In his book One Up On Wall Street: How To Use What You Already Know To Make Money In The Market, Peter Lynch tells lots of stories about how to recognize great businesses and how to choose investments. One of my favorite stories in the book is about how Lynch noticed the L’eggs eggs all over his house. This made him think about the amount of L’eggs pantyhose that his family was buying and whether this might be an interesting business. Read more from CNN Money here.

But if you’re serious about buying stocks, anything by Peter Lynch is a must read. When my team members from China would visit the US, they could count on 2 things from me. A trip to Alpaca Peruvian Charcoal Chicken in NC and a copy of One Up On Wall Street.

Datadog

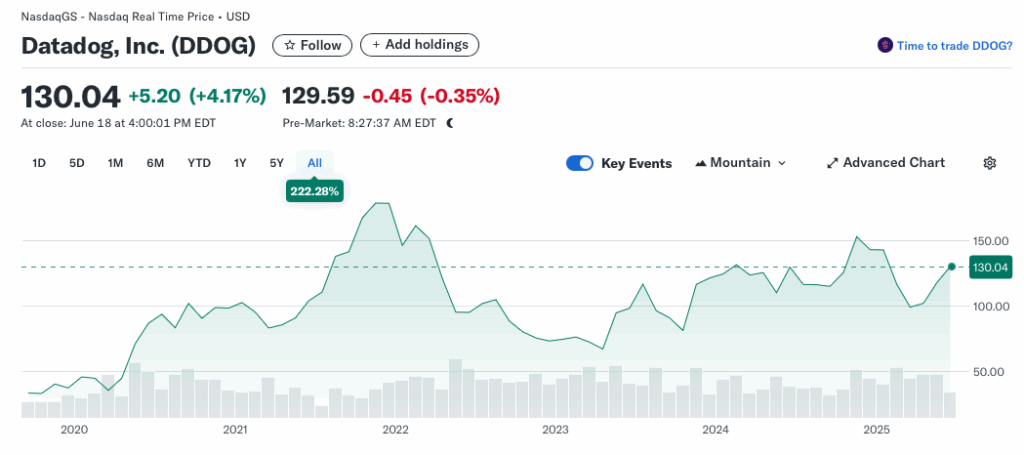

With that in mind, I decided to invest in a company called Datadog in 2020.

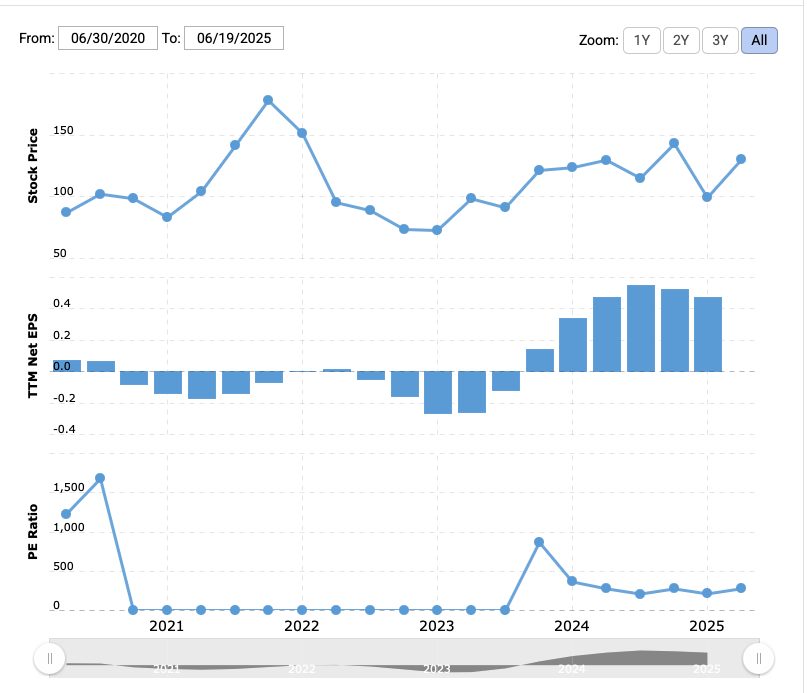

From a p/e standpoint, it’s hard to justify an investment in Datadog.

