In an earlier post on Mutual Funds and ETFs, we talked about mutual funds and ETFs, how they work, the fees they charge and how we get our money out after investing. Mutual Funds and ETFs are baskets of securities, but it is important for investors to know a little bit about how they manage their investments.

Basket of Securities

I like the idea of a basket of securities. A professional makes decisions about the securities to buy and sell. I get instant diversification without having to know a lot about the companies that issue all of those securities.

For a passive fund, it’s even simpler. The fund or ETF, buys and sells what’s in the index. Read the earlier post for more details.

But Wait, What Securities?

Have you ever asked yourself this question about your fund? What does it buy, who decides? Are there any rules? All important questions.

Fund Objective

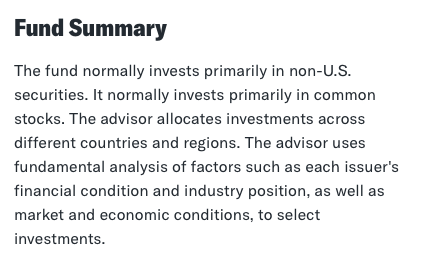

A good place to start is the Fund Objective, also sometimes called the Fund Summary. This is typically a paragraph or 2 describing in layman’s terms (that’s us) how the fund will invest our money.

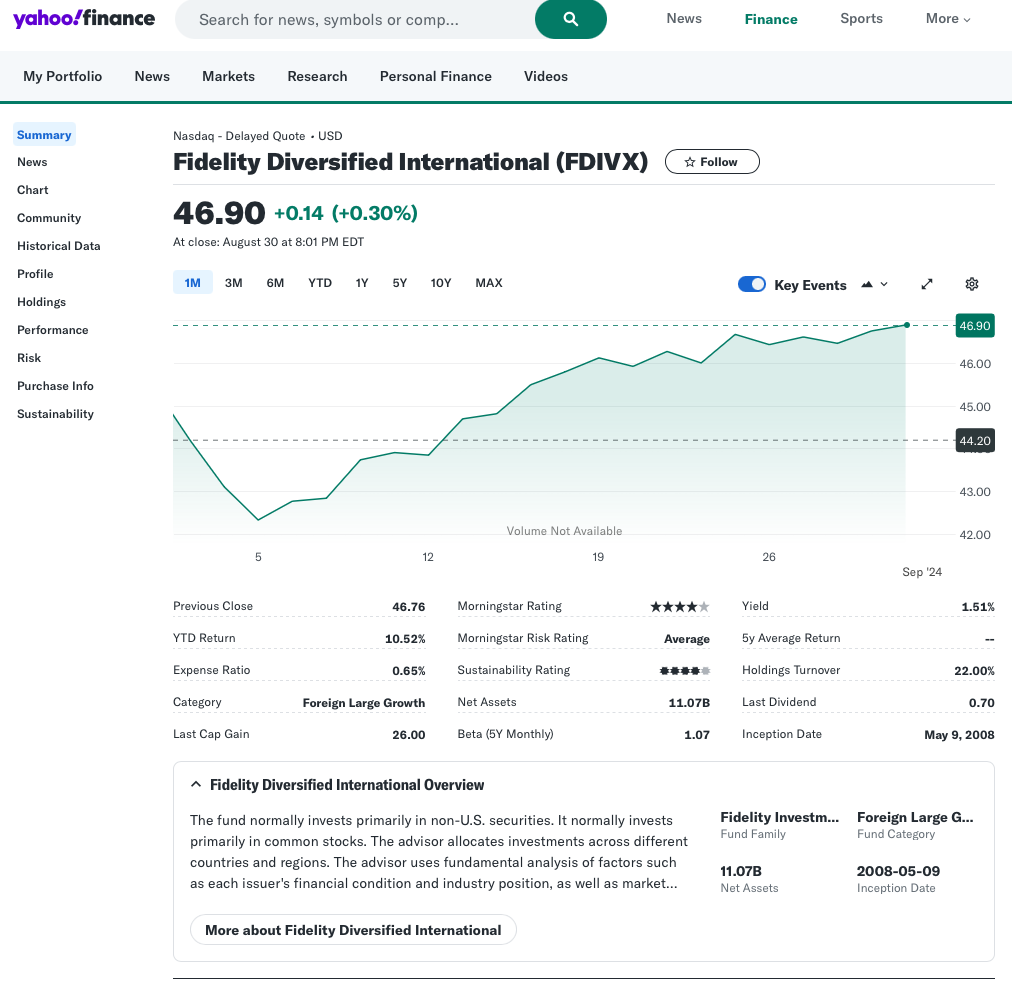

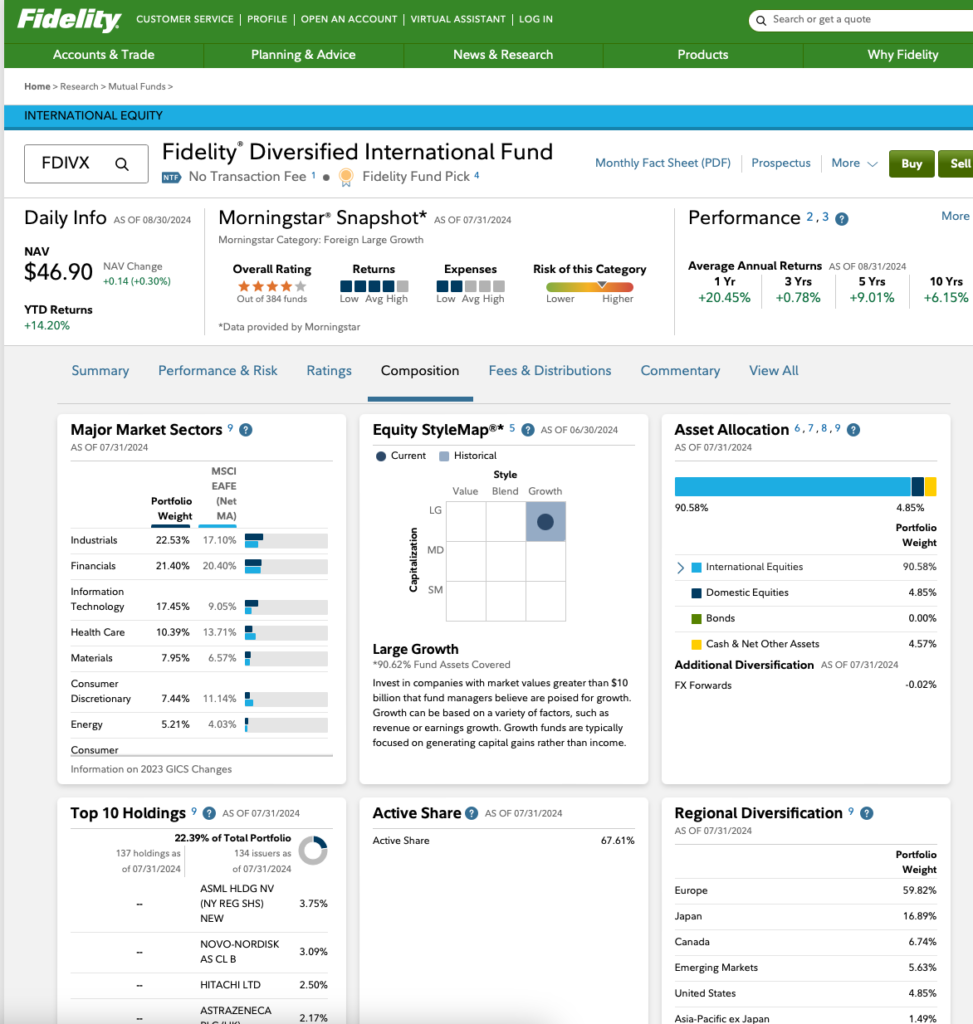

Let’s start at Yahoo Finance. You could also go to Google, Morningstar, or the fund’s own website. Let’s take a look at the Fidelity Diversified International Fund.

Before we even get to the published objective, we can tell a few things from the fund name. Fidelity is the fund company. This is an international fund, so we’d expect some of the investments to be made in foreign companies, and it is diversified so it should be invested in lots of companies across many industries.

We get a little more info from the Fund Category. This fund is categorized as Foreign Large Growth. This tells us it invests in large foreign growth companies.

Objective

Sorry, I meandered a bit…back to the objective:

- Non-US Securities – this could be stocks, bonds, warrants, options, etc. for companies outside the US.

