Warren Buffet said this. He’s done pretty well for himself. Maybe there’s something to this?

What Does That Mean?

It’s a catchy and news-worthy quote, but how do we take action? And by we, I mean those of us who don’t have billions of dollars and who don’t manage many large corporations including Berkshire-Hathaway, GEICO and Sees Candies.

How do we make money while we sleep?

Compounding

Understanding how compounding works is a good start to making money while we sleep. Read more here. For the cliff-notes version, interest on interest is a big deal. It causes our money to grow exponentially.

Time

Read more about why it matters here. One of my favorite stories, which you can read in the linked post, is about a secretary named Sylvia who grew her wealth to over $8million over a 60+ year investing career.

When you put time and compounding together, magic happens.

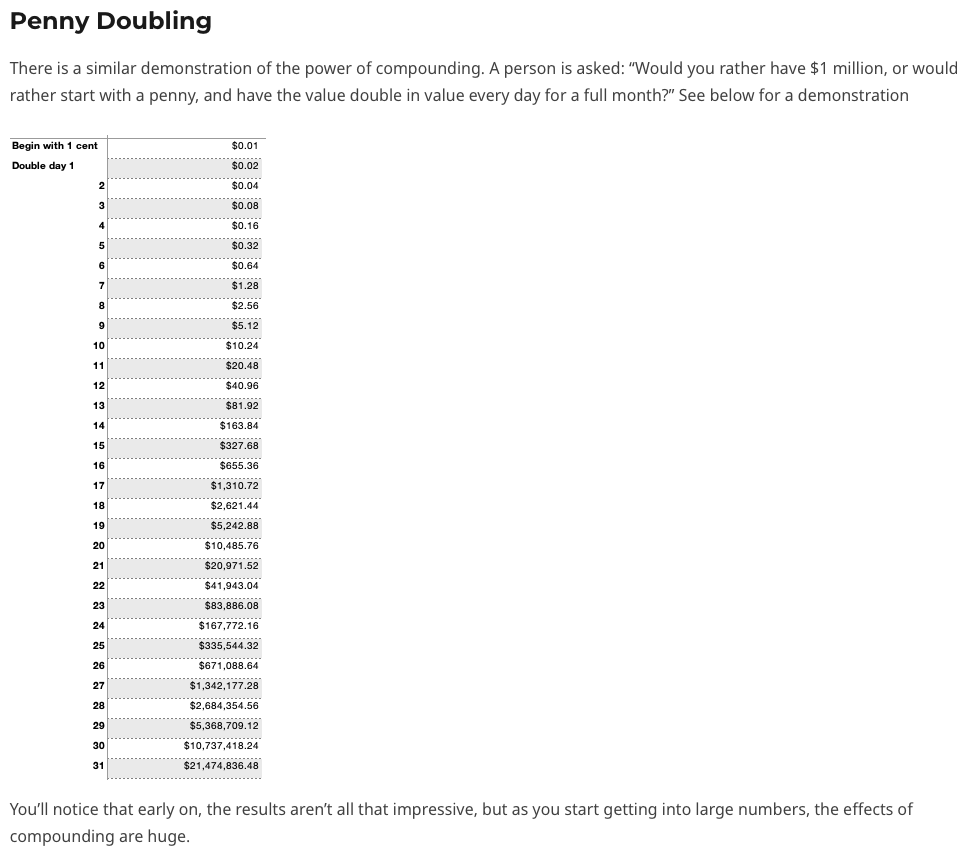

Penny Doubling

Here’s what I wrote in the compounding post:

Compounding is awesome, but time is important as well.

Patience

Waiting is particularly hard today, because we are used to getting what we want immediately. Remember when we had to wait for Christmas to watch Rudolph, or we waited for the Charlie Brown Thanksgiving Special. Even the horror of having to wait a week for the next episode of our favorite TV show.

Now with streaming, I can get them whenever I want. Why wait? Need to research something, pull out my phone and ask Siri. Remember driving to the library and spending half a day to hunt down the answer? And actually having to crack open a book??

Don’t get me wrong. This is awesome, except that people can fact check my stories real-time, but as investors, our inability to wait hurts us.

And advances in the investing world make it harder for us as well. We used to get stock quotes once a day in the newspaper. We got a statement from our brokerage monthly.

Today, I can get quotes every second of the day on my phone, and I open an app to see how much I’ve gained or lost today.

Sylvia, from the post The Secret to Building Wealth probably never looked at stock quotes or statements – for 67 years.

Making Your Money Work

Now that we understand what compounding is, and the importance of time, how do we put our money to work? It’s about time it started to contribute, right.

First, we need to find the right job for it.

I’ve got some money that I want to put away for 20 years or more. This is going to work in a nice low-cost S&P 500 fund. History tells us that the S&P 500 gains about 10% per year with dividends re-invested.

But we also know that the S&P 500 has dropped over 40% some years and that it has a pull-back every 3 years or so.