Today’s p/e is 276. Microsoft, a stellar growth company has a p/e of 37.

The Bull Case for Datadog

So if Datadog seems way overpriced, what’s the bull case? First off the name.

How could you not buy just on this? And the logo!!

But seriously, toward the end of my technology career, Datadog was everywhere. I had teams that were using it and loved it and I had other teams that were not, but were blown away when they saw what it could do. What it did was:

As boring as that sounds, think of the complexity of the technology today. We run in the cloud, we connect to applications throughout our own business and in other businesses through API’s (application programming interfaces). A product like Datadog is a must to ensure transactions are processing as expected and to troubleshoot issues when they’re not.

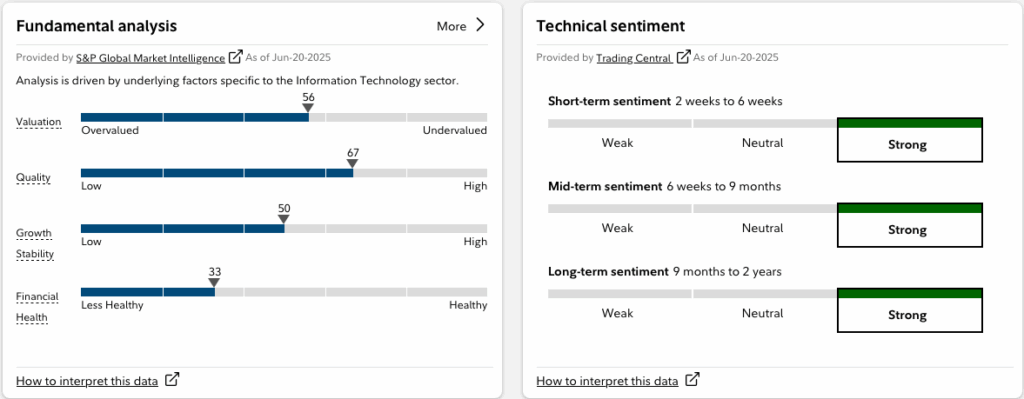

For a growth business, the analyst sentiment is pretty positive.

So basically, I love the name and logo, my team members say that they can’t survive without it, and analysts are pretty positive on the business.

And then there’s 2 Glorious Growth Stocks Down 36% and 57% You’ll Wish You’d Bought on the Dip, According to Wall Street

Sounds like it’s worth a small investment.

A Rocky Ride

Whenever we invest in a growth company, and a company with a p/e of 276 is definitely a growth company (i.e. it is priced on expectations of future growth rather than on current earnings), we should expect lots of volatility.

Datadog has not disappointed.

If we bought in 2021 at $178 per share, we’re pretty unhappy. If we bought last month at $99 we’re pleased. But, we buy growth companies because we expect the stock price to rise exponentially over long periods of time. Where will Datadog be in 10 years, 20?

I’ve bought shares of Datadog from $82 up to $147.

Conviction

I’ve written a lot about conviction. When we get a stock tip from a friend, our conviction is low. We probably don’t know a lot about the company and its financials, and we expect that since we got a hot tip, the stock price will rise quickly. If it doesn’t we’re disappointed and we sell.

If we like the business and the product, we’ve done our research and we truly expect the company will win in the long-run, we have conviction. We believe, so it’s easier to ride out the jaw-dropping pull-backs that come with a growth company.

For me, many of the Datadog pull-backs have been buying opportunities. I believe that even the $147 that I paid is cheap. 10 years from now, I expect Datadog to be double, triple that or even more. It has a fantastic product and solid financials.

Sometimes I’m right, sometimes I’m wrong. So I make small purchases, take advantage of the inevitable pull-backs, and keep an eye on earnings reports and analyst insights.

