130.20 | -1.56% |

| 02/01/2002 | 1,106.73 | -2.08% |

| 03/01/2002 | 1,147.39 | 3.67% |

| 04/01/2002 | 1,076.92 | -6.14% |

| 05/01/2002 | 1,067.14 | -0.91% |

| 06/01/2002 | 989.82 | -7.25% |

| 07/01/2002 | 911.62 | -7.90% |

| 08/01/2002 | 916.07 | 0.49% |

| 09/01/2002 | 815.28 | -11.00% |

| 10/01/2002 | 885.76 | 8.64% |

| 11/01/2002 | 936.31 | 5.71% |

| 12/01/2002 | 879.82 | -6.03% |

| 01/01/2003 | 855.70 | -2.74% |

| 02/01/2003 | 841.15 | -1.70% |

| 03/01/2003 | 848.18 | 0.84% |

| 04/01/2003 | 916.92 | 8.10% |

| 05/01/2003 | 963.59 | 5.09% |

| 06/01/2003 | 974.50 | 1.13% |

| 07/01/2003 | 990.31 | 1.62% |

| 08/01/2003 | 1,008.01 | 1.79% |

| 09/01/2003 | 995.97 | -1.19% |

| 10/01/2003 | 1,050.71 | 5.50% |

| 11/01/2003 | 1,058.20 | 0.71% |

| 12/01/2003 | 1,111.92 | 5.08% |

| 01/01/2004 | 1,131.13 | 1.73% |

| 02/01/2004 | 1,144.94 | 1.22% |

| 03/01/2004 | 1,126.21 | -1.64% |

| 04/01/2004 | 1,107.30 | -1.68% |

| 05/01/2004 | 1,120.68 | 1.21% |

| 06/01/2004 | 1,140.84 | 1.80% |

| 07/01/2004 | 1,101.72 | -3.43% |

| 08/01/2004 | 1,104.24 | 0.23% |

| 09/01/2004 | 1,114.58 | 0.94% |

| 10/01/2004 | 1,130.20 | 1.40% |

| 11/01/2004 | 1,173.82 | 3.86% |

| 12/01/2004 | 1,211.92 | 3.25% |

| 01/01/2005 | 1,181.27 | -2.53% |

| 02/01/2005 | 1,203.60 | 1.89% |

| 03/01/2005 | 1,180.59 | -1.91% |

| 04/01/2005 | 1,156.85 | -2.01% |

| 05/01/2005 | 1,191.50 | 3.00% |

| 06/01/2005 | 1,191.33 | -0.01% |

| 07/01/2005 | 1,234.18 | 3.60% |

| 08/01/2005 | 1,220.33 | -1.12% |

| 09/01/2005 | 1,228.81 | 0.69% |

| 10/01/2005 | 1,207.01 | -1.77% |

| 11/01/2005 | 1,249.48 | 3.52% |

| 12/01/2005 | 1,248.29 | -0.10% |

| 01/01/2006 | 1,280.08 | 2.55% |

| 02/01/2006 | 1,280.66 | 0.05% |

| 03/01/2006 | 1,294.87 | 1.11% |

| 04/01/2006 | 1,310.61 | 1.22% |

| 05/01/2006 | 1,270.09 | -3.09% |

| 06/01/2006 | 1,270.20 | 0.01% |

| 07/01/2006 | 1,276.66 | 0.51% |

| 08/01/2006 | 1,303.82 | 2.13% |

| 09/01/2006 | 1,335.85 | 2.46% |

| 10/01/2006 | 1,377.94 | 3.15% |

| 11/01/2006 | 1,400.63 | 1.65% |

| 12/01/2006 | 1,418.30 | 1.26% |

| 01/01/2007 | 1,438.24 | 1.41% |

| 02/01/2007 | 1,406.82 | -2.18% |

| 03/01/2007 | 1,420.86 | 1.00% |

| 04/01/2007 | 1,482.37 | 4.33% |

| 05/01/2007 | 1,530.62 | 3.25% |

| 06/01/2007 | 1,503.35 | -1.78% |

| 07/01/2007 | 1,455.27 | -3.20% |

| 08/01/2007 | 1,473.99 | 1.29% |

| 09/01/2007 | 1,526.75 | 3.58% |

