I’ve written about how we rarely get a warning in advance when the market is going to be down. Usually, the market tanks and some pundit tells us why this makes sense after the fact, like we all should have seen this coming.

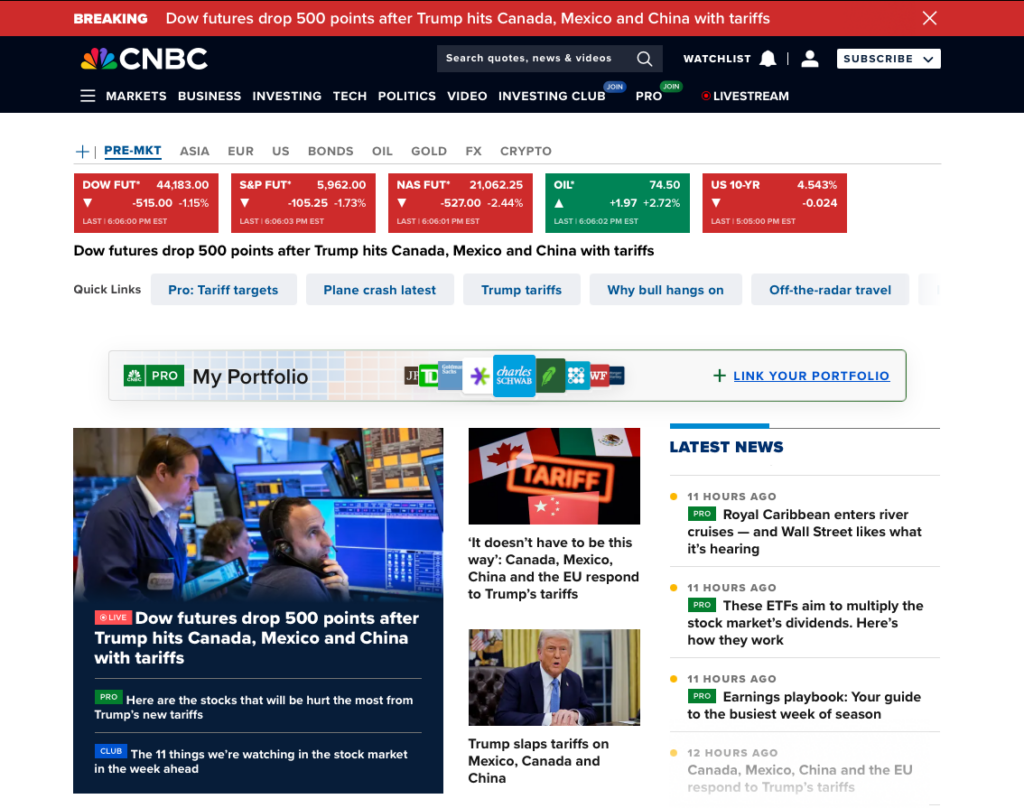

But today (Sunday, February 2, 2025) we are given fair warning. CNBC is telling is that stock futures are down because of the new tariffs that are going into effect.

This is helpful. So thank you.

Are Tariffs Bad?

That’s a really good question. Let’s start with defining what a tariff is. From investopedia:

So starting tomorrow, goods and service that we buy from China, Mexico and Canada will get more expensive.

This is bad news for GM and for anyone who wants to buy a car.

GM is a US company, but it produces components and assembles vehicles in Canada, Mexico and China, as well as in many other countries. While they knew this might be coming and they can move some things around to try and minimize the impact, there is no way to eliminate the impact completely and because it targets parts and plants, which are complicated and costly, any movements will take time (and cost).

GM is just one of many examples, but just like with inflation, higher prices hurt both business and consumers.

Is There Any Good News?

Maybe.

When imported items become more expensive, stuff made in the good ole US of A becomes more reasonably priced (in comparison).

Let’s go back to cars. If cars with parts from Canada and which are assembled in Mexico become more expensive, cars produced from parts made in the US and with US labor become more attractive. This creates more US factories and puts more US workers to work.

While this could cause short-term pain, it may have long-term benefits to employment.

American Independence

I know, 1776….but really, since then we’ve given up independence in quite a few areas. We are dependent on other countries for energy, manufactured goods, and even technology.

I love Taiwan Semiconductor Manufacturing (Ticker: TSM). It’s one of my best performing companies, but it is Taiwan Semiconductor Manufacturing.

We use lots of chips here in the US. Many are made by TSM. It would be great if more were built here and we kept the intellectual property here.

Same for lots of stuff we buy. Search amazon for an item. You may need to scroll down a page or 2 to find a manufacturer name you recognize, and even then, it is still likely that parts came from overseas or it was assembled outside the US.

What Do I Do?

Take a breath.

Tomorrow will likely be a rough day in the market. Maybe Tuesday as well.

But who knows? Tariffs are also leverage. They are a way to let the other party (in this case China, Mexico and Canada) know that we want more favorable (to us) trade practices. They may offer concessions to reduce or eliminate tariffs.

There will be situations where some companies will get beaten down unfairly and they’ll become buying opportunities. And since a huge percentage of the trades each day are initiated by algorithms run by computers (read here) the markets could rise due to discount buying.

But we don’t know when this will happen and we won’t know until after it’s happened.

So it’s best to tune-out and stay the course.

Decisions you made last week, last month or last year should dictate your strategy, not fear of what might happen tomorrow or the next day.

Wrap-Up

I regularly joke about how nice it would be if we were told when the market was going to fall. But in reality, we should expect that it will fall 10% or more fairly often. But the gyrations of the market shouldn’t change our strategy.

Money we need in the next 5 years should be in safe investments. These are investments like cash and ultra conservative short-term bonds and bond funds that will not fluctuate much, if at all.

Our investment money can be invested aggressively knowing that our short term needs are covered and we can ride out any market pull-backs. We know that the S&P 500 returns, on average, 10% each year with dividends reinvested.

Tariffs or not, 5 years from now, I would expect the S&P 500 to be higher than it is today. At 10 years, it is even more likely that it will be much higher than today.

Hang tight and enjoy the ride.