Bonus Topic: Covered Call Options

I’ve written in detail about covered call options here and here. I’m pretty conservative with my investments and generally avoid options and other derivatives in favor of real assets like stocks and equity mutual funds or fixed income products like bonds and bond funds.

The reason is because derivatives derive their value from something else. And they are typically highly volatile. Their value changes exponentially compared to the security on which they are based.

With some option contracts, the potential for loss is unlimited. You heard that right. Unlimited. No bueno.

Covered call options provide a little more safety. Essentially, we buy an asset and then sell a contract that allows another investor to buy that asset on or before a certain date at a certain price. Read the posts for more details and some examples.

I have a personal rule that I’ll only sell covered call options for a price that is greater than the price I paid for the asset.

Example

On 2/21/25, I bought 100 shares of Datadog for $122.75 per share. The total cost was $12,275.00. I immediately sold a March 28, 2025 covered call with a strike price of $123. I received a premium of $5.62 per share, so $562 for 100 shares.

How cool is that. I pocket $562 immediately. If the shares rise above $123, the option buyer can exercise his option and buy the shares for $123 each. I get an additional $25 in cap gains because I bought at $122.75 and sold for $123.

Because Datadog is volatile, it’s share price was below $123 on March 28, so I kept my shares (and the $562 premium). It was $103. Yikes.

On the following day, I sold an option on these same shares with a strike price of $123 and an expiration of June 20, 2025. I only got $261. Still a nice chunk of change, but because the price of Datadog had dropped well below the $122.75 that I purchased for, investors were less excited about a $123 call. So I got a lower premium.

Today is June 20. Datadog closed at $127.50. Because $127.50 is more than the strike price of $123, I sold my shares. The option contract buyer got 100 shares at a price of $123. He paid $261 for the contract, so his current gain is (Current price of 127.5 – Cost 123 = $4.50) but we also need to account for the cost of the option contract so subtract $2.61. That leaves $1.89. Multiply this by 100 shares and the option holder made $189.

But I sold 2 option contracts on the same shares. My cost for the shares was $12,275. I received (562+261=823) $823 in option premium + $25 in cap gain = $848 in total. That’s a 848/12,275 = 6.9% return for 4 months. That’s an annualized return of over 20%.

Option Thoughts

For a company like Datadog on which I’m bullish, I typically buy a long position that I intend to hold forever. And I may also supplement with some additional shares on which I’ll sell covered calls.

This way I have some to keep and I make a few bucks on other shares.

This is important. While the 6.9% return is awesome, if Datadog goes up 100%, I’ll be unhappy because my gain is capped – in this case at 25 cents per share.

Option risk one is that the underlying security price drops. In the Datadog scenario, I’m not too concerned about this because I expect it to be volatile, but to win in the long run.

Option risk 2 is the risk that we cap our gains and miss out on huge returns from a great business. I suspect at some point I’ll kick myself for selling these shares at $123. That’s why I hold some long shares to mitigate risk.

For a volatile stock like Datadog, for which we have high conviction, buying some shares and selling covered call options can be a nice way to generate income.

Wrap-Up

Read Peter Lynch.

Investing ideas come from lots of places.

Then do your research. I listened to a podcast where a hedge fund manager said that she looks at over 100 investment opportunities a year and at most invests in 1 or 2. Sometimes none.

It’s our money at risk. We need to put it in the investments that have the best chance to grow. We won’t be right all the time, but doing some research and ruling out great ideas that don’t have the fundamentals or the growth potential is a great start.

Think of things that you know, either from your work or personal experiences. This can be a great way to start finding companies that could be long-term winners. Next do your research. Try and find reasons not to invest. If there aren’t many, maybe you have a winner.

And for the particularly volatile high conviction stocks in our portfolio, selling covered call options, with a strike price above the purchase price, can be a nice way to build some income while we wait for the long-term gains we’re expecting.