| 10/01/2007 | 1,549.38 | 1.48% |

| 11/01/2007 | 1,481.14 | -4.40% |

| 12/01/2007 | 1,468.36 | -0.86% |

| 01/01/2008 | 1,378.55 | -6.12% |

| 02/01/2008 | 1,330.63 | -3.48% |

| 03/01/2008 | 1,322.70 | -0.60% |

| 04/01/2008 | 1,385.59 | 4.75% |

| 05/01/2008 | 1,400.38 | 1.07% |

| 06/01/2008 | 1,280.00 | -8.60% |

| 07/01/2008 | 1,267.38 | -0.99% |

| 08/01/2008 | 1,282.83 | 1.22% |

| 09/01/2008 | 1,166.36 | -9.08% |

| 10/01/2008 | 968.75 | -16.94% |

| 11/01/2008 | 896.24 | -7.48% |

| 12/01/2008 | 903.25 | 0.78% |

| 01/01/2009 | 825.88 | -8.57% |

| 02/01/2009 | 735.09 | -10.99% |

| 03/01/2009 | 797.87 | 8.54% |

| 04/01/2009 | 872.81 | 9.39% |

| 05/01/2009 | 919.14 | 5.31% |

| 06/01/2009 | 919.32 | 0.02% |

| 07/01/2009 | 987.48 | 7.41% |

| 08/01/2009 | 1,020.62 | 3.36% |

| 09/01/2009 | 1,057.08 | 3.57% |

| 10/01/2009 | 1,036.19 | -1.98% |

| 11/01/2009 | 1,095.63 | 5.74% |

| 12/01/2009 | 1,115.10 | 1.78% |

| 01/01/2010 | 1,073.87 | -3.70% |

| 02/01/2010 | 1,104.49 | 2.85% |

| 03/01/2010 | 1,169.43 | 5.88% |

| 04/01/2010 | 1,186.69 | 1.48% |

| 05/01/2010 | 1,089.41 | -8.20% |

| 06/01/2010 | 1,030.71 | -5.39% |

| 07/01/2010 | 1,101.60 | 6.88% |

| 08/01/2010 | 1,049.33 | -4.74% |

| 09/01/2010 | 1,141.20 | 8.76% |

| 10/01/2010 | 1,183.26 | 3.69% |

| 11/01/2010 | 1,180.55 | -0.23% |

| 12/01/2010 | 1,257.64 | 6.53% |

| 01/01/2011 | 1,286.12 | 2.26% |

| 02/01/2011 | 1,327.22 | 3.20% |

| 03/01/2011 | 1,325.83 | -0.10% |

| 04/01/2011 | 1,363.61 | 2.85% |

| 05/01/2011 | 1,345.20 | -1.35% |

| 06/01/2011 | 1,320.64 | -1.83% |

| 07/01/2011 | 1,292.28 | -2.15% |

| 08/01/2011 | 1,218.89 | -5.68% |

| 09/01/2011 | 1,131.42 | -7.18% |

| 10/01/2011 | 1,253.30 | 10.77% |

| 11/01/2011 | 1,246.96 | -0.51% |

| 12/01/2011 | 1,257.60 | 0.85% |

| 01/01/2012 | 1,312.41 | 4.36% |

| 02/01/2012 | 1,365.68 | 4.06% |

| 03/01/2012 | 1,408.47 | 3.13% |

| 04/01/2012 | 1,397.91 | -0.75% |

| 05/01/2012 | 1,310.33 | -6.27% |

| 06/01/2012 | 1,362.16 | 3.96% |

| 07/01/2012 | 1,379.32 | 1.26% |

| 08/01/2012 | 1,406.58 | 1.98% |

| 09/01/2012 | 1,440.67 | 2.42% |

| 10/01/2012 | 1,412.16 | -1.98% |

| 11/01/2012 | 1,416.18 | 0.28% |

| 12/01/2012 | 1,426.19 | 0.71% |

| 01/01/2013 | 1,498.11 | 5.04% |

| 02/01/2013 | 1,514.68 | 1.11% |

| 03/01/2013 | 1,569.19 | 3.60% |

| 04/01/2013 | 1,597.57 | 1.81% |

| 05/01/2013 | 1,630.74 | 2.08% |

| 06/01/2013 | 1,606.28 | -1.50% |

