Yesterday, I wrote a post about the importance of having cash in a rocky market. While cash doesn’t gain much, it also doesn’t lose much.

This got me thinking. My wife and I put in a little effort to maximize our cash return. But I know many folks don’t realize they have lots of options when it comes to cash.

Asset Allocation

Asset Allocation is an important part of managing our finances. I’ve done a detailed post on asset allocation here.

Simply put, asset allocation is making choices about how much of our assets are in Cash v. Fixed Income v. Equity.

Today we’ll focus on the Cash piece of this.

My Local Bank

I remember when I got my first real job in High School. I opened up a passbook savings account at the Beverly National Bank. Each week I would deposit my pay check and watch the balance in my passbook grow. Back then, we got 5.25% annual interest.

Today’s Interest Rates

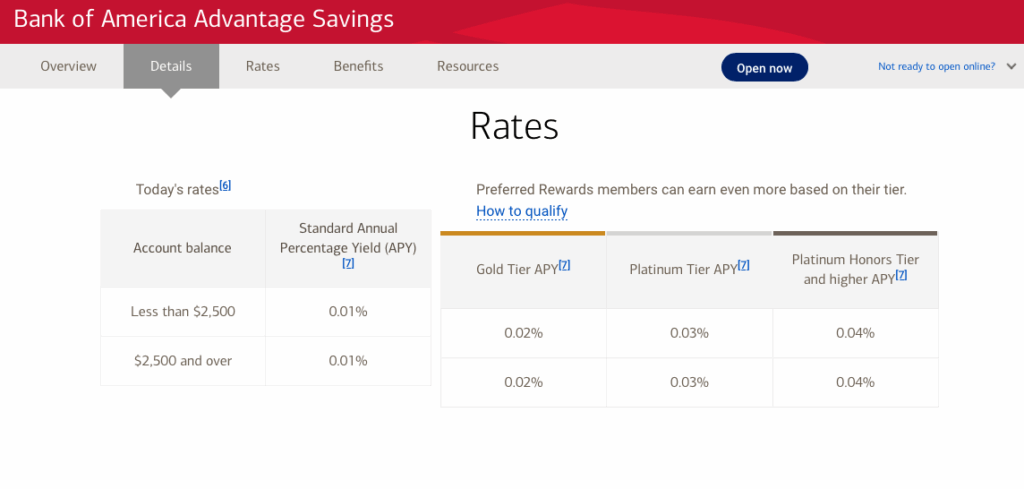

I took a look today to see what my options are locally. I took a look at Bank of America.

Platinum Honors members receive a whopping 0.04% interest. If I put $100,000 into this account, I’ll earn $40 this year in interest. So at the end of the year I have $100,040.

Inflation

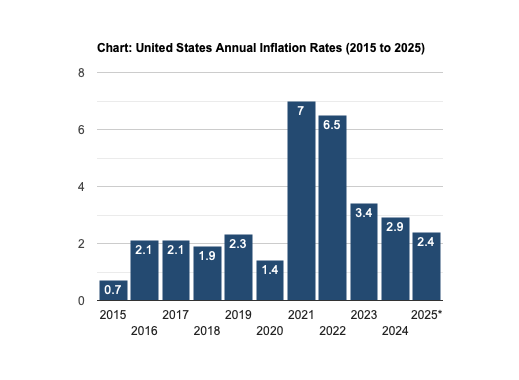

But don’t forget inflation. While I would have more money than when I started the year, Inflation is nearly 3% right now which means stuff will cost 3% more at the end of the year. That means my $100,040 will only buy $97,038.80 worth of stuff. I need to earn at least 3% or I’m losing buying-power.

Here’s some historic values on inflation.

Does it Matter?

Yes and No.

Let’s start with the No.

Some of my cash is in an emergency fund. Read more here. Some more of my cash is stored away to pay my electric, rent, phone, heat, and other bills.

In the case of emergency fund money, we want this close by and accessible. We may want to keep it in a safe place at home, where it earns no interest, or we want it in a bank where we can withdraw it in a hurry when an emergency arises.

