While we all celebrate our first Fed rate cut, and enjoy a robust stock market rally, don’t forget about plain old boring cash.

Savings Account Interest

When I was a kid, I would deposit my paper route money in my passbook savings account and I could depend on it growing at 5.25% each year. Pretty cool.

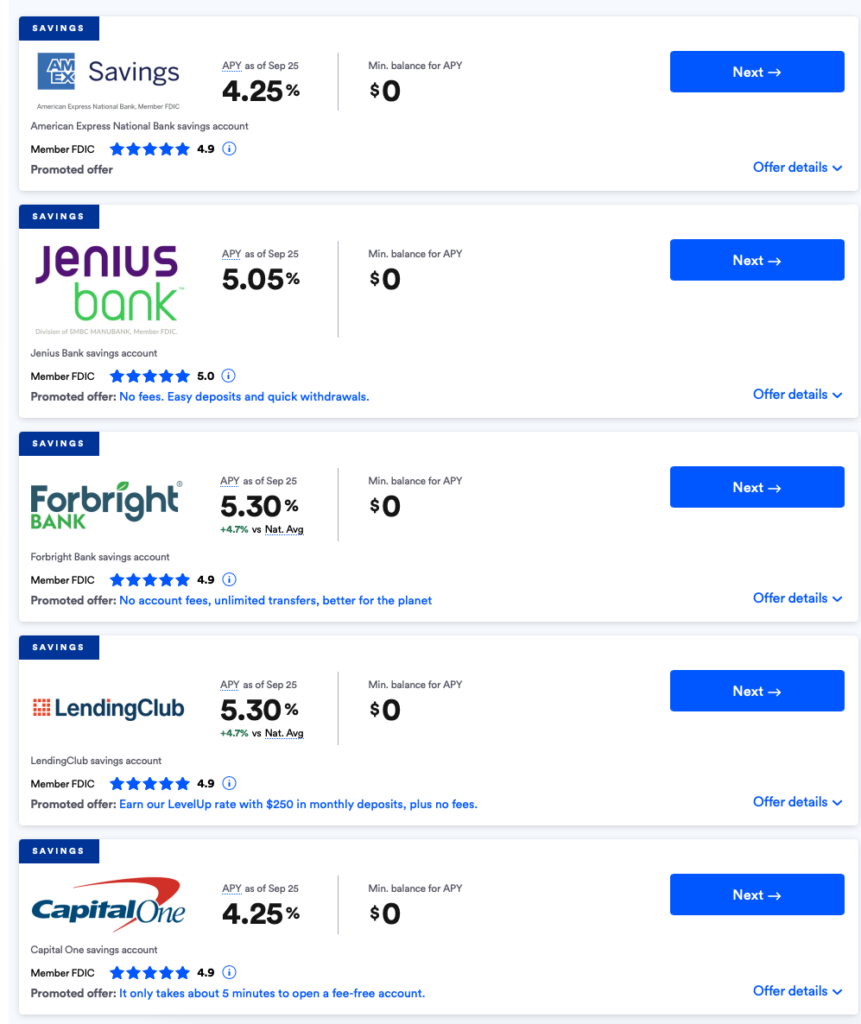

Fast forward to the 2000’s and interest rates hit historic lows. I remember interest rates of 0.01% on savings just a few years ago. Warning, some banks are still paying ridiculously low interest, even though you can get a 1 year treasury bond for 4.35%, or put your money in a high yield savings account at 5.30%. See rates at bankrate.com.

Online High Yield Accounts

Are they safe? I’ve heard horror stories. I’ve heard of Capital One so maybe I’d trust them, but Jenius bank??? Come on.

I’ve done some research on Jenius and they seem legit. They are a subsidiary of SMBC Manubank, which has been around for a while in different forms and is FDIC Insured.

Horror Stories

In one of my financial classes, I talked about Beam Financial. In the days of .01% interest rates, around 2020ish, Beam offered high interest savings. Read the linked article from CNBC. People couldn’t get their deposits out. It was a disaster.

The article refers to Beam’s vendors, and notes one, Huntington National Bank. Details are sketchy, but I suspect that Beam was a middleman and not a bank. This is a grey area in which a tech company can act as an intermediary and take deposits and then re-invest them in an FDIC insured bank. The problem is that the intermediary is holding the depositor’s cash for a period of time. So while the end deposit would be in an FDIC insured bank, who knows where it is when it’s in-transit.

But, depositing directly in an FDIC insured bank is typically safe. Do some research, but the FDIC logo means a lot.

Regroup

OK, back on track. To summarize, bank interest had been quite low for a long time. During peak inflation, interest rates shot up and unless we were in one of those low-interest banks, we had gotten used to 5% or so interest on our deposits.

Cash

The high interest rate environment made Cash a reasonable investment again. When rates were .01%, I had all of my investments in stocks, bonds and mutual funds. But come 2022 or so, when treasuries and CDs started to pay close to 5% interest, Cash became an attractive asset class to invest in.

I took some of the money I had in high-yield stocks and bonds and moved it to treasuries (technically bonds, but extremely safe, so almost cash), CDs and High Yield savings. Even my brokerage cash accounts were getting 5% interest.

Things Have Changed

So, today, we’re focused on the hot news of interest rates declining and the stock market rallying. This is good for our equity and fixed income investments, but not so good for our cash. I noticed my brokerage cash interest rate is down from 5% to 4.67%. Still not bad, but something to watch.

What Do We Do?

I’m glad you asked.

As with any investment decision, we keep our eyes open and see what’s going on. While it seems likely (today) that the Fed will continue to cut rates, if inflation boils up again, the Fed could hold steady, or even increase rates. And the interest rates for cash and fixed income will closely track the Fed’s changes.

That’s not helpful. I also can’t tell you what the stock market will do.

This is what makes investing fun. We don’t know what the future brings but we have tools to combat the uncertainty. The greatest tool we have is time. Returns compound over time and if left alone will grow at surprising rates. Read more here.

We also have asset allocation. We don’t put all of our eggs in one basket. We have equities for long-term growth, we have fixed income to provide a steady flow of income, and we have cash for safety.

Tweaks

If we do anything, we may want to make small tweaks to our asset allocation. When I was getting 5% for CDs and Treasuries, I sold some high-yield companies. This shifted my allocation slightly more towards cash. I may want to shift slightly back to equity. Perhaps when some of my treasuries mature, I’ll take some of the proceeds and buy high yielding equities.

Shop

It’s also a good time to shop for better rates on Cash. Bankrate, Nerdwallet and other sites publish a current list for high yield savings rates.

Even if you love your neighborhood bank that pays 0.01% interest but allows you to come in for banking or for a small loan, it may be worthwhile to take some of the money and invest it in a high yield savings account or a Treasury.

Wrap-Up

With interest rates moving down, and likely to continue heading lower, we may no longer be benefitting from those high interest payments. If we’ve become dependent on these to support our budget, we may need to shop around for some Cash alternatives. Note, if this is money that’s part of your budget, stick with Cash. That’s not money to invest.

For investors, it may be time to tweak our asset allocation to move more towards equity and fixed income, which would benefit from lower rates.

Either way, it’s not time for big moves, but anytime there is a change in the economy, it is a good idea to assess your portfolio for impacts and evaluate whether an adjustment is required.