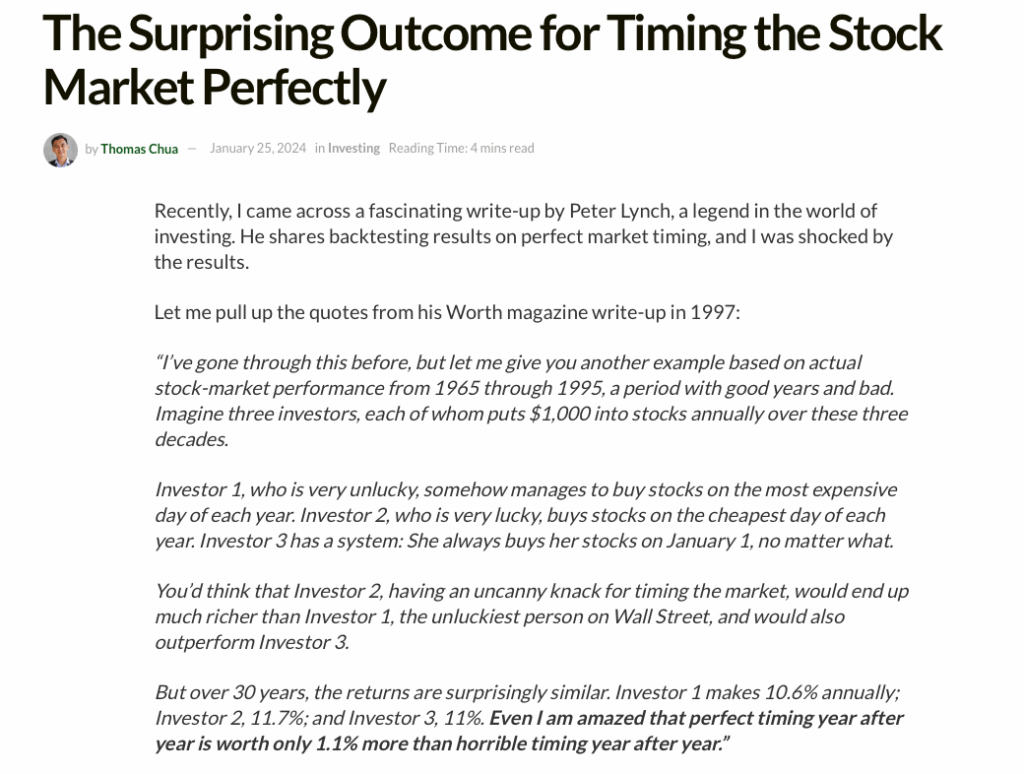

This weekend, I read an article in Benziga called Peter Lynch’s Market Observation: ‘Far More Money Has Been Lost By Investors Preparing For Corrections, Than Has Been Lost In Corrections Themselves’.

Interesting.

Here are the facts behind it.

Pretty fascinating.

Need to Act

I wrote some posts about this recently here and here and here. The first 2 talk about volatility and how dollar cost averaging can help us stay on track. The 3rd talks about our need to act. This is the one that defeats most of us.

If something’s broken, we fix it. That’s how most of us our wired. Today, it’s pouring rain here. I see the gutter is overflowing. I put on my coat and hat, grab a ladder and climb up to see what the problem is. I pull the leaves out of the downspout and we’re back in business.

Well done.

Do Nothing

Unfortunately in investing, taking action is more likely to cost us.

The Peter Lynch analysis is a great reminder of this.

