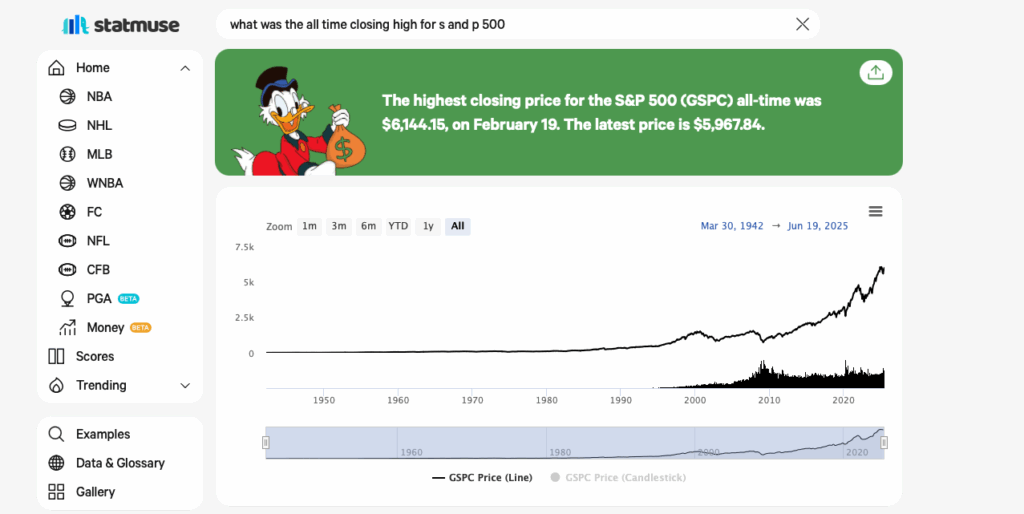

Whether we’re invested in individual stocks or we hold some nice low-cost mutual funds and ETF’s (read more about mutual funds here), today, 6/21/2025, we’re pretty pleased. The S&P 500 is within spitting distance of all-time highs. I’m not sure that “spitting distance” is a precise measure, but the point is we’re pretty darn close. See here from statmuse.

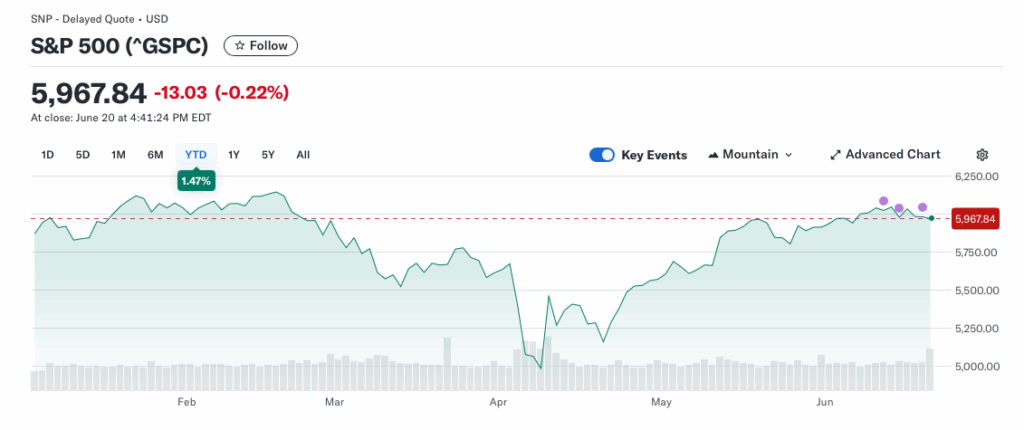

That’s good news for investors. After a rocky start to 2025, the S&P 500 is now up 1.47% year-to-date.

And for those keeping track from a political point of view, it is up over 3% since the election.

Not anything to write home about, but up is good.

Why Up?

As pleased as I am, I have to ask myself why?

There are lots of potential headwinds and as we know, investors don’t like uncertainty.

Given this, wouldn’t we expect equities to be in decline?

Tariffs

This is a biggee. I honestly don’t know if tariffs are good for equalizing the trade imbalance, creating a revenue stream to help pay down or national debt, or for providing leverage to keep fentanyl out of our country and to help improve other areas where our trading partners have been taking advantage of us.

However, I do know the impact of tariffs could hurt businesses, shareholders and the American people. If you’re a business, and you rely on goods or production facilities overseas (and that is almost all businesses) then you’re in a quandary. Are import costs going up? By how much? Should I move manufacturing onshore? How much will it cost to build factories in the US and pay workers? (hint: it’s a lot more than most overseas locations). And what if I start building here and a deal happens that makes it cheaper for me to keep and expand my overseas locations.

Apple moved a ton of manufacturing to India. They started years ago. They can now produce US-bound iPhones in India instead of China to avoid the sky-high China tariffs. But India could have high tariffs as well.

Apple has deep pockets. Many other businesses do not. During this quarter’s earnings calls, many companies noted the tariff risk and decided not to provide definitive forecasts for 2025 because of uncertainty.

Yet the S&P 500 is near all-time highs.

