Everything is down.

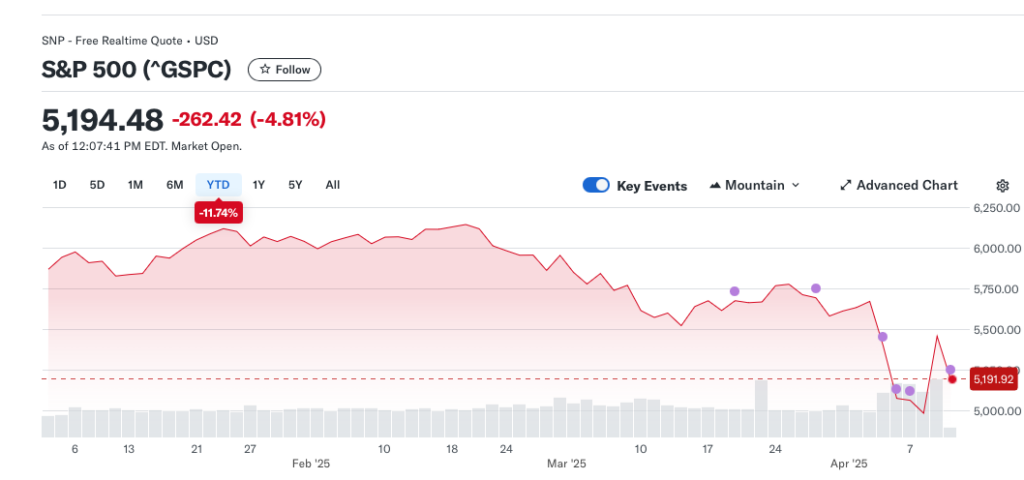

We had a brief reprise on Wednesday April 9 when some of the higher tariffs were rolled back to 10%, but today Thursday April 10, we’re down again.

I look at my holdings. My mutual funds are down, my stocks are down, my bond funds are down, especially long-duration treasuries. The mid-cap stock funds that I bought for stability (no exposure to the magnificent 7) are down even more than my large cap funds.

Things were pretty good this year until tariffs showed up.

For those who weren’t paying close attention, this is what the S&P 500 looks like this year.

Tariffs

I won’t even try and explain the economic and political side of tariffs. There are lots of experts on social media, but the truth is, we’ve never implemented tariffs like this before so we really don’t know. Anyone who says differently should be regarded with a healthy dose of skepticism.

But I can shed some light on why the tariff excitement is making stock prices go crazy.

Corporate Earnings

Companies are valued based on their ability to generate a profit.

For a nice stable company that has been around for a long time, like Coca Cola (Ticker: KO), it’s a fairly straight forward process to evaluate earnings. The company has been around since 1886, so we have quite a bit of history to help.

