By any measure, long-term diversified equity (stock) investment builds wealth. This is not to say, I can put all my money in Fred’s Computer Chip Company and become rich. But if I invest in a diversified basket of well-researched stocks, or a nice low-cost S&P 500 fund, history shows that I’ll grow my wealth. Read here for more.

And as a rule, I am not one to try and time the market. If I have money to invest, I believe the best time to invest is now. Since time is such a huge factor in building wealth, I will have more time for my investments to grow if I invest today than if I invest next week. And despite what we may think, none of us can predict with any certainty what the market will do in the short-term.

Cash on the Sidelines

But that said, it is smart to keep some cash on the sidelines for when opportunities arise.

I’m over 60 and retired, so I have a large cash position to pay my expenses. Money I expect to spend in the next 5 years is never tied up in equities for precisely the reason we just discussed. While I expect my equity investments to grow over long periods of time, who knows what they will do in the next 5 years and I don’t want to be in a position where I need to sell equities in a down-market to pay for my spending.

So, cash on the sidelines is money that is earmarked for equity investment, but is waiting in my brokerage cash position for an opportunity.

What’s an Opportunity?

This is a tough one. I miss quite a few.

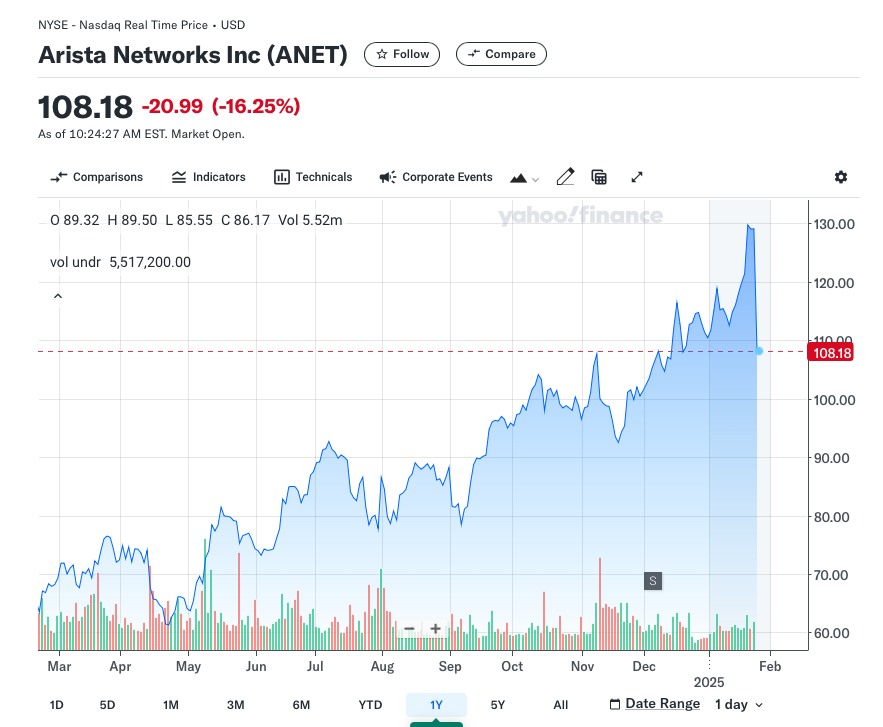

I wrote a post about a year ago about a pullback in one of my favorite stocks, Arista Networks (Ticker: ANET). The post, here, was about a market pull-back where Arista was down to $254 per share. While the stock was down big, it had been up big the prior week so the pull-back brought it back to the price it started at the prior week. Not a bargain.

Or so I wrote.

Quick Note: Arista stock split 4:1 on December 4, 2024. So to compare to today, we need to divide the price by 4 and multiply our shares by 4. This means that the split-adjusted price when this post was written was (254 / 4 = $63.50).

Today, 1/27/25, Arista is down over 16%.

I thought $63.50 wasn’t an opportunity 9 months ago, and it is up 70% since.

In My Defense…

I missed an opportunity to buy a stock that went up 70%, but I stand by my rationale. My point was that a big pull-back in a particular stock is not necessarily an opportunity.

An opportunity is not necessarily something on sale. What is my thesis for the company? What percentage of my portfolio is it? These are important questions to ask before buying.

But yes, this was a lost opportunity, but as an Arista shareholder, my shares have done quite well since my 1st purchase in 2017, and I’m quite happy.

…But What’s an Opportunity?

So that didn’t help.

Let’s look at today.

The Dow is down a bit. The Magnificent 7 weighting of the S&P 500 has driven it down 1.48%, and the tech-heavy NASDAQ is down a whopping 2.45%

China has let the world know it has a cheaper, easier, more cost effective, less power-hungry AI solution. Gasp!

Chip stocks plummet on the idea that we’ll need fewer chips with this great new solution we heard about over-night.

Energy stocks also tumble because we’ll need less power to fuel these new energy efficient data centers. We were wrong all along about the power needs.

Take a Breath

First of all, and most importantly in my mind, this is China. Have they ever lead us astray? Can we really trust their announcements, their financials, or technical details? I’m taking this with a grain of salt.

But, I’ve also written about how I’ve sold some of the Nvidia and Broadcom in my portfolio. I love the companies, but I’ve taken some gains because this whole AI thing is a bit squishy to me. I’m optimistic about the chips in our cars, thermostats, washing machines and everything else we own and I think this is a long-term catalyst for the chip industry, but I’m still on the fence about this whole AI thing.

