That’s a lot. But, let’s put it in perspective.

My wife and I have 64% of our net worth invested in equities. The 64% is a mix of individual stocks and some mutual funds. We’re both retired, so we need our investments to grow and generate income to pay our bills. If we live to the normal life expectancy, we need to plan for 30-40 years of income. This means we need to have a good chunk of money in cash to handle expenses, as well as a chunk in fixed income (bonds) to provide income, and a good chunk (for us, the 64%) in equities for growth. Read the post on asset allocation for more details on asset classes and how to determine the best allocation.

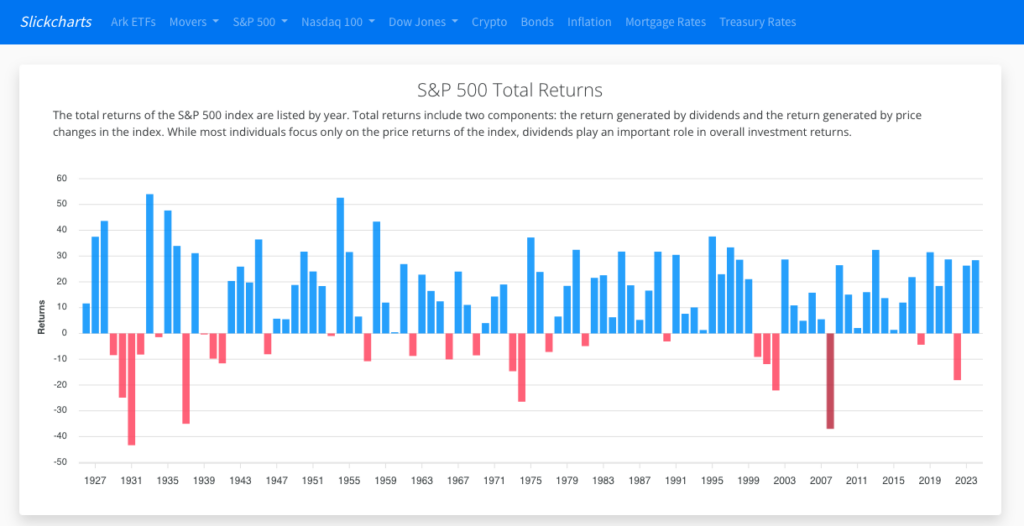

Now, I know that my equities will have bad years. Remember 2022? 2008? 2000? Checkout the chart below from slickcharts.

It hurts when the overall market pulls back 37% like it did on 2008. That’s why we have an asset allocation strategy. The money we need for spending is in safe investments – mostly cash, high-yield savings accounts, and CDs. A market downturn won’t impact them.

The money that generates income is in fixed income securities – and at our stage in life, for my wife and I, this is mostly low-risk short-term bond funds. While the value of these assets will fluctuate and will likely go down in a pullback, the interest rates paid will be fairly consistent. Read more about fixed income here.

But, equities is where we put the portion of our money that needs to grow. And to make sure our money will last through our life-expectancy, we’ll need a lot of growth. Luckily we have time. I have a good chunk in cash and fixed income so I don’t expect to tap into the equity assets for 5 years or more. More on equities and stocks here.

Refocus

OK, that was important background before we get into today’s topic, so let’s recap.

- My wife and I are retired. We don’t have a salary coming in anymore

- We rely on our investment portfolio for income to pay our bills today and to grow so that we have money 30-40 years from now

- Our asset allocation strategy is designed to balance our spending needs with our need for growth

We manage this ourselves. We’ve determined the allocation strategy and review it periodically and adjust as needed. We choose our own investments. We’ve chosen bond funds for fixed income and equities is a mix of stocks and mutual funds. We also actively manage our cash, looking for the best rates from CDs and high-yield savings.

This takes an investment of time and it requires continued learning, which brings us to the subject of the $13,967 investing class.

Class?

OK, so I didn’t actually go to a class, but I feel like this particular lesson has been unfolding over the past 2 years and I learn something new regularly. And I did absolutely pay $13,967.

Our Old Friend Intel

I have written quite extensively about my Intel journey so I’ll try to recap briefly and stick with new material as best I can. I recognize that I can sometimes veer off course.