2023 and 2024 were good years for the S&P 500. It gained over 20% each year. Odds are that we’ll see a tough year or 2 ahead. It may be this year, next, or the year after. And while it is unlikely that we’ll hit 20% this year, it may. After less than 2 months, it is up over 4%, so who knows.

But the good news is we don’t care. Read more here.

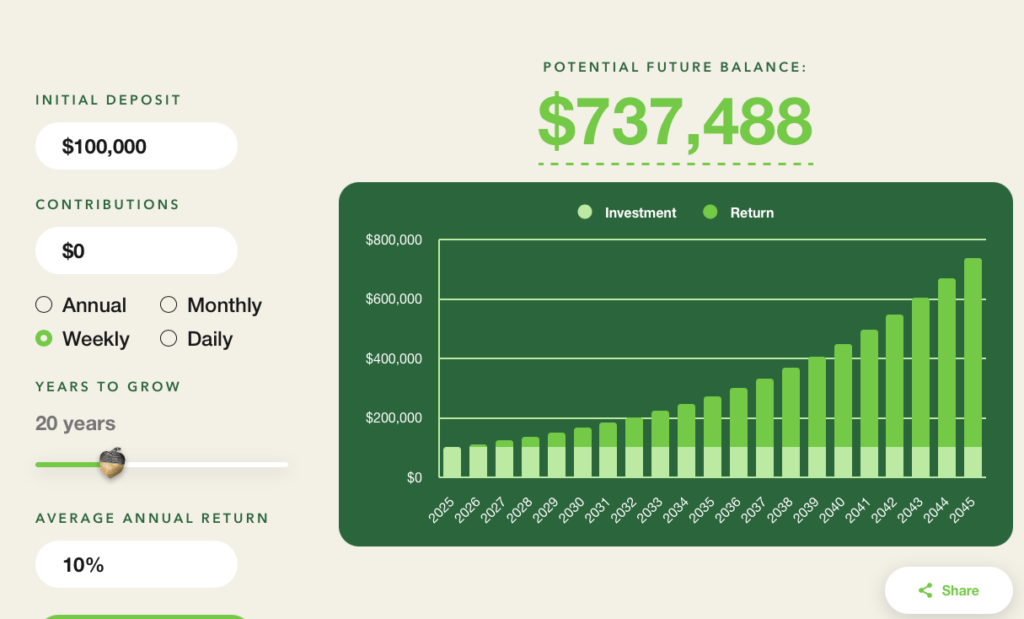

It’s a pretty good bet that the S&P will be up substantially 20 years from now. Let’s look at a hypothetical. What if I took $100,000 of my retirement money and put it in an S&P 500 index fund that averaged 10% annual return. How much would I have in 20 years?

Check out the chart above from acorns. The dark green is the return. That’s cool.

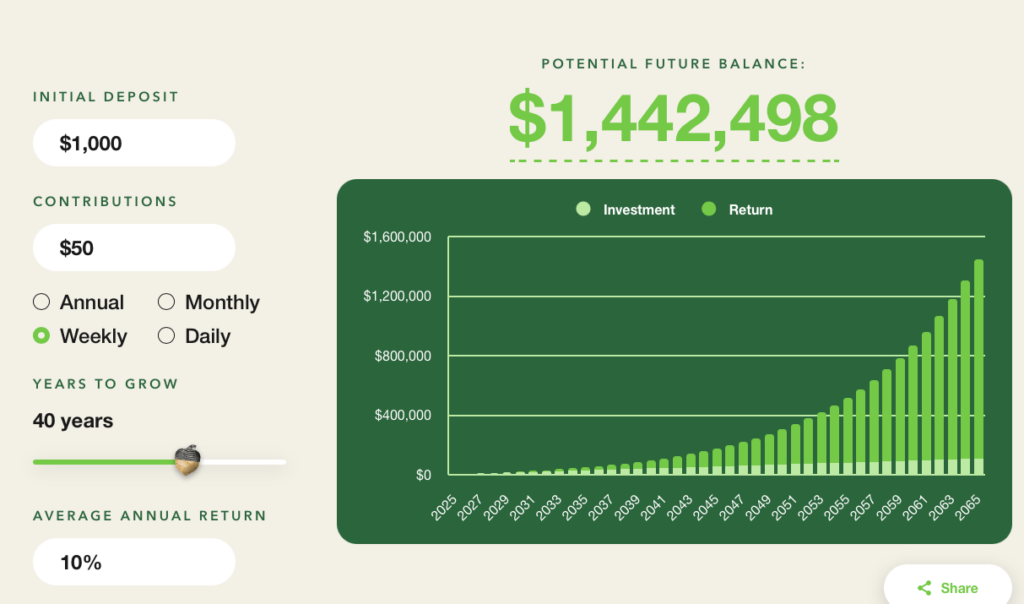

Now imagine I’m younger (and better looking), I put some money here and add a few bucks every month. If I’m in my 20s, my time period could be 40, 50 or 60 years. Try it out here.

