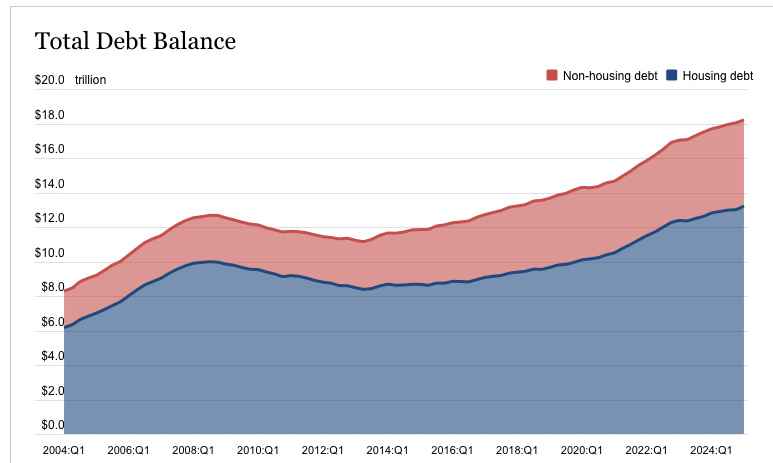

Americans love credit cards, loans and buy-now-pay-later. Don’t believe me? Check this out.

Housing debt makes sense to me. We need a place to live and houses are expensive. But the non-housing debt is worrisome. It’s increasing pretty rapidly. Let’s take a look at some household debt numbers from the Motley Fool.

And some trend info from the same article.

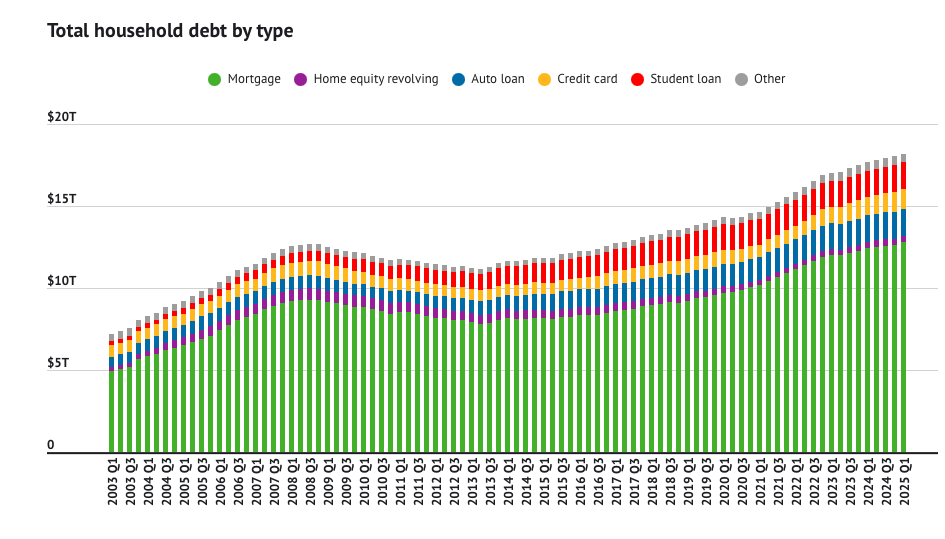

The article is worth a read. But the highlight for me is that the average household has

- $6,580 in credit card debt

- $263,923 in mortgage debt with a $2,205 monthly mortgage payment

- $24,373 in auto loan debt for which we’re paying $742 per month for a new vehicle and $525 for a used vehicle.

That’s a Lot

You ain’t just whistlin’ Dixie…those are some pretty large numbers. And with the average household income at $80,000 (read here) it’s easy to see how many households are falling behind.

And interest rates are staying relatively high. It’s costing us more in many cases to pay interest on that debt.

At which point you’re all saying “No Kidding”. We all know this from our own experience, but nice to know we have lots of company.

Why is this Important?

My parents had debt. We had a home loan and car loans. My friends have debt.

That’s unlikely to change as we all need some help with big purchases like a home or vehicle.

But it’s important because it limits our options. A lot.

A guy down the street from me lost his job in the 2008 meltdown. He wanted to move to take a new job, but he owed more on his house than it was worth. His only alternative was bankruptcy. And while bankruptcy may seem like a get out of jail free card, it follows us around afterwards.

