I can’t count the number of posts where I’ve professed my love for the S&P 500.

The S&P 500 is an index created and maintained by Standard and Poor. It is a list of the 500 largest US publicly traded companies, along with their weight in the index. Weight is determined by the size (market capitalization) of each company.

There are many ETFs and Mutual Funds that track the S&P 500 Index. These funds are a great way to invest. We get instant diversification. We hold a piece of the 500 largest publicly traded US companies and we benefit from their economic gains. Pretty cool.

Buy Buy Buy

Over my investing career, I have been a big buyer of S&P 500 funds.

About 20 years ago, I decided to supplement my mutual fund investments with some stocks. I did some company research, made some good decisions and some bad ones, I learned along the way, and I ended up with a pretty solid portfolio of companies to supplement my mutual funds.

If you’ve read my other posts, you know some of the names on this list of companies. Amazon, Apple, Google (through parent company Alphabet), Berkshire Hathaway and Nvidia. Nvidia is a pretty new holding, but the others I’ve held for 15 years or more.

Grow Grow Grow

While I’ve made plenty of poor investment choices during my investing career, Amazon, Apple, Google, Berkshire and Nvidia have been pretty good ones.

While I put a small amount of money in at the start and added little bits along the way, each of these companies have now become a significant piece of my portfolio. I’m OK with that. I follow them closely and remain optimistic that they will continue to grow faster than the S&P 500.

I may be right on this, I may be wrong, but I’m holding the shares I have. I even bought a little more Amazon during a recent pullback.

…And Then…

A week or so ago, I got an email from the broker who holds my 401k saying that they were retiring some of the funds I held in my account. No problem, I’ll move all of those assets into a nice low-cost S&P 500 fund.

After I made this re-allocation, I updated my mutual fund spreadsheet.

Mutual Fund Spreadsheet

Let’s take a quick look at this sheet.

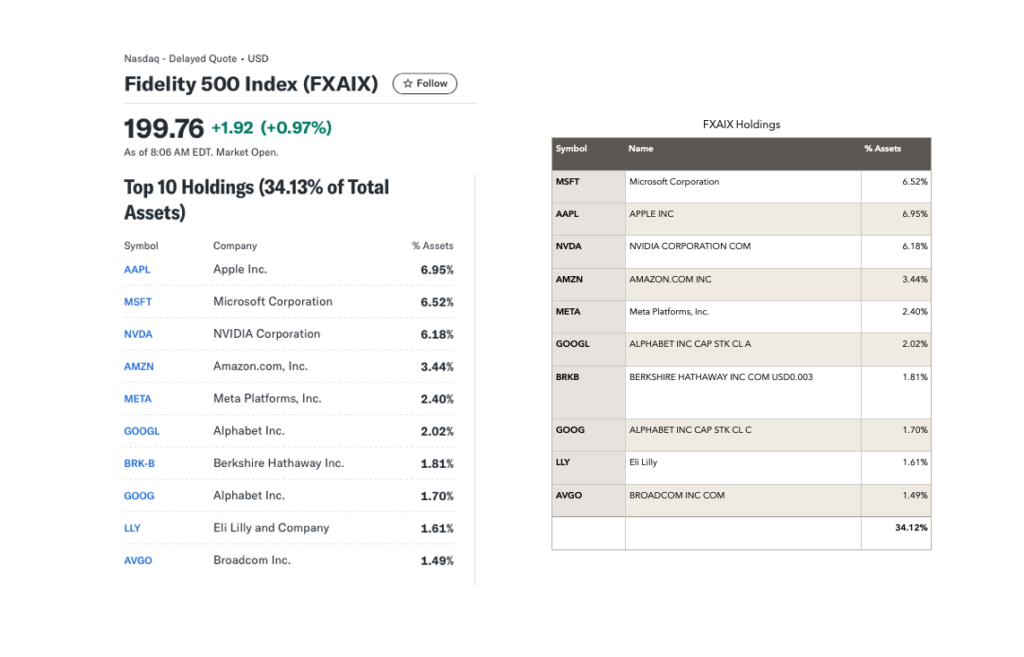

First, I grab the most recent top 10 holdings for the mutual funds that I own. I look the weightings up on Yahoo finance (left side table), and then enter them into a table on my spreadsheet (on the right). I do this for each fund I own.

