Quick story today. I’ve written about my love for Costco and some other great companies, but today I have a love letter to cash – more specifically, money market mutual funds. Let me tell you why.

My wife and I are retired. We’re both shy of social security age, so we are living off of savings and investment income.

Solar

I am a big fan of home solar panels. We added 22 panels in 2022 and they cover nearly 100% of our electric use. This was awesome as electricity prices skyrocketed right around the time we installed. Prices have since come down a bit but it’s still cool.

We have a hot tub and a couple of mini-split heating units so we use quite a bit of electricity.

Last year, we decided to add 5 more panels and 2 batteries. This will cover 100% of our needs, we can sell some back to the electric company, and we can get by indefinitely if a power line goes down or if Russian hackers attack the grid.

I signed the contract last October.

Payment

1st payment was due today. I pay for all equipment as soon as we get all the permits and approvals. Today is the day. I need to shell out $24,000.

That’s a large chunk of change for us. Certainly not something I have hanging around in the checking account.

That means I need to move some money from my investment account. To do this, I’ll need to sell some securities.

Is This a Good Time to Sell?

Most of our readers will guess that April 23, 2025 is not a good time to sell. The S&P 500 is way down from its recent high. My Tesla shares are down over 50%.

It’s not a good time to sell.

Money Market Fund

Anytime is a good time to sell assets invested in a money market fund.

Let’s take a step back. What is a money market fund?

It is not a money market account. That’s different.

Some banks offer a money market account. It is basically a savings account that pays a slightly higher interest rate and may have some withdrawal restrictions of minimum balance requirements. It is FDIC insured up to $250,000

A money market fund is offered by an investment company. It may have some of the same restrictions about minimums or restrictions on withdrawals, but it will typically pay a higher rate than what the bank offers. It is also not FDIC insured.

A money market fund is an investment product. It strives to keep a $1.00 share price, but that is not guaranteed. That said, I know of only 1 fund that ever “broke the buck”.

Break the Buck

You can read more here from investopedia, but essentially, bad investment decisions or an economic meltdown like the one we had in 2008 can cause a money market fund, which invests in ultra-safe short term instruments, to lose money and drop below the $1.00 Net Asset Value.

This is bad. It’s only happened twice (I only knew of one, but the investopedia article was informative – thanks!). And it almost never happens.