For my monthly bills, this money is in and out. It doesn’t stick around a long time. I’m not too concerned with growing the balance. I’m only concerned that the money is there when my checks clear.

So for these sources, I can live with low to no interest.

Cash Investment

I wasn’t sure what to call this, but for folks like me who are in retirement, or for folks who might be stashing aside some cash for a purchase within the next 5 years, we want to do a little better than 0.04%.

The cash to fund my monthly budget, and for my emergency fund is in my checking account. Since I no longer have a paycheck, I have a reminder set up when this dips below a certain dollar amount and I add some more cash. I add that cash from a money market fund in my brokerage account.

We’ll talk about what this is in a sec, but for me, it is important not to have to sell securities in a down market. For this reason, I keep cash that I’ll need in the medium term – next month and a little beyond – in a place where I won’t lose money and will do a little better than Bank of America is willing to offer.

Similarly, if I were saving for a boat, I don’t want to invest that money and risk losing it, and losing the boat because I no longer have a down-payment, but I want to earn more than 0.04%.

A Better Savings Account

Bank of America names their savings account The Bank of America Advantage Savings. It is certainly their advantage.

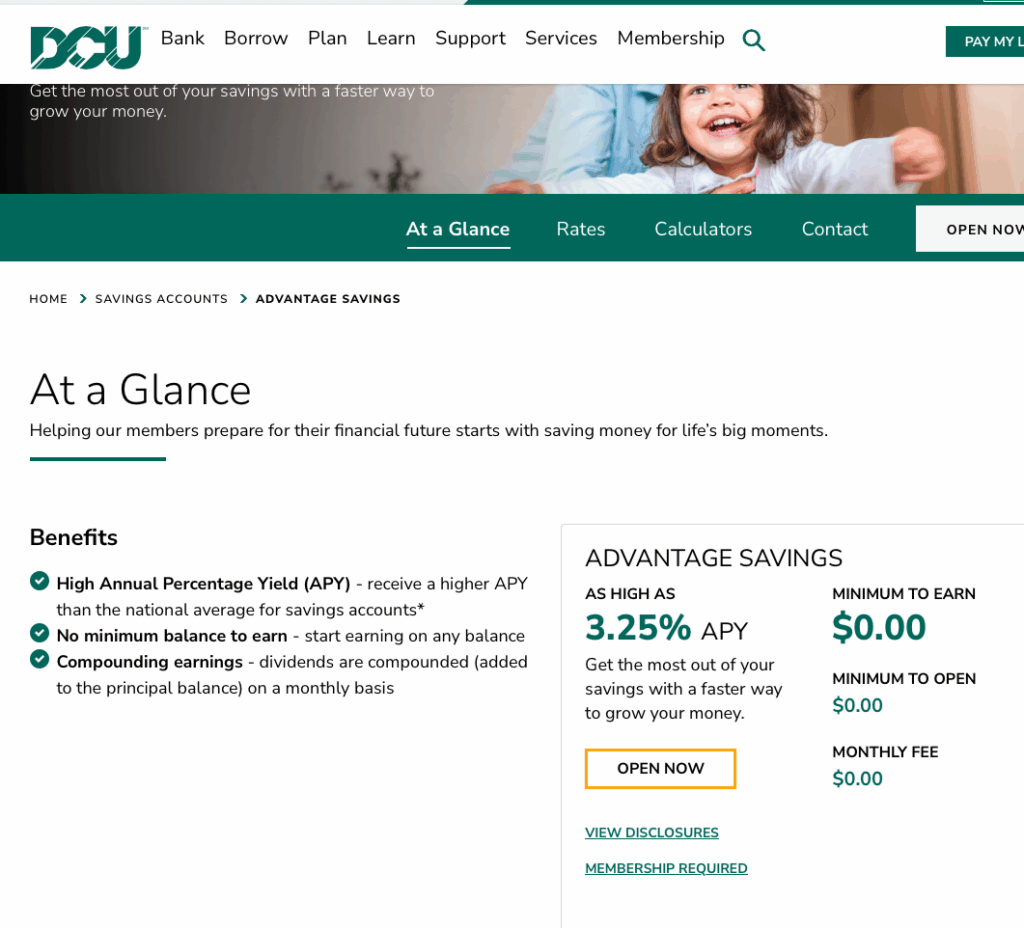

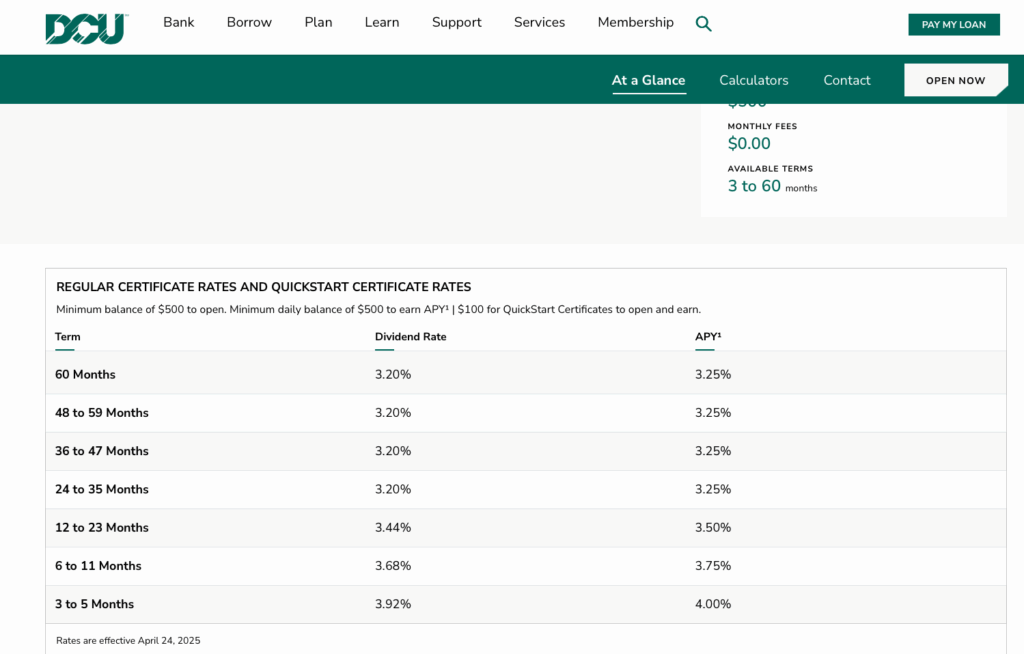

With a little looking, I can find a local credit union that offers 3.25%

At 3.25%, this one has a chance of not losing to inflation. This is a good start.

