Reader Mike asks about rental property as an investment. While I’ve never owned rental property, I have taken a look so I’ll share what I’ve learned. I’m hoping neighbor Mike will jump in as he is actually a rental property owner. With that out of the way, here’s what I know…

Investment

Our definition of investment is something we purchase with an expectation that it will be worth more in the future. Property, specifically houses, and multi-family units, have a pretty solid track record of increasing in value over long periods of time.

But like stocks, this increase is not constant.

I had a neighbor (oddly, also named Mike) who moved into a home on our street in 2007. He moved out in 2009 when the bank foreclosed on him. Prices spiked in 2007 and early 2008 in the height of the housing bubble. You couldn’t lose money. I got something in the mail every week with an offer to refinance my home and unlock the value to add a pool or a deck, buy that boat, or purchase my dream vacation property.

The fliers stopped coming in mid-2008 when the housing market crashed. The price of my house dropped almost 50% overnight. Watch The Big Short. It is a very entertaining, and also pretty comprehensive story of how the housing bubble played out.

The point is that, while home values have risen over long periods of time, they go through the same volatility as stocks.

Risk

And like every investment, there is risk involved.

Pricing Risk

This is what we just discussed. We may buy a property, spend money to improve it, and still find that it drops in value because of economic or housing market factors that are beyond our control. This could be a storm that we can weather if we own the property outright, but if we have a mortgage, the mortgage-holder may pressure us or even foreclose.

Occupancy Risk

We buy a nice 3 decker downtown in a safe neighborhood. On the day we close, we have 3 great tenants who have been there for years. All of a sudden the housing markets slump. 2 of the tenants find they can now afford their own house. Bye Bye.

I may have my units unoccupied for a time while I try and find new tenants. I may need to do some repairs or renovations to get the property up to current standards. And all this while I’m not collecting rent.

And even in good times, tenants can move on.

Bad Tenant Risk

Shortly after I graduated from college, I moved into a rental apartment in a somewhat shaky section of downtown Worcester. My buddy had bought a 4-unit rental property and I agreed to move in with him. Could be an adventure, right?

Before we could move in, we spent a week cleaning the place. The prior tenants in our unit were smokers. We had to clean the soot off the walls, windows and every surface in the place. It was disgusting.

And then there was a large closet that looked to be the home for a dog (at least we thought it was a dog). The carpet was raised above the carpet level in the rest of the house. We found several layers of carpet. As the animal soiled a layer, they threw down a new rug. We had to rip all this out and had to replace the flooring underneath.

Tenants won’t always treat our property the way we would.

We interviewed tenants before offering them a lease. We had prospective tenants who showed up for an interview with a nicely dressed well-behaved family. Several days after signing, a completely different family moved in.

Rental laws in Massachusetts at that time were heavily in favor of renters. Once they are in, it is hard to get them out. Even if they stop paying their rent.

Your New Part-Time Job

Congratulations. You’ve got rental property. Sit back and let the cash roll in.

Not so fast. If something breaks, leaks, squeaks, or squirts, you’ll get a call. And these things tend to happen at hours when you’re sleeping or working at your real job. If one tenant annoys another, expect calls to mediate.

Stuff breaks around my house all the time. I need a new heating system, roof, or even just some repairs on the deck. This happens and my wife and I take good care of our home. It happens even more with tenants who may not be so careful.

We may need to collect rent from a tenant who dodges us. And while we get some tax breaks, our tax return gets more complicated. We may need an accountant. We may find we need to learn a bunch of new skills.

But it Could Be Worthwhile…

Absolutely. I had a co-worker who bought a multi-family unit in Providence. Soon after he bought another, then another. Then he left his finance job. He’s been doing this more than 20 years and I’m sure the values of his properties have risen beyond his initial cost and he’s done pretty well for himself.

Many people make money on this. We just need to be aware of, and plan for the risks before we jump in.

Alternatives

I looked at the risks and additional work involved and decided rental properties weren’t for me. But there are similar and less risky/labor intensive alternatives. How about a REIT?

What the heck is a REIT?

a REIT is a Real estate investment trust. Per investopedia:

Click here to learn more.

