Investing can be hard. There is a lot of misinformation, or worse yet, partially correct information out there, that can hurt us if we’re not thorough in our research.

Many of us invest in index funds. These are a great way to diversify, but it is important for us to understand what they are and how they work. Let’s look at an example.

The S&P 500 & US Equities

In many of my posts, I’ll say that the S&P 500 has gained roughly 10% per year, with dividends reinvested, over the last 100 years or so. I make this statement because it is true, and to emphasize that a basket of diverse US equity investments (shares of large publicly-traded US companies) have tended to grow over long periods of time.

I firmly believe that we need to invest in equities in order to build wealth. My statements about the S&P 500 are meant to encourage readers to invest by providing a historical perspective on the wealth building track record of the S&P 500.

My statement does not mean that we can buy shares of any company, even companies in the S&P 500, and expect them to increase in value. In this post, I’ll try and clarify exactly what I mean.

…Future Returns

The S&P 500 has gained roughly 10% per year, with dividends reinvested, over the last 100 years or so. And while the past is not necessarily indicative of future growth potential, I am optimistic about the US economy.

US families continue to have babies who need diapers, formula, and new clothes constantly. Babies grow into teens where they continue to need clothes, but need books, school supplies, sometimes cars, and then they get jobs which drives economic growth both because these teens are contributing to the economy (by making our McDonald’s burger or our Starbucks coffee) and by spending the money they earn to buy more things.

In addition, the US economy continues to innovate. I look at Apple and Amazon as great examples of growing US companies. Apple sells $200 billion dollars worth of iPhones every year. And beyond iPhones, Apple sells Apple music, Apple TV+ and Apple Care within its services business. The services business was minuscule 10 years ago. Today, the services sector revenue alone is larger than that of healthcare giant Johnson and Johnson.

Amazon started as an online book-seller. Then it was the everything store, then it introduced Amazon Web Services, then it became its own delivery company eclipsing Fedex and UPS, and in its most recent earnings call, Amazon reported that’s its advertising business was growing quickly. Watch out Google and Facebook.

But Wait…

Let’s pause for a second, because I think this is where this gets misleading. Some companies are great performers. Others are not. We are also in a period where the top companies in the S&P 500 index have gotten a lot of press for being stellar performers. And the market has been hot this year, so many stocks have big gains.

Let’s dig in to what the S&P 500 really is.

The S&P 500 is a list of the 500 largest US publicly-traded companies and their weighting by market cap. So someone at Standard and Poor (OK, probably a computer) goes out and gets a list of all publicly traded companies in the US and their market cap. Market capitalization is simply the share price times the number of shares outstanding. It is the value of the company.

This list is sorted based on market cap with the largest companies first. A line is drawn at # 500 and everything below the line is deleted. That’s the index.

Market Cap

Market cap is important here because the S&P 500 is a market cap weighted index. That means that larger companies make up a larger portion of the index.

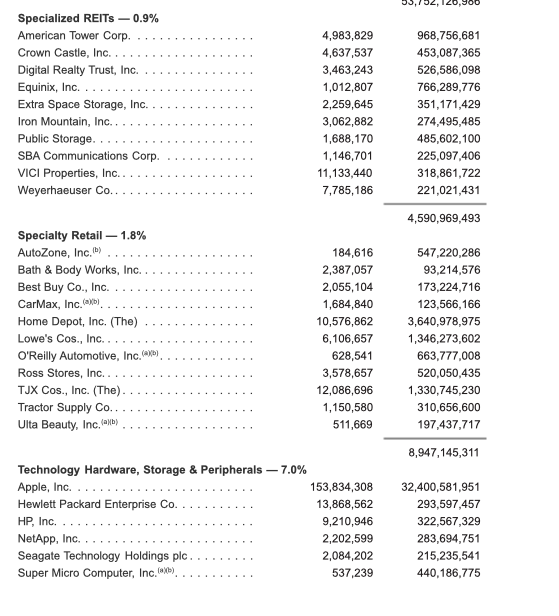

Let’s take a peek at a section of a holdings report for an S&P 500 mutual fund. You can find this on the mutual fund’s website.