But even some credit card debt and car loans limit what we can do. A lot of folks are skipping vacations this year. I suspect that the debt burden plays a role in that.

If I’m paying $742 each month for my auto loan, there is no way I’m also shelling out $75 to play 18 holes on a weekend.

US Government Debt

Those who read my posts regularly probably knew this was coming.

Debt works the same for everyone.

And while we may think this is not true of the US government, it is, and we’ll talk more about that.

Credit Score

A higher credit score means that a person has demonstrated an ability to manage their debt. This person is making regular payments and keeping their debt load low. More about credit scores here.

Someone with a high credit score will be likely to be approved for new loans or cards and will receive a lower interest rate because the lender is taking on less risk.

The US Government has a very high credit score. It doesn’t have a FICO score, but it is rated by Moody’s, Standard and Poor and other rating agencies in the same way we are rated.

The US Government always makes its treasury bill, note, and bond payments on time and always pays back the full amount borrowed at maturity. Good for the US. This means investors are happy to buy treasuries. They’re considered one of the lowest risk investments.

The US Government’s score has recently dropped with several of the ratings agencies because of the amount of debt ($37 trillion – yikes!) we have.

Interest and Repayment

The US government has many years of history of paying its interest and principal on time.

But just like us, when interest rates go up, it makes it harder to meet the interest payments.

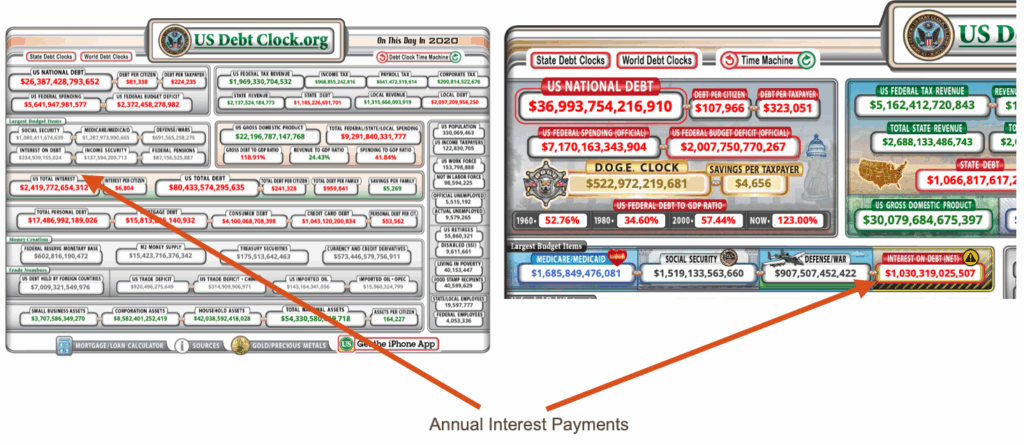

In 2020, 1 year treasury bonds were paying about 1% interest. I remember because I has a few that matured in 2020, and I was struggling to find an alternative that paid better than 1%.

Fast forward to today and 1 year treasuries are paying 4.18%. That’s over 4x the interest payments compared to 2020. Take a look at how this impacts the annual debt payments that the US Government is on the hook for.

Using the time machine feature on usdebtclock.org, I can see that in 2020, the US government was paying a whopping $334 billion every year to make interest payments on debt. At that time, we were spending $691 billion on defense, so debt payments (for which we got nuthin’) cost us almost half of what defense cost.

Fast forward to today, interest payments are now over $1 trillion per year. Just On Interest!

People are pissed at Bezos, Musk and others who have billions, but our government is setting $1 trillion on fire every year. We get no benefit. This is used to pay interest to all the nice investors who have purchased our debt.

As one of those investors, I say thank you, but still…

And the interest is now more than we spend on defense. Americans are angry about the huge increase in defense spending. But at least we get something, though sometimes it is a $10,000 toilet seat, but still we get something.

Interest payment costs are rising a lot faster than defense costs.

Wrap Up

Debt is a serious issue.

Many of us have home, student, auto loans as well as some credit card debt. It’s no fun to make interest payments. We’d rather use that money to buy stuff or go on adventures.

Same for the US Government. Wouldn’t it be great to fix our roads, fix social security, improve benefits for veterans, or parents…pick your favorite issue. An extra $1 trillion each year would go a long way towards fixing a lot of stuff.

This is why we need to address the US national debt. You can read more here, here and here.