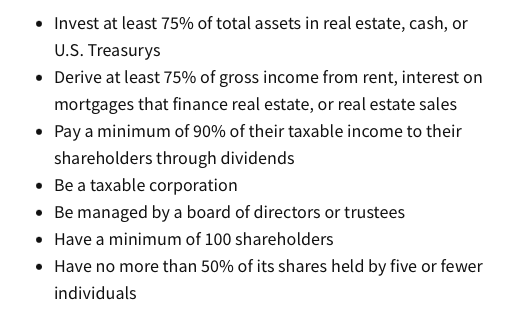

Here are some other important facts to know about REITs

Realty Income

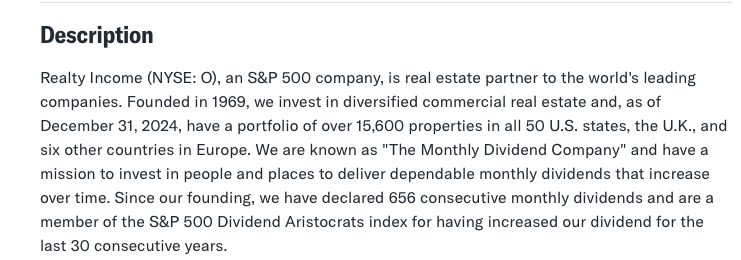

Realty Income (Ticker: O) is a very popular REIT. It’s known as the monthly dividend company because it pays a dividend monthly, instead of quarterly.

Here’s a little about Realty Income

Realty Income owns retail properties that it leases to clients like 7-eleven and Walgreens. They tend to be pretty stable long-term leases and they have net-lease contracts that require the tenant to pay many of the costs associated with the properties.

With Realty Income, you could invest as little as a few dollars, you could be a part owner of over 15,600 properties and you’ll never have to hunt for tenants, collect rent, and it is very unlikely that a 7-eleven or Walgreens employee will call you at 2 am to fix the boiler.

Many Types of REITs

If Realty Income is not your cup of tea, Take a look at Prologis (Ticker: PLD). Ever driven down the highway and seen a huge concrete bunker of a building lined with truck bays?

3 or 4 have gone up near me just in the past year or 2. Retailers are trying to keep up with Amazon and upping their shipping game. Prologis will rent them a terminal or space in a terminal anywhere in the US, or throughout the word.