Iran/Israel

From a humanitarian perspective, this is horrifying. People are dying. The Israel/Gaza troubles and the Russia/Ukraine invasion were bad enough, but now the US is considering entering an active war.

International conflicts are escalating. This is frightening. Iran is a long way away, but while they may not have a missile they can launch to hit the US (or maybe they do, who knows?) they can certainly do plenty of damage with the internet, drones and other modern tools.

And don’t forget 9/11. That was an inside job. Do you think that it’s possible with all the illegal immigration (call them what you will, these are people in the US that we know nothing about – we don’t even know they’re here) that there could be some Iran-friendly radicals in the US that could attack us from inside with guns, bombs, cars, planes…

Immigration

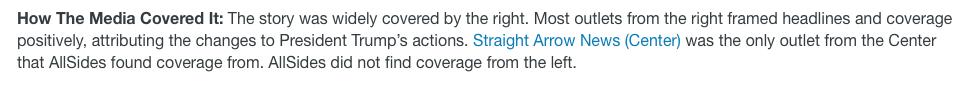

I read this story yesterday on Allsides.

What’s even more fun is this analysis.

If you get your news from the left or even center leaning media, you will not be aware that border crossings are down. That’s unfortunate.

So, it seems to me that this is good news. While I can’t say that I’m happy with how some of this has been handled, I think the results have been positive. When folks come into the country legally, we know they exist, we know a little about them and we have a chance to assess their criminal record. Assuming we end up in either an active or passive conflict with Iran, I’d like to think we know a little about the Iranian nationals that are in the US. That would make me feel safer.

But anyway, I’ve diverged into political opinion, so let’s get back on track.

The business/equity risk on inflation is actually the opposite problem. We’ve done a fine job stemming the flow of illegal immigrants across the border. However, many businesses and government officials who represent them are sounding the alarm about the impacts to farming, food production, hospitality and other key US industries. Read more here from pbs.

And then we changed our mind.

I’ll take the high road and not debate the US economic pros and cons of either move, but I will say one thing.

Uncertainty.

Interest Rates

When interest rates are low, we don’t hear much about them, but in the past few years, interest rates have become media darlings.

Interest rates are important to us as individuals. As banking customers, the bank pays us interest on our deposits. When rates are high, we get more interest. Yay!

But for borrowers who need a home loan, car loan, student loan or who are paying off credit card debt, higher interest rates are lethal.

Same for businesses. Businesses need to borrow a lot of money to build plants, buy raw materials, pay workers, ship things…when interest rates go up it gets harder to borrow money, and the money that can be borrowed costs more in interest payments.

Higher interest rates are very bad for business. But at least we’re having civil discourse about it.

So, the higher rates – that are remaining high – are bad for business. And the fighting amongst those who feel interest rates need to come down to protect business and those that feel they need to stay steady to prevent a recession are causing, you guessed it, uncertainty.

…and the Other Stuff

I’d love to say that’s it, but how about the federal deficit? We’re still spending like drunkin’ sailors as the deficit balloons to $37 trillion and over 120% of GDP. I won’t beat this to death as I’ve covered this here, here, and here. But this is a real problem.

Social security’s own trustee says that it will run out of money in 2035. Folks will still get payments, but at a lower amount – maybe 75%. Too soon to tell but given that very few of us have a pension and American’s retirement savings are not where they need to be, this is a problem.

And we don’t really have a federal budget. We tend to go through the usual process of threatening government shut-downs and then passing a last-minute hail Mary to avoid disaster and help us not have to deal with any fiscal responsibility for now.

Uncertainty.

Wrap-Up

The market hates uncertainty. We’ve all heard this thousands of times.

It just ain’t so.

The S&P 500 is near an all-time high.

However, to be clear, I remain bullish on the US. We’ll solve all of these problems. We’ll do it slowly, we’ll make mistakes along the way and we’ll cause other problems we need to solve.

American business is resilient. Great businesses grow during adversity. The less successful ones will die off, but the strong thrive. And new start-ups grow from the ashes. 10, 20, 30 years from now, I expect the S&P 500 to be much higher than it is today. I expect it will be a rocky ride, but that’s no different than the last 10, 20, 30 years.

So what’s my point?

Good question, I kinda forgot myself, so let’s reel it in for a 2nd time.

The point is that successful investing isn’t just about great businesses. It is in the sense that we ultimately want to own companies with above-average earnings, but there are an awful lot of factors involved. Amazon is a fantastic company and an amazing growth story, but all of the issues we’ve talked about today can impact its business.

So I guess the secondary point is to ignore the cute pithy investing rules like “the market hates uncertainty”, “be greedy when others are fearful”, “sell in May and go away”, and take a step back and look at what’s going on.

Today there is a lot of uncertainty. That’s cool, but look at all these factors that we talked about. What are the posisble outcomes? How might they impact our favorite investments? Does this make it a good time to buy or to hold steady?

Investing is about more than great companies. It’s about investing cycles. The economy, the world, and the various markets all follow cycles. We never know when they’ll start and end, but the cycles themselves are similar. As investors, it’s important for us to recognize this and not look at individual businesses (or any investment) in isolation.