When in doubt, go with a story.

I’ve written a bit about asset allocation. In my mind, having a well-thought out asset allocation plan, and updating it as our lives change, is as important as choosing the right investments.

Yeah Right

If I’d chosen a nice low-cost S&P 500 fund like IVV in December 2009, I’d have gained 441%. Pretty awesome.

But if I’d invested in Amazon instead, I’d have gained over 3,400%

Take a Breath

I picked these dates and I picked Amazon to be dramatic. In December of 2009 we were still in the throws of the financial crisis and no one knew if the stock market would ever recover. It took a while to realize that things might be OK, and we then went on one of the greatest bull market runs of all time.

Also, who knew Amazon was going to continue to grow the way it did? In reality, back in 2009, a stock-picker probably would have balanced their Amazon shares with some nice stable choices like Boeing.

Boeing is up 241%, which is nothing to sneeze at, but much less than either Amazon or a nice S&P 500 index fund.

Stock Picking

Stock picking is hard. No one knows what’s going to happen (except congress, which is why they should’t be allowed to trade stocks).

Some people spend the time and make good choices, and are able to hold during the inevitable pull-backs. These people beat the market. Most don’t.

Look at Amazon. I bought some shares after it split in 2022 for about $100. A few month’s later those shares were down to $81. Many analysts were saying the party is over. Many people I know would have sold to prevent further losses.

Stock picking is hard.

Asset Allocation

But back to asset allocation. Why is this so important?

But before that, what is asset allocation anyway?

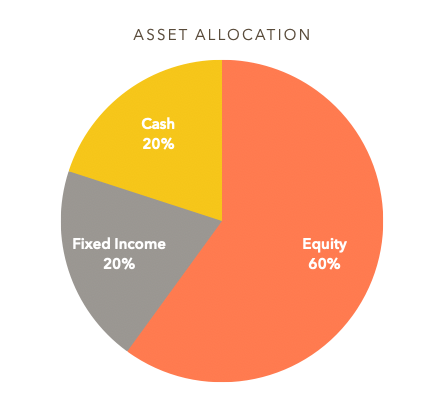

Asset allocation is making a thoughtful decision about what % of our assets will be invested in various asset classes. For most of us, that’s Cash, Fixed Income and Equities.

Equities are the highest risk and highest potential reward. The price may fluctuate wildly, but if we can ride that out for 10 or 20 years, we’ll likely be much better off.

Cash is stable. Low risk but low reward. The interest we receive will barely beat inflation, on a good year.

Bonds are in the middle. We take some risk, but the reward, the stable payment, is lower than we’d expect from equities.

Ideally we want some of each. On a year when stocks are down 20%, it’s nice to have some bonds. When the market implodes like it did in 2008, cash is nice.

One of my favorite sayings: The biggest investing risk is having to sell assets at an inopportune time.

I held onto my $81 Amazon shares and they’re at $229 today. Suppose I needed the money back in 2022. I would have had to sell and a paper loss becomes a real (and painful) loss. In these times, it’s nice to have some of my money in cash or bonds (or even other stocks) that I could sell to avoid having to take a loss.

My Mom

My Mom’s story is a great example for why asset allocation matters.

Back in 2019, I began helping my mom with her finances. At that time she was living at home alone. She was healthy. And she was receiving both her and my dad’s pensions. The pensions were covering 100% of her spending.

My mom was 83 and healthy and no reason she couldn’t live to 100. Not guaranteed, but it would be smart to plan for it.

She’d been retired almost 20 years, but we still invested her assets aggressively. Planning til 100, we had more than 15 years for her assets to grow.

And because she did not need to use her retirement money to pay her expenses, she could afford to be a little more aggressive than if she were regularly selling securities to fund her living.

In 2019, looking ahead, I kept a chunk of money in cash in case she wanted to do some home renovations, travel, or buy her son a nice gift.

I had some bonds for balance and safety, but a good 70% was in a nice S&P 500 fund.

Alzheimers

Not long after, Alzheimers reared its ugly head. Now looking ahead, things have changed dramatically. My mom is likely going to need some in-home care.

We adjusted her allocation to have a lower % in equities and more in cash. The plan to 100 was now prioritized lower than planning to have cash in hand to pay for some additional help.