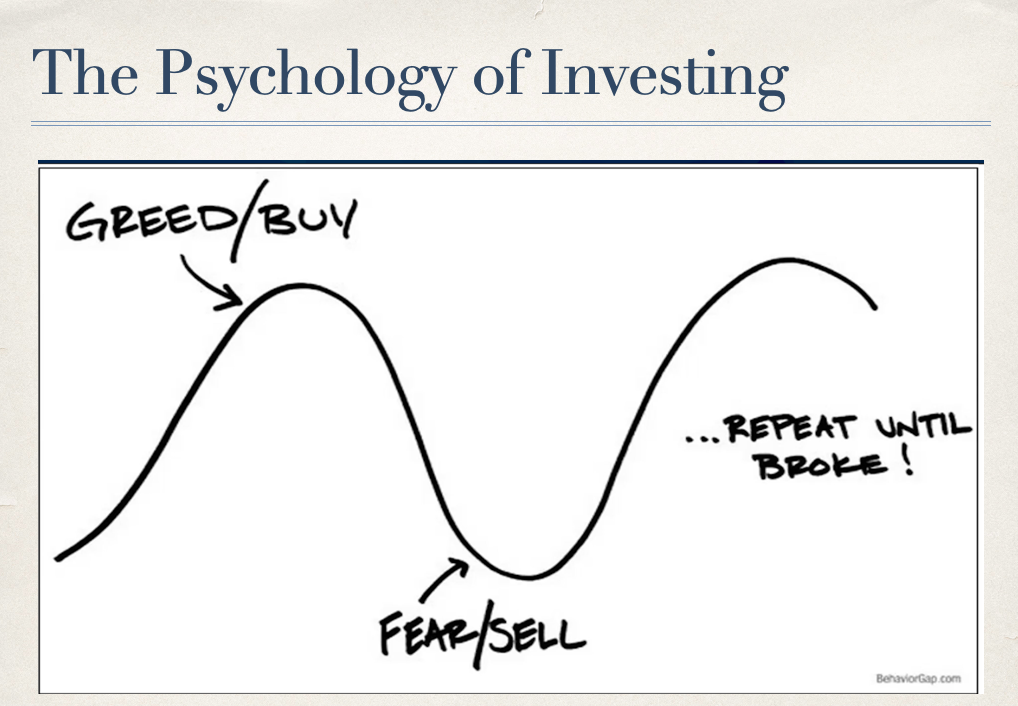

I also like this version.

Often we’re our own worst enemy.

Being Lazy Works

OK, it’s not really lazy, but having the ability to sit on the sidelines and not take action during market pullbacks is important.

Here are the keys to be able to do this.

- Don’t have money in the market that you’ll need in the next few years. If the market is melting down, and the money you need to pay next month’s rent is in the market, you’re in trouble. But if your short term needs are covered, and your long term investments pull back, it is easier to stay the course.

- Make sure you have conviction in your investment choices. I wrote about the hot stock tip I got from a friend. I sold as soon as it dropped. I didn’t know the company, I didn’t understand what it did or who ran it, and I had no thesis for why this company would win. I had no conviction. Contrast this with an S&P 500 fund. I am bullish on the 500 largest US publicly traded companies. I could talk for an hour about why. Conviction helps us stay invested.

- Dollar Cost Averaging. I am a huge fan of setting our portfolio investments on auto-pilot. Like investor 3 above who invested every January. We can do this through our workplace defined contribution plan, or by reinvesting our stock or mutual fund dividends. This strategy simply means setting a regular schedule for adding to our investments.

Wrap-Up

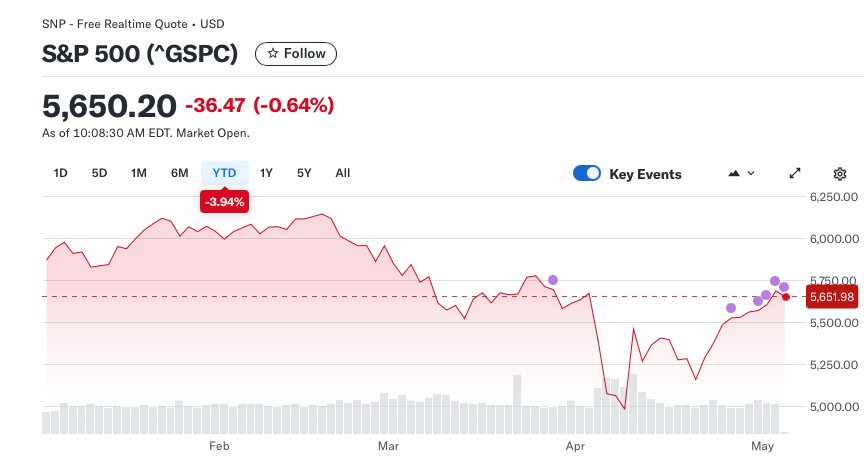

Look at the S&P chart for this year. We had a huge tariff-fueled pullback which we’ve largely recovered from.

Same thing happened in 2020. COVID fueled sell-off followed by a quick recovery.

The same happened in 2008, but then it took years instead of months to see some recovery.

But, despite the fact that the market pulls back pretty regularly, every single time, it has gone on to new highs.

The key to building wealth is having the patience and conviction that allows us to ride out the volatility. Read Sylvia’s story here.

It’s not easy, but knowledge, conviction, a solid asset allocation strategy, and dollar cost averaging can all help.