If you are the average American, the answer is simple. Not enough.

Why is this? Well, with many Americans living paycheck to paycheck, it’s hard to put money away. This is a common answer, but it’s not the whole story.

Many wealthy families are also significantly behind in their retirement saving. So what gives?

Are You A Saver?

I am a saver. I wrote about wanting a 10-speed bike when I was a kid and with a mom at home and a dad who taught in the public school system, there was no money available for a big purchase like a bike. The odds weren’t good on Santa either. Santa tended to bring a few toys, but often clothes or a winter coat (bastard!).

I got my bike. I got a paper route. This took some schmoozing as paper routes were in great demand in those days. You had to know a kid, help him out and hope he passed it to you. My brother and I schmoozed and ended up with a couple of routes. One in the morning and one in the afternoon.

My wife is a saver also. She grew up in a refugee camp in a foreign country and she’s had a job since she could walk. Until her first job out of college, her entire paycheck went to her mom. Everyone in the family worked and the money went to support the family.

I’ve written several posts on saving. Both my wife and I are competitive about saving. Read here, here, and here.

Savers are Made

I strongly believe that savers are made not born. I’ve read interesting articles like The Science Behind why we are Bad at Saving for Retirement. The bottom line is we don’t like to save.

Given the choice between using our pay to buy a bike or giving our paycheck to the family, we’d buy the bike. Or even better, don’t get the job and get the bike as a gift from our parents, or Santa.

Don’t Lose Hope

The point is not that if you aren’t a saver, all hope is lost and you might as well let it ride. It’s just that if your life experiences haven’t built these habits. It’s going to be a little tougher.

The good news is that it is not that hard. In easy ways to save, I talks about some of the ways my wife and I put some money aside with absolutely no pain.

As soon as we start depriving ourselves, we tend to loose momentum. That’s why New Year’s resolutions rarely work. Ideally, we need to find ways to build saving into our lives so that it does not cause us to deprive ourselves of the things we want.

Ball Hawking

In ball-hawking, I wrote about how my dad, my wife, and I all got the disease. We became obsessed with finding golf balls. My dad had thousands. My wife just did a count and has over 200 from just the past few months.

It’s a sickness. Sometimes my wife is so excited about finding balls, she loses sight of the golf and forgets to finish out a hole.

One of my buddies plays new Titleist Pro V1x golf balls. They cost $5 each. I’ve never bought a new ball in my life.

That’s some big lifetime savings for me, my dad and my wife. And we’ve replaced the deprived feeling of not having a new golf ball with the excitement of finding near-new balls of different species.

It Adds Up

Provided we put the savings to good use, it adds up quickly. Read more in Compounding.

Many of us have a 401k at work. Read more about retirement plans here.

This is a great way to save. The money comes out of our paycheck automatically so we don’t need to think about it. Unfortunately sometimes these plans are seem too difficult to navigate and some folks tend to forego them because they can’t get the help they need to use them effectively.

Spend 20 minutes reading my post and you’ll be a master.

Want extra help on mutual funds, read here.

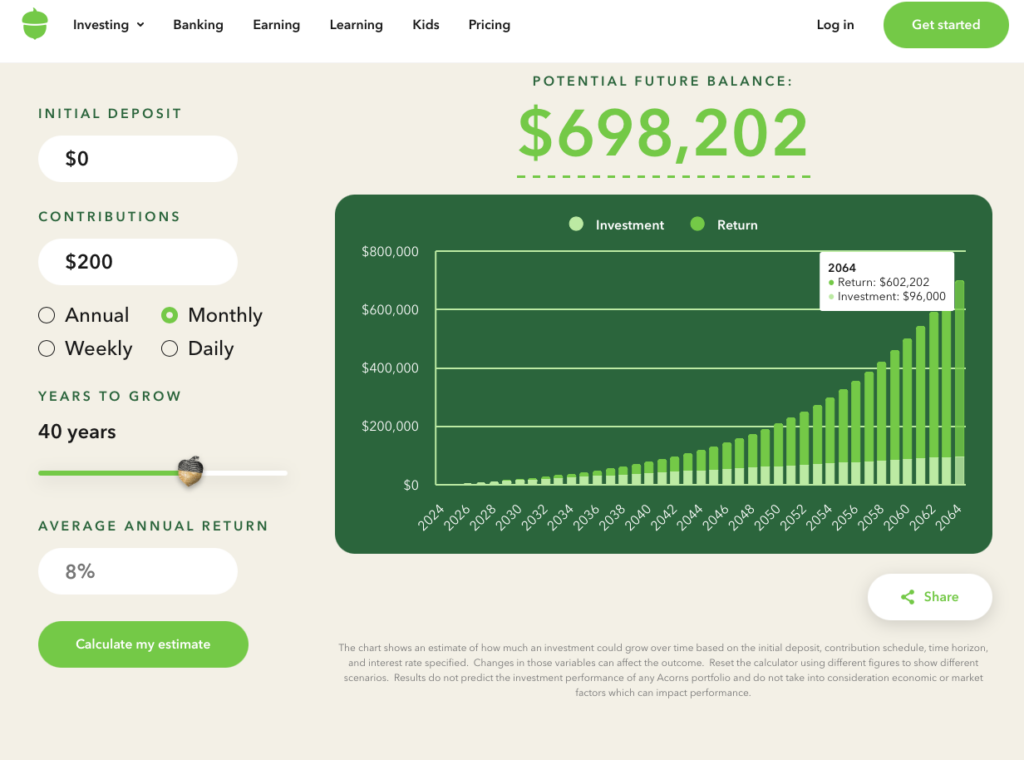

Here’s a projection from acorns.com.

Projection

Let’s say we’re 23 years old. We decide to participate in our company’s 401k plan. We decide we’ll contribute $200 each monthly paycheck. After 40 years, when we’re 63 years old, we could have almost $700,000.

Variables

That word could gets everyone. I could have $700k. I could have zero.

I can’t tell you what you’ll earn over the next 40 years.

I can tell you that a nice low-cost S&P 500 fund owns shares of the 500 largest US corporations, including Microsoft, Amazon, Apple, Walmart, Starbucks, Caterpillar and Visa. I can also tell you that the S&P 500 index has returned on-average 10 percent per year with dividends re-invested over the last 100 years.

For more about the S&P 500: I’M BUYING AN S&P 500 ETF. WHAT AM I GETTING? and SO HOW DO I KNOW THE S&P 500 WILL GO UP?

Back to the Projection

The interesting part of the projection and about compounding is that as the numbers get bigger, the growth takes off.

The first 10 years are pretty slow going, but then things start moving. Check out the penny doubling example and the Al & Peg scenario in the compounding post.

We’ve only put in $96,000 of our own money over the 40 year period, but we’ve gotten over $600,000 in investment return.

Wrap-Up

Some of us are savers. If we are, that gives us a head start. But even if we’re not, it is not that difficult to put aside a few dollars and invest it. Over a long period of time, this has proven to be a wealth-building machine.

And we need to build wealth because we are responsible for funding our retirement. That’s a huge bummer. Pensions have gone the way of the dinosaur and the federal budget is in shambles, so it’s up to us.

There is a lot of debate about how much each of us needs for a comfortable retirement. The number is different for everyone. But, whatever that number is, we need to start building wealth now. Find ways to save and invest.

There are several links above to posts that can help with both the tactics and the mindset shift required to build wealth. Check out the blog page for over 100 additional posts.

With a little knowledge and a bit of planning, we can all make this work.