Energy on the other hand…

Energy

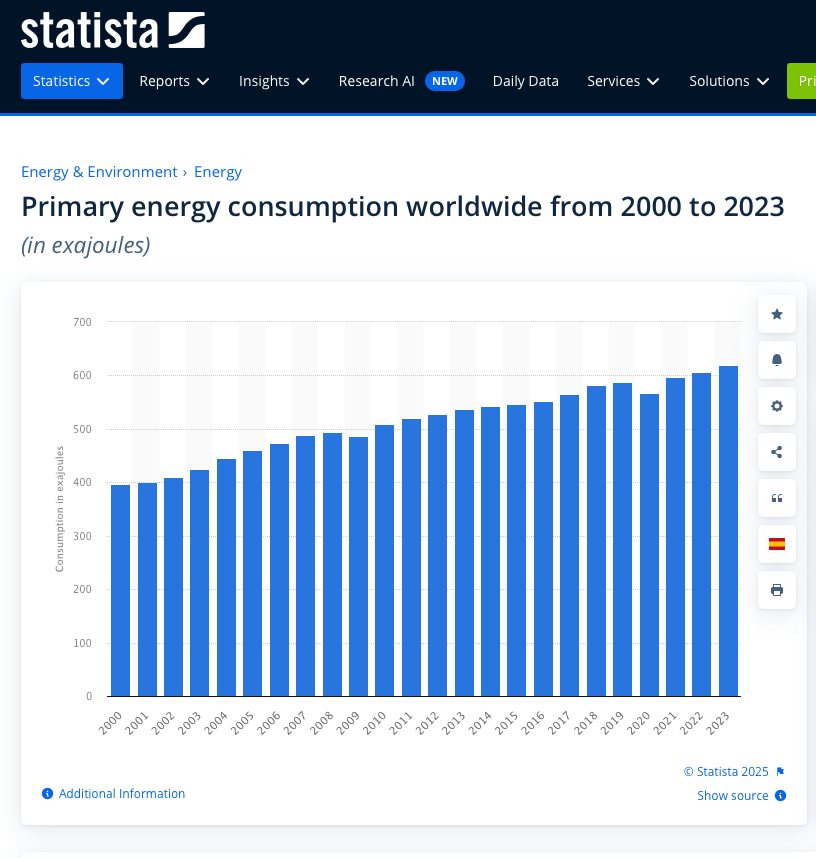

I’ve long had a suspicion that the world will keep using more energy. AI aside, we all have more things that need power. And according to Statista, I could be right.

Based on this realization, I bought shares of NRG and EMCOR recently.

NRG is a large consolidated energy company that operates in the US and Canada.

EMCOR is an engineering contractor. EMCOR builds complex projects like data centers and factories. It will benefit from infrastructure spending and the overall growth driven by technology (even without AI).

Friday

On Friday, 2 days ago, I was looking at EMCOR and NRG and seeing that they were both up double digits in 2025. I was kicking myself for not buying more in late 2024. For EMCOR, I bought a small number of shares to start to watch the company (as this is an unfamiliar industry for me). For NRG, I wrote covered calls on all my shares, but the more I read, the more I liked the company.

So, Friday, I added both to my shopping list and adjusted my price targets higher. I was willing to buy more shares at a higher price than I’d originally planned, but a lower price than the stock was at on Friday.

Now Here’s The Opportunity.

I know. You’ve been waiting.

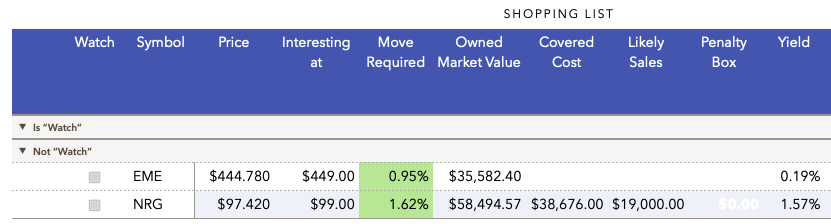

Today, both EMCOR and NRG prices fell below my new target price – set on Friday. Here’s a snapshot from my shopping list.

EME becomes interesting at $449 per share. It was at $531 per share at market close Friday but it’s down over 16% today so it is below my target. It’s like Christmas.

Same for NRG. It closed Friday at $105 and has dropped 14% today to $97.40, which is below my target of 99.

Interesting

I come up with the price at which the company is interesting when I refresh my thesis. For these 2 companies, I updated my thesis on Friday because of their rapid rise. A major change in a business – whether it is a price change, a stock split, an acquisition, or other news, generally is a good opportunity for us to update our thesis.

When a company’s price falls into the interesting range, it’s not an automatic buy. But when it becomes interesting and it drops more than 10%, it deserves some attention.

Wrap-Up

The market is very efficient. It reacts to business events quickly so there are rarely opportunities for us mortals. Computers make most of the trades in the market. They are all located in New Jersey so they are close to the exchange and they crunch numbers constantly so they are many steps ahead of us.

But a crazy piece of news like the China AI news today can set off a trading frenzy. And it’s not just wild news like this. The market has pull-backs all the time. Our favorite companies have a slow quarter or hit short-term headwinds and the stock plummets.

It’s a good idea to proactively plan for the price target at which you’ll back up the truck. And it’s a good idea to have some cash, earmarked for equities, sitting on the sidelines in case opportunity knocks.

A price decrease isn’t always an opportunity, but sometimes it is. And you don’t want to be deciding in the middle of the market frenzy. Many a bad decision has been made this way.

Am I right? Again, who knows? I’ll probably write about this again in a year or so to see how this is working out, however, I don’t expect to sell my NRG or EME shares for many years.