As the disease progressed, we started to talk about more in-home care, or potentially moving to an assisted living facility. Again we adjusted the allocation.

The goal with asset allocation is to think a year, 2 years, or even 5 years out. We want to rotate our money from higher risk assets to lower risk assets as we get closer to needing them.

The Goal

In order to do this effectively, we need to be aware of the goal. And to make this more complicated, we all have multiple goals.

The way we save for retirement makes this more difficult than it seems. Throughout a 30 or 40 year career, we put money away every paycheck to fund our retirement. It’s as if when we hit that magic retirement age, we’ll take all our money in a big bag and start spending.

But that’s not the case. We’ll likely start taking some out each month to cover expenses, but some will stay invested so that it can continue to grow and can pay our expenses when we’re 97.

And we may have other goals. How about that boat we had our eye on?

I plan to buy this one for $50,000 in 5 years (not really, I prefer a friend with a boat). I’m taking the money out of equities today and putting it in cash. I’ll need $50,000 in 2030. If the market tanks and my balance goes to $25k, I’m in trouble. I’m not getting the boat. That’s asset allocation.

Asset allocation involves matching the funding strategy to the goal.

Wrap Up

Aside from I don’t want the headache and expense of a boat and congress shouldn’t be allowed to trade the stocks of the companies they regulate, we did learn a couple of things.

Picking winning stocks is hard. Most of us are better off with mutual funds, and nothing beats a nice low-cost S&P 500 fund. But we don’t need to beat the market to be comfortable.

Asset allocation can play an important role. Many folks feel like once they are in retirement, they’ve missed the opportunity to significantly grow their wealth, but this is not the case. By focusing on financial goals and understanding when we will need to sell assets to generate cash to spend, we can develop a plan that allows us to invest some portion of our assets aggressively even at 65, 70 or even 80 years old.

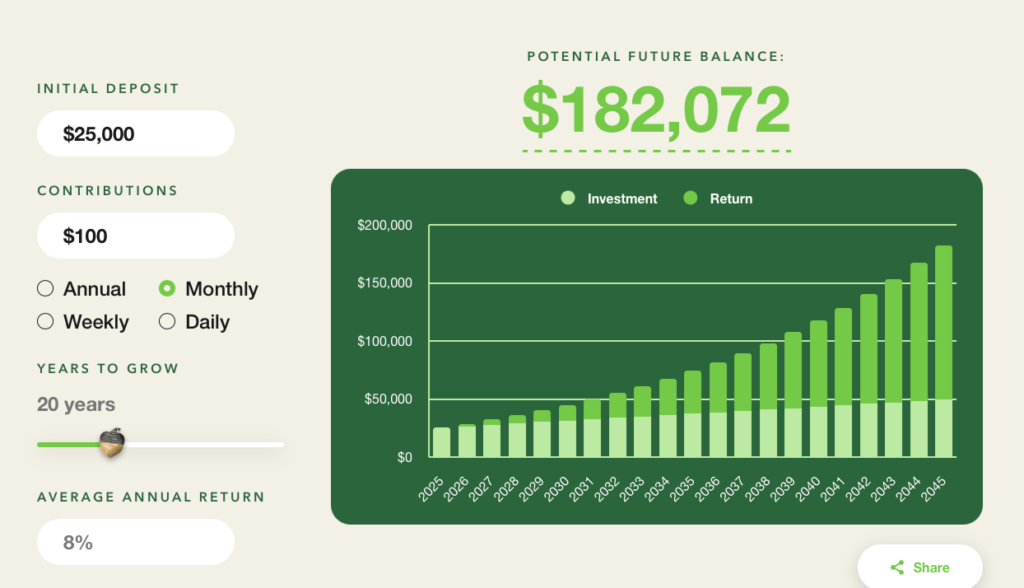

Let’s say I’m 65 and retiring and taking social security. I use my social security and regular 401k withdrawals to pay my bills, but I keep $25,000 of my 401k invested aggressively in an S&P 500 fund. I buy an additional $100 in shares of the S&P 500 fund each month. In 20 years, when I’m 85, that’s grown to $182,072

from acorns.com