There is a ton of information online about when to take social security. While many conclude that it makes better fiscal sense to wait until full-retirement-age (67 for me) or 70, when we can get the largest benefit payment, I decided to take it as soon as possible.

ssa.gov

The Social Security Administration has lots of personally tailored info for us at ssa.gov. If you’ve not done so already, go out and create a free account. I can login and see my payroll history from when I was 16 through retirement and it tells me what my monthly benefit payment will be at 62, at full-retirement-age, and at 70.

Make a Spreadsheet

This is the key to a healthy breakfast, or at least, it’s the first step to making a healthy financial decision.

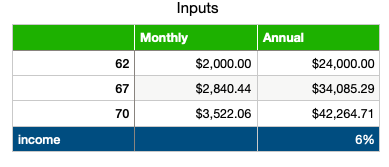

Waiting makes a big difference. My monthly payment increases by 42% if I wait til 67 instead of taking at 62. It increases a whopping 76% if I delay to 70 instead of 62.

Let’s take an example. Let’s say our monthly payment amount at age 62 is $2,000. Our monthly payment amount would balloon to $2,840 at 67, and $3,522 at 70. Who doesn’t want an extra $1,522 per month???

So here are our inputs (ignore the income line for now…it will be fun later):

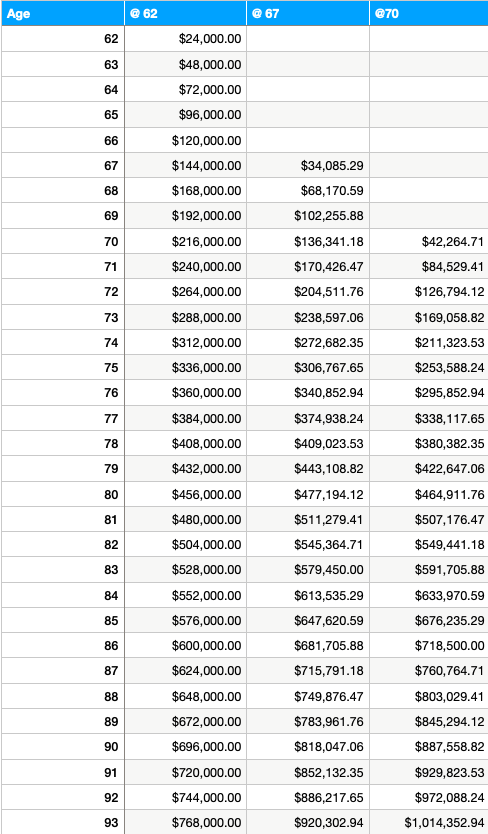

My first step is to project out how much I’ll receive if I start at 62, 67 or 70. It looks like this. I simply take my monthly amount X 12 months, and add to prior year’s total.

So, first interesting point…by starting at 62, with a lower monthly income, I’m ahead of the game until age 78, where taking at 67 pulls slightly ahead, taking at 70 still lags.

70 isn’t the best move until I hit 80 years old.

But Wait!

So my choices are pretty simple. I have 3.

- Take my money at age 62

- Hold off and take it at 67

- Hold off even longer and take my money at 70

As my dad used to say when looking at a long putt, “let’s analyze this.”

With option 1, I get some money now. With options 2 & 3, I get nothing now but a bigger check in the future.

How about a build-my-own option 4?

What if I take my money at 62, don’t spend it, and instead invest it.

Here’s where that income line comes into play.

This is my retirement money, so I’m not investing in bitcoin. I’ll probably choose a 50-50 mix of a nice low-cost S&P 500 Index fund and a very conservative short-term bond fund.

While the S&P 500 fund will likely outperform in the 5 years between age 62 and 67, I’d like to add a little less volatility with the bond fund. No guarantees here, but I believe 6% annual return is highly likely.

I’m betting that I can grow this money, which is exactly what the government is doing. They believe that if you leave the money with them, they can grow it enough to afford the increased monthly payments at age 67 or 70. I believe I’m smarter than they are.

