Yeah!

If you’ve read my posts, you know that I’ve frequently recommended investing in a nice low-cost S&P 500 fund. Why is this?

- We need to invest some money in equities in order to build wealth

- The US economy, and the S&P 500 as a proxy for the US economy, has grown exponentially

- This growth, while not always linear, is likely to continue

Equities

Equity means ownership. Equity investments are ownership shares of businesses. And while not all businesses succeed, a basket of equities like the S&P 500 can be a great investment.

I wrote about this in SO HOW DO I KNOW THE S&P 500 WILL GO UP? Historically, the S&P 500 has grown significantly, and while there are often periods of short-term headwinds in the economy, we continue to have babies, buy things, invent things, and export things to other countries. When this stops, we could slow down, but that doesn’t seem to be the case right now.

Why do we need equities to grow wealth? Check out at Sylvia’s story here.

While cash may get us 4% interest in a high yield savings account, only a few years ago, we got less than 1%. Bonds provide income with less risk. Here’s a table from Fidelity that shows fixed income rates for various durations.

Keep in mind that interest rates are high and these numbers were much lower a few years ago. And while these are some solid returns, they are not the 10% or more we have traditionally averaged in the S&P500 over the last 100 or so.

But don’t take it from me, here’s a great article from Investopedia with the history of the S&P 500 as well as some facts and figures to support this claim.

US Economy

I continue to be bullish on the US economy. Corporate earnings have been pretty strong. The stronger companies are reporting solid earnings, but project a weakening outlook for 2025. Inflation continues to be high and tariffs are a big unknown.

I was however, quite pleased to read Warren Buffet’s optimistic take on the America in his recent letter to shareholders.

One way or another, the sensible – better yet imaginative – deployment of savings by

citizens is required to propel an ever-growing societal output of desired goods and services. This

system is called capitalism. It has its faults and abuses – in certain respects more egregious now

than ever – but it also can work wonders unmatched by other economic systems.

America is Exhibit A. Our country’s progress over its mere 235 years of existence could

not have been imagined by even the most optimistic colonists in 1789, when the Constitution

was adopted and the country’s energies were unleashed.

True, our country in its infancy sometimes borrowed abroad to supplement our own

savings. But, concurrently, we needed many Americans to consistently save and then needed

those savers or other Americans to wisely deploy the capital thus made available. If America had

consumed all that it produced, the country would have been spinning its wheels.

The American process has not always been pretty – our country has forever had many

scoundrels and promoters who seek to take advantage of those who mistakenly trust them with

their savings. But even with such malfeasance – which remains in full force today – and also

much deployment of capital that eventually floundered because of brutal competition or

disruptive innovation, the savings of Americans has delivered a quantity and quality of output

beyond the dreams of any colonist.

From a base of only four million people – and despite a brutal internal war early on,

pitting one American against another – America changed the world in the blink of a celestial eye.

I agree. I expect America will continue to grow and that the 500 largest publicly traded US companies will perform quite well and will continue to build extraordinary wealth for shareholders.

Put Your Money…

I’ve written quite a bit about my personal investment choices. You’ve heard my stories about winners like Amazon, Apple, and Netflix. You may have read my love letter to Costco, here. I’ve also written about mistakes like Under Armor, Intel, and others that have been costly lessons learned.

Stock picking is challenging. Great companies are not always great investments. But, that said, it’s hard to go wrong investing in the broad US economy and a nice low-cost S&P 500 fund is a great way to do that.

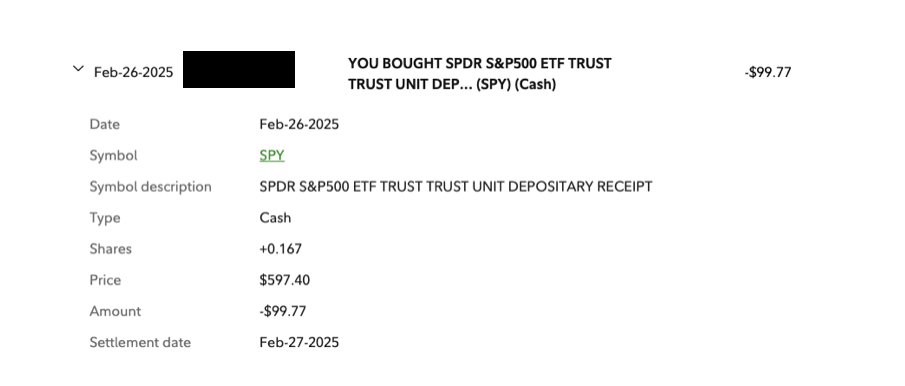

So….at 9:52am on February 26, 2025, I invested $100 in the SPDR S&P 500 ETF Trust (Ticker: SPY)

Here’s the proof:

I placed a market order so I got 0.167 shares at a cost of $99.77, not $100. But let’s see what happens.

What Will Happen?

No one knows. Especially in the short term. If I listen to CNBC, the S&P 500 is overvalued. There are economic headwinds with inflation and tariffs. Don’t expect gains in 2025, and perhaps expect losses.

I’ll go one better. Forget 2025, expect pullbacks every few years. Here’s some great info from the Motley Fool on market corrections to help set your expectations.

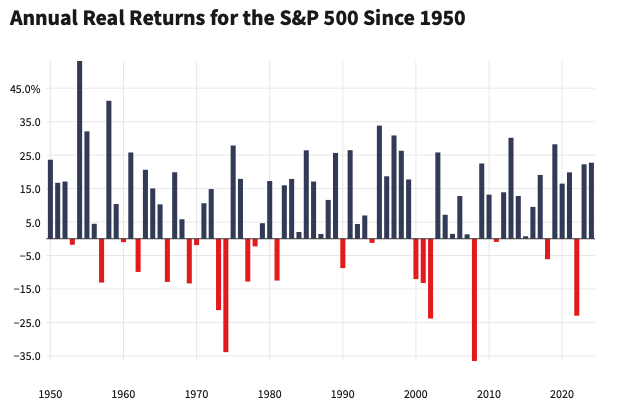

However, remember this chart from the investopedia article.

The S&P 500 has been up more than it’s been down, but the down years have been painful.

But, despite what the media says about expectations for 2025, we have no idea what will happen in the short term. 2009 – 2020 was the longest bull run in history. Somewhere around 2011, the media began warning that the market was over-valued. Who knows?

Wrap-Up

I did it.

I invested $100 in SPY.

I am going on record saying that on February 26, 2032, my 0.167 shares (my $100 investment (OK, $99.77)) will be worth at least $200.

Why?

I expect the S&P 500 to grow at 10% per year. The rule of 72 tells me that my money will double in 7.2 years. I’m rounding down so I’m saying my $99.77 will be worth $200 on 2/26/32.

The rule of 72 says that 72 / expected rate of return = # years for investment to double.

I invite you to join me. Put $100, $10, or $1,000 into SPY today and watch. Don’t use the rent money or the grocery money, but find a few bucks.

Better yet, start with a few today and add regularly.

What if I started with $100 and put in $20 per week for 20 years?

Here’s what our friends at acorns say:

Will we get 10% annual return? Who knows?

For the past 100 years, the S&P 500 has been a wealth-building machine. I have no reason to believe that this won’t continue well into the future.

And I’ve put my money where my mouth is.