I’ve written a few posts lately about how I’ve gotten investment ideas. I talk a lot about how I loved the Netflix DVD by mail service and after a little bit of research, I decided to make an investment in the business.

More recently, I wrote about General Mills and their move into pet food. This was a move I watched over the course of 6 years. Initially I thought they were nuts; then I warmed to the idea, did some reading and then decided to invest. You can read the full story here.

It Starts With an Idea

The idea is the easy part. If we keep our eyes open, we’ll see lots of businesses that look like great ideas. Lemonade (Ticker: LMND) is an intriguing one for me. I read about them back in 2020 and was excited about their goal to upend the stodgy insurance industry. I invested. Great idea, but it never panned out and I sold my shares for a loss in 2023. I recently bought back in. Stay tuned for an upcoming post where I try to explain why this isn’t a bone-head play.

The point is that ideas are everywhere. If we dig into almost any business, we’re bound to find something that sounds like a catalyst that could make that company a money-making investment. We do our research. Sometimes we’re right, sometimes we’re not.

Home Solar

I wrote a post about adding solar panels to my home. So far, I’d rate this a smashing success. I spent about $30k to install, got about $11k back on taxes, so for a 19k investment, I’m saving about $3k per year. In less than 7 years, the system will pay for itself. From there on out, it’s free money. And the 8 months per year of a zero dollar electric bill are a delight.

To quote the sheep “home solar good, solar investment bad”. It’s been a while since I read Animal Farm. That may not be the exact quote. My apologies to the sheep.

Solar Investment

Even before I took the plunge, I was optimistic about solar. Looking back, I blame myself, but I also blame the media. There is a lot of hate for Jed Clampett and his cohorts. No one likes oil. And don’t even mention coal. Fossil fuel is not cool.

I’ll get back to my blame of the media in a sec, but the point is that we were hearing a lot about the possibilities for solar and wind. They are our energy future. Then add in the 30% incentive the US government is offering to citizens who install solar. How can these businesses not be money-makers?

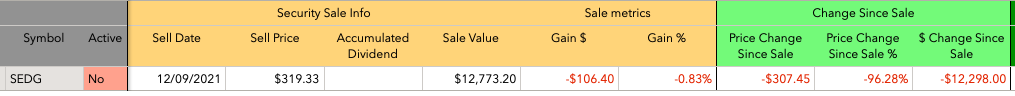

So, solar is the idea. The abundance of glowing articles in the media and the tax incentives are the catalyst. I then did some research to find the best investments. An investing newsletter I subscribe to likes Solar Edge, so I decided to give them a shot.

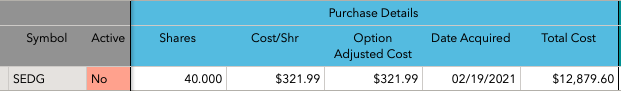

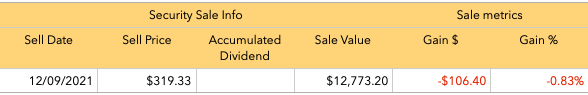

I bought 40 shares at 321.99 per share on 2/19/2021. At the time I felt pretty good about the company and about the potential for solar.

What The Hell Do I Know?

Over the next few months, I started revisiting my thesis on a number of growth companies, including Solar Edge. My first question (to myself) is: “Am I excited about this company because of something I believe, or is it because of something someone else believes?” Read my post on conviction. For me, it is critical that I believe in the company.

With Solar Edge, I could not tell myself with conviction that I believed. I believed in solar, and I believed in the folks who wrote the newsletter, but that’s not good enough. I sold in December of 2021.

I lost $106.

$106 is cheap money to learn an important lesson. Conviction matters.

Things Changed

2022 comes along and I start looking into roof-top solar. I do a lot of reading and research. 2 of my golf buddies have solar so we talk about this instead of focusing on our game. We need the distraction.

I end up with inverters from a company called Enphase. Interestingly, the Enphase inverters are installed on each panel as opposed to the Solar Edge inverter, which services all panels. This way if one Enphase inverter goes down, the others still produce power, whereas the Solar Edge system relies on 1 big inverter so the system as a whole goes down on a failure.

I also looked into solar batteries, where Enphase is a leader as well.