- It normally invests in common stocks. We’d expect to see mostly common stocks, but it does not rule out investment in the other types of securities.

- Different countries and regions is good. That’s the diversification we were looking for.

- And then we see some information about how the advisor chooses companies in which to invest.

Quite a bit of info in one paragraph. Almost enough to make a buy decision, but wait.

Holdings

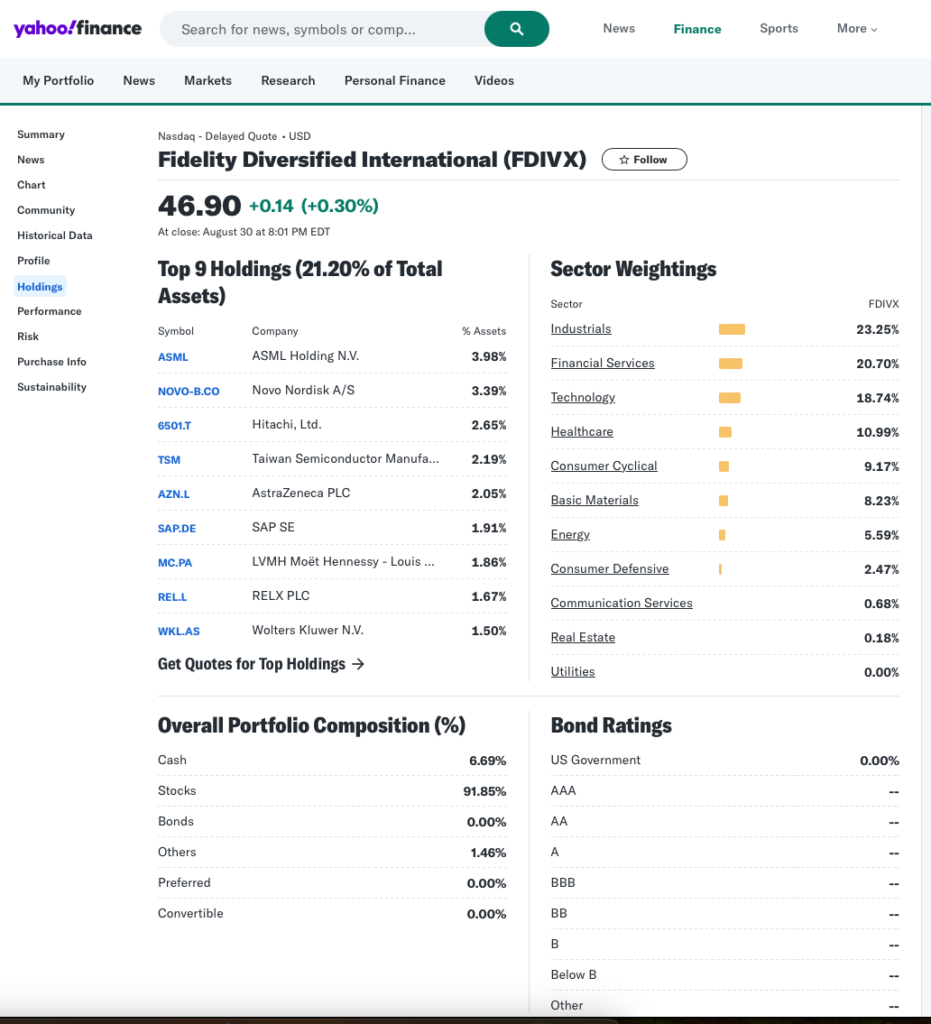

There is a tab on Yahoo Finance called Holdings. Click here and we see some information about what the fund owns.

We see the top holdings. Check. Yup, all non-US companies. Fun Fact: The holdings you see here, or on any website are the holdings as of the prior quarter end. What the fund holds today, or what they intend to buy or sell, is a more closely guarded secret than the Colonel’s chicken recipe.