The report shows the companies owned by the fund, grouped by the sector of the US economy in which the company operates. The next column is the number of shares held by the fund and the column after that is the dollar value of those shares.

You can see that the value of Apple is larger than the entire Specialty Retail sector and Specialized REITs combined.

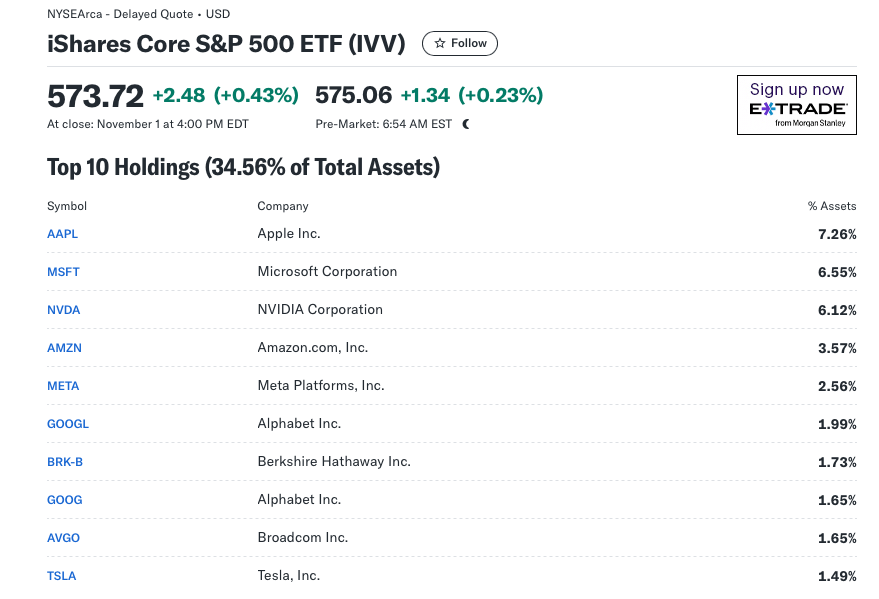

If we go to Yahoo finance, we can see that the top 10 holdings of the S&P 500 account for almost 35% of the assets. That means the other 490 companies account for 65%.

How Do Index Funds Work?

So now we know that the index is a list of securities and their weighting in the index. There are hundreds of different indexes and each has its own methodology and weightings, but let’s stick with the S&P 500.

So for the S&P 500, we have a list of the 500 largest US companies and their weighting based on market cap.

Fund companies like Fidelity, Vanguard and Blackrock subscribe to the Index. That means they pay Standard and Poor for regular updates.

These companies then create an index fund by taking a pool of money, and buying shares of each of the 500 companies in the index. How many shares? This is determined by the weighting. If the fund is started with $100,000 of seed money (the fund company typically puts together its own money to “seed” the fund before opening to investors), $7,260 would be allocated to purchase Apple shares because Apple is 7.26% of the index.

Then What?

2 important things happen next.

First, trading happens. Investors start putting money into the fund to invest, and some investors are taking money out to pay bills or buy houses or pay for college educations.

Remember this is an index fund. It has no fund manager, it is run by a computer based on the index provided by Standard and Poor.

So at the end of each day, the fund figures out its net dollars in or out. If it has had more buys than sells, it has money to invest. If it has had more sells than buys, it may need to sell securities to raise cash.

Whether it is buying or selling, it needs to continue to maintain the S&P weightings for all 500 companies so that the fund’s make-up matches the S&P weightings. This may mean that it needs to trade shares of 500 companies on any given day.

Index Changes

There is a reason that fund companies pay Standard and Poor (and other index providers) to come up with these lists. Things change every minute of every day.

Every time the stock price of a company within the index changes, the market cap changes. Market cap = share price times # shares outstanding. When the stock price changes, the market cap changes. For example, if Apple’s price goes up today, it could end up as 7.27% of the index – which changes the model that the fund needs to manage to.

If the 500th company in the index (the smallest) has a big price decline on a given day, it could move to position 501 and drop out of the index.