| 07/01/2013 | 1,685.73 | 4.95% |

| 08/01/2013 | 1,632.97 | -3.13% |

| 09/01/2013 | 1,681.55 | 2.97% |

| 10/01/2013 | 1,756.54 | 4.46% |

| 11/01/2013 | 1,805.81 | 2.80% |

| 12/01/2013 | 1,848.36 | 2.36% |

| 01/01/2014 | 1,782.59 | -3.56% |

| 02/01/2014 | 1,859.45 | 4.31% |

| 03/01/2014 | 1,872.34 | 0.69% |

| 04/01/2014 | 1,883.95 | 0.62% |

| 05/01/2014 | 1,923.57 | 2.10% |

| 06/01/2014 | 1,960.23 | 1.91% |

| 07/01/2014 | 1,930.67 | -1.51% |

| 08/01/2014 | 2,003.37 | 3.77% |

| 09/01/2014 | 1,972.29 | -1.55% |

| 10/01/2014 | 2,018.05 | 2.32% |

| 11/01/2014 | 2,067.56 | 2.45% |

| 12/01/2014 | 2,058.90 | -0.42% |

| 01/01/2015 | 1,994.99 | -3.10% |

| 02/01/2015 | 2,104.50 | 5.49% |

| 03/01/2015 | 2,067.89 | -1.74% |

| 04/01/2015 | 2,085.51 | 0.85% |

| 05/01/2015 | 2,107.39 | 1.05% |

| 06/01/2015 | 2,063.11 | -2.10% |

| 07/01/2015 | 2,103.84 | 1.97% |

| 08/01/2015 | 1,972.18 | -6.26% |

| 09/01/2015 | 1,920.03 | -2.64% |

| 10/01/2015 | 2,079.36 | 8.30% |

| 11/01/2015 | 2,080.41 | 0.05% |

| 12/01/2015 | 2,043.94 | -1.75% |

| 01/01/2016 | 1,940.24 | -5.07% |

| 02/01/2016 | 1,932.23 | -0.41% |

| 03/01/2016 | 2,059.74 | 6.60% |

| 04/01/2016 | 2,065.30 | 0.27% |

| 05/01/2016 | 2,096.95 | 1.53% |

| 06/01/2016 | 2,098.86 | 0.09% |

| 07/01/2016 | 2,173.60 | 3.56% |

| 08/01/2016 | 2,170.95 | -0.12% |

| 09/01/2016 | 2,168.27 | -0.12% |

| 10/01/2016 | 2,126.15 | -1.94% |

| 11/01/2016 | 2,198.81 | 3.42% |

| 12/01/2016 | 2,238.83 | 1.82% |

| 01/01/2017 | 2,278.87 | 1.79% |

| 02/01/2017 | 2,363.64 | 3.72% |

| 03/01/2017 | 2,362.72 | -0.04% |

| 04/01/2017 | 2,384.20 | 0.91% |

| 05/01/2017 | 2,411.80 | 1.16% |

| 06/01/2017 | 2,423.41 | 0.48% |

| 07/01/2017 | 2,470.30 | 1.93% |

| 08/01/2017 | 2,471.65 | 0.05% |

| 09/01/2017 | 2,519.36 | 1.93% |

| 10/01/2017 | 2,575.26 | 2.22% |

| 11/01/2017 | 2,647.58 | 2.81% |

| 12/01/2017 | 2,673.61 | 0.98% |

| 01/01/2018 | 2,823.81 | 5.62% |

| 02/01/2018 | 2,713.83 | -3.89% |

| 03/01/2018 | 2,640.87 | -2.69% |

| 04/01/2018 | 2,648.05 | 0.27% |

| 05/01/2018 | 2,705.27 | 2.16% |

| 06/01/2018 | 2,718.37 | 0.48% |

| 07/01/2018 | 2,816.29 | 3.60% |

| 08/01/2018 | 2,901.52 | 3.03% |

| 09/01/2018 | 2,913.98 | 0.43% |

| 10/01/2018 | 2,711.74 | -6.94% |

| 11/01/2018 | 2,760.17 | 1.79% |

| 12/01/2018 | 2,506.85 | -9.18% |

| 01/01/2019 | 2,704.10 | 7.87% |

| 02/01/2019 | 2,784.49 | 2.97% |