Enphase

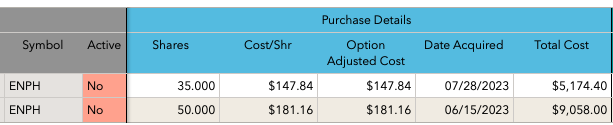

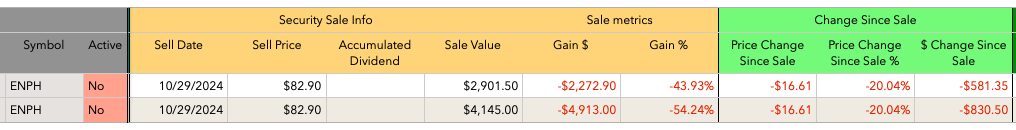

Because of all my reading and talking, I am newly energized (ha ha) on solar and I’m excited about Enphase. I decide to make a small investment.

Of course it immediately drops 40% in value so I buy more. Innovative company, great product, outstanding reviews, and huge government incentives – investors are getting this wrong.

Enphase has a couple of small recoveries, but continues the trek down. I start looking at research reports – what did I miss?

Inflation

Oh, crap! Bacon, egg and milk prices have skyrocketed. Many people can’t afford breakfast. What makes me think they’ll be shelling out $30k for solar?

But wait, they can finance, right? But when inflation goes up, what happens to interest rates? Who can afford to finance?

So yeah, one of the research reports that I read went into great detail about the risk inflation posed to solar businesses. Despite the incentives, inflation was a huge head-wind.

Sell, Sell, Sell

I go back to my earlier thought – “What the hell do I know?” I know a lot about the products – panels, inverters, batteries…but this doesn’t mean I understand the business of solar.

I drink a lot of coffee. That doesn’t make me an expert on Starbucks. I’m more comfortable with my Starbucks investment, because my love of their coffee has lead me to read about the business.

I can list quite a few things about the Starbuck’s business that I love. Did you know that Starbucks customers have over $1 billion in unredeemed gifts on Starbucks cards? Read here. This is a $1billion no interest loan to Starbucks. Brilliant!

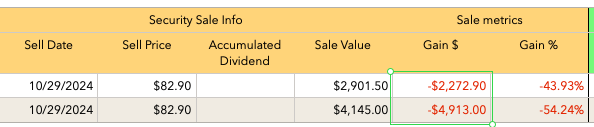

I need to make sure that I don’t confuse my love of the product and my knowledge of the product with a conviction in the company and the business. My investment in Enphase taught me this valuable lesson (cost: $7,185.90).

Above are my 2 purchases and below are the sale details for the same 2 purchases.

Wrap-Up

A few things for the wrap-up.

Conviction

The lesson learned here is that knowledge of, and conviction in the product does not always translate to business success. There are many great companies that produce great products and services that are not great investments.

Conviction in the company and the business is a must. Read here.

Many of the companies in which I’ve invested have pulled back 50, 60, even 90 percent. My belief in the company has helped me stay invested through these downturns. With Solar Edge, I discovered I did not have the conviction, and with Enphase I discovered my conviction was in the product and not the company.

Was I Right?

Who knows? I suspect that 20 years from now, folks who own Solar Edge and Enphase will be quite pleased. I think solar is a big part of the world’s energy future and I think Enphase especially will be a leader. But for me, suspecting this is not enough.

But for now, I’m happy I sold. Look what’s happened to Solar Edge since I sold.

And Enphase

But to be clear, while I’m happy I sold, not having invested at all would have been far smarter. But if I’m going to lose money, I at least want to learn from the experience.

The Media

I’ve veered off of financial education and written a few opinion posts about my disdain for the mainstream media. I believe that these posts, and the research that went into them have made me more skeptical and have made me realize that I need to work harder to find the facts.

Lots of glowing articles about solar does not really mean we are in a solar boom. I’ve read about the affordability. I’ve read about the increase in installations. All this is interesting, but investment research reports will tell you that Enphase is facing headwinds because inflation has put a huge damper on solar.

Here’s an interesting article by Forbes that recognizes the catalysts as well as the headwinds. Read here.

…and finally…

As investors we’ll all make mistakes. As long as we have a diversified portfolio, none of them should be fatal. It’s important to learn from them.