It’s Friday. You made it through another work week. Congrats.

I have a bunch of quick thoughts for this week, so buckle up.

I Love Dividends

Over the last 5-7 years, as I was nearing retirement, and then entering retirement, I’ve become much more excited about dividend paying stocks. Read more here and here. What’s not to love about a company that I can invest in that has the possibility of capital gain and also pays a quarterly dividend?

Today’s example is Bank OZK.

I had been watching Ozark on Netflix. Loved it!

2 years ago when my wife and I were driving to Florida for a winter vacation, we passed several branches of Bank OZK. One thing lead to another and I started researching the company. I’m a little afraid of big banks because they are in so many different businesses that they are hard for someone like me to evaluate. The smaller regional banks seem a little more straight-forward. I liked what I read about OZK, I liked the P/E of 7 ish, and I loved the 5% ish dividend.

I bought a little, sold some covered calls, bought some more, and watched. 2 years later, I own 1,764 shares of OZK. That puts my holdings at over $80,000, which is a lot for one stock for me. Here’s why I’m fairly comfortable with that.

- I’ve sold covered calls 35 times on OZK. My option premium has been $11,274

- I’ve made $975 in capital gains on the covered shares that I’ve sold

- In the time that I’ve owned OZK, I’ve made $3,451.41 in dividends

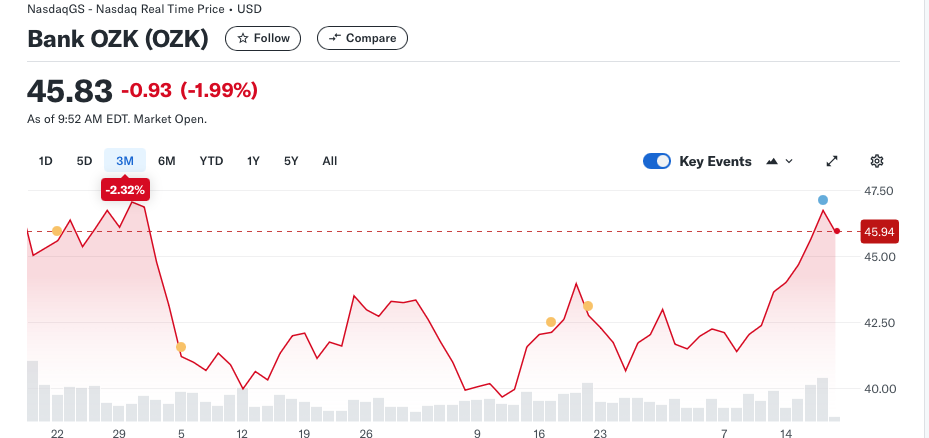

OZK did have a pretty big pull-back recently over some real-estate loan concerns.

As you can see, it seems to be recovering. Overall, I think it is a high quality company.

Today’s Surprise

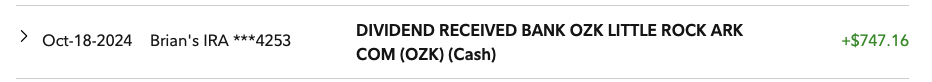

So here’s what I saw today in my IRA

It’s like Christmas morning. If I end up keeping the 1,764 shares I own, I’ll get about $750 every quarter and a total of almost $3,000 every year. Unless the company decides to cut their dividend (like Intel did), I get this same dividend payment whether the stock price goes up or down.

Dividend Re-Cap

Dividend-paying companies can be a great addition to your portfolio. Like any equity security, they come with risk. If I had had to sell my OZK shares to raise cash last month, I would have lost money. I need to keep my eye on OZK’s real estate loans to ensure I’m not putting myself in a risky position.

If this sounds like a lot of work to you, there are lots of mutual funds that pay healthy dividends while owning a portfolio of blue-chip companies. Here are some examples from the Motley Fool.

Credit Scores

I read 2 horrifying articles on Clark Howard’s website.

First up, The #1 Mistake That Can Hurt Your Credit Score. Apparently there is a misconception out there that folks need to maintain a credit balance, and pay monthly interest, on their credit cards in order to improve their score. I’m guessing that this is likely a hot topic on Youtube and Tiktok and there are lots of experts pushing this strategy.

It’s not true. Read more here to learn about how credit scores are calculated.

Second, and even more scary is Can a Credit Bureau Share My Personal Information, Including My Social Security Number?

I almost skipped this one because I said to myself, “that’s crazy talk”. But it’s not, and if you think about it, we know that when we apply for a loan or credit card, the finance company checks with the credit reporting agencies (Experian, Transunion and Equifax) to get our credit history. Do we know the rules these agencies follow?

Apparently not. At least I don’t. Read Clark’s article and immediately create a credit freeze at all 3 agencies.

Hearing Glasses????

Our friends at Soundly just posted a review of hearing glasses. Check out the video here

The Nuance hearing glasses are not yet available but look pretty interesting. Especially if you’re dealing with behind-the-ear hearing aids AND glasses.

I love to see progress on the hearing front. After years of the same old low-quality, high-cost hearing aids, we’re starting to see some real innovation thanks to the OTC ruling which allows hearing devices to be sold without a prescription.

Happy Friday!