| 03/01/2019 | 2,834.40 | 1.79% |

| 04/01/2019 | 2,945.83 | 3.93% |

| 05/01/2019 | 2,752.06 | -6.58% |

| 06/01/2019 | 2,941.76 | 6.89% |

| 07/01/2019 | 2,980.38 | 1.31% |

| 08/01/2019 | 2,926.46 | -1.81% |

| 09/01/2019 | 2,976.74 | 1.72% |

| 10/01/2019 | 3,037.56 | 2.04% |

| 11/01/2019 | 3,140.98 | 3.40% |

| 12/01/2019 | 3,230.78 | 2.86% |

| 01/01/2020 | 3,225.52 | -0.16% |

| 02/01/2020 | 2,954.22 | -8.41% |

| 03/01/2020 | 2,584.59 | -12.51% |

| 04/01/2020 | 2,912.43 | 12.68% |

| 05/01/2020 | 3,044.31 | 4.53% |

| 06/01/2020 | 3,100.29 | 1.84% |

| 07/01/2020 | 3,271.12 | 5.51% |

| 08/01/2020 | 3,500.31 | 7.01% |

| 09/01/2020 | 3,363.00 | -3.92% |

| 10/01/2020 | 3,269.96 | -2.77% |

| 11/01/2020 | 3,621.63 | 10.75% |

| 12/01/2020 | 3,756.07 | 3.71% |

| 01/01/2021 | 3,714.24 | -1.11% |

| 02/01/2021 | 3,811.15 | 2.61% |

| 03/01/2021 | 3,972.89 | 4.24% |

| 04/01/2021 | 4,181.17 | 5.24% |

| 05/01/2021 | 4,204.11 | 0.55% |

| 06/01/2021 | 4,297.50 | 2.22% |

| 07/01/2021 | 4,395.26 | 2.27% |

| 08/01/2021 | 4,522.68 | 2.90% |

| 09/01/2021 | 4,307.54 | -4.76% |

| 10/01/2021 | 4,605.38 | 6.91% |

| 11/01/2021 | 4,567.00 | -0.83% |

| 12/01/2021 | 4,766.18 | 4.36% |

| 01/01/2022 | 4,515.55 | -5.26% |

| 02/01/2022 | 4,373.94 | -3.14% |

| 03/01/2022 | 4,530.41 | 3.58% |

| 04/01/2022 | 4,131.93 | -8.80% |

| 05/01/2022 | 4,132.15 | 0.01% |

| 06/01/2022 | 3,785.38 | -8.39% |

| 07/01/2022 | 4,130.29 | 9.11% |

| 08/01/2022 | 3,955.00 | -4.24% |

| 09/01/2022 | 3,585.62 | -9.34% |

| 10/01/2022 | 3,871.98 | 7.99% |

| 11/01/2022 | 4,080.11 | 5.38% |

| 12/01/2022 | 3,839.50 | -5.90% |

| 01/01/2023 | 4,076.60 | 6.18% |

| 02/01/2023 | 3,970.15 | -2.61% |

| 03/01/2023 | 4,109.31 | 3.51% |

| 04/01/2023 | 4,169.48 | 1.46% |

| 05/01/2023 | 4,179.83 | 0.25% |

| 06/01/2023 | 4,450.38 | 6.47% |

| 07/01/2023 | 4,588.96 | 3.11% |

| 08/01/2023 | 4,507.66 | -1.77% |

| 09/01/2023 | 4,288.05 | -4.87% |

| 10/01/2023 | 4,193.80 | -2.20% |

| 11/01/2023 | 4,567.80 | 8.92% |

| 12/01/2023 | 4,769.83 | 4.42% |

| 01/01/2024 | 4,845.65 | 1.59% |

| 02/01/2024 | 5,096.27 | 5.17% |

| 03/01/2024 | 5,254.35 | 3.10% |

| 04/01/2024 | 5,035.69 | -4.16% |

| 05/01/2024 | 5,277.51 | 4.80% |

| 06/01/2024 | 5,460.48 | 3.47% |

| 07/01/2024 | 5,463.54 | 0.06% |

Scenarios

A picture is worth 1,000 words so let’s start with a spreadsheet and then we’ll discuss.