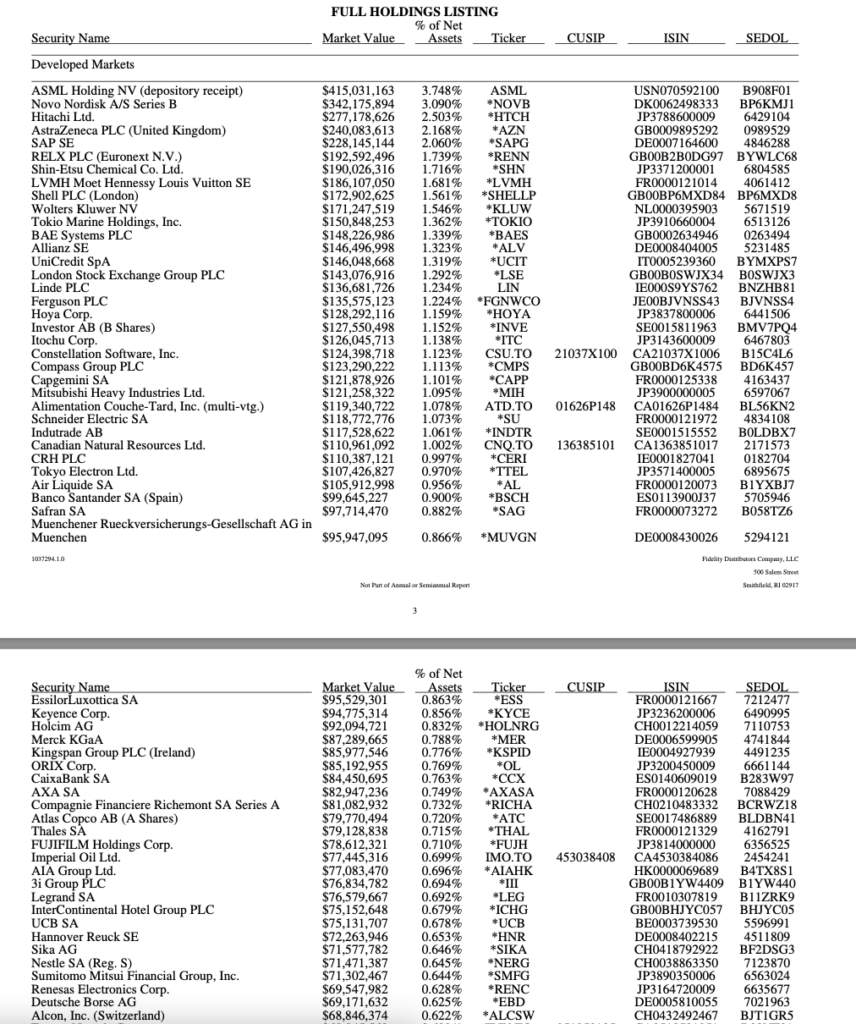

If you want to see the whole list of holdings, you can go to the fund company website and download it. Take a look at a partial list for Fidelity International (couldn’t fit all on one screen).

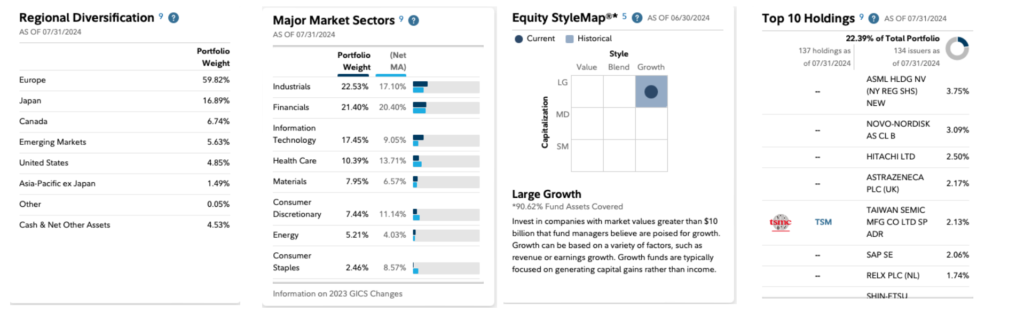

On Fidelity’s page, you can also see similar info about the groupings of securities the fund owns.

The fund owns shares of companies in the industrial, financial, health care and other sectors. It owns mainly large cap growth companies according to the Equity Style Map. It owns 90.58% International Equities and no Bonds. And Regional Diversification shows us that investments are spread across Europe, Japan, Canada, Emerging Markets, and we have a small piece in US.