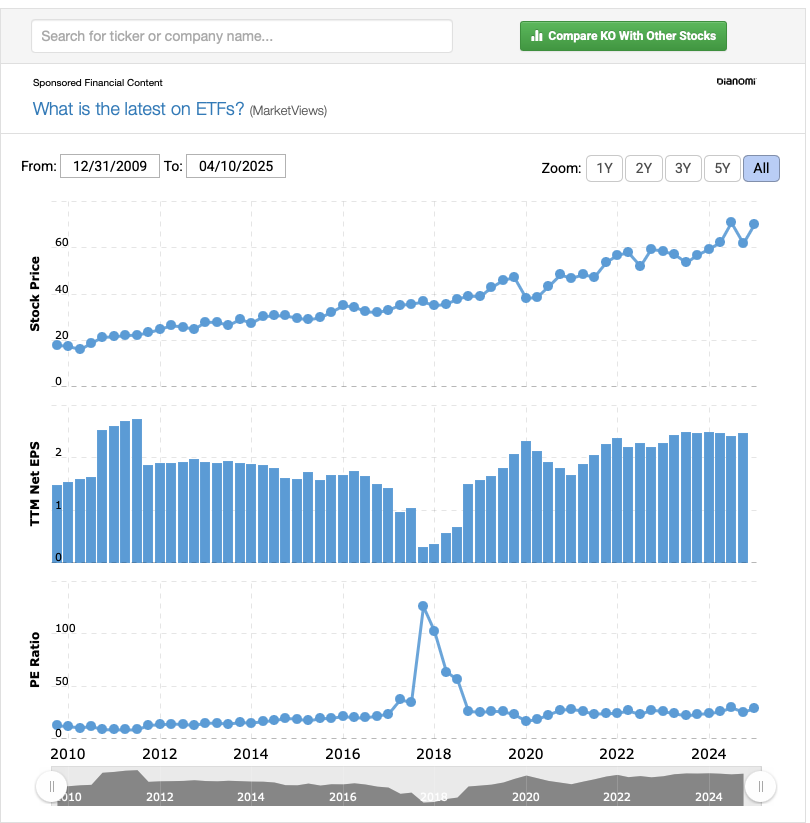

For a company like Coca Cola, I like to look at the price to earnings ratio (p/e). That tells us the price that we’re paying for every dollar of earnings. All other things being equal, we want to pay less for higher earnings. KO has a p/e of 28.21.

I like to look at the macrotrends p/e history charts. Here we see the stock price of KO on top, the trailing twelve month (TTM) earnings in the middle chart, and the p/e ratio below (price divided by earnings).

Coke’s stock price has increased over the years, but so have its earnings. Price is a little ahead of earnings so the p/e has risen in recent years from 23 to 28, but there were periods of 28 or above in the past.

As an investor, I want to get a bargain. I want to buy Coke when its p/e is low – compared to its historical p/e.

What Determines Earnings?

We won’t analyze the balance sheet, but simply put, the earnings are what’s left over after we pay operating expenses, interest on loans, dividends and any other shareholder equity (buybacks). That’s it.

Companies, analysts and investors need to project out sales growth assumptions and operating expense projections in order to derive a future value of earnings (forward earnings as opposed to trailing twelve months earnings). This is a bit of an art.

The big problem with tariffs is that it is now virtually impossible to project out operating expenses. I know what things cost today, but I can’t even begin to assess what they’ll cost tomorrow, or in 6 months or a year. What will the tariffs be then?

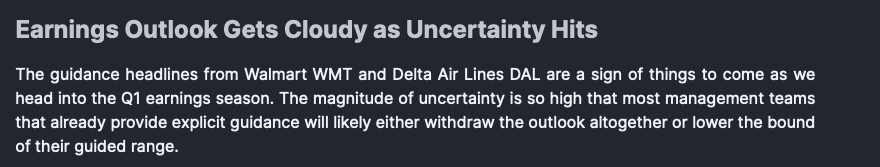

Walmart and Delta in their recent earnings calls decided not to announce any forward looking guidance. Read here.

Are Stocks Cheap?

My wife asked me this. My answer was “I have no idea.”

They are cheap compared to 3 weeks ago.

But, if I can’t assess how much it will cost these businesses to run their operations, I have no idea if they are cheap or not.

Let’s take an example. Nike (Ticker: NKE) is a great American company that has lost its way a bit recently. Nike brought back a former leader to run the company and was making some changes. Then tariffs hit.

Nike makes many of its sneakers in Viet Nam. Tariffs on imports from Viet Nam were 43%, now they are 10%…for now…will they go back to 43%? Higher?

Try projecting future earnings and expenses in this environment.

Just Move Onshore

Simple answer, make the sneakers in the US and avoid tariffs.

How long will it take to set up factories here? How much more will we need to pay US workers. The average salary in Viet Nam is $8,400 per year. Do you know anyone in the US who will be willing to make sneakers 8 hours per day for $8,400 per year?

And that’s after Nike builds lots of factories here in the US – how long will that take? And what will it cost?

Some economists have speculated that many businesses today would no longer be viable after the original tariff proposal.

So are they cheap?

Will Things Get More Expensive For Consumers?

Yes

How can they not?

While some retailers like Walmart have committed to holding prices steady, I expect to be disappointed.

Many of their suppliers are in China. China’s tariffs are at 125%. If a toaster costs Walmart $5 and they sell it for $10, what will they do when the toaster costs them over $11. They can’t survive selling at a loss.

Now we’ll likely find some toasters made in other countries with a 10% tariff, but changing over supply channels can be both costly and time consuming.

Wrap-Up

So while most of us can’t assess the 2 year, 5 year, 10 year impacts of new tariffs, we can think through the near term business risks to help us better understand why stock prices are going crazy.

Between the introduction of higher than expected tariffs, the rollback to a still high 10%, and the lack of clarity of the future tariffs, it’s hard for investors to evaluate companies and its hard for companies to plan where to build manufacturing plants and where to source items from.

Tariffs + uncertainty = caution.

This may be the buying opportunity of a lifetime. It may just be the start of another 10%, 20%, or 90% slide.

Until we have some clarity, it’s best to take a pause.