Let’s Do The Math

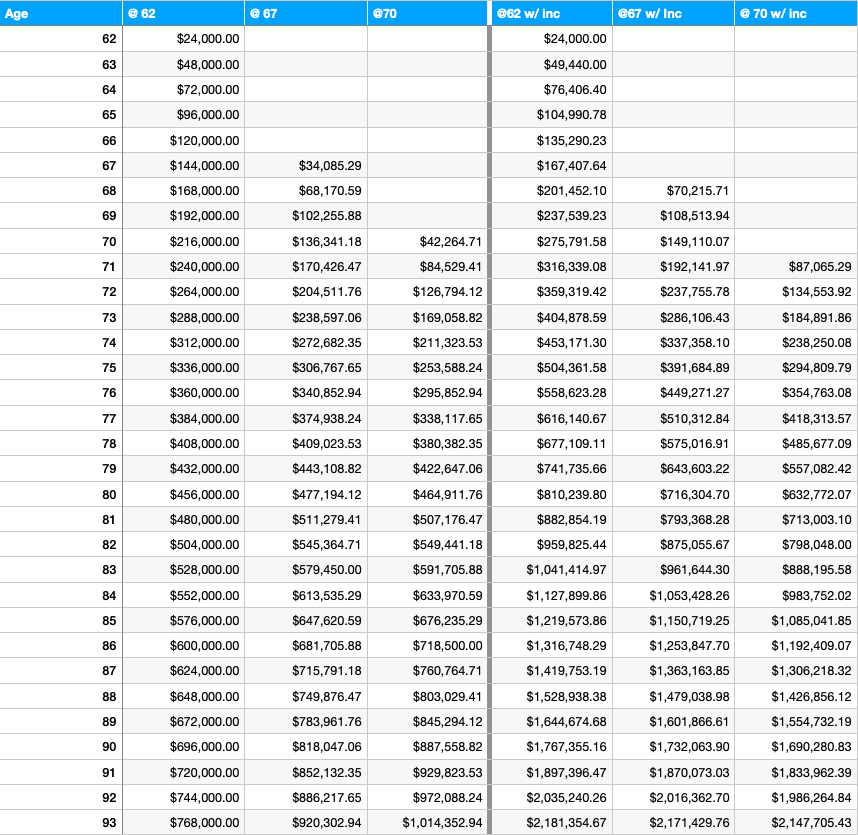

I’ve added 3 columns where I show how my social security income grows assuming that I add 6% investment return on the prior year’s income.

Just for kicks, I ran this out through age 93, which assumes I never spend any of this money. It’s an interesting exercise, but the likely scenario is that I start taking some money out to pay living expenses at some point.

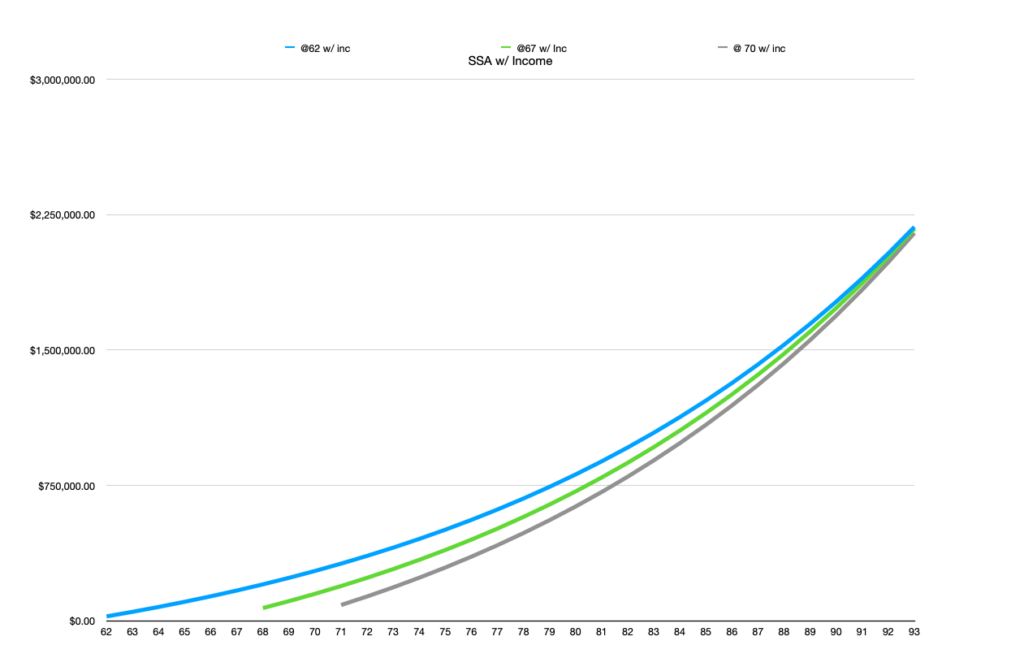

But the point is that by taking the money at 62 and investing it, I end up ahead of where I would have been if I had taken the larger monthly payment at age 67 or 70.

Stop and cash-out at any point, or start spending some of the proceeds, I’m still ahead.

Here’s the chart:

My Thought Process

Firstly, this is a projection based on an assumption of 6% return. While I believe this to be a highly likely scenario, who knows? The market could be flat or even down over the next 5 years.

So why did I submit my application this morning to take social security at age 62?

Social Security Runs Out Of Money In 2035

I’m sure you’ve seen the headlines. Read more here.

There are a lot of assumptions baked into that projection, but in the end, I’m more comfortable with the money in my control than in the government’s.

