Many of us, myself included, believe that we can grow our wealth by buying shares of publicly traded companies. There are thousands of companies that are traded on US and international exchanges, all of which are available to us as investors. So how do we choose?

I’ve written a bit about analyzing companies and creating a thesis. I’ve also written about conviction. It’s important that we’re committed before we invest. Investing means taking some of our hard-earned money, buying shares of a company, with the expectation that our company will grow in value and we can sell it for a higher price at some point many years from now.

All these things are important, but today we’ll talk about another important aspect of choosing a company in which to invest.

Who’s Driving the Bus

Warren Buffett of Berkshire Hathaway fame once said “They say in the stock market, ‘Buy into a business that’s doing so well an idiot could run it, because sooner or later, one will.””

I agree. As investors, we look for great businesses. But even great businesses will make mistakes, and sometimes that mistake is putting the wrong guy in charge. We want businesses that are strong enough and resilient enough to survive missteps. The good news is that companies and shareholders will usually correct these situations pretty quickly at the better companies.

But that said, an often under-appreciated investing strategy is investing in great leaders. This is tougher than it sounds. We’re not able to call up and interview the CEO of a company before we buy shares, but we can get a glimpse into the minds and the values of these leaders through their letters to shareholders in their annual reports.

Costco

A few weeks ago, I wrote my love letter to Costco. Read it here.

I at least skim through at least 50 annual reports every year. When I skim through, I’m looking for some insight, observation or comment from management that gives me a better understanding of the company, its leaders, or the industry in which it operates. There are pages and pages of financials, and for these, I’d rather skip and read an analysis by an analyst who follows that particular industry. But there are often valuable nuggets hidden within, especially in the letter from management.

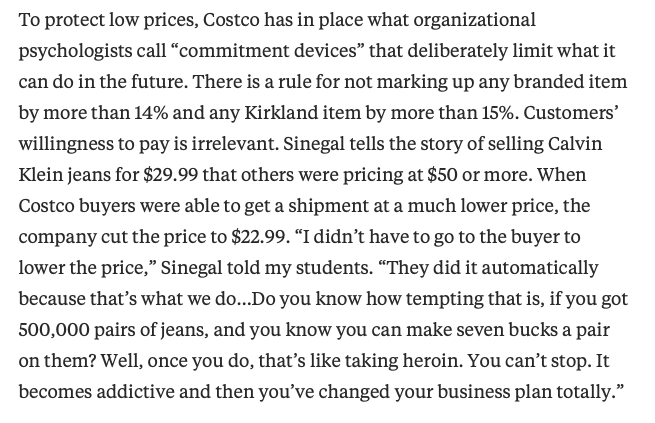

Costco consistently talks about its stakeholders, customers, employees, and partners and things that it’s doing to balance the success of all 3. I’ll repeat the low-price story from this year’s report to demonstrate.

It turns out this has worked pretty well for Costco.

I have shares that I bought in 2010 that are up over 1,600%.

What I find remarkable is that this culture is baked into Costco and is not the result of a single leader. When I first bought shares, Jim Sinegal was CEO. He passed the reigns to Craig Jelinek, and Craig retired recently and handed off to Ron Vachris. The culture carries on, as noted in the Calvin Klein jeans story, it’s just how they do it.

Berkshire Hathaway

Last weekend, I read Warren Buffet’s annual letter to shareholders. This is available in the Berkshire website here. Last year after reading his letter, I wrote THE GREATEST 15 PAGES YOU’LL EVER READ.

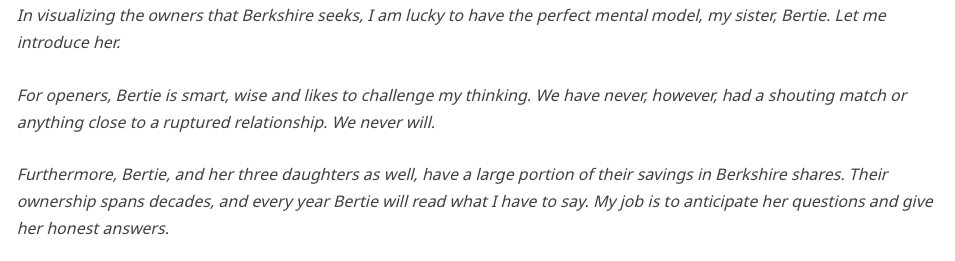

Last year, Buffet wrote the letter as if he were writing to his sister Bertie. He wrote:

What stands out in reading Buffet’s annual letters is the honesty and transparency. Some may think this is a stunt and it is important to be skeptical. How do we test this?

