There has been a lot of excitement about social security lately. Social Security is funded by us and our employer. Since this is “our money”, we expect that it will be paid out to us when we retire.

While that makes sense, there has been a lot of talk about:

- the government cutting benefits

- social security running out of money

Both of these are causing anxiety for those of us in, or close to, retirement. Let’s take a look at what’s going on.

Social Security is Projected to Run Out of Money

Yup, you heard me right.

Social security is paying out more in benefits than it is taking in from employees and employers via payroll taxes. Shocker! A government agency is over-spending, who’d have thought.

Social security retirement benefits are maintained in a trust fund, managed by a group of trust fund advisors. Money that is not paid out in benefits is invested in government securities to help grow the trust fund. Important point: the trustees are not investing in Bitcoin and Gamestop to try and juice our returns.

2021 was an important year for social security. In 2021, benefit payouts exceeded tax revenue.

How Does That Happen?

Unfortunately, it’s pretty simple. Social security is paying us until we die. In some cases, it is paying our spouse even after we die. And we’re all living longer.

And while payroll tax rates have increased somewhat, they’ve not increased enough. The payroll tax rate in 1990 was 12.4%. In 2022, it was 12.4%. See detail here.

Meanwhile, life expectancy in the US in 1990 was 75, and in 2020, it was 78. In that time, life expectancy grew by 4%, while payroll taxes went up and down a bit, but basically stayed flat.

There are probably other factors, but in 2021, we started paying out more than we took in.

…And Another Thing…

Quick story…I was excited to get a notification that my mom is now receiving social security benefits. Yay Mom!

My mom is 88 and is a retired school teacher. She gets a state pension and has never contributed a nickel to social security. Neither has her employer, the State of Massachusetts.

Many, but not all, pensioned employees are now eligible for social security due to the Social Security Fairness Act: Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

This article has more info and says the WEP is a rare bi-partisan success.

I’m all for providing benefits to teachers, firefighters and law enforcement, but it looks like another good idea that we didn’t budget for.

Will This Correct Itself?

No.

In 2021, we paid out more than we took in.

Our workforce is shifting. Every year, there are more people retiring and claiming benefits than there are people joining the workforce and paying in to the program.

Without intervention, social security’s trustees project that social security will run out of money in 2033.

Running out of money means the trust fund is depleted. At that point, social security can only pay out money that comes in via payroll tax. This is projected to cover about 70% of what is due to recipients.

That’s cool, but what does that mean for the folks paying into social security in 2033? It sounds like their money is going into my pocket (assuming I’m still alive and collecting). What happens when they retire?

Wrap-Up

Thanks to Mike T for bringing this subject up over a lovely breakfast at Peg’s diner this morning.

I did some reading and learned a few things. For anyone who wants more detail, check here.

The sad reality is that we live in a world of government deficit spending. It’s unpopular to make the hard decisions to cut programs or increase taxes, so we borrow more, over-spend, and kick the can down the road.

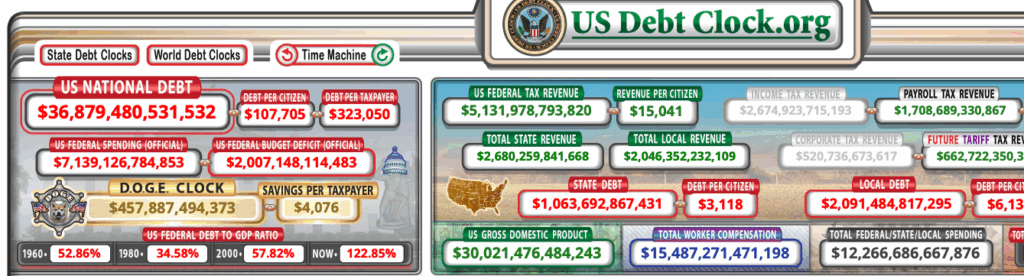

And for those keeping score. The US debt remains at about $37 trillion.

All the more reason that each of us needs to save more and invest for our future. I have lots of posts on both topics.

Mike and I are doing our part. Instead of going for the $50 Depot Diner breakfast, we ate at Peg’s. $14 for 2. Mike paid because he splurged and added an orange juice in addition to his coffee and breakfast. Thanks Mike!

And don’t be afraid to let your representatives in Washington know your thoughts.

Good luck.

While many citizens will arm wave & complain about Trump, in his “one big, joyous bill” (or whatever he calls it), in attempting to keep his commitment to eliminate tax on social security payments – a significant amount will be added to the already bloated deficit. Most of those on Social Security (incuding myself) will be huge fans of these tax cuts, but then many of this same group will villify Trump for spending too much! Sorry folks, you can’t have it both ways! I fully support what Trump is doing – keeping his campaign promise to the elderly while cutting othrr less important or in some cases, wasteful spending. The yov’t will not let Social Security ho bankrupt. I give Trump credit for not continuing to kick the can down the road & leaving even tougher decisions for future generations to deal with.