I’m taking my cut as soon as I can.

US Debt

I’ve written a bit about the US debt here and here, and I’ve written about it in relation to social security here.

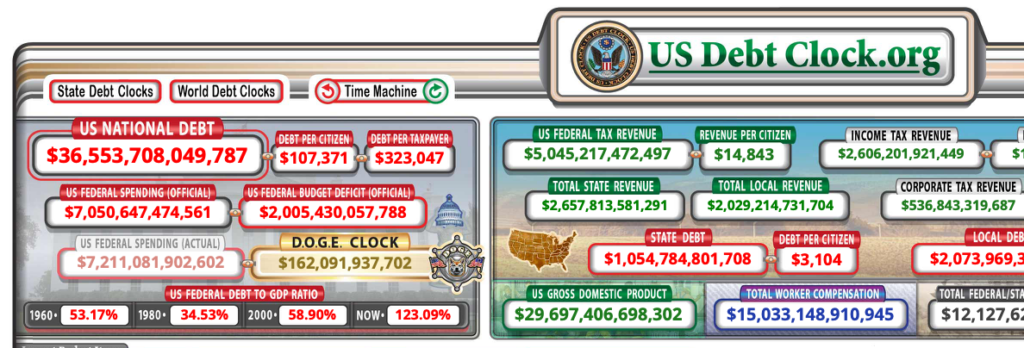

I won’t rehash it all here, but the debt is over $36.5 trillion today. That is an inconceivable number, so let’s break it down. Each tax-payer’s piece of that debt is $323,047.

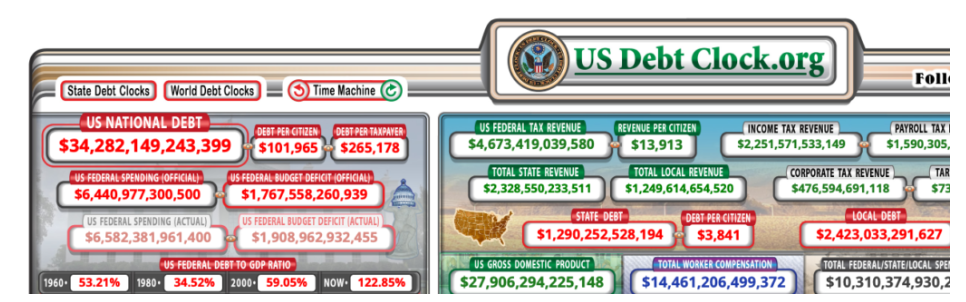

When I wrote my first post less than a year ago, the debt clock looked like this.

Today it looks like this.

The US debt is up over $2 trillion in less than a year. Each tax-payer’s piece is up over $50,000.

My grandson, who is 3 and my granddaughter, who is 6 month’s old, both owe $107,000 each.

This is terrifying. The politicians that we put in office continue to spend like drunken sailors. I wrote this letter to my congress members. Read it here.

While us old folks continue to say “You can’t take my social security. That’s my money!” This may be technically accurate, but the reality is that our government has chosen to spend trillions on things it can’t afford (and continues to increase its spending) so when the chickens come home to roost, I suspect everything will be on the table.

So, I’ll take as much money as I can now before it runs out.

Spend While You’re Young

I’m 62 and in pretty good health. Most of my retired buddies are in the same boat. These are the glory years of retirement. We’re healthy, we can play golf, travel, drive… things many take for granted, but our health is going to get worse not better.

I hope that I’m willing and able to hop in the car and drive to Florida when I’m 80. Or that I can get myself to the airport, go through security and spend 3 hours tucked into a basic economy seat. But, I may just decide I want to hang out at home and complain about the weather, the noise, the neighbors…

I may decide that rather than investing that $2,000 per month, I want to spend it now while I’m healthy.

Wrap-Up

I’ve given this topic a lot of thought.

As it is primarily a financial decision, I started with a spreadsheet. This helped me evaluate the 3 different scenarios that social security offers, as well as my own scenario 4.

But there are other considerations for me.

The US debt scares me. That is outside if my control and it clearly is getting worse by the hour. You can watch it real time at usdebtclock.org, or what’s really terrifying is looking at the comparison of today v. my post from mid-2024.

For many reasons, I’d rather have some money now, than wait 5 or 8 years for a theoretically larger paycheck.

I’m excited.

Let me know your thoughts.

Good info thanks for sharing. A former coworker/chief accountant gave me a similar spreadsheet back in the 1990’s and the story is the same then & now, gotta debate when I retire but that day is getting closer !

Sounds like we can go to more expensive restaurants! Congratulations!

Yes!!!

Nice article.

I always wonder why folks say wait. Your look at taking it early and investing it proves me right. (Which isn’t often true with my financial decisions.)