Re-Cap 1

With a couple of clicks, we’ve learned quite a bit. If we’re looking for a fund that holds mostly non-US equities, and is diversified across the globe, and across industries. This might be a good choice.

Should We Believe This Info?

It’s on Yahoo and it’s on Fidelity’s website so it must be true, right? How do we know? It comes from the people who are selling the fund.

Who Makes Sure This Information Is Accurate?

It really starts with the Investment Company Act of 1940. I can feel your eyelids drooping so I’ll make this quick. While mutual funds had been around for a while, it wasn’t until the investment company act of 1940 that we saw some investor protections. The act lays out the framework for today’s mutual funds.

We also have the United States Securities and Exchange commission (SEC) which polices funds and fund companies to ensure they adhere to these rules.

What is a Fund?

It also helps to have a little background on what a fund is. You may know that the ’40 act (that’s what the cool kids in the fund industry call it) is the investment company act. Every mutual fund is its own individual company. While Fidelity and Vanguard and Blackrock are massive fund complexes that have lots of funds, each fund is its own company. Every fund has a board of directors who oversee the fund operations. Every fund board hires an independent auditor to audit the fund’s financials. Your mutual fund is a company and is governed by a lot of the same rules and processes followed by other US companies.

So, it’s good to know that the SEC, the board, and the external audit firm are all watching out for shareholder (our) interests, but let’s get back to how we know what our fund owns, and more importantly, how can we trust that it will continue to own investments that align with the fund objective.

It’s important to know what our fund invests in, but it is also important to be confident that the investment strategy of the fund will not change over time. We don’t want our diversified international fund to become a China fund without our knowledge and consent.

Fund Operations

Behind the scenes, there are a lot of groups involved to support fund operations. Today, we’ll talk about 3 of them – Portfolio Management, Trading, and Compliance.

Portfolio Management

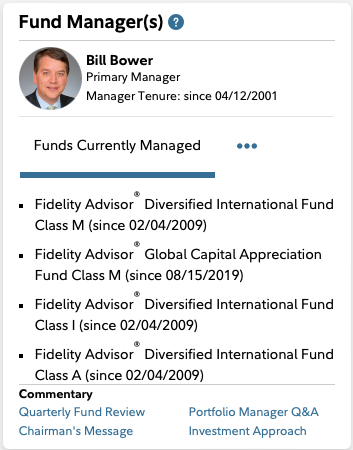

Every actively managed mutual fund has a portfolio manager or a portfolio management team. You’ll see the names of these folks on the fund company website.

The portfolio manager maintains a list of securities he’d like to buy if the fund receives cash (shareholder buys) and a list of securities he’ll want to sell if the fund needs to raise capital for shareholder redemptions. The portfolio manager is also evaluating current holdings to look for opportunities to buy and sell. This is a somewhat complicated process and we won’t get into the dirty details here, but the portfolio management team is constantly working to make the best use of shareholder capital to meet the fund’s objective.

When the portfolio manager wants to buy or sell, he creates an order and sends it to the trading team.

Traders

Large fund firms don’t trade in the same way you or I trade. If I want to buy 5 shares of Amazon, I go online to my broker’s website, put in the order and seconds later, I see a confirmation that the 5 shares are in my account and my cash balance has been debited.

If I’m a trader for a fund company, I’m getting orders from many different portfolio managers. Portfolio managers are trading in much higher volumes. A portfolio manager who has a fund with billions of dollars invested is likely trading thousands of shares at a time. The trader is getting orders from multiple fund managers, so the trader needs to buy and sell huge quantities of each security.

The fund trader has 2 main challenges – first, they probably can’t buy or sell all the shares they need right away. There just isn’t that much volume in the market. Second, if they place their full order right away, the volume that they are trading will likely move the price of the security.

Say I’m a fund trader and I’m trying to buy 100,000 shares of ASML (the largest holding in FDIVX). At today’s price of $903.87 per share, I’m buying over $90million worth of shares. Yahoo finance tells me that ASML trades, on average, 1.3 million shares per day. If I want 100,000 shares, that’s a good chunk of that daily average volume.

That means I’m not going to be able to get these shares right away. I’ll need to buy small chunks from other shareholders over the course of the trading day, or maybe multiple days. I also don’t want to let the world know how much I’m buying. The overall demand of 100,000 shares may push the price up quickly. I also don’t want to let the market know one buyer (me) is buying that much. If I (or my firm) are well known in the market, this could be seen as a bullish call on that security. My interest may spark a trading frenzy which will drive the price up.