Money Market Account

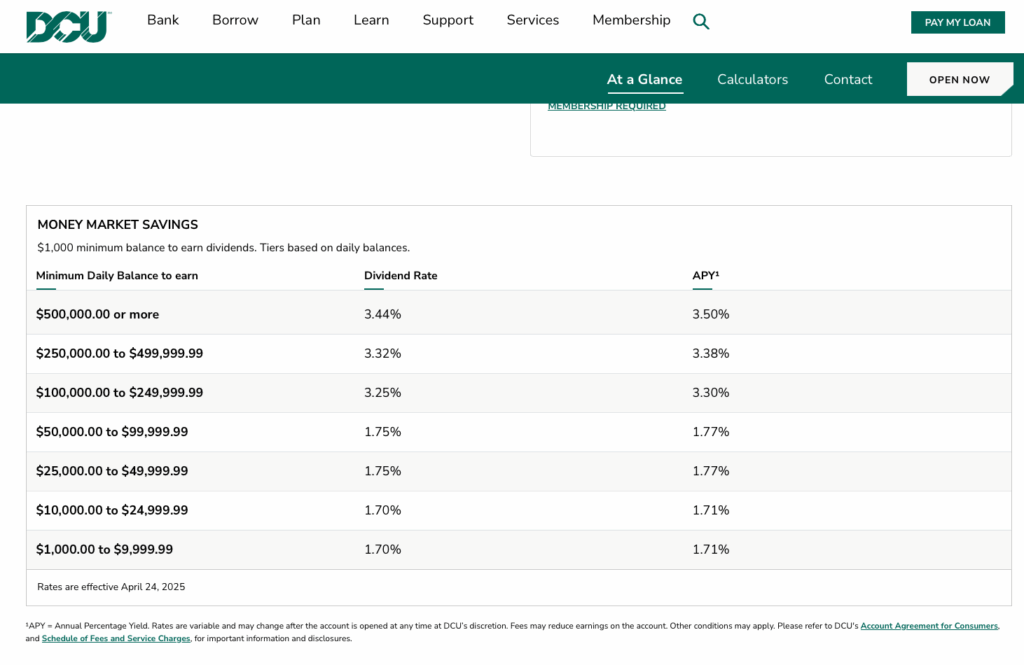

Many banks will offer an upgrade from the standard savings account, called a money market account. Some will have a minimum investment, and others may have a tiered interest rate structure. Like a bank checking or savings account, a money market account is FDIC insured.

Here’s an example from DCU

A Word About FDIC

We like the Federal Deposit Insurance Corporation (FDIC). Member banks pay into FDIC, kind of like we buy auto insurance. They pay and hope they never need to use it.

If a bank goes belly-up, the FDIC guarantees each account holder will have their deposits insured up to a maximum of $250,000. Have $251,000? You may only get $250,000 back if your bank has a financial crisis. I say “may” because there have been situations where the FDIC has made all depositors whole even if they exceeded the $250,000 limit.

If you’re concerned about the limit…say you have $750,000 you’d like to deposit but are afraid of what might happen if your bank folds. You could open up 3 seperate accounts under 3 different registrations and each would be covered up to $250,000. One could be in your name, one in your spouse’s name, and one joint account in both names.

But, one of the great benefits of bank checking, savings, CD, money market accounts, and high yield accounts is that they are all typically covered by FDIC. But check carefully before depositing money.

Certificate of Deposit (CD)

A CD is a little more risky but typically offers a higher interest rate to compensate the CD holder for the risk. The 2 risks involved are interest rate risk and liquidity risk.

First let’s look at DCU’s CD rates

Interest Rate Risk

If I buy a 60 month CD (5 Years), I get the same interest rate as I would in the regular savings account – how can that be?

There is interest rate risk with the savings account. If the Federal Reserve drops rates, the rate we receive for our savings account will drop. It’s 3.25% today, but it could be 2% six months from now.

Likewise rates could go up. With the CD, I could lock in 3.25% for 5 years but then rates could be up to 5% next year. I could be stuck with years of a lower than market rate.

Both products have interest rate risk.

Liquidity Risk

When I buy a 5 year CD, I am committing to allow the bank use of my money for 5 years. The bank is able to offer a higher interest rate to me because it may tie up some of the money I’ve invested in longer term, less liquid cash and cash equivalent investments (it’s not buying fixed income or equities).

Because some of that money may be committed to longer term investments, the bank is not able to easily get my money out of those investments if I want my money sometime between the purchase date and the maturity date. Because of this, I’ll likely agree to a penalty if I ask for my money early.

With the savings or checking, I can get my money anytime I want. Not so for the CD.

CDs often offer higher than current market rates, but be aware of the liquidity and interest rate risks.

CDs are also FDIC insured.