You can read the full story at Lessons from Intel. But, now we have some new lessons to talk about.

Reading the Tea Leaves

They say Hindsight is 20-20. It’s easy to be a Monday morning quarterback. When the event is over and the dust has settled and all the information is available, it’s pretty easy to judge.

As investors, we never have all the information. In fact, the information we have is certainly incomplete and generally biased. There is never certainty, which is why there is money to be made in investing. We’re taking a risk. And generally, the higher the risk, the higher the reward.

Intel

I continue to learn from Intel. Information coming out today was not available, or had not even happened when I made the decision to invest in 2022. Let’s take a look.

I decided to invest in Intel in 2022. I’ll recap what I said in the earlier post:

I Was Optimistic About Intel

Back in 2022, I had been reading a lot about the chip shortage. It was effecting cars and home appliances. Everything had gotten smarter – at least things had – and computer chips were in short supply. I looked at the situation and thought about whether this was a supply-chain issue that would be resolved at some point or if this was a sustainable trend.

In investing there are no sign-posts that answer these questions so we need to do our research and make an informed decision. I believed that computer chips would be in short supply for many years to come and our appetite to add them to cars, TVs, stoves and phones would be a long-term growth driver.

A Basket of Chip Stocks

I wasn’t sure there would be one clear winner, so I bought shares of Intel (INTC), Broadcom (AVGO), Nvidia (NVDA), and Taiwan Semiconductor (TSM). Intel was my least favorite. It seemed as if its best years were behind it but it paid a healthy dividend and at the time, I was looking to move my portfolio towards income-generating equities. More on dividends here and here.

Watch and Learn

I knew going in that Intel especially, but all of these investments, needed some oversight. I bought a basket of chip stocks because I didn’t know enough to pick a winner, but that meant I needed to watch closely and keep up with the businesses to learn more about the company and the industry as a whole.

We all Know What Happened

Nvidia exploded. Taiwan Semi and Broadcom had stellar runs as well. Intel had a brief spike and then spiraled down. It is down over 50% in 2024. For comparison, Nvidia is up 182% and Taiwan Semi is up 87%.

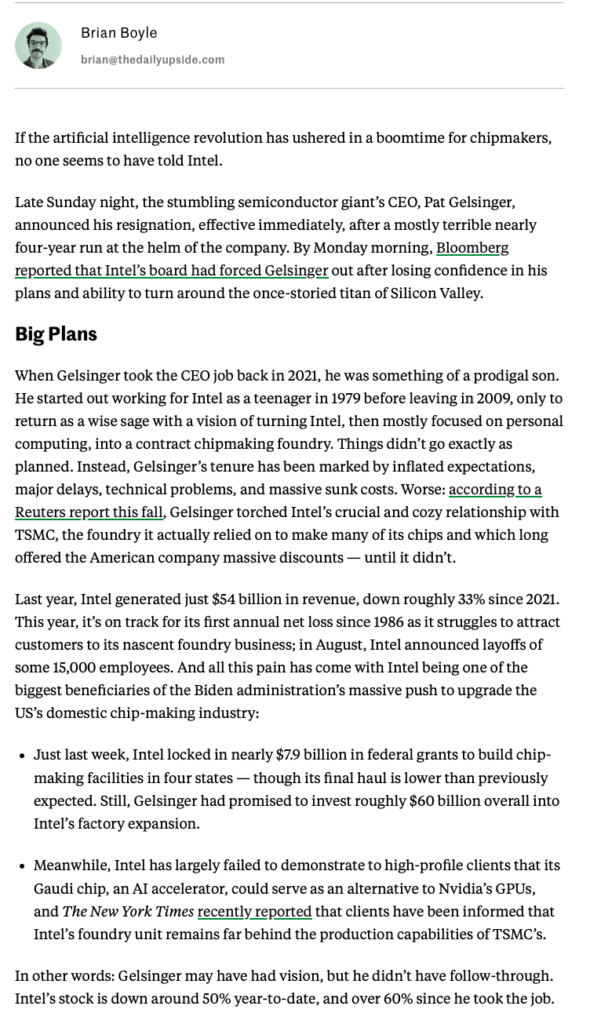

This week we read that Intel Announces Retirement of CEO Pat Gelsinger. This is how Intel phrased it. The media was less kind. Intel CEO resigns after a disastrous tenure.

