I seem to read a bit lately about angry old men (hey wait, that’s me) ranting about social security. “I’ve paid into social security my whole working life. That’s my money and you can’t take it away.”

As a retiree, more sympathetic I could not be (het wait, that rhymes).

ssa.gov

If you haven’t already done so, go to ssa.gov and create a login. You’ll get all kinds of cool information like your expected social security benefits at different ages, and a nice chart that shows your lifetime earnings.

Fun fact: The first year of earnings for me was 1979. I earned $1,257. I was 16 years old working at York Steak House and Zayre department store. Please don’t tell Uncle Sam about the paper route I had when I was 10.

At the bottom of this chart, I can see that over my lifetime I paid over $100,000 in social security tax, and my various employers paid even more on my behalf.

My Money

This money was taken out of my paycheck every month that I worked. My employer also payed monthly. This money is earmarked for my retirement when I can claim social security.

What is Social Security?

Let’s ask the good folks at Investopedia.

What a nice idea. We know people become disabled and grow old and this often makes them unable to work. We also know that left to their own devices, many people won’t save. So the government nicely decided to do it for us and make employers help out.

Well done.

So yes, I agree. This is my money. Angry old men (and women) unite.

Grey Area

I will admit that this is a bit of a grey area for me. ssa.gov tells me what was taken out from my salary and what was contributed, and gives me a projection of what my monthly check will likely be at various retirement ages. But there is no place I can go to check my balance. How much do I have now? How is it invested? What’s the annual return?

If I can’t see it, it doesn’t seem like it’s mine.

You Can’t Take It Away

Coming up to the election, I heard this quite a bit. The republicans want to take away social security. AARP sent me quite a bit of info on the risk to social security and asking me to respond to surveys and write my elected officials.

And the angry old men shouting “You Can’t Take It. It’s Mine!“

And again, I agree with my compadres. This money came out of my check just like my 401k deferral. I expect that I will get it back when I retire.

National Debt

I’ve written about this a few times here and here particularly. The 2nd link is to a post called YOU OWE ME $271,790!! A LOOK AT THE US DEBT.

No one takes me seriously on this topic. I followed up this post with an open letter that I sent to my elected officials expressing my concern and asking for some help addressing the debt. Read it here.

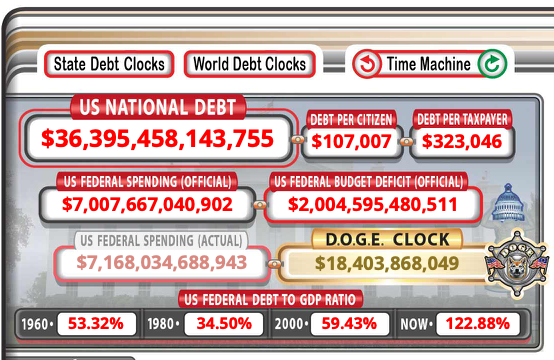

And if you check out the debt clock today, only a few months after the post on $271,790. The debt per taxpayer is $323,046.

What’s another $40,000 amongst friends?

D.O.G.E

This is a new one. The debt clock now shows the real time savings objective from reducing government waste, fraud and abuse. Today, it’s an objective. I look forward to this being an actual $ figure. But I love the transparency.

Back to Debt

So, the US Government is in debt. It needs to borrow more every day to finance government programs. Our tax dollars are far from sufficient. The debt is growing at an alarming rate.

And that $323,046 number is calculated by taking the total debt that we (the US Government) owe divided by the number of taxpayers. So that’s real. That’s our piece of the debt.

What Do I Really Have?

So if I’ve contributed to Social Security my whole life, and my employers have made contributions on my behalf, then that’s my money. But don’t I need to pay my debts before I take it? Or at least, don’t I need to develop a budget so that we can offset the benefits by our debt payments,

But That’s Not How It Works!

You’re right. That’s not how the government works. But that is how the rest of the world works.