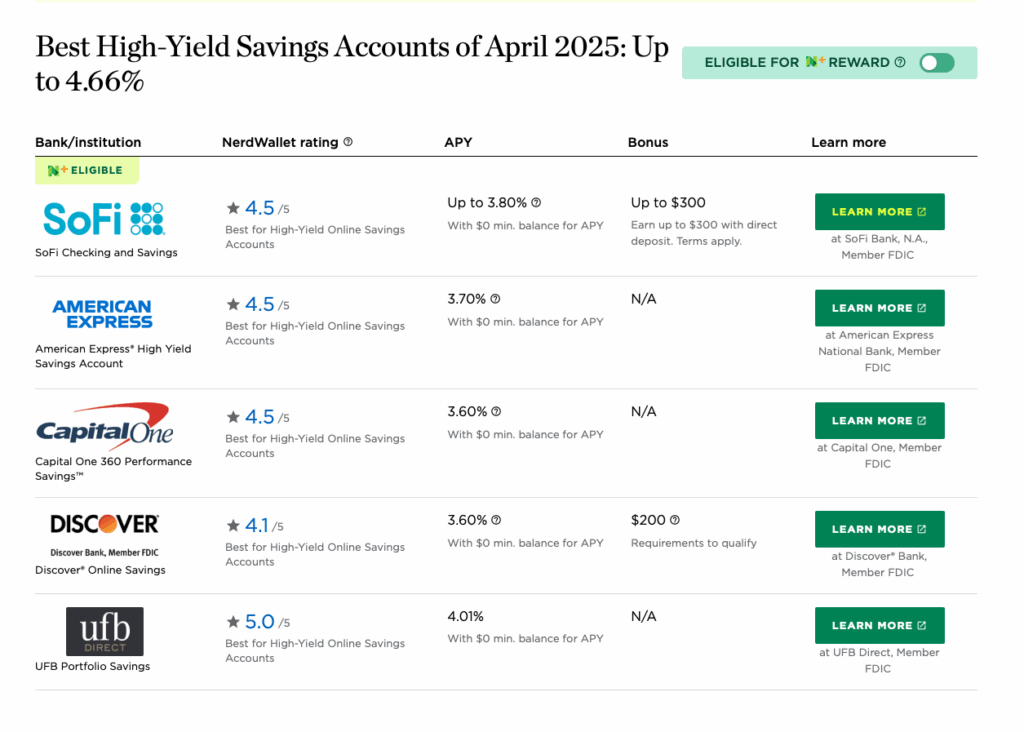

High Yield Savings Account

High Yield Savings accounts offer higher interest rates than most checking, savings, money market accounts, and CDs. They can do this because they often do not have a physical presence. Here are some of the top offers compiled by our friends at Nerdwallet.

You will drive around the neighborhood a while before you’ll find any of these banks. Even if you came across an American Express office, they wouldn’t help you with your high yield savings account. These are typically online only.

And like a typical savings or checking account, the rates vary. They will rise and fall inline with the Fed rate.

Most High Yield Savings Accounts are FDIC insured.

Cash Investments

All the choices we’ve discussed so far are bank products. They are FDIC insured (but check to make sure) and regardless of the interest rate, the principal is guaranteed. We won’t lose money, though our buying power may not keep up with inflation.

But there are cash-like – sometimes called cash equivalents – investment products that come with more risk but may provide higher returns to compensate us for taking that additional risk. These products are generally sold by investment companies (like Fidelity Vanguard and Schwab) but not by your typical bank.

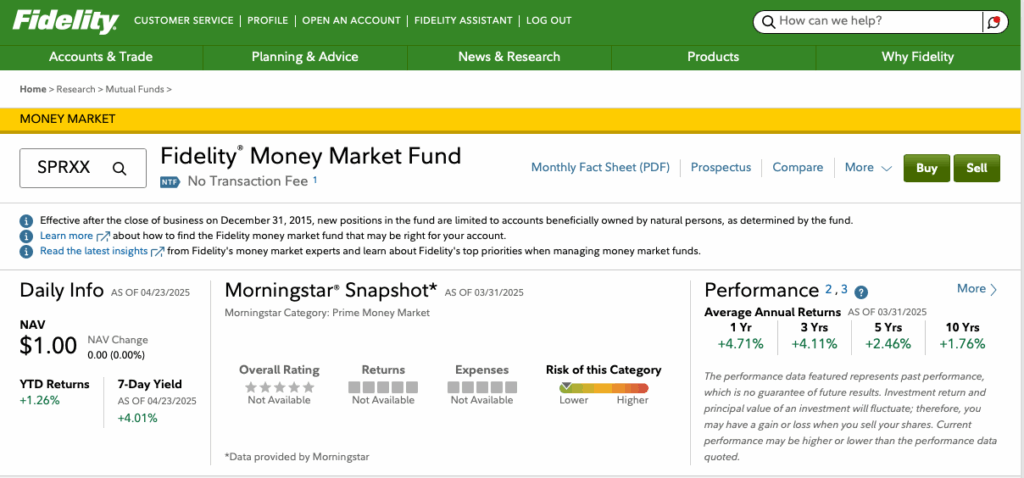

Money Market Funds

While named like the bank’s money market account, this is a very different product.