In addition, there are corporate actions like stock splits and dividends that need to be accounted for. This is all stuff that Standard and Poor takes care of.

Fund Reallocations

The fund needs to bring some manner of structure to all these moving pieces. A fund will typically specify in its prospectus that it rebalances to the index every quarter, or twice annually, or at some other period. This means that at the beginning of the period, the fund takes the allocation from S&P and reallocates the assets.

In the above example, the allocation for Apple is 7.26%. Regardless of the stock price gyrations for Apple throughout the period, the fund will maintain a 7.26% allocation for Apple.

When the period ends, the fund will get the new allocations from S&P and will make lots of trades to rebalance the portfolio.

The fund still needs to maintain the start of quarter allocations, which means it may need to trade all 500 stocks when it gets new money in or needs to redeem shares to raise cash, but it doesn’t try to allocate to mid-period index allocations at the same time.

Index Reallocations

And the index provider also injects a little bit of structure into the process. While companies could theoretically drop in and out of indexes with price swings, indexes typically announce companies leaving/entering the index well in advance, and then perform a quarterly reallocation.

Here is a list of the S&P changes for 2024 from our friends at Bankrate.

S&P 500 Changes

So the criteria is pretty simple. As companies grow larger and work their way into the top 500 publicly traded US companies by market cap, they join the index. When they shrink, they drop out.

Let’s look at the impacts of this for a second.

If a company like Crowdstrike is growing, it’s stock price is going up so its market cap (outstanding shares times price) is increasing so it becomes a larger company than one of the index components. Now that it has place in the S&P 500, every S&P 500 fund needs to buy shares of Crowdstrike in the open market.

Think about this for a second. The funds must adhere to the index. They’ve stated this in their perspective and the SEC will hold them accountable. The index has now added Crowdstrike, so every single S&P 500 fund buys shares on its next reallocation date. This will likely drive the price of Crowdstrike up. Demand is huge – every fund is buying shares, and supply is fixed. Crowdstrike doesn’t create new shares, the funds need to buy from existing shareholders.

Same goes for Whirlpool and VF Corp (2 companies I unfortunately held). When they were removed from the index, every S&P 500 index fund sold their shares. This drove prices down further. Talk about adding insult to injury. Whirlpool, a great American company, fell on hard times as interest rates rose. Share prices plummeted as people stopped making big purchases. Because of the drop in price, Whirlpool was removed from the index.

Then comes the selling by the index funds. No one wants to buy so the index funds are forced to sell at lower and lower prices to liquidate their shares. They have no choice. They can only hold S&P 500 funds. Ouch!

Is That Good or Bad?

You can tell by the Ouch! that it is not so great – at ;east at the time it occurs. The fund takes a bit of a hit on the Whirlpool sale. But, if Whirlpool keeps going down or even goes to zero, the fund is out of that investment. It only holds the 500 largest publicly traded US companies. It never rides a stock down to zero. We, on the other hand, sometimes get overly attached to our companies and lose our shirts as we ride them down to zero.

We also have the new additions like Crowdstrike, Palantir and Solventum. These are growing companies that have worked their way onto the list of largest publicly traded companies. Some of these will fall back to earth, but some will grow.

Look at Apple. It joined the S&P 500 in 1982. Here’s a full list of the S&P 500 companies. It has grown over 26,000% in the last 20 years. The winners make up for quite a few VF Corps and Whirlpools.

Why is This Important?

As investors, it’s critical that we understand how our investments work. Our S&P 500 fund may suffer a short term loss of value or get a quick bump when a company is removed or a company is added. These are short term moves driven by trading activity.

But, for those of us who are long-term investors, that brief pop or drop doesn’t matter. It helps to understand what the fund and the index are doing so that we understand the movement, but the theme we need to remember is that our S&P 500 index fund is buying growing companies, and selling companies that are declining. In the long term, this has proven to be a successful strategy for building wealth. Will it in the future? I’m optimistic that it will.

Wrap-Up

This morning, I was reading a Yahoo Finance article on the addition of Nvidia and Sherwin-Williams to the Dow Jones Industrial Average. Here is the full article.

