This one is a slippery slope for me. As a rule, I will not buy shares of a company that I’ve sold. But there have been a few exceptions…

Selling

I don’t make a sell decision easily. I generally start to see a pattern that puts my thesis at risk and I watch for a while. It took me a long time to sell Under Armor. I love their product. More and more athletes and teams were wearing Under Armor. Their brand was strong. Their founder was the CEO. I felt they had momentum and there was a huge market opportunity.

As the stock dipped, I held on. I still believed. Growth companies are tricky because the metrics can be misleading. The financials never look great, but we’re really buying into the growth story that management is selling.

Then the growth story sputtered. Excess inventory. Yuck! Discounting. Yuck! These are bad signs for a growth company.

I followed Under Armor down a bit longer and then I sold. My journey looked like this:

The ride up was exhilarating. The ride down, not so much.

Like most of us, I didn’t sell at the peak. I waited to see cracks in the company’s performance against my thesis and then I hung on a bit hoping the company’s turn-around efforts would work.

As a side note, hoping for a turn-around has not once worked well for me.

These are hard lessons. I don’t typically want to relive them. So I don’t buy back in.

Are You Sure?

I’m wearing an Under Armor shirt right now. I still love their stuff. I’ve read quite a bit about the company. I feel like I’m invested. Why not jump back in if things start to look promising?

Under Armor has a strong brand. It could fix its problems and return to (business) greatness. But maybe it won’t. If it doesn’t, I’ll be really mad at myself for getting fooled twice.

There Are Other Fish In The Sea

Yes, I need to find a new idea, then I need to research a company I know nothing about, and probably many, because the first idea rarely takes.

But, there are lots of great companies, and besides, this is fun for me.

If I don’t get inspired for my next idea by having lunch, grabbing a snack, or buying athletic-wear, there are lots of stock screeners to help me start.

Lemonade

In yesterday’s post, I promised a follow-up on my decision to buy more shares of Lemonade and why this isn’t a bone-head play.

Here goes.

History

Lemonade caught my eye back in late 2020. They had a plan to disrupt the stodgy insurance industry using automation. I loved the idea and bought shares. Financials were rough, but that was to be expected. Growth was strong. And then my favorite newsletter recommended them a few times and I bought more.

Here’s what that ride looked like.

I went from $50 per share to $140 and then began the long ride down. After a dead-cat bounce in 2022ish, it continued down. I got out at around $20. I had lost a good chunk of change.

Lessons Learned

Unbridled Enthusiasm.

This is a great phrase for investors to learn.

It was the downfall of Billy Mumphry and it lead me to more losses than I should have had on Lemonade.

When things are good and the media is telling you that the company is great, it is a good time to re-check ourselves.

As enthusiastic as I was, Lemonade was a small, unproven growth company with huge expenses, light on capital, and it was an insurance company. It’s not building technology. And it is going up against a lot of big insurance companies (and their lobbyists) who want it to fail.

It’s OK to take a nibble, but don’t go all-in.

Unbridled enthusiasm.

This lesson cost me about $20,000. That one stung.

I’m Baaack

So, no one was more surprised than me when I decided to buy more Lemonade last month.

A Little More History

…and one more thing…The big deal for me with Lemonade was that they promised to use AI (3 years ago, before every company started promising that they would use AI to change the world) to automate claims. Customers would enter claims on their phone and they would be approved in seconds with no human intervention.

I worked at an insurance company. There were a lot of folks in the claims department and the company made a fortune. Imagine if you could get rid of these folks…hmmmm.

So I bought shares and I also bought a pet insurance policy from Lemonade. Read more here.

There is nothing better than a little boots-on-the-ground research. Let’s see how they do.

My First Claim

My dog Rosco is a disaster. He’s had 2 ACL surgeries, surgery for a broken toe nail, a broken tooth and 2 skin mass removals. We are no strangers to pet insurance claims.

I was excited for my first claim. Luckily Rosco provided and it wasn’t long before I was entering his claim info into the Lemonade app.

After entering I got a string of emails. I was asked for additional info, I was asked for permission to contact Rosco’s vet. 10 days later, the claim was approved.

Same experience for the next 2 claims. I’m no expert, but this isn’t how I envisioned AI working.

Liars

Maybe liars is a little strong, but the folks at Lemonade clearly haven’t figured out how to automate. This explains why their operating costs are higher than expected.

I’m watching the stock price dive while I’m realizing that they are not doing what they said they could do. Sell, Sell. Sell.

I sold my shares but kept the insurance. Their prices are competitive.

What Changed?

This year Rosco continued his frequent vet visits. More visits meant more claims.

Earlier this year, I input my claim info on the phone and it was immediately approved. This happened 2 more times. One was a $1,500 surgery.

I think they finally figured it out.

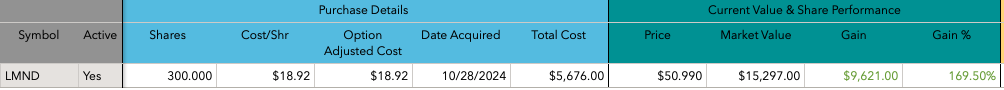

I gave Rosco $5,000 and told him he could invest in Lemonade or Chewy. He chose Lemonade. This way I can say it was his decision, not mine.

How Did Rosco Do?

Good dog!

$9,621 is a good start to paying us back for all the dream bones and vet visits.

Wrap-Up

Lemonade is still not profitable, and with its recent price jump, it is a media darling. This worries me. It’s equally likely that it could be at $100 in a year or $5.

But, I think it has finally lived up to its promise to automate claims.

I broke one of my rules and I bought a stock that I had sold, but I did it because I had first-hand evidence that the company had solved a problem that I believe contributed to it’s decline.

I have leaned my lesson about unbridled enthusiasm so I will enjoy the shares I have and will not buy more. I paid a lot for this lesson.

I’ll still follow closely, but I’m optimistic (for now).