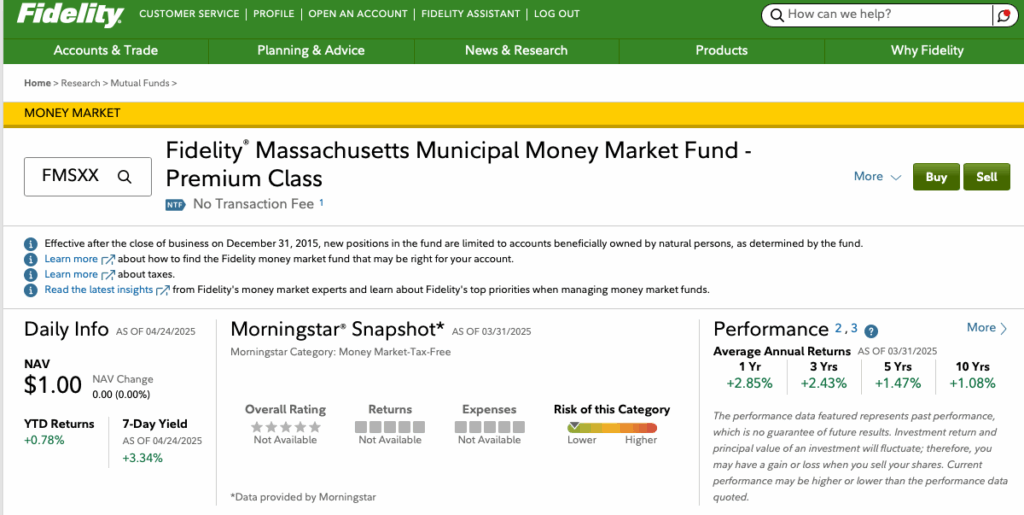

Let’s look at an example

A money market fund is an investment fund that invests in a diverse basket of short-term, low risk investments.

The Net Asset Value (NAV) is generally $1.00. The fund is trading cash-like securities. The values don’t change. The fund is earning a rate of interest on that cash and it returns that to shareholders as earnings.

You can see that Morningstar rates the risk as low. The return is pretty good. It’s getting about 4.01% today, but has already earned 1.26% YTD (and we know what the S&P 500 has done).

The fund holds a lot of treasuries – while these are technically fixed income and not cash, they are generally regarded as a cash equivalent.

It holds some CDs, and it holds something called a repurchase agreement. What the heck is that?

Let’s say you needed some cash for 24 hours and I had some cash hanging around that I’d like to earn some return on. We agree that I’ll buy your snowblower for $500 today and then sell it back to you for $501 tomorrow morning.

That’s a repurchase agreement. They’re very short term, usually overnight. And there is some sort of collateral – usually a treasury bond, but in this case a snowblower.

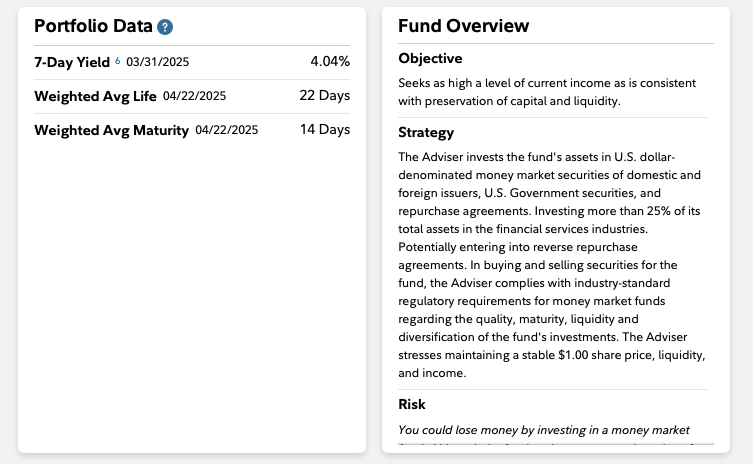

Here are some interesting fund facts.