I then have a table that calculates, based on the $ I have invested in that fund, how much of each company I own through the fund.

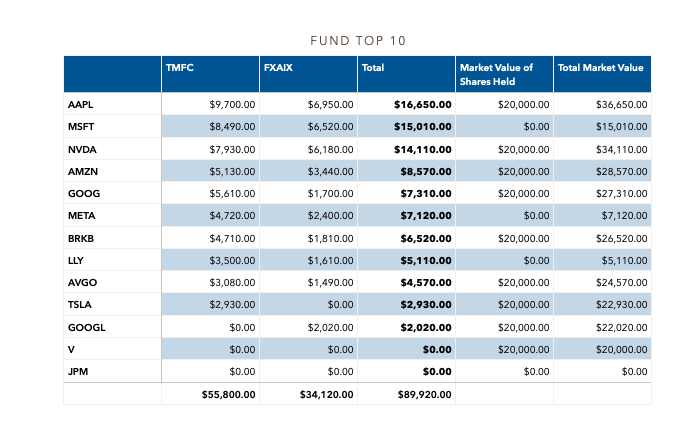

This is a sample for discussion, not my real holdings.

Let’s assume I have $100,000 in each of these 2 mutual funds – TMFC and FXAIX. Columns 2 and 3 take that $100,000 and multiply it by the % assets in that fund for the security. For example $100,000 in FXAIX times the 6.95% weight of Apple, means that I own $6,950 worth of Apple shares through the fund.

I calculate the amount of each security that I own through each fund. I then look up how much of the security I own through direct share purchase and I can see my total exposure to that security.

In this example, I own $20,000 of Apple through shares I’ve bought. My $100,000 purchase in TMFC and FXAIX give me additional ownership of $9,700 and $6,950 respectively. So my total exposure to Apple is $36,650, not the $20,000 I thought. That’s almost double.

I’m Over-Allocated

While I remain very optimistic about these companies, I am retired and I can’t afford to be taking huge risks. The low-cost S&P 500 funds that I was relying on to provide diversity were not doing so in my case.

Other Indices

We’ve talked a bit about the Dow Jones Industrial Average. This is another popular index. It is published by Dow Jones and is made up of 30 companies chosen to represent the US economy.

Many of the S&P 500 top weighted holdings are also in the Dow. That won’t help me.

Luckily there are lots of indices. I love index funds because they tend to be lower cost than actively managed funds, and over time, they tend to out-perform their actively-managed counterparts. More about mutual funds here.

Here are some of the other indices.

- The Wilshire 5000 is a total US index including all publicly traded companies headquartered in the United States

- The Russell 3000 is an index of the 3,000 largest publicly held companies in the US

- The Russell 2000 is an index of the 2,000 smallest stocks from the Russell 3000

There are also indices made up of just small cap companies, mid cap companies, Real Estate Investment Trusts (REIT) and then many flavors of international indices.

So What Did I Do?

First, I said a quick thank-you to my spreadsheet. It’s doing a fine job.

Next, I started to look at my holdings in groups. I have another spreadsheet that has the Asset Class and Sub Asset Class for each holding. I realized that while I have a solid allocation of REITs, I was short in small caps and mid caps. While this is not necessarily a problem, I’ve done fine so far with little to no mid cap and small cap allocation, I saw this as an opportunity to diversify a bit for safety.

I also hunted down a large cap stock index that did not over-weight Amazon, Apple, Microsoft…. The one I chose gives me exposure to JP Morgan Chase, Proctor and Gamble, Johnson and Johnson… These are stable US companies I’d like to own, but I want a fund that prioritizes these weightings above Amazon, Apple…

Wrap-Up

Investing is a hobby for me. I love to keep up with what’s going on in the economy and I like reading about the companies and industries in which I invest. I own shares of 65 individual companies, and I own a total of 103 securities when I include mutual funds, treasuries, and CDs.

That’s a lot to keep track of.

I have dozens of spreadsheets that help me assess my holdings, my portfolio allocations and performance.

And while I would still bet that FXAIX will beat many of the other index funds in which I’ve invested, I need to ensure I am not over-allocated in a few companies.

I’m confident that Amazon, Apple, and others will continue to outperform, but what if I’m wrong. I can’t have any one company represent too large a portion of my portfolio.

Let me know your thoughts.