Brokers

So as a fund trader, I am going to use 3rd party brokers to help me get all the shares I need. I may place orders on multiple systems, or make phone calls (the old fashioned way) to brokers trying to get my hands on shares of ASML. I likely won’t let them know I’m looking for 100,000 shares. I may tell them I want a few thousand shares. The trader works the order throughout the day, or days, trying to accumulate the needed shares without tipping his hand.

Same works for a sell order. A trader doesn’t want to offload a huge number of shares right away as that will depress the price of the security. The trader’s job is to get the best price for the trade.

Compliance

I spent a good chunk of my career working in mutual fund compliance technology. I loved it and learned a ton, but I’ll tell you, nobody likes compliance. We’re the ones always checking up on you and telling you that you broke the rules. We’re always picked last when choosing sides for kickball.

However, if you are a shareholder, you should be happy that your fund company has a compliance team. Write them a thank you note. They’ll appreciate it.

Quick Aside

While the prospectus and the web site tell us that the Diversified International fund “Normally invest primarily in non-U.S. securities and normally invest primarily in common stocks.” the portfolio manager, working with the fund firm’s Chief Investment Officer, will come up with specific rules to support this objective. There will be limits in how much the fund can invest in any given country or industry to make sure that the fund maintains its diversity without exposing itself to undue risk by overweighting a particular country or industry.

That’s a lot of big words. Basically, these rules prevent the portfolio manager from going all-in on Malaysian hemp stocks because that may be the hot trend at the time.

Compliance (again)

The Compliance team is tasked with monitoring adherence to all of these rules. So, sticking with our example above, the portfolio manager and the chief investment officer likely agreed on the % of the fund’s assets that could be invested in Malaysia. They also probably created a limit for the % of assets that could be invested in the hemp industry, or at least in the materials sector, which covers hemp and other materials.

Our compliance team will ensure that the portfolio manager adheres to these rules. The compliance team will need to test that this rule is not violated when the portfolio manager places a request to buy or sell. They’ll need to test again, before the trader sends the order out to the brokers, because the funds holdings and ratios will have changed since the order was initially opened by the portfolio manager. The rule is tested again after the traders have completed all trades to fill the order. We talked about how this can sometimes take a while. Again, holdings and ratios will have changed. If this new order puts the portfolio manger over a limit, the portfolio manager may be forced to sell some shares to stay within all of the limits outlined in the fund objective.

Recap 2

While the portfolio manager has a lot of discretion over the securities that he buys and sells for the portfolio, it is important for shareholders to know that there are rules in place and oversight processes and systems that ensure the portfolio manager doesn’t stray from the fund’s objective.

As a shareholder, we choose the Fidelity Diversified International Fund because we want international exposure. We want to have some of our portfolio invested in non-US companies and we want to leverage the expertise of a professional portfolio manager to help navigate. What do we know about international economies, politics, and companies? We could use some help here.

But, we also want to ensure we are not over exposed to any one country, or any one industry.

As an investor, I rely heavily on these 4 charts that can be found on the fund’s website. These 4 tell me an awful lot about what I’m buying.

But this is a snapshot in time of what the investment looked like at the end of the last quarter. What about today, what about next week, and what about 10 years from now?

Luckily there are lots of investor protections here in the US.

- The US Government (via the Securities and Exchange Commission) highly regulates mutual funds and how they operate.

- Each mutual funds is an independent company with a board of directors and an independent external auditor who oversee fund operations

- Portfolio management, trading and compliance teams work together to effectively manage the securities in a fund’s portfolio and ensure that the fund stays true to its stated objective.

Wrap-Up

The US has over 33 trillion dollars invested in mutual funds. Read more here.

That’s a pretty big investment. As an investor who holds mutual funds, I think it is important that we understand a little bit about how mutual funds work so that we can be confident in our investments. Trust and confidence make it much easier to hold on to our investments when the market hits a speed-bump.

It’s our job to choose funds that make sense for our investing goals, and it is important to know that the funds we choose have people and processes in place to ensure we can depend on them and the information that they provide to investors.

Thanks for reading. Let me know what you think.