| 2years | 5 years | 10 years | 15 years | 20 years | |

| 01/01/1990 | 01/01/1992 | 01/01/1995 | 01/01/2000 | 01/01/2005 | 01/01/2010 |

| 329.08 | 408.78 | 470.42 | 1,394.46 | 1,181.27 | 1,073.87 |

| 24.22% | 42.95% | 323.74% | 258.96% | 226.32% | |

| 01/01/1998 | 01/01/2000 | 01/01/2003 | 01/01/2008 | 01/01/2013 | 01/01/2018 |

| 980.28 | 1,394.46 | 855.70 | 1,378.55 | 1,498.11 | 2,823.81 |

| 42.25% | -12.71% | 40.63% | 52.82% | 188.06% | |

| 10/1/2007 | 10/1/2009 | 10/1/2012 | 10/1/2017 | 10/1/2022 | 7/1/2024 |

| 1,549.38 | 1,036.19 | 1,412.16 | 2,575.26 | 3,871.98 | 5,463.54 |

| -33.12% | -8.86% | 66.21% | 149.91% | 252.63% |

In the first grouping, I started with Jan 1, 1990. $329.08 is the closing price of the S&P 500 on that day. This is a simple XLOOKUP on the above table. I then calculated the subsequent dates 2 years out, 5 years, 10….and you’ll see the S&P 500 closing prices on those dates. Finally, you’ll see the % gain from 1/1/1990 to the date in question. For example, the S&P 500 gained 24.22% from 1/1/1990 to 1/1/1992.

I repeated the process 2 times. One beginning on 1/1/1998, and one on 10/1/2007. On the final one, because we haven’t reached 2027 yet, I used the S&P 500 price for 7/1/2024.

Insights

There are examples, even in this small sample, where I lose money after 2 years, and in 1 case, after 5 years. Also, looking at the first grouping, I’m up 323,74%, then 5 years later I’ve dropped to 258.96%, and then to 226.32%. No surprise, that was the carnage of the 1999 internet bubble.

Here’s the funny thing…3 different 20 year periods ended with a 226.32% gain, a 188.06% gain, and a 252.63% gain. Divide by 20 years, and the average annual return is around 10%.

Wrap-Up

I love this stuff. It’s one thing to read about an average 10% return over the last 100 years or so, but it is another to do the math myself.

The data is easy to find. I could have selected any dates. And I specifically chose periods that contained big pullbacks – the 1999 crash, the smaller 2001 crash, the 2008 crash and the 2018 and 2020 pull-backs.

Imagine investing in 1979 to 1989 – every year was up. Similarly, besides the 2018 pullback and the 2020 pullback, 2009 – 2024 has been a pretty fantastic time to be an investor.

There are no guarantees. Especially when it comes to equities. However, I am optimistic about the future growth potential of the 500 largest US companies. While I’m sure we’ll have recessions, we’ll see high inflation again, and we’ll have national and world disasters that will test our faith, I expect that over 5,10,15 and 20 year periods, equities will prove to be a solid investment strategy and the key for each of us to build wealth.

The numbers are here – test for yourself. And let me know what you think.

Does the mix of the S&P500 skew the data?

Great question Mike. There’s been a lot of discussion about the out-sized weightings of NVDIA, Apple, Meta, Alphabet, Tesla, Broadcom, Amazon and other big tech companies in the S&P 500 index. These companies make up about 30% of the index. And since tech has done very well in the past few years, the index has performed well (better than 20% gains in each of the last 2 years). But many companies have not performed as well. So is the index still a good proxy for the US economy? So probably not as good a proxy as it was, but I’ll look into this. Great question.