Money Market Fund Yield

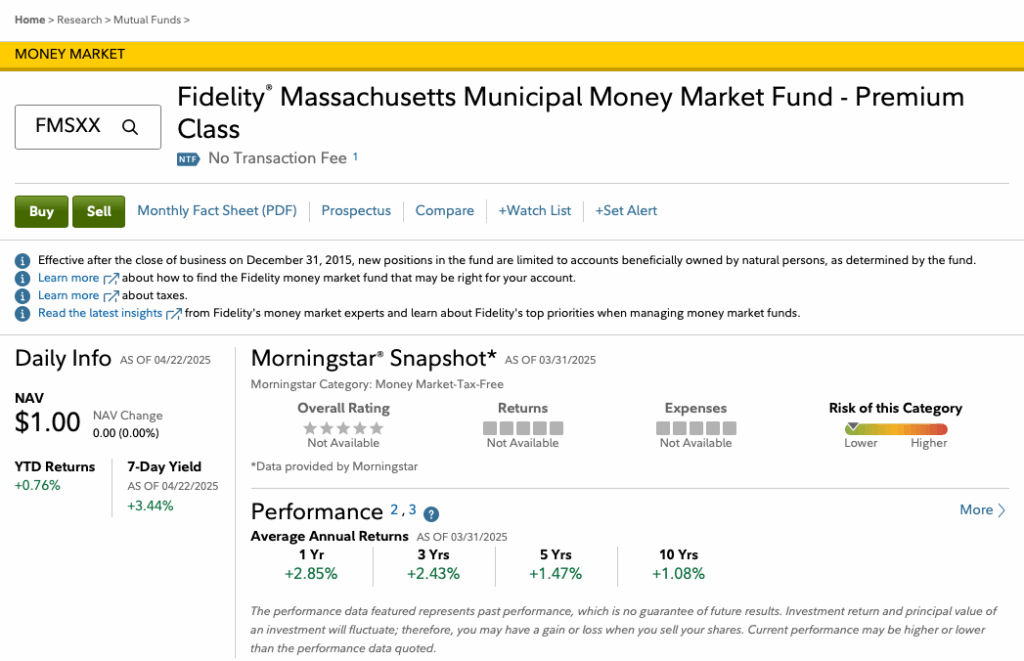

Today I sold shares of my Fidelity® Massachusetts Municipal Money Market Fund – Premium Class fund.

Not only is it a money market fund, it is a municipal money market fund, which means it invests in municipal money market securities which means the interest is tax-free.

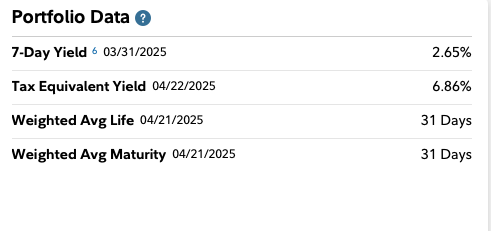

Lower on the page, I can see the 7-day yield compared to the tax equivalent yield.

The 7-day yield is the average income of the fund over the last 7 days, assuming the rate stays the same for 1 year – so it is an annualized return figure based on recent experience.

The tax equivalent yield makes some assumptions to derive what I’m actually yielding, since I’m not going to pay taxes on any of the interest.

A 2.65% yield isn’t too bad – much better than the bank, but a 6.86% yield after the tax advantage is pretty cool.

Redeeming Shares

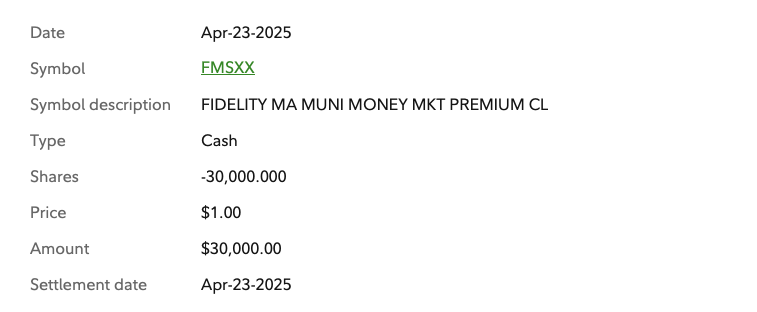

I put in my sell order this morning. Because this is a mutual fund, it will hold my order until the fund is valued after market close today. I’ll then be paid out at the current NAV, which barring some major unforeseen catastrophe will be $1.00 per share.

I bought for $1 per share. I’ll sell for $1 per share.

I’m only redeeming a portion of my fund balance, so I continue to hold quite a few shares that I will likely redeem in the future for $1 per share.

The whole time, I’m earning a decent rate of tax-free interest income.

Wrap-Up

I love cash – in this case, a nice municipal tax-free money market fund.

It pays tax-free interest and unless a major catastrophe hits, it always retains its value.

It is not FDIC insured. We’re taking a risk both on the NAV and on the FDIC coverage, which is why the reward (rate of return) is higher than your bank’s FDIC insured money market account.

They have similar names, but they are very different products.

Either way, I’m getting my solar, I will save more on electricity, and I’ll be able to live off the grid. I also get a nice tax break this year.

And the best part is, I did not have to sell any fixed income or equity securities which have all pulled-back pretty significantly lately.

…And Another Thing…

And here’s the trade confirmation. Yup. $1 NAV.

The interest on a money market fund varies in-line with the fed rate. When rates are high, we get higher money market fund interest rates.

We’re not going to build huge wealth, but it’s nice to have some less-risky assets that hold their value during a market pull-back.