Just like the S&P 500, the Dow adds and removes companies based on its own criteria. This is normal.

Today, I decided to read the comments attached to the article and I was somewhat surprised to see:

Martin seems angry. It’s as if he thinks the Dow Jones Industrial Average Index is somehow cheating. Why would any investor blindly hold onto the original Dow stocks?

Indexes Evolve

Indexes evolve, and that is a good thing for index fund investors. We’re always getting shares of the more successful companies and selling shares of companies in decline.

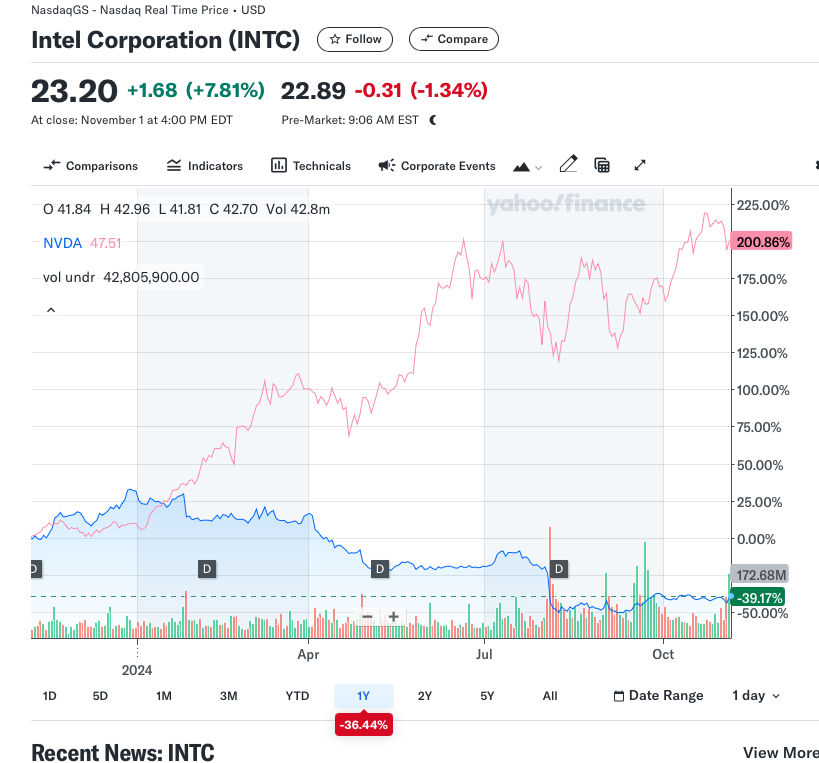

See the chart below with the blue line representing Intel and the red representing Nvidia.

or, Sherwin Williams in blue, replacing Dow Chemical in green.

Dow Jones decided that Sherwin Williams was a more relevant representation of a growing US industrial company than Dow Chemical. And Nvidia is a better representation of the chip sector than Intel. I agree. Our economy is growing after the COVID slump. Companies that represent the economy in these indexes should also be growing.

Investors Need to Evolve As Well

And outside of the indexes, we, as investors in individual companies need to constantly reevaluate those companies just as our indexes do.

Apple and Amazon are large positions in my portfolio. I constantly monitor them and I continue to read about products, services and sales growth that makes me optimistic about their future. Above, I talked about Apple’s growth in the services business and Amazon continually developing new businesses to elate its customers. These things continue to build my commitment to these investments

I’ve written quite a bit about my Intel journey. I bought it for its dividend, the dividend was cut as the business results were suffering. Management promised renewed growth but it always seemed a quarter away.

I sold my Intel shares. Intel went on a brief rally and was loved by media outlets, and then reality set in. The stock plummeted.

I sold my shares for a loss, but I sold when the story changed. The share price has continued to slide. They’ve dropped about 16% since I sold. I’m not riding this one to the bottom.

Just like our index providers, we need to critically assess our holdings. Buy and Hold does not mean close your eyes and hope for the best. It means do your work to find great companies and stick with them. Constantly monitor the company’s results against your investment thesis. Sometimes we need to make the hard decision to sell.