You can see the maturities are all short. Also, you can see under risks that you could lose money. The Adviser stresses maintaining a stable $1 share price….

Meaning the price could go lower. This has only happened twice. Every money market fund shows this as their 12 month low and high.

It could go below, but it is quite unlikely.

And this is an investment product. It is not FDIC insured.

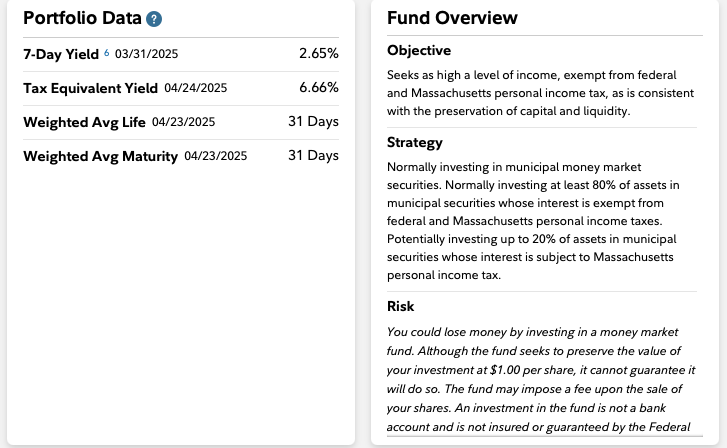

Municipal Money Market Funds

Now that we’re starting to earn some real money on our cash, we need to start to think about taxes. This is not a concern in a tax deferred account like a 401k or IRA, or in a tax free account like a Roth, but if our cash is in a high yield savings, or a brokerage cash position, we’ll be paying taxes each year on the interest earned. Depending on our tax rate, 10% – 25% of our interest may be going to Uncle Sam.

Municipal money market funds are the tax free cousin of money market funds. These funds invest in similar short term, low-risk securities, but the securities in which they invest are all issued by municipalities.

Let’s look at an example.

This fund – note the $1 NAV – invests in Massachusetts municipal securities so it is tax free at the state level for Massachusetts taxpayers, as well as at the federal level.

Here’s some more info.

7-Day Yield

For money market funds, most securities held are very short-term. Some are only held overnight. Because of this, the yield is measured on a 7 day basis. The fund looks back at the income received over the past 7 days and then annualizes this to come up with a yield figure that can be used to compare across money market funds.

Our annual yield for this fund is 2.65%. Not bad. But the tax equivalent yield is 6.66%. That’s pretty awesome for a fund that is highly unlikely to lose money.

The 6.66% may be a bit of a stretch. The fund is likely estimating this at the top tax rate. If we’re at a lower rate, our return may be a little less.

This is also not an FDIC insured product. And we could lose money. Again, it has only happened 2 times, but it could. But, as with the ther money market fund, here is the 12 month range.

Wrap-Up

I often talk about stocks and bonds. They are more complicated and as long-term investors, we need to participate in the equity and fixed income markets (at least via nice low-cost mutual funds) in order to build wealth.

But cash is a lot less boring than it may seem. We can just stick it in a Bank of America savings account and lose to inflation over time, or we could diversify into other types of accounts, or more aggressive money market funds.

All of these options are relatively safe investments. They are certainly less risky than either stocks or bonds. And they can help us get a reasonable return that can keep pace with, or beat, inflation.

Given what we’ve seen with the plunging stock and bond prices in 2025 so far, it is awfully nice to have some cash assets that have at worst, stayed even, and at best, gained a tax-equivalent yield of over 6%.

In yesterday’s post, I talked about needing to pay a large bill and needing some cash. Selling bonds or stocks would have caused me to take a significant loss. Having some of my money in a municipal money market fund allowed me to raise capital without taking a loss.