As a consumer, we likely have a job that provides income. We pay our bills, buy stuff and put money aside every month to pay off our debt, whether it’s mortgage payments, credit card payments or car loans. That’s basic financial management.

But the government doesn’t work that way!

That’s why the government owes almost $37 trillion.

Wrap-Up

I hate to be a downer, but thems the facts.

The US debt is serious business.

I’m sure it is difficult to be a politician. Constituents want stuff. If you say no, constituents won’t support your campaign and won’t vote for you. Then you’re out of a job. It’s easier to say yes and let the next guy deal with the debt you’ve accumulated.

This is a huge over-simplification, but we need our elected officials to adopt some financial accountability. People are living longer, and things are getting more expensive.

Finding out that my individual share of the debt is far larger than the total amount my employers and I have contributed is a huge bummer.

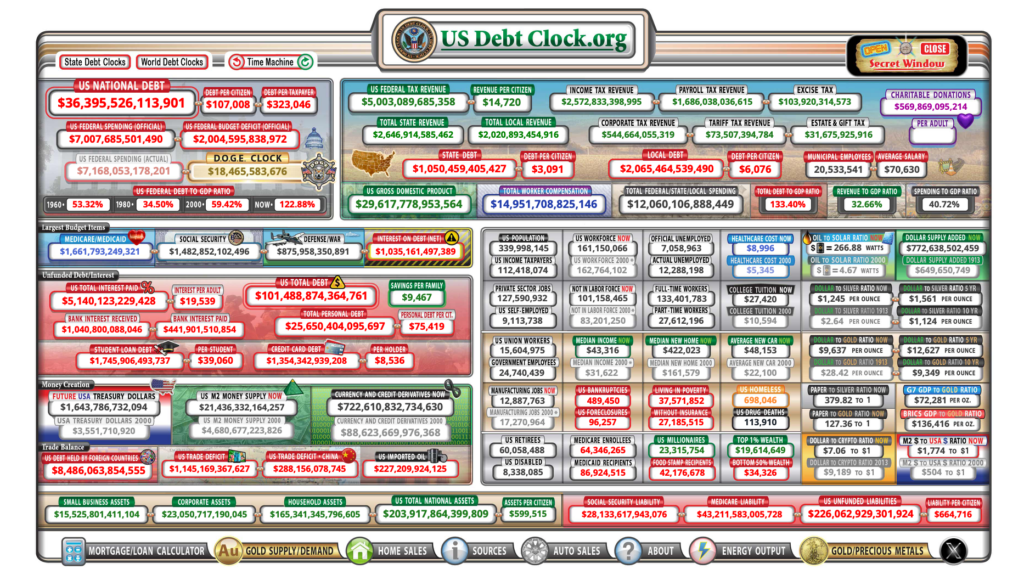

Oh Yeah, and even putting the debt aside. Social security and medicare cannot keep up with population growth and expense growth. Take a look at the defecit per person. This is from the debt clock. $664,717 per citizen. Not taxpayer, citizen. The good news is that the unfunded liability amount includes your piece of the national debt so you don’t have to do the math.

Houston, we have a problem.

And spend some time with the debt clock. DOGE is new. That’s cool, but there are numbers on the US workforce, Healthcare costs, oil to solar ratio, college tuition. Take a look here.

…and another thing…

Updated 1/26 based on a reader’s feedback – thanks Mike B.

I started looking a little further into social security funding. Check out here from AARP.

To summarize, social security was taking in more money than it paid out up until recently. As the boomers move from working and paying social security tax to retiring and collecting social security, the program is running at a net deficit and at the current rate, the reserve will be depleted in 2035.

At this point, benefits can still be paid (at an estimated 83%) using the income from payroll taxes.

Some answers, but lots of questions.

More to come on this topic.

Always an interesting read, thanx – Bo

Always an interesting read, thanx – Bo