Here’s an example. I put in $1,000 and commit to another $50 per week.

Wow!

Equity

Let’s take a quick pause. This is our equity investment bucket. Read more here about asset allocation. Equities are more volatile but have proven to be stronger long-term performers. All of our money should not be in equities, but it can still get a job.

Fixed Income

Fixed Income is the boring cousin of equity, but it’s hiring.

Our equity investments are working for us to build wealth 5 years or more out.

Our fixed income is going to provide us (wait for it…) income.

Let’s look at an example. I like the Fidelity Total Bond ETF (Ticker: FBND). This fund generates a little higher yield by investing in some high yield (a.k.a junk) bonds as well as high-quality investment grade bonds. A little extra risk, but it yields 4.66%.

So how does our money work for us here? Let’s say I took $100,000 of my retirement money and put it in FBND. Each month, I’d get an interest payment of $388. I’d get a total of $4,660 per year.

The price of FBND will fluctuate somewhat, and the yield could fluctuate as well, but in general, I can rely on a healthy monthly payment without doing anything.

Dividends

And for those who want the best of both worlds, there are dividend stocks. You can read more here and here.

Mature companies that are past their high-growth start-up days often have a surplus of cash. This is a nice problem to have. And surprisingly, there is not much that these companies can do with extra cash. They could pay down debt, invest in the business, or give it to the owners. That’s us. As equity share-holders, we are the owners. One of the ways we get paid is through dividends.

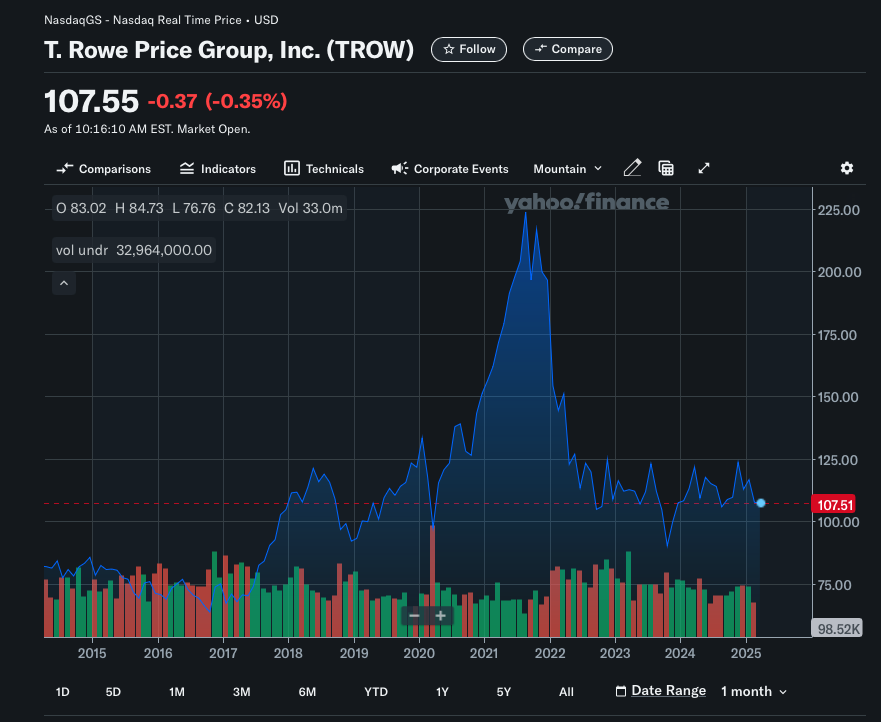

Let’s look at an example. T. Rowe Price is a well-known asset manager. It trades under ticker TROW.

TROW is not a stellar equity investment based on its price performance. If we had bought shares in 2015, we’d be up about 35%. Not bad, but not great.

But TROW pays a 4.71% dividend. Let’s say I took $25,000 of my retirement money and bought shares of TROW in 2015. My initial $25,000 investment would be worth $33,750 today. But, all along the way, I would have received over $1,000 each year in dividends.

Wrap-Up

Making our money work for us, so we don’t have to, isn’t just for big-shots like Warren. Compounding and Time are the key factors that will help us.

It’s also important for us to understand our needs and set our expectations accordingly. Our equity assets will have a higher growth rate but will be much more volatile. We need to hang on and trust in the S&P 500.

Our fixed income assets will fluctuate in value somewhat but will regularly return us an interest payment that we can choose to reinvest or we can spend.

Dividend stocks (which are equities) share some of the benefits (and risks) of both. We get a regular dividend payment and the potential for growth.

And smart diversification is important. This is a big word that simply means “don’t put all of your eggs in 1 basket”. This is why I like funds and etfs. A fund manager or an index buys a basket of securities so we don’t have to choose.

Invest and be patient. Your money will work for you.

Further Reflection

I have a few more things to say about TROW. Probably deserves its own post. Read here.