I recently used T. Rowe Price (ticker: TROW) as an example of a stock that makes me money while I sleep. I noted that its price appreciation wasn’t great over the past 10 years, but that it paid me steady income. Here’s the 10 year chart comparing TROW to the S&P 500.

That Stinks

That investment stinks. Over 10 years, the S&P 500 is up almost 200% and TROW is up a measly 26%.

True, but the point of my post about earning money while you sleep (here) is that we need to put money to work in different ways. Equities like the S&P 500 have proven to reward us over time but they are volatile. If the S&P 500 is at a low when we need our money, we could be in trouble.

We also may want a steady source of income (I do, I’m retired) and bonds and dividend stocks fit this bill nicely. The post is more eloquent, but you get the idea.

My TROW Experience

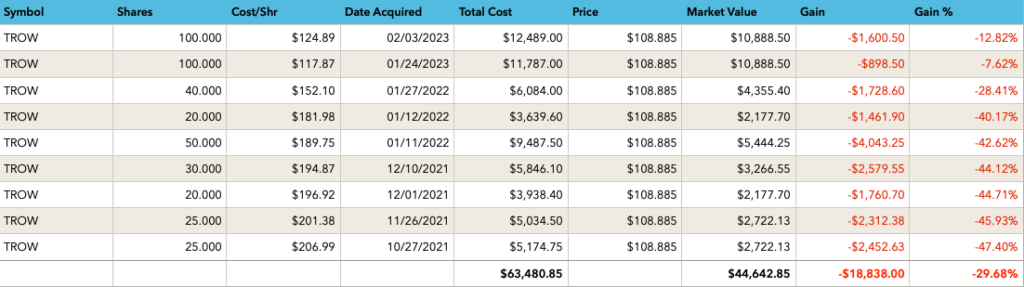

My price appreciation story on TROW is even worse.

Before we get to that, my thesis is that TROW is a trusted asset manager that’s been around since 1937 and pays a regular dividend. TROW sells many types of investments, including pension plans and its business is continuing to grow. TROW also has a lot of cash on hand and a reasonably low debt load. All important for an income investment.

I started buying shares in 2021

Do we all remember what happened in 2021ish? Anyone? Inflation!

And as a quick refresher, dividend stocks are in high demand when inflation is low. When treasury bonds are paying less than 1%, people are lining up to buy stocks like TROW, which pays a 4.69% annual dividend. That demand drives the price of the stock up.

When treasuries start paying 5%, investors looking for safe income sell stocks like TROW and flock to treasuries where there is almost no risk of capital loss, as long as we hold to maturity.

I bought TROW at exactly the wrong time. Here’s my holdings snapshot. Down 30%. Ugh!

Dividends & Options

So, as I pointed out in the earlier post, TROW is not a growth stock for me. I expect modest growth over the next 20 years, but I’m buying for the dividend. I have a $44k market value so I get 4.69% of that each year or a little over $2,000 per year in dividends.

I know what you’re saying, this doesn’t come close to making up for the $18k in unrealized capital losses. You’re right.

But the purpose of TROW is to produce income now, not to grow. My S&P 500 fund is filling that role. And while I’m unhappy that TROW is down, I understand my mistake (buying too much as inflation was gearing up) but remain optimistic about its long-term prospects.

I also regularly sell covered calls on my TROW positions. More on covered calls here, but essentially, I am selling another investor the option to but my shares on or before a specified date at a specified price. I always set the price higher than my purchase price so I don’t end up making money on the premium and then losing on the sale. It’s a little complicated so read the post.

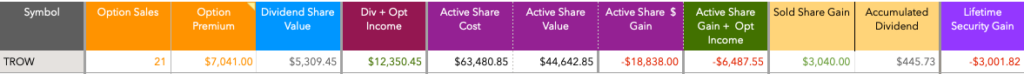

So, if I include dividends and option income, I’m still behind in the investment, but much less so.

I’ve sold options 21 times. My total premium is over $7k. I’ve made an additional $5k in dividends. I’ve got a paper loss of $18k, but after adding back the dividend and option income, I’ve only got a $6K net loss on TROW. And I had some shares I sold prior to 2021 that I had a $3k gain, and I earned $445 in dividends over the short period that I held the shares. All in, I’m down about $3k.

But the cash from dividends and option premium is real money in my pocket. The $18k is a paper loss.

I remain bullish that when inflation subsides, the share price of TROW will grow, albeit slowly.

Wrap-Up

As part of an investing thesis for a company, it is also smart to be explicit about our expectations for returns.

For Apple, Amazon, and Netflix, as well as a few others, I expect high growth. I expect them to beat the S&P 500. I expect to hold them 20 years or more. I also expect they will be down big at some times, but time is on my side.

My S&P 500 funds, I expect to do exactly what the S&P does. The S&P 500 has returned, on average, 10% per year with dividends reinvested over the last 100 years or so. I’d expect it to continue. Read why here.

My income stocks, like TROW, I expect will grow slowly over the next 20 years. This is the first time I’ve managed my own investments through a period of rapid inflation. I learned a lot. Knowing what I know now, I would have taken a smaller position in TROW and had a better understanding of why dividend paying stock prices fall steeply during rising inflation. Oh well. Another investing lesson paid for by me so you don’t have to.

But while TROW and others grow slowly, I will earn a nice dividend payment while I sleep. I do nothing. It just shows up. TROW pays quarterly. It is pretty cool when I see a payment of $500 every quarter in my account and I’ve done nothing.

Covered call options are an advanced topic. I have a strict rule that I will never sell a call option at a strike price below my purchase price. This is a great way to accelerate income on my income stocks, but I have to do a little work for this.

Happy Thursday.