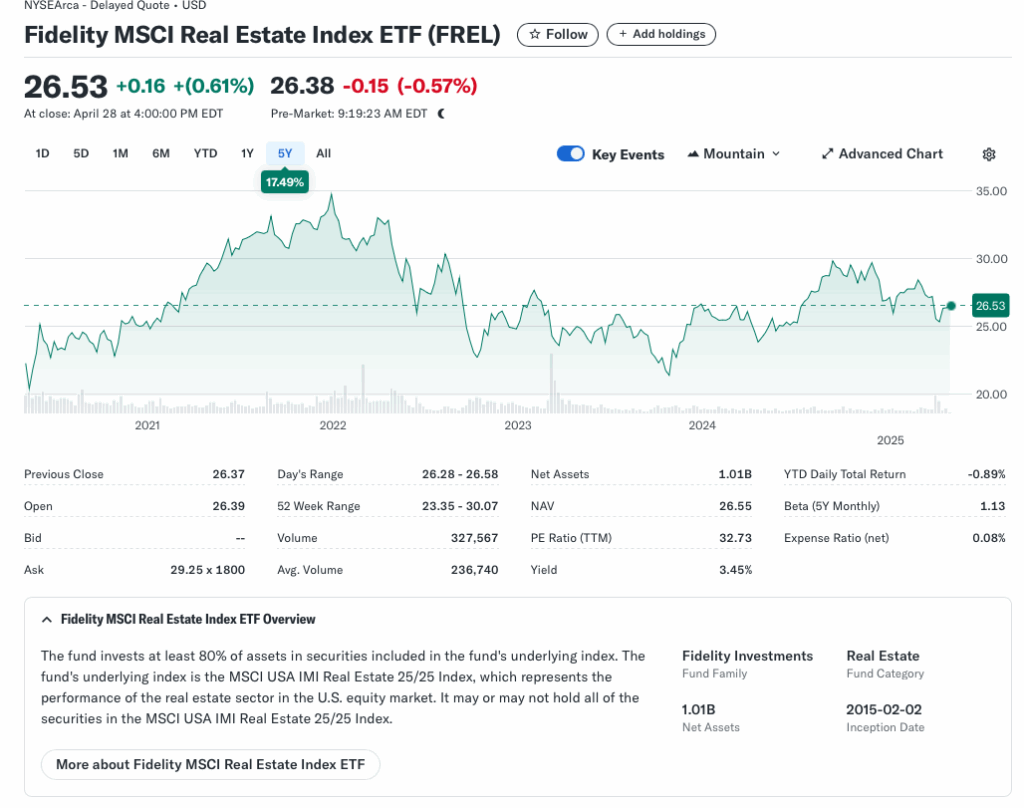

Or if individual REITs seem too risky, you can also buy a REIT fund or ETF that will invest in many different REITs. Here’s an example.

FREL is a passively managed ETF that invests in a diverse group of REITs – everything from cell towers to self storage to doctor’s offices.

How Much Can I Make?

And that’s the big question – right?

Whether we’re buying rental properties or investing in REITs, the purpose is to grow our wealth.

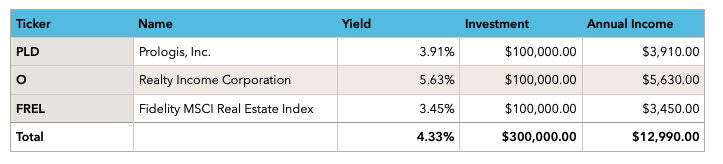

Let’s take a look at the current yield for each of the REITs and ETFs we discussed above.

The table above assumes that instead of taking $300,000 and using it as a down-payment on a rental property, we use it to spread across our 2 REITs and 1 REIT ETF.

We’ll make about a 4.33% return on our investment each year. That’s $12,990 in our pocket. Tax deferred if it’s in an IRA, Tax-free if it’s in a Roth or an HSA, or taxable at our ordinary income rate if it is in a traditional brokerage account.

How does that compare to owning? I don’t know. Maybe neighbor Mike will have some thoughts. My guess is that you could do better to much-better by owning your own property, because you will be taking on more work and more risk.

REIT Price Performance

And just like we need to be aware of our investment property’s value, our REIT has value as well. Every REIT has a stock price. Ideally that price goes up over time as the value of that company and the income that it generates, grows. But the REIT is a company and its managers could make bad decisions, or the particular market it serves or the economy in general could take a hit.

Just like any other stock, a REIT’s price will fluctuate. We may be less concerned as we’re invested primarily for the income, but it is something we need to be aware of.

Wrap-Up

Rental property is not for me. I am 61, retired and I’m looking to work less, avoid stress, and I’ve got a shorter runway to make a venture like this profitable.

But I know folks who have made this work. Sure there are horror stories. The horror stories are fun to tell and make the rounds more often, but there are many folks who have had great experiences.

Not for me, but I applaud those who are willing to take the risk and do the work because it can be quite lucrative.

I look forward to some reader feedback.

First hand experience here, I grew up in 3 family rentals in Providence and my extended family owned a few over the years, so not unfamiliar territory here.

My better half & I now own/ run 2 houses with 5 total units, her since 2000, me since 2010.

I’m sure there are many opinions but my overall view is it’s a good path to slow income and equity growth if you’re patient, but it’s not fast or easy. $’s. We both bought distressed properties and rehabbed them, hers was weary but inhabitable when she bought it, mine was vacant and abandoned for a few years.

As such we are both very “hands on” in the repairs & maintenance area, but you will also want to have a ready list of good contractors at hand for emergencies (Plumber = #1, Electrician = #2).

All of Brian’s comments about the challenges are spot on, after decades doing this we’ve experienced most all of the issues he notes, and you have to learn to keep a distance from tenants as they are clients and not family or friends, even the best ones will test you at some point.

Lastly I would share that in time (if the realty market cooperates) the equity side of the equation has been good to us, but accessing the value of those $’s is a challenge, I often tell people we are equity rich but cash poor, so until we sell we won’t see the actual $ gains impact our lifestyle, and my better half has sworn to never sell her rental property so it’s a family heirloom now, lol.

Hope this is helpful, happy house hunting for the brave souls out there !

Great info! Thanks Mike.

Nice article and comment. Rental property ownership scares the hell out of me. Too many bad experiences have been shared over the years. A friend says the best screening is to take tenants with a credit score of 700 or more.