I pulled up the 1996 letter. While Buffet has become more conversational in his letters since then, the 1996 letter shares the same honest feel.

But what is striking is Berkshire’s consistency.

Here’s an example. Berkshire has 2 separate business models. It owns companies like GEICO, Sees Candy and Brooks Running that it owns and controls. Berkshire also invests a large amount of capital in publicly traded companies like Coca-Cola, Wells Fargo, and Apple.

Berkshire believes that its investments need to be excluded from the results it publishes so that it gives a more accurate picture of how the business is operating. While investment earnings paint a more rosy picture, Buffet feels that including it clouds the picture of how the underlying businesses are running.

Buffet states this in his most recent report. He also stated this in 1996. Consistency matters.

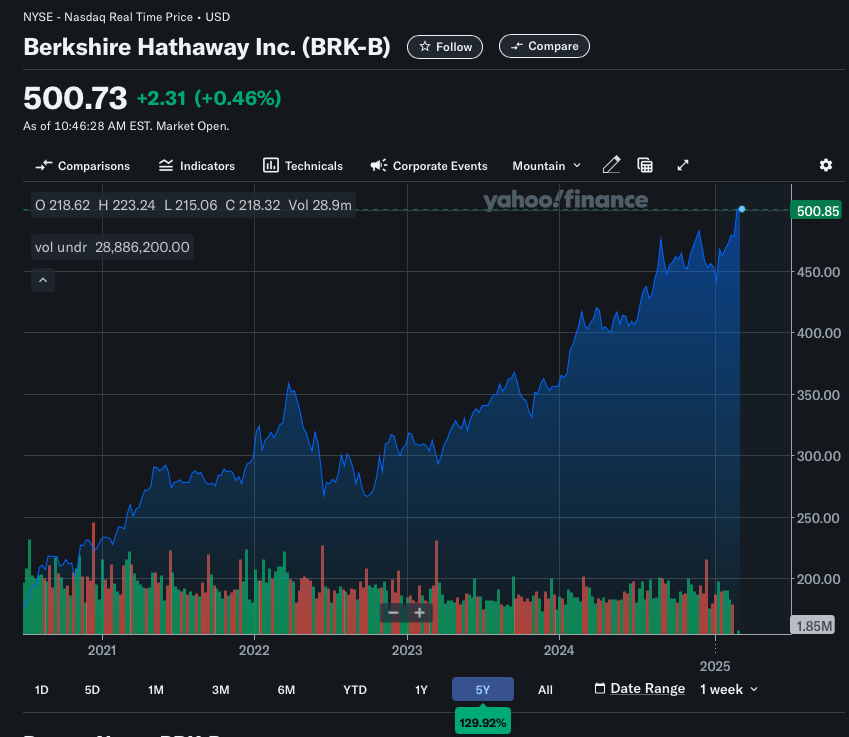

This has worked out pretty well for Berkshire.

I have shares of Berkshire that I bought in 2011 that are up over 500%.

Wrap-Up

A company’s values matter. While a company still needs a good business model and needs to make smart decisions, Honesty, transparency, and treating stakeholders well can be signs that a company will perform well in the long-run.

Costco and Berkshire choose to highlight their values and convictions in their annual reports. This gives us a good understanding of how they operate. They are also great businesses.

Warren Buffet is a master capital allocator. He’s also carefully built a succession plan (he is 94 after all) so that Berkshire will live on after he’s no longer making the decisions.

Costco has a fantastic business model. Over 80% of members renew their membership each year. Members trust that they’re getting the best deals and see the membership as a good value. Costco has navigated leadership changes without a hiccup.

But Don’t Invest With Your Heart

I feel like I need to make a clarification here. The investing scrap heap is filled with nice people and friendly companies that failed. There are many sustainable funds that invest capital only in companies that meet specific criteria to make shareholders feel good about how they’re investing. I’m not advocating for these.

My point is that solid companies with great business models that speak to us honestly and transparently can be great opportunities.

I have a good chunk of my life savings tied up in shares of public companies. I watch them closely to see how they make decisions, how their businesses are performing, and what management has to say.

Many letters from management in annual reports are filled with positives. Here’s what’s going great and here’s how important our people are. Berkshire and Costco have both talked candidly in these letters about mistakes made (Amazon has as well). This is rare.

As a shareholder, it’s nice to be able to feel that your companies are reporting honestly about business results.

I sleep much better at night on my Costco and Berkshire investments (and Amazon).