As we begin 2025, stock market experts are warning that the market is overvalued.

What do we do?

We must act!

Now!

Before it’s too late!

Hold On

Warren Buffett says “The Stock Market is Designed to Transfer Money from the Active to the Patient”.

This is one of my favorite quotes about the stock market.

Example Please?

First some background. As I was going to bed last night, I started thinking about where I am today (61 years old, retired at 56, feeling confident that my savings will last me many years) v. how I was feeling in 2008.

For those who haven’t read all of my 100+ posts, I’ll recap. In 2008, I was caught up in a layoff in the financial industry and found myself out of work. My 401k was down about 50%, like everyone else, and my daughter was starting her first year at a very expensive university. And I was engaged to be married.

This was a tense financial time for me.

So with that in mind, I knew I had to take action. My 401k balance was dropping by thousands of dollars daily. I sold equities and bonds and moved to cash. I hired an advisor.

These were all big mistakes.

Back to the Example

In late 2007, I was happily employed. 11 years with the same investment firm. I liked my team, my boss, I had a comfortable salary and bonus and things were good. My 401k was invested 80% in equity and 20% in bonds.

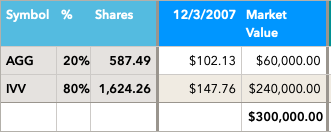

My 401k looked something like this. The $ value is made up because I don’t know exactly what I had in 2007. These are also not the exact investments I held, but I had a low-cost S&P 500 stock index fund and a US bond index fund.

For this demonstration I am using the iShares Core S&P 500 ETF (IVV) and the iShares Core U.S. Aggregate Bond ETF (AGG).

The table shows the shares owned, the price on 12/3/2007, and the market value. Pretty straight forward.

A Brief Look at 2008

For those who don’t remember, 2008 was financial chaos. The world economy went into a melt-down, largely lead by the US housing market. Essentially, housing prices were sky-rocketing. You could buy a house today and guarantee that it would be worth more tomorrow. Name any other investment at any other time in history that had that sort of guarantee.

Every week I got a flyer in the mail from another loan company encouraging me to unlock the equity in my home. Take out a home equity loan and buy that vacation home, new car, boat, or all 3. My house became an ATM.

Everyone was buying and it was the era of NINJA loans – No job, No income, no problem. Sign here.

While I am prone to exaggeration, this is 100% true. Check out the movie the big short. Or read the book.

Crash

So the finance community, never one to let others cash-in without joining the party, created a security called a collateralized debt obligation (CDO). Basically, they packaged up a bunch of shaky mortgages and sold them as securities to investors. These were mortgage-backed securities.

In the past, when the world had been sane and house prices weren’t increasing daily, mortgage backed securities were a very safe bet. They were backed by mortgages. People tend to pay the loans on their homes.

Remember the stories about people leaving the keys on the kitchen table and walking away? This really happened. They put nothing down, made a few payments, but when the housing market imploded, they walked away leaving the banks, and the investors who purchased the CDOs holding the bag.

…and then the whole world economy melts down…read the book or watch the movie. It’s fascinating.

What Happened to my 401k?

These words were uttered by quite a few folks in 2008. But, since this blog is all about me, let’s look at my experience.

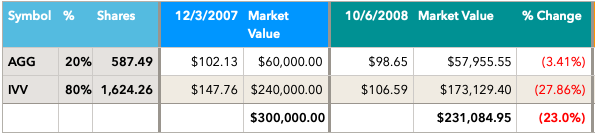

Just before the hammer fell and I lost my job, my 401k was down close to 25%

A quick note on asset allocation (read more here). While over the past 100 years or so, equities have significantly out-performed fixed income, having some fixed income can help ride out volatility. As you can see, my equity position is down nearly 28%, but my bond fund is only down 3.4%

I’ve lost a big chunk of my 401k savings in a very short period of time. Here’s the chart. Blue is IVV, green is AGG. It’s nice to hold bonds in a market melt-down.

Sell, Sell, Sell

I lose my job, attend the college orientation for parents (payment schedule) and start wedding preparation. Oh Boy!.

I can’t afford to lose $10,000 per day. I sell.

Stop and Think

All this is true. The market was tanking with no end in sight. I had some big expenses on the horizon. Jobs in financial services had disappeared. In fact many of the biggest companies (Lehman, Bear Stearns) no longer existed.

But was my 401k meant to pay for any of my upcoming expenses? Hint, the answer needs to be no, unless you’re retired.

I had some savings in a bank account and a high-yield savings account. This may not be enough, but never did I have a plan to tap my 401k at age 42.

…And What Happened Next?

As has happened with every single market pull-back and melt-down in the past, including the great depression of 1929, and the dot.com bubble of 2000, the market went higher. It took some time, but it did.

…But Not Right Away

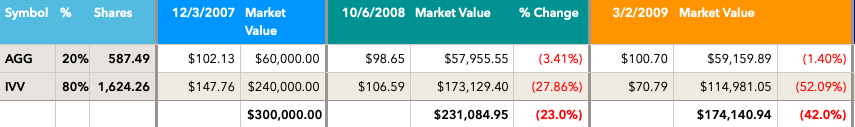

While I sold in late 2008, we’ll look at what my experience would have been if I had hung tight.

In March of 2009, I’d be down even more. I’m now down 42%. Good thing I sold.

But Then Things Improved

As it always has, the market improved. Why? Investors became more optimistic. Companies cut costs (I was one of these costs) and got creative, as they always do, and found new ways to grow. We continued to have babies, buy diapers and formula, new cars, and even homes. By 2024, we’re up over 200%, if only we’d just help tight.

So let’s take a look at where I would have ended up on 2015, 2019, and 2024, had I held-tight through the panic and kept my original investments.

And here’s what the IVV & AGG stock price chart looks like.

Quick note, don’t forget dividends. This info is price change only. Bond funds like AGG pay a healthy dividend. IVV is an equity fund, but it also pays a dividend. You can take these in cash or reinvest in more shares, but either way, they’ll improve your overall gain.

16 Year Price Chart

2008 is a mere blip. Didn’t feel like it in November of 2008.

Wrap-Up

As the market pulls back in the first few weeks of 2025, after 2 years of more than 20% growth, is it time to sell?

It may be, but what’s the reason? If the reason is that the market is going to pull-back, how do you know? And how do you know when to get back in? You need to be right twice on timing the market. I watch a lot of stock market news. That doesn’t happen often.

Regardless of this year’s pull-back. Or gain? Who knows what tomorrow will bring? History shows us that staying put builds wealth in the long-term. What feels like a crisis today wil likely be a blip in the rear-view mirror 20 years from now.

Asset Allocation is your friend. The money for your retirement, in your 401k or IRA, is for expenses we’ll pay years from now. Even though I am 61 and retired, a good chunk of my 401k money is for expenses in my 80’s. It has 20 years to grow. A pull-back in 2025 will likely be a blip in 2045 when I’m taking this money out.

Money we need in the next 5 years should not be invested. It should be in low-risk investments like cash (bank account or high yield savings account) or treasuries. That’s it.

The market can remain irrational longer than you can remain solvent. Who knows what the market will do? But we have years of data that show how the market builds wealth in the long-run. As long as you don’t need the money right now, you can ignore the short-term gyrations. And holding fixed-income in addition to equities can help lessen the impacts on your portfolio.