I’ve talked about some of my more interesting investment decisions like being wowed by Netflix’ service and after loving it for years decided to look into the company. Or watching the TV Show Ozark and then driving by Bank OZK and deciding to look further. The best investment ideas seem to arrive in slightly strange ways.

Today I realized that just like building wealth, investment ideas take time and patience to develop. I cannot remember an instance where I said I’m going to find a great investment idea today, and I did just that.

Pay Attention

This is easy for me because I like to read business news. I read and mostly remember, and I build a library of thoughts and ideas in my head that start to come together over time. That sounds a little nebulous, so let’s take an example.

Blue Buffalo

I remember reading a story years ago about General Mills buying a small pet food company called Blue Buffalo. Why the Cheerios maker wanted pet food seemed like a poor decision to me. I didn’t think much of it, but it went on my mental dumb-ideas list.

Over the years, I’ve read a few articles about Blue Buffalo – sometimes articles about other things, but somehow it got to a recommendation for Blue Buffalo. And I heard some friends talk about it in a positive way. This stuck somewhere in my subconscious but was not something I explored further.

Whitebridge Pet Brands

Yesterday, while perusing Yahoo Finance, I caught a headline about General Mills making a big investment in Whitebridge Pet Brands.

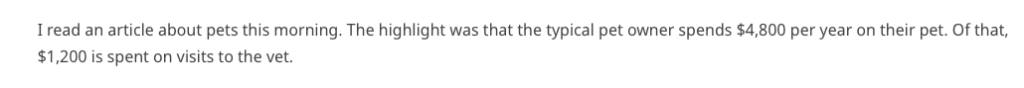

All my subconscious info about General Mills and Blue Buffalo came back to the surface. Mixed with this was my post from a few months back where I wrote about how much people spent on pets.

Here’s the opening line.

Ah Ha!

So…people spend a lot on pets. General Mills bought Blue Buffalo, which I thought was dumb. General Mills is doubling down on pets in a big way with $1.45billion. Maybe this deserves another look.

I read a few research reports. It turns out that General Mills was being hit by the consumer slowdown, but its Blue Buffalo brand helped offset the weakness in cereal. Turns out we’ll cut back on our breakfast, but will still serve our pet a premium meal.

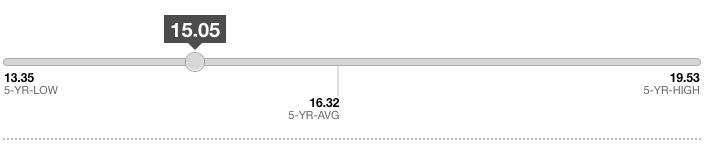

General Mills (Ticker: GIS) has a 3.8% yield and a p/e of 15, which is a little below the 5 year average.

Looks Good

I don’t expect this to be the next Apple or Amazon, but I like the growth potential of the investment in pets and the company will pay me a cool 3.8% every year in dividends while I wait for growth to pan out. Seemed worth an investment to me.

Wrap-Up

So, in the short span of 6 years, I’ve come up with an investment idea.

General Mills announced the whole Blue Buffalo thing in 2018 (here) after which, it germinated in my head and was mixed with some research and writing on the extraordinary sums of money we spend on pets and 6 year later, I have an investment in the company.

Will it work? Your guess is as good as mine.

I have a pretty good track record. My equity investments in total have crushed the S&P 500. For every Whirlpool, Under Armor or VF Corp that I lost money on, there is an Amazon, Apple or Netflix. A company can only go to zero once but can double many time over. I have Apple shares that I bought in 2008 for $4.49 that are worth over $225 today. That’s a gain of about 5,000%.

For me, successful investing means doing some research and a little thinking. I worked hard for my money and I don’t gamble. Sometimes, my ideas take years.