Today’s News

Below is an article from the Daily Upside.

What Stands Out

Worse: according to a Reuters report this fall, Gelsinger torched Intel’s crucial and cozy relationship with TSMC, the foundry it actually relied on to make many of its chips and which long offered the American company massive discounts — until it didn’t.

In my earlier post, I remarked on how Intel had been a bit of a media darling shortly after I sold. Everyone loved Gelsinger and Intel. The US government was funneling huge sums of money into Intel to build onshore chip factories and hire skilled laborers in the US.

In the fall of 2024, we hear that Gelsinger had been torching a key relationship. Was this going on in 2022? Maybe at that time, it was thought to be a positive. Screw TSMC, we’ll do it in the US.

It’s easy to judge in hindsight.

Investing is Risky

No Kidding. Tell me something I don’t know.

We’ve heard this, but what does it mean?

It means that when we make an investment, we have an incomplete set of information and we are missing perspective that will become clear at some point in the future.

Hey, I like that. Pretty eloquent.

That is the risk. We’re putting our hard-earned money into something and we don’t know what the result will be. Even worse, when the result starts to come more in focus, we may look like buffoons.

I remember when working at an investment firm, a colleague told me that every day, companies send their top management to us to pitch their company to our fund managers and research analysts. Half will leave the room saying “what a great company, let’s invest.” while the other half will walk out and say “those guys are clowns, I’m selling my shares.” Who’s right? We won’t know for years, or maybe decades…

Know it Alls

No one likes a know it all, yet the media seems to trot them out anytime there is a blip in the market. I wrote a post about this a while back called This isn’t Helpful.

In the post, I refer to an article titled Here are all the reasons why Monday’s major market wreck is happening.

Where is the article on Friday that says Market wreck coming on Monday. Sell now!

The point is, it is very east to know all after the fact. And while I tend to laugh this off, it makes me angry for 2 reasons:

- It makes us feel foolish. We should have known.

- More importantly, it makes us feel like the “experts” know more than us. Who are we to be investing?

And that is a big problem. I read yesterday that the bottom 50% net worth household in the US hold less than 4% of stock. This includes stock held directly, through retirement plans and through mutual funds.

That means that while the market is up over 25% YTD in 2024, most households have not participated in that gain. They’re actually losing money to sky-high inflation.

You can’t win if you don’t play the game. I’m full of cliches today, huh? My mission is to explain the rules and de-mystify how investing, saving and financial products work so that everyone can participate.

The $13,967 Lesson

$13,967 is the amount I lost on my Intel investment. I lost about 35% of my initial investment over the course of 2 years. That’s a big loss, but at least I learned a few things along the way.

The key lesson today is about risk. The key risk that no one talks about is lack of information and lack of perspective. Like the fund managers and research analysts, we read and we listen and we make a judgement call, knowing that more information will come in the future. Things that looked like a catalyst today may end up looking foolish.

If the company succeeds and makes a fortune, we’ll look like geniuses. If it tanks, like Intel, we’re fools.

And if we invest for any length of time, we’ll look like both many times over.

But for every Intel, Under Armor, Lemonade, and FIVRR in which I lost money, there are Amazon, Apple and Netflix that doubled many times over to more than offset my losses.

The key to success is asset allocation and diversification.

A good asset allocation strategy puts a portion of our savings in equities that we can afford to invest for the long-term. Yes it hurts when it inevitably pulls back, but it is money that we won’t need for 5 years or more. We can ride it out. The biggest risk with equities is having to sell them at inopportune times to fund our spending.

Diversification spreads our investment across different industries, countries, company sizes, so that a downturn in one area does not sink our entire portfolio. A mutual fund is a great way to get instant diversification. An S&P 500 fund holds the 500 largest public US companies.

Wrap-Up

Intel has taught me a lot. I’ve written about it a few times to share my lessons so hopefully you won’t need to pay $13,967 to learn them.

But, if you choose to invest, you will pay to learn some valuable lessons. It’s inevitable. You will make good decisions to invest in great companies and you will lose money. The best you can do is learn from the experience and move on.

But your investments in great companies that are also great businesses will reward you many times over.