If you’ve read my posts on covered call options, here, here and here, you may have wondered who is buying the option contracts that I’m selling.

Covered Calls

Trading in options can be risky, however, covered calls are probably the safest of all option trades.

On a covered call, I am buying shares of a company (at least 100 because each option contract covers a round-lot of 100 shares). I own the shares and then I sell the option to buy those shares at a specified price on or before a specified date.

Example:

If I were to sell one -LMND241129C35 option contract, I would be selling the option to buy 100 shares of Lemonade (Ticker: LMND) for $35 (strike price) on or before 11/29/2024 (expiration).

Ultra Conservative Option Trading

I hate to loose money. I am quite conservative so I have a set of rules for my option trades:

- Short term – target expiration in 1 month or less, not to exceed 6 months – I don’t want to take undue risk

- Strike price higher than purchase price – don’t let a high premium trick you into taking a loss on the security sale

- Only buy underlying companies that I would be willing to hold for 5 years, even if the stock price falls (I do my research and have a thesis). Because sometimes they do fall and if sold, that one sale can wipe out a lot of option premium.

So, Who’s Buying?

So, now with my disclaimers out of the way….I’m buying 100 shares of a company I like. I’m selling the option to buy these shares at a slightly higher price within the next month.

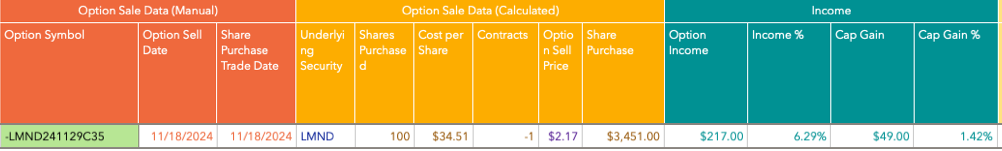

Let’s go back to our example and look at my big option spreadsheet

There are lots more columns, but let’s stick with these for now.

Column 3 is the share purchase trade date. Column 4 is the underlying security and column 5 is the # shares purchased. On 11/18/24, I purchased 100 shares of Lemonade. Column 6 shows that I paid $34.51 per share for a total cost of $3,451.

I immediately sold -LMND241129C35 which gives another investor the option to buy these 100 shares on or before 11/29/24 for $35 per share or $3,500 for the 100 shares covered by the contract (it is all or nothing).

The option sell price was $2.17. The price represents 1 share, but since the contract covers 100 shares, I got $217. You see this in column 10. You see in column 11 that this is 6.29%. That’s a pretty nice return for 11 days of holding the stock.

The next column shows that if I sell the shares for the $35 strike price, I’ll make an additional $49, which is 1.42%

I may make 7.71% in 11 days. Annualize that, that is over 200%.

Who is the Idiot on the Other Side?

This sounds ridiculous. Someone paid me a 6.29% premium to buy a stock, hold it for 11 days and then sell it for a little bit more than the price on the day I bought it. Why wouldn’t they just buy the stock on that day? This sounds insane.

Lemonade’s Price Could Go Down

It is rare that you’ll see a premium of 6.29% for 11 days. For most stable companies, we’ll see 0.5% to maybe 3% for a month. That premium pays the holder (me) for taking the risk that the price will go down. The more volatile (risky) the stock, the higher the premium.

What if Lemonade goes to zero? I got the $217 premium, the stock is worthless, I am out the $3,451 that I paid for the stock, less the $217 premium, so still over $3,000. I took a risk and was compensated. The option buyer lost his premium but that was it. He has no obligation to buy the shares.

So buying the option allows the buyer to participate in potential upside without taking the risk of owning the stock.

Options are Derivatives

Those who lived through 2008 know that derivative is a dirty word. Read The Big Short if you want to learn more.

But derivative in this context simply means a security whose value is derived from another security. The option contract has no value once it expires. The value is in the underlying security and the ability to buy that security at $35 before 11/29/24.

After I sold that contract on 11/18/24, the value of that contract rose and fell in relation to the stock price of Lemonade.

For example, as the price of Lemonade rose above $35, the option contract became more valuable as the $35 contract price was now less than the market price.

But like all derivatives, the derivative price moves are exponentially higher than the underlying security’s price moves.

Let’s look at the rest of the spreadsheet.

Wow!

First of all, Lemonade share price has increased from $34.51 to $45.67. It’s up 32.3% in 2 days. Wow!

Back to the 6.29% premium. That premium reflects the extreme volatility of Lemonade. Lemonade’s share price has been as high as $160 and as low as $14 over the past 4 years. This volatility makes for high risk and the holder (me) is being paid a high premium to take that risk.

Look at the option price. I sold the option contract for $2.17, and it is now at $11.30. It is up 420.74%. The stock is up 32%, which is awesome, but the option is up more than 10x that.

Option Trading

I wouldn’t touch this with a 10 foot pole as it is extremely risky. But all the kids on Reddit are doing it.

Whoever bought this option 2 days ago for $2.17 could sell it now for $11.30. And since it is 100 lots, it’s really $1,130 – $217 = $913 gain. Sweet – almost $1,000 in 2 days for a $217 investment and the option holder never held a share of Lemonade.

So the option buyer (no longer an idiot) can participate in the gain for a much lower cost by buying an option. I had to put up $3,451. He only put up $217.

The option buyer will also have an exponentially higher return on the positive side, and no risk on the downside. He pays the premium and his maximum loss is the $217 premium.

Fun Facts

I have sold 1,008 option contracts. 612 of those have expired worthless. Often the premium is wasted.

Of the options that have closed above the strike price, typically, it is only a few percentage points above strike. The option buyer is typically making anywhere from $100 to maybe $1,000 on the hundred shares.

For the 396 contracts that were “in the money” – meaning that the stock price was above the strike price at expiration, the total % increase from purchase price was 2.24%.

This Lemonade option is unusual. But this is what the kids on Reddit are looking for. Highly volatile stocks. If the stock goes up, the option goes up exponentially higher. If the stock goes to zero, they are only out the option premium.

To me, this seems like a tough way to make a profit.

Wrap-Up

I’ve written about selling covered calls and I often think about who is on the other side of the trade, but I’ve never written about it. It’s interesting to think about who is paying all this option premium and why.

It’s a lot of money and while a lot can be made if the underlying security shoots up in price, this seems tricky.

I’m happy to write covered calls and take the premium, but seems like it is a tough job to make money if you are buying call options. The